-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

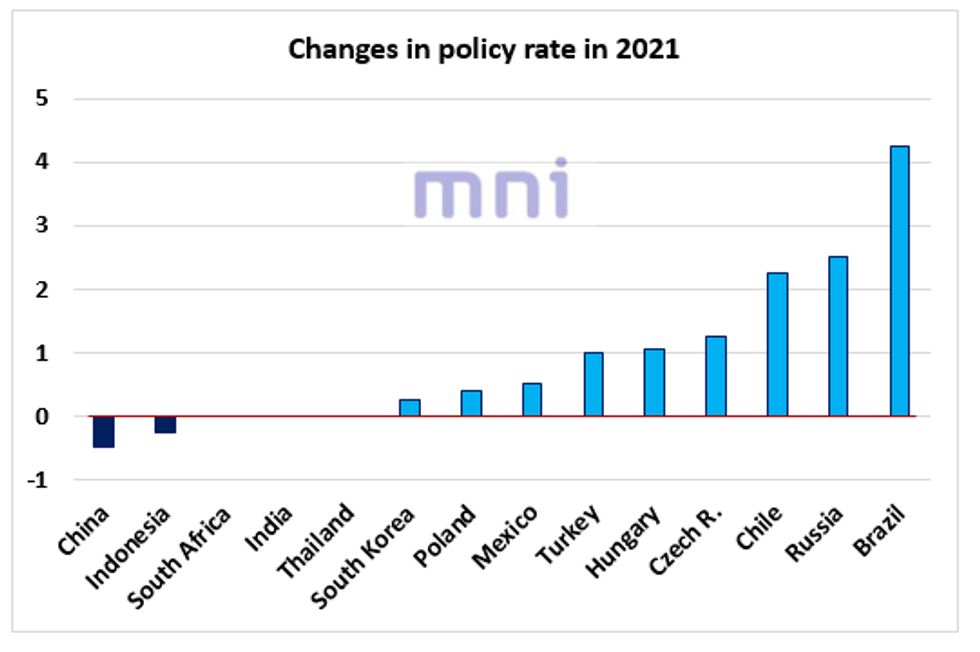

Free AccessRising Inflationary Pressures Is Leading To More 'Panic' Tightening

- As inflationary pressures continue to surprise positively in the EM world, a rising number of central banks have been surprising the market by hiking more aggressively in recent weeks to reduce the inflation risks going forward.

- Yesterday, the Chilean central bank decided to raise its benchmark rate by 125bps (supported by the entire board), which was above the 75-100bps expected by market participants.

- Last week, it was Poland that decided to surprise markets by raising its benchmark rate by 40bps for the first time since 2012 as inflation keeps surging with CPI September coming in above expectations at 5.8% YoY. The market was expecting the NBP to keep its policy rate unchanged following recent policymakers' speeches.

- The chart below shows the changes in the major EM central banks' policy rate in 2021.

- The most aggressive EM central bank so far has been the CBB, which raised its policy rate by 4.25% since January to 6.25% (Selic was at 6.5% prior the Covid shock).

- Not surprisingly, the TRY is the worst performer this year, down nearly 20% against the USD, amid rising political and economic uncertainty, especially after the CBRT decided to cut its benchmark rate by 1% last month to 18%, which sent the Lira to new all-time lows.

- Interestingly, as inflationary pressures has eased in some Asian / SE Asian economies (i.e. Indonesia, Thailand, Malaysia...), central banks have kept interest rates steady while the economic recovery is taking place.

Source: Bloomberg/MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.