-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessSF Pres Daly's Employment Metric Points To...Imminent Rate Hikes?

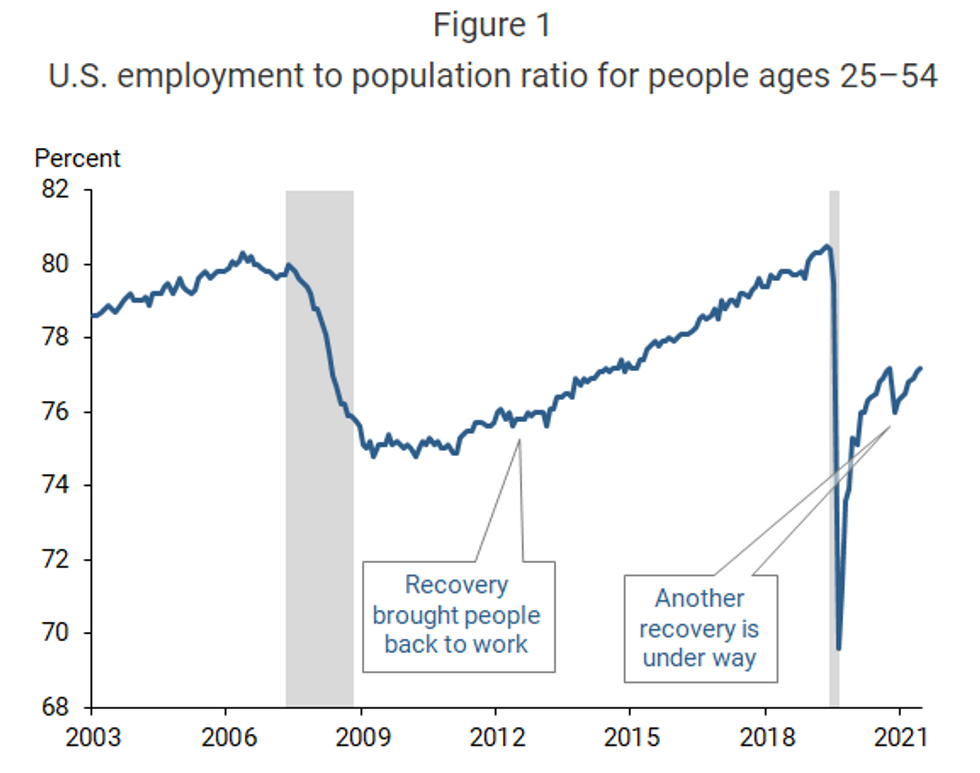

In a blog post today titled "What Is Full Employment?", SF Fed Pres Daly (a dovish-leaning 2021 voter) writes that she sees "no reason to expect" factors such as fears of COVID, childcare, or unemployment benefits "to be permanent or even highly persistent features of the labor market".

- As such, she sees prime-age (25-54) employment-to-population to continue rising as more and more people come back into the labor force and get jobs, comparing to the last decade's cycle.

- Note that SF Fed research earlier this year pointed to labor market slack being "higher than implied by the current headline employment rate".

- It's worth looking at the last cycle when the ratio rose 3pp between the bottom in 2009 (74.8%) and the first Fed hike in 2015 (ending that year at 77.4%, nearly 3pp below the 80.3% 2007 peak). By comparison, at 77.2% in June 2021, we're 3.3pp below the peak of 80.5% in Jan 2020.

- That's arguably in nearly as "tight" shape than in 2015 when the Fed was hiking rates, if the comparison is simply current level vs pre-recession peak. And if simply comparing the magnitude of recovery: the ratio fell below 70% in April 2020, and has already recovered more than 7pp (a bigger recovery than was seen over the entire cycle last time).

- So while employment may not yet be "full" by those standards, history suggests it doesn't have to be for the Fed to start hiking (even judging "full-ness" by Daly's standards).

Source: SF Fed

Source: SF Fed

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.