-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessSluggish Inflation, Raging Covid Outbreak Continue To Batter Baht

Spot USD/THB has extended its relentless surge this morning and last trades +0.035 at THB33.285. The rate breached key resistance from Apr 2, 2020 high of THB33.177 yesterday, printing its best levels since 2018. Benign inflation reported yesterday might be adding some pressure to the baht, given that the latest data were released after a split BoT decision to keep interest rates unchanged, where dissenters voted for a cut.

- From the technical point of view, a break above THB33.325, which capped gains on Oct 30/31, 2018, would provide another notable bullish signal, opening up Aug 14/15 highs at THB33.380. Bears keep an eye on the RSI, which has operated in overbought territory since mid-June. Its pullback under the 70 threshold, coupled with a move in the spot rate under Jul 29/20 lows of THB32.820/32.780, would inspire hopes for a deeper sell-off.

- Thailand's headline consumer-price inflation slowed to +0.45% Y/Y in July from +1.25% recorded in June, missing BBG median estimate of +0.88%, but there is an important caveat. The government's subsidy measures put a lid on price growth and the Commerce Ministry said that in their absence inflation would register at +1.8% Y/Y.

- Separately, consumer confidence gauge compiled by the UTTC fell to 40.9 in July, the lowest level since 1998. The UTTC noted that "there is much uncertainty over the government's vaccine distribution plan, while political instability and anti-government rallies are gathering pace and oil prices are rising".

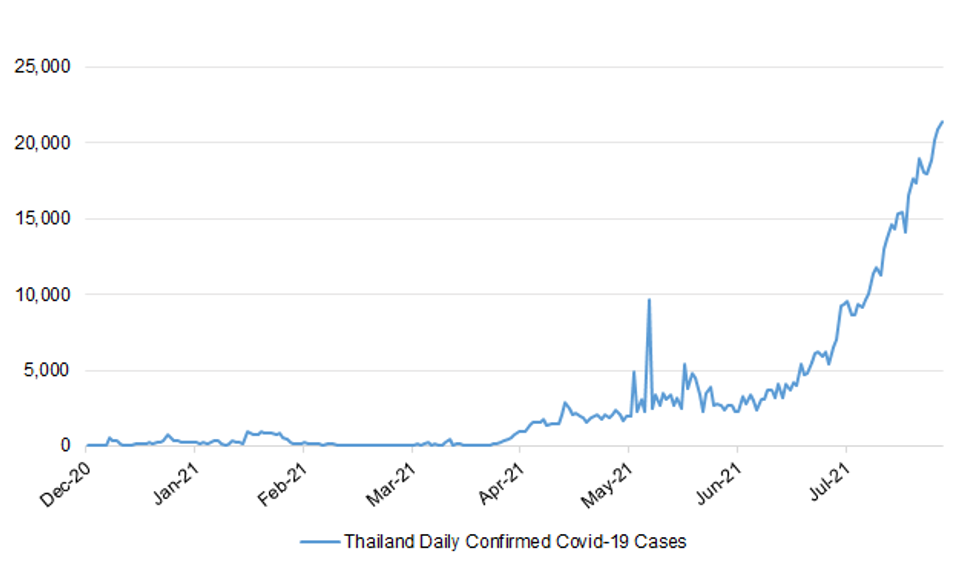

- A Bangkok court will today decide on revoking the government's order, which restrained reporting on Covid-19 news. The country reported a record 21,379 new cases and a record 191 deaths today, while officials flagged Thursday that 100,000 Bangkok residents remain in home isolation.

- The BoT will provide their weekly update on foreign reserves later today, while next week's docket features nothing outside of the next such update.

Fig. 1: Thailand Daily Confirmed Covid-19 Cases

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.