-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

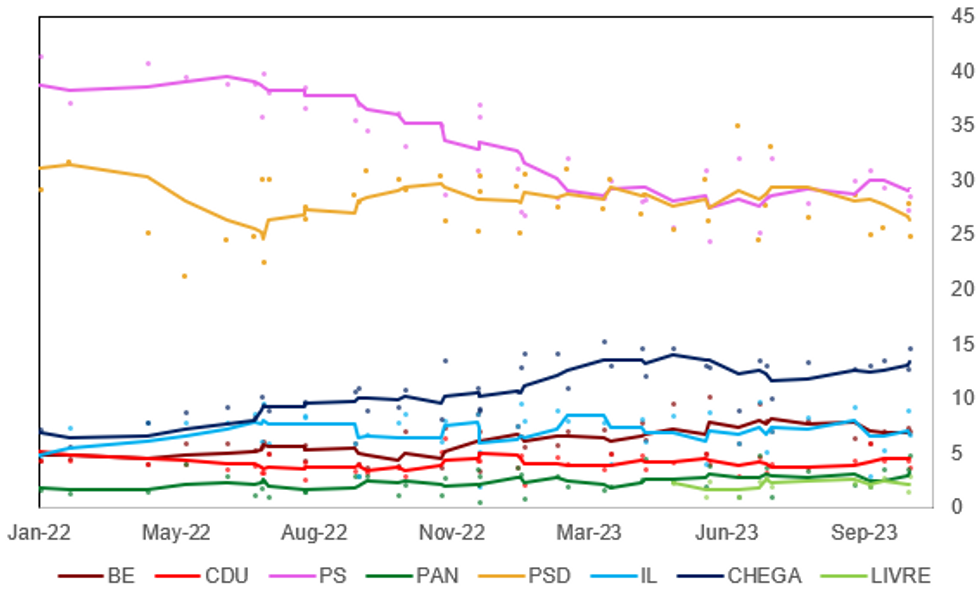

Snap Election Would Be Closely Contested Affair

Following the resignation of PM Antonio Costa earlier today, President Marcelo Rebelo de Sousa is set to hold meetings with heads of the main political parties this week before deciding on whether to dissolve the Assembly of the Republic that would usher in snap elections. The alternative would be to allow the governing centre-left Socialist Party (PS) to nominate/elect a new leader to take over from Costa as PM. However, the nature of Costa's resignation involving a corruption probe into his office and gov't ministries could be deemed so serious that the president deems a snap election necessary.

- Since the Jan 2022 general election, in which the PS won a majority of 120 seats in the 230-seat parliament, support for the party has declined from 41.4% in that vote to an average of 28.4% in October. If repeated in an election this would certainly see the PS lose its majority, requiring it to build a coalition with other parties, namely the left-wing populist Left Bloc (BE) and the communist CDU.

- An election could deliver a change in gov't, especially if the scandal hits PS support. The centre-right Social Democratic Party (PSD) - polling an average of 26.1% in Oct - could work with the libertarian Liberal Initiative (IL), itself polling 7.0% in Oct.

- The wildcard would be the right-wing nationalist CHEGA! (Enough!). PSD President Luís Montenegrostated in the summer that "no is no”, saying there would be not “political governance agreement” with the party, and “there’s no point in fuelling this issue any further”. However, it remains to be seen whether this stance holds up should a PSD-IL-Chega coalition carry a majority post-election.

Source: Aximage, Intercampus, ICS/ISCTE, CESOP, MNI

Source: Aximage, Intercampus, ICS/ISCTE, CESOP, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.