-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessSONIA: Thoughts on flattening of Greens/Blues/Golds yesterday

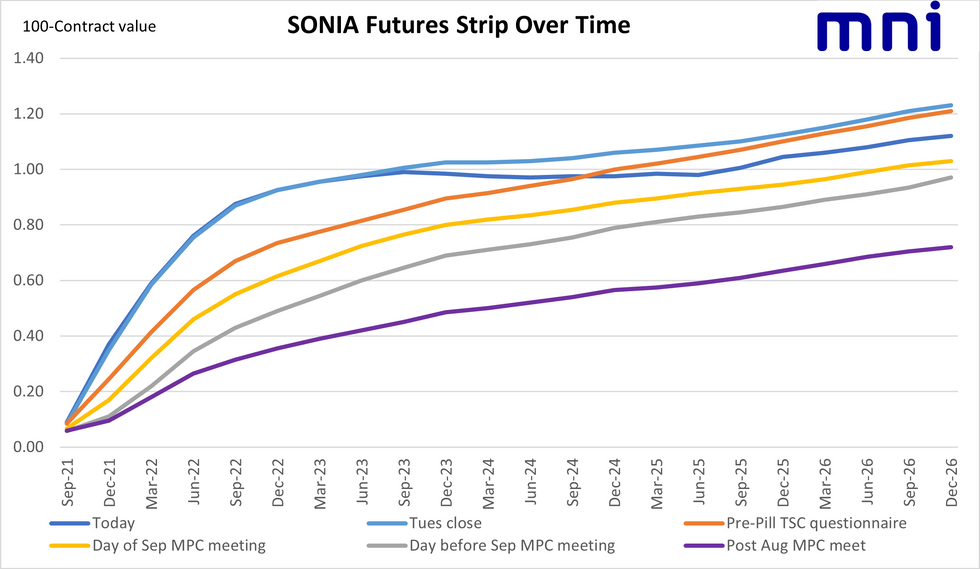

- Yesterday morning we wrote about how SONIA calendar spreads were seeing much bigger moves at the front end than further out the curve, and hence the terminal rate was not picking up as much as the moves seen in Whites/Reds would suggest.

- Below we chart the SONIA strip at key recent days. Looking back to just after the August MPC meeting, the strip was a fairly gentle upward sloping curve which was fairly straight - implying hikes fairly evenly spread over the next five or so years, and still upward sloping at the end of that period.

- Hawkish events since then (Sep MPC meeting, Pill TSC questionnaire, Saunders weekend comments) have increasingly caused a steeper front-end of the strip and some marginal flattening further out.

- However yesterday there was a significant development as we saw Greens/Blues/Golds rally but only limited movements in Whites/Reds. This has led to a noticable flattening and even some inversion of the curve from Sep23 for a couple of years.

- So why have we seen this flattening? This could possibly have been brought on by yesterday's slightly disappointing GDP data. The MPC seems very focused on keeping inflation expectations under control (and also to a lesser extent seems to want to get on with ending APF reinvestments). However, the medium-term outlook for growth is looking increasingly uncertain - not enough to stop the Bank hiking over the next year or so, but enough for a more substantial pause as Bank Rate reaches 1.00%.

- Recall that 1.00% is the rate at which the MPC will start to consider active gilt sales. If we go back a few months, there had been lots of talk of the Bank's terminal rate being around 1.00% before APF sales commenced, and then to let APF sales do some of the tightening as the Bank waited to see the impact of both gilt sales and the previous rate hikes. This could be something coming back into market participants' thoughts.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.