-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

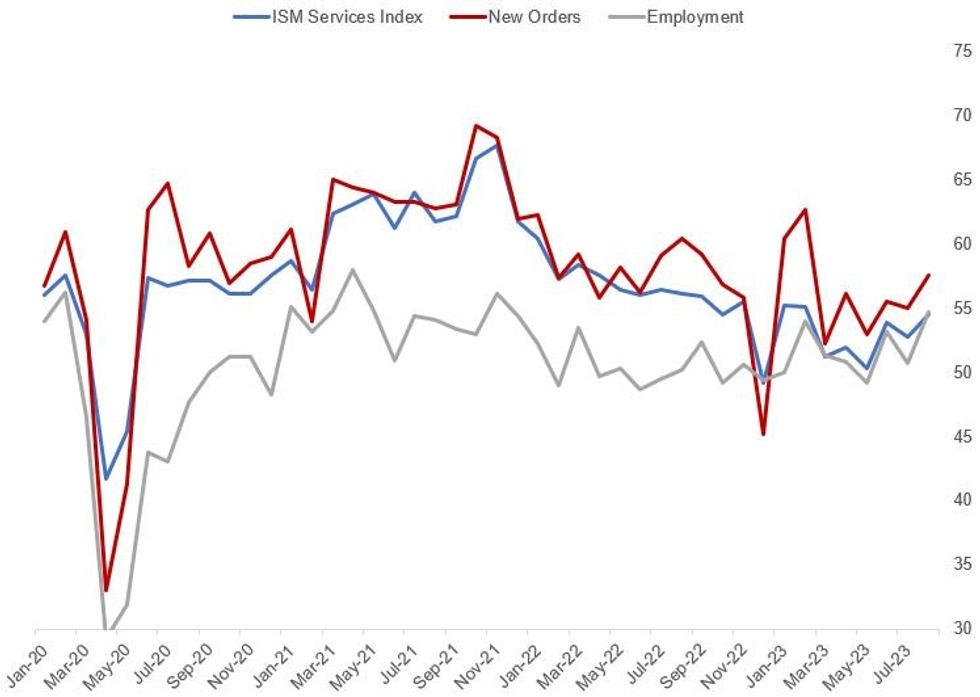

Upside ISM Services Surprise Underlines Demand Resilience In Q3

August's ISM Services reading came in strong at 54.5, beating expectations of a drop to 52.5 from July's 52.7, and above the high end of analyst expectations of 53.9.

- This reacceleration to the highest reading since February after a dip in July added further evidence that the US economy has been resilient through Q3, with the ISM noting the 54.5 print is consistent with 1.6% Q/Q annualized real GDP growth (albeit that's lower than most current estimates).

- The report showed strength across most key categories, including Production/Activity (+0.2 to 57.3), Employment (+4.0 to 54.7), New Orders (+2.5 to 57.5), New Export Orders (+1.0 to 62.1), and Prices (+2.1 to 58.9). The Employment reading was the highest since Nov 2021, New Orders highest since Feb, Prices Paid since April, and New Export Orders since September 2022.

- As ISM Services chair Anthony Nieves told MNI at the start of August after the July report regarding New Orders, "I expect this to rebound a little bit as well and get more into the mid 50s on the composite [PMI] as we get into the tail end of of the third quarter and going into the fourth quarter", basing his optimism on seasonal factors.

- August's wasn't an unambiguously positive report. Inventories jumped (+7.3 to 57.7) but Inventory Sentiment rose (+4.9 to 61.5), the latter indicating that firms felt their inventories were too high vs activity levels.

- Backlogs fell the most in series history back to 1997 (-10.3 to 41.8) with some respondents citing the arrival of long-awaited shipments, but the ISM noted that 49% of respondents didn't measure backlogs.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.