-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUSD/CNH Hits Fresh YTD Highs, Implied Vols Point To Gradual Depreciation Trends

USD/CNH has hit fresh highs for the year today (7.3114). This is the highest level for the pair since early Nov last year. Nov 3 highs were 7.3309, beyond that lies the 7.3500 region. USD/CNH continues to take its cue from the higher USD/CNY fixing levels and subsequent onshore spot gains. Broadly markets aren't expecting fireworks for the yuan, with USD/CNH remaining firmly in an uptrend at this stage.

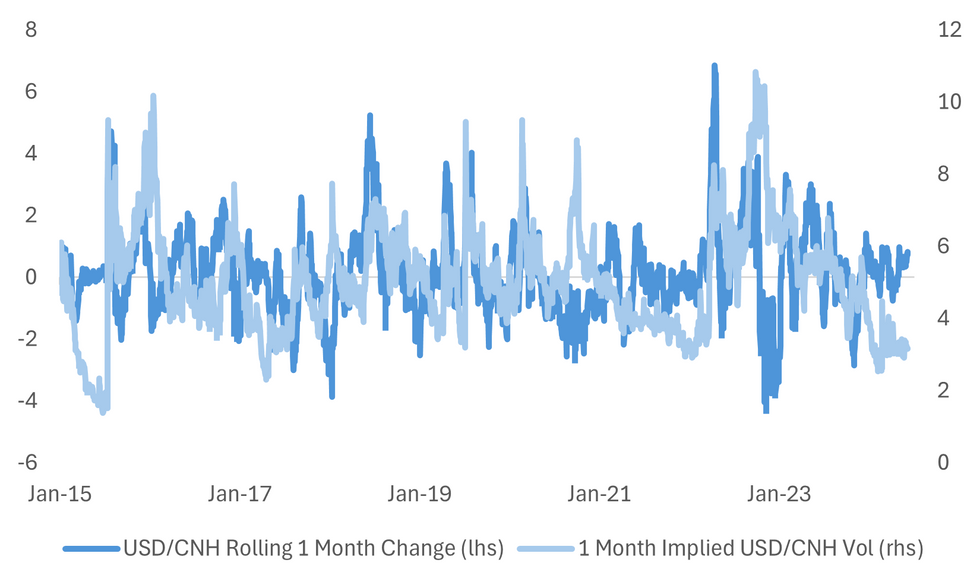

- Even as USD/CNH hits fresh YTD highs, implied vol levels remain low from a historical standpoint. The chart below plots the rolling 1 month change in spot USD/CNH against the implied 1 month vol level.

- The rate of change in 1 month CNH is quite modest by historical standards, even with elevated spot levels, which speaks to the gradual nature of the run higher in the pair.

- When rates of change in USD/CNH get into the 3-4% range, implied vols are naturally higher, but equally such moves may see firmer push back by the authorities on yuan depreciation pressures.

- Such a backdrop may also encourage the market to buy protection, although that doesn't appear to be happening at the current juncture.

- Longer term implied vols are drifting higher, with 6mth up to 5.25%, which will also incorporate US election risks. Still, this is well below 2023 highs.

Fig 1: USD/CNH Rolling 1 Mth Change Versus 1mth Implied Vol

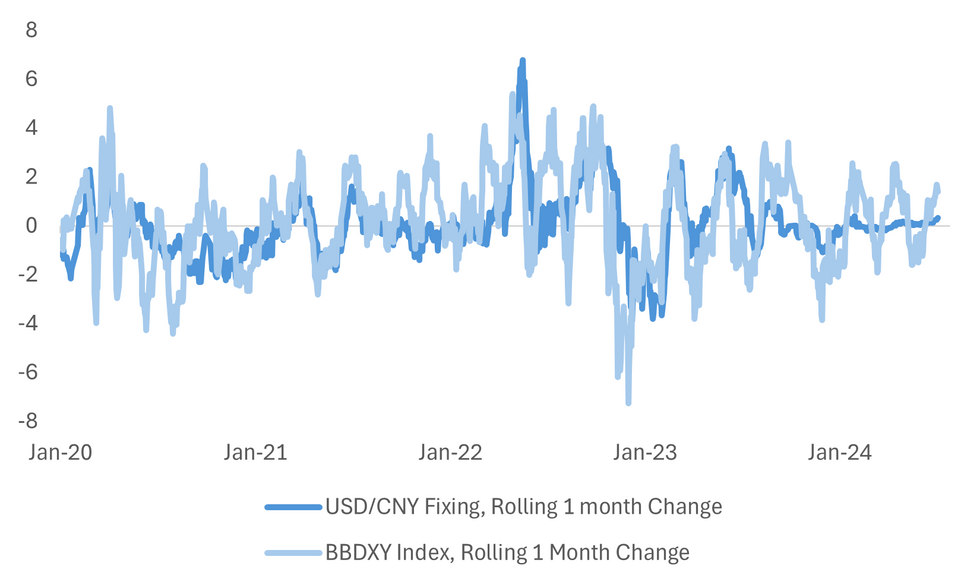

- The USD/CNY fixing beta with respect to broader USD moves also remains very lows, see the rolling 1 month change for the fixing BBDXY index below.

- Again, this points to steady yuan losses rather than anything dramatic. This may change if a USD downtrend emerges, with the authorities potentially willing to encourage some retracement in USD/CNY under such a scenario.

- However, a continued strong USD backdrop is likely to see the fixing maintain a low beta to such moves. A widening of the daily trading band etc, which is something some sell side analysts are mindful of, is a risk that can't be discounted, but option markets aren't priced for such a scenario.

Fig 2: USD/CNY Fixing & BBDXY USD Index Rolling 1 Month Changes

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.