-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

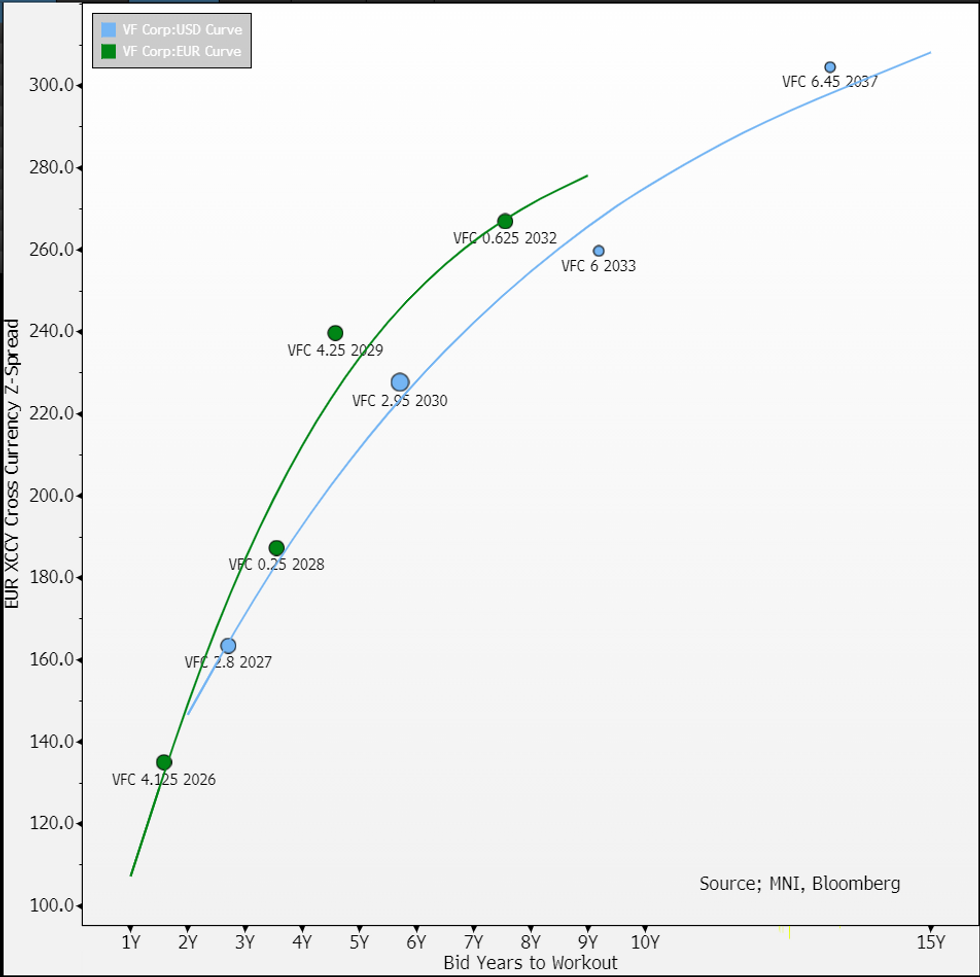

VF Corp (VFC; Baa3 Neg/BBB- Neg) 1Q (to June) Results up ahead

Reminder VFC earnings after the US close tonight. Since our comments last week it's sold off +40bps on the 4Y+. Seems investors sharing our nerves. As we said lead indicators we look at don't look great, macro backdrop adding fuel on that. Levels do make tonight's print more interesting/2-sided.

Couple of asides from us;

- 1Q is seasonally weaker - i.e. stick to YoY terms (not QoQ) and expect margin contraction/deleveraging as SG&A stays sticky through the fall. Seasonality is driven by Outdoor segment which is stronger in Q2/Q3. WC tends to be negative particularly in Q2 as inventory builds up ahead of a peak Q3 sales but unclear if we will see that tonight - it may be doing targeted clean-up on inventory. Focus on FY FCF guidance.

- Outside of North-Face no one is rolling over "tough comps". Vans & Dickies are rolling over double digit falls last year, timberland a -6% fall. By geography similar story ex. APAC (rolling +18% growth last year). I.e. little-to-no excuses for falls now.

- Consensus (cc sales at -11%) has set the bar well low; in-line earnings is nothing to celebrate over and is not indicative of a turnaround.

- Focus on any spreading of weakness in headline sales; it's currently concentrated (i.e. double digit) in Vans and geographically in the US. Also continuing losses in those segments cannot be ignored; they are 26% and 52% of group sales respectively.

- Stock is up +35% yet analyst earnings estimates have stayed subdued leaving it trading rich on forward P/E. I.e. do not be too surprised if you see a sharp fall for equities.

- If it continues using the term "FCF including non-core asset sales" in guidance we (and seems consensus) estimate the non-core asset sales component to be small ($50-100m). That guidance is currently at $600m (12m to March 2025).

If you need to catch-up, there has only been three main updates since FY earnings;

- Supreme brand sold for $1.5b in cash and will go towards paying down debt leaving only $0.5b of the debt due over the next two years unfunded. Pro-forma leverage will be net 4.5x/gross 5.5x on NTM EBITDA consensus of $850m. Stock rallied on the announcement - a rare sight when proceeds were earmarked for deleveraging - and likely reflective that investors & mgmt can now focus on fixing profitability. The brand was a $538m business running a strong 22% margin - one of its best performers.

- New Vans Head was announced as Michelle Choe, the then Chief Product Officer of Lululemon. Impressively she wiped $3b in market cap from lululemon on departure and added back $350m into VF. Whole VF management is new.

- Moody's came after the supreme sale echoing our above pro-forma leverage numbers and leaving ratings unch but on neg. outlook. It's patience in IG - after 7-straight quarters of falling sales - is remarkable. Leverage is well into its downgrade territory.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.