-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS - Week Ahead 2-8 December

MNI POLITICAL RISK - Trump Targets BRICS w/New Tariff Threat

MNI Gilt Week Ahead: Triple issuance week?

MNI US MARKETS ANALYSIS - French Politics Undermines EUR

Won Weaker Despite Unemployment Drop

After strengthening yesterday the won is weaker in early trade on Wednesday. USD/KRW last up 2.05 at 1131.90. The pair is still some way from its 2021 lows at around 1082, since the return from LNY the rate has finished higher in 15 of the previous 22 sessions. Some of the opening gap from yesterday still hasn't been filled around 11136, above which bulls target yesterday's high of 1138.25. and then the psychological figure of 1140. Bears will target the March 12 low at 1127.65.

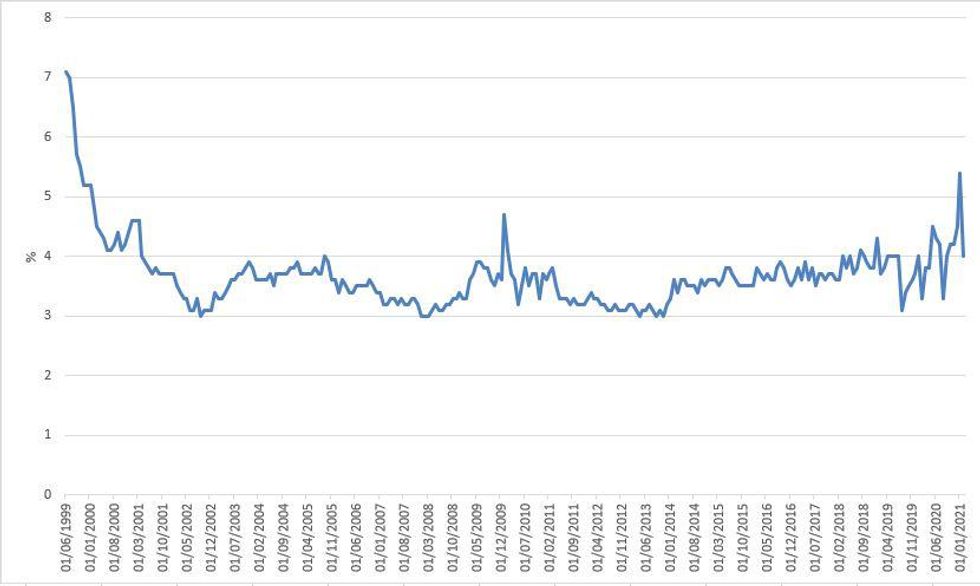

- Data earlier in the session showed South Korea's unemployment fell to 4.0% in February, a sharp drop from 5.4% in January which was a 20-year high. There has been a strong turnaround in public employment enabled by a resumption in government job programs, while private sector jobs have struggled on elevated social distancing measures. There has also been improved sentiment among businesses and consumers, helped by robust exports and the start of vaccinations. The finance ministry was positive after the data, saying they expected the improvements to continue.

- Fig.1: South Korea Unemployment Rate

Source: MNI/Bloomberg

Source: MNI/Bloomberg

- Elsewhere the Seoul metropolitan area will implement more stringent antivirus measures on virus-prone facilities and expand testing on foreign workers at industrial complexes in the area to better contain the coronavirus. The measures will be in place until March 31. South Korea reported 469 more coronavirus cases in the past 24 hours, up from 382 yesterday and back above the 400 threshold. The government have also said they will continue to use the AstraZeneca vaccine, even as several European government's declare a hiatus on its use. South Korean President Moon Jae-in and first lady will get AstraZeneca vaccine on March 23, in plenty of time to attend G-7 summit in June. Over 602,000 people in South Korea have now had the vaccine.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.