US STOCKS: Market Seems Gun-Shy To Short It Again

The ESM5 Friday night range was 6006.00 - 6082.50, Asia is currently trading around 6040. A potentially protracted Middle East war, a short oil market surging and President Trump commenting the US “could get involved”, and still the US stock market continues to be very well supported on any dip. A market that was caught very short all the way and has now been forced back in seems very reticent to attempt to sell it again.

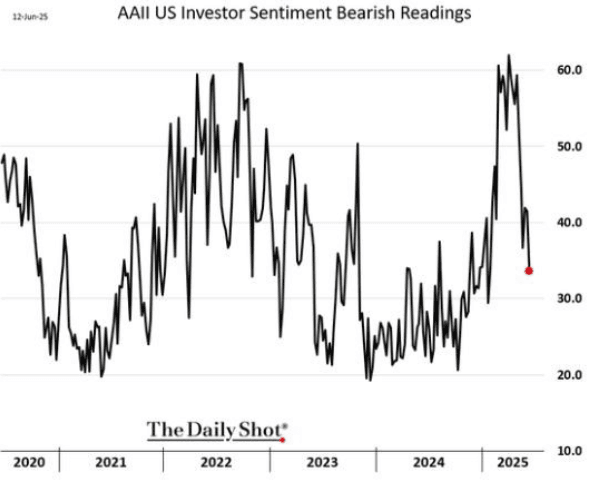

- Bob Elliott on X: “ A lot of bears have capitulated.” See Graph Below

- Lance Roberts on X: “Equity allocations across major investor groups have reached a record 53%, while allocations to debt and cash have fallen to multi-decade lows of 18% and 13%, respectively. Despite all of the headline concerns, investors are chasing risk assets more than ever. Of course, that also highlights increased vulnerability to shifts in risk sentiment.”

- “In 2025, U.S. companies are announcing record share buybacks, with repurchases projected to surpass $1 trillion for the year—a move intended to support stock prices and improve financial metrics.”

- Friday night saw strong demand back below the 6000 area and at 1 point it had almost erased all its losses before falling away into the close. This morning US futures initially tried lower but in very similar price action have bounced back and they are currently trading positive in our session. ESU5 +0.14%, NQU5 +0.22%

- Momentum type funds and share buybacks have kept the market well supported as an underweight market has been forced to reenter. Share buybacks are set to enter their blackout period starting this week, will this be the signal for a potential pullback ?

In the short-term stocks look overbought, if the S&P can’t hold above 6000 we could see the start of some sort of a retracement. The first buy-zone is back towards the 5700 area where demand could be expected.

Fig 1: US Investor Bearish Sentiment

Source: @SoberLook, The Daily Shot

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

RATINGS: Moody's Downgrades US's AAA Rating As Deficits Seen Ballooning

Moody's has downgraded the US's long-term credit rating to Aa1 trom Aaa. The move may not have been fully expected today. But it was the last holdout among they S&P and Fitch to demote the USA from the top rating, and they placed negative outlook on the US last year (now stable). Fiscal deterioration, both past and anticipated as Congress wrangles with the Republican fiscal bill, is cited as the key factor. From the release (link):

- “While we recognize the US’ significant economic and financial strengths, we believe these no longer fully counterbalance the decline in fiscal metrics."

- "This one-notch downgrade on our 21-notch rating scale reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns...We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration."

- "If the 2017 Tax Cuts and Jobs Act is extended, which is our base case, it will add around $4 trillion to the federal fiscal primary (excluding interest payments) deficit over the next decade. As a result, we expect federal deficits to widen, reaching nearly 9% of GDP by 2035, up from 6.4% in 2024, driven mainly by increased interest payments on debt, rising entitlement spending, and relatively low revenue generation."

- "We anticipate that the federal debt burden will rise to about 134% of GDP by 2035, compared to 98% in 2024."

- "Federal interest payments are likely to absorb around 30% of revenue by 2035, up from about 18% in 2024 and 9% in 2021. The US general government interest burden, which takes into account federal, state and local debt, absorbed 12% of revenue in 2024, compared to 1.6% for Aaa-rated sovereigns."

US FISCAL: "Extraordinary Measures" Continue To Dwindle Amid Debt Impasse

The "extraordinary measures" available to Treasury to stave off a debt default were down to $82B as of May 14, per a Treasury Department release today.

- That compares unfavorably with a high of $335B in January when the debt limit impasse began. Combined with $562B in Treasury cash on hand, though, after April's large tax intakes, that makes for around $644B in available resources before the "x-date" is reached.

- Resources are gradually being eroded since reaching nearly $800B in mid-April.

- Per Tsy Sec Bessent's letter to Congress last week, "after reviewing receipts from the recent April tax filing season, there is a reasonable probability that the federal government's cash and extraordinary measures will be exhausted in August while Congress is scheduled to be in recess. Therefore, I respectfully urge Congress to increase or suspend the debt limit by mid-July, before its scheduled break, to protect the full faith and credit of the United States."

CANADA DATA: Sales Activity Points To Potential Marking Up Of GDP Ests

There was mixed news on the housing and wholesale/manufacturing sales fronts this week, which on net look to slightly upwardly bias Q1 GDP estimates, pending next week's retail sales reading.

Housing starts blew through expectations at 278.6k in April (226.2k expected, 214.2k prior). This came after building permits fell a worse-than-expected 4.1% M/M in March as reported Wednesday.

- Meanwhile, he Canadian Real Estate Association reported existing home says April sales unexpectedly contracted -0.1% M/M (+1.0% expected, -4.8% prior). Sales are now down 9.8% Y/Y, while prices fell 1.2% M/M (3.6% Y/Y on the price index). (Link)

- Overall, confidence appears subdued, which is likely to translate into subdued activity.

On the sales front, March data was soft but positive versus expectations and could add a slight upward drift to Q1 GDP expectations.

- Manufacturing sales were less negative than expected at -1.4% M/M (-1.9% expected/flash estimate, -0.2% prior rev up 0.4pp). The decline was led by primary metals -6.5%, an area hit by U.S. tariffs, and oil -4.2%. Overall Q1 factory sales grew +1.6% vs prior +1.1%.(Link)

- Wholesales ex-petroleum and grains rose 0.2% in March, vs the advance estimate / consensus -0.3%. Sales volumes fell 0.3%. Overall Q1 wholesales rose 2.5%, led by machinery/equipment and autos/parts.