MNI US OPEN - Fed Expected to Hold, Convey Patient Stance

EXECUTIVE SUMMARY

- MNI FED PREVIEW - HOLDING IN ANTICIPATION

- IRAN PREPARING MISSILES FOR POSSIBLE RETALIATORY STRIKES ON US BASES

- US PLANS TO EASE CAPITAL RULE LIMITING BANKS’ TREASURY TRADES

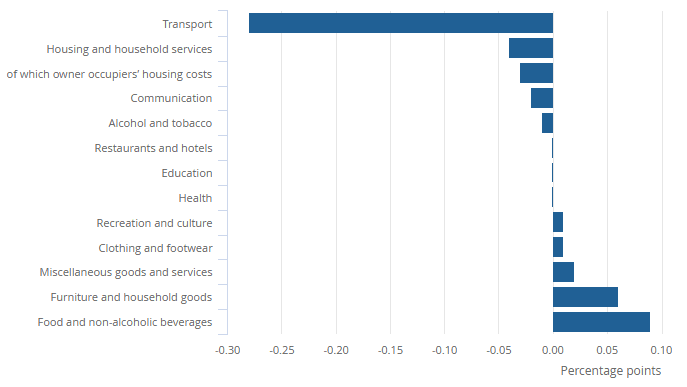

- UK FOOD, CORE GOODS INFLATION HIGHER THAN EXPECTED, SERVICES A LITTLE LOWER

Figure 1: Contributions to change in UK CPIH annual inflation rate

Source: ONS

CENTRAL BANK PREVIEWS

MNI FED PREVIEW - JUNE 2025: Holding in Anticipation

The FOMC will hold rates for a 4th consecutive meeting in June, and continue to convey a patient stance on future rate cut decisions amid elevated policy-related uncertainty. The new quarterly projections will still signal the resumption of rate cuts later this year, but likely only one 25bp reduction instead of the two cuts envisaged at the March meeting. While risks to both the Fed’s inflation and employment mandates remain elevated, with the new 2025 forecasts looking increasingly reflective of stagflation, the Committee should still signal rate cuts through end-2026 of a similar magnitude to its previous set of projections.

MNI BOE PREVIEW - JUNE 2025: All About the Vote and Minutes

The June MPC meeting will be a surprise to markets if the outcome is anything other than an on hold decision with unchanged official guidance. Expectations are relatively strongly pointing towards a 7-2 vote split with both Dhingra and Taylor likely to follow up their votes for a 50bp cut in May with a vote for a sequential cut (the magnitude of which is unlikely to elicit a market reaction). The main focus is on whether the dataflow has been enough to convince any other members of the MPC to vote for sequential cuts.

MNI SNB PREVIEW - JUNE 2025: Rates to Follow CPI?

Markets see a 25bp policy rate cut to 0.00% as most likely but do acknowledge the risks of an outsized cut into negative territory, with OIS-implied odds standing around 80:20 for a 25bps move vs a 50bps step. Inflation has slowed further since the March meeting and turned negative, moving below the SNB’s target range for the first time in 4 years. However, the SNB targets medium-term CPI trends, rather than short-term, which will be the focus in the update to inflation forecasts.

MNI NORGES BANK PREVIEW - JUNE 2025: Gearing Up for the H2 Cut

Norges Bank is firmly expected to hold rates at 4.50% on Thursday, at a quarterly meeting which includes an updated MPR and rate path projection. We expect guidance that the policy rate “will most likely be reduced in the course of 2025” will remain unchanged, with a risk of firmer guidance towards a September cut. Developments since the March meeting should warrant a modest downward revision to the rate path, but we still expect the June iteration to be consistent with two cuts this year.

MNI BCB PREVIEW - JUNE 2025: Hike or Hold, Caution to Remain

A narrow majority of analysts lean towards the BCB keeping the Selic rate steady in June at 14.75%. This follows lower-than-anticipated inflation figures last week, better behaved inflation expectations and the strong performance for the Brazilian real across 2025. However, with economic activity appearing resilient and the labour market still tight, the Copom may opt to hike rates by a further 25bp, as the committee continues to stubbornly pursue the convergence of inflation to target.

MNI CBRT PREVIEW - JUNE 2025: Room to Hold Until July

The CBRT is expected to keep its one-week repo rate unchanged at 46.00% this month following a 350bp hike in April, but risks of a rate cut are noted by some analysts given the recent slowdown in monthly inflation. However, upside price pressure stemming from FX weakness post the arrest of the Istanbul mayor Ekram Imamoglu in March ultimately warrants further caution, while increased funding through the key policy window has already led to a reduction in the weighted-average funding rate.

NEWS

US/MIDEAST (NYT): Iran Is Preparing Missiles for Possible Retaliatory Strikes on U.S. Bases, Officials Say

Iran has prepared missiles and other military equipment for strikes on U.S. bases in the Middle East should the United States join Israel’s war against the country, according to American officials who have reviewed intelligence reports. The United States has sent about three dozen refueling aircraft to Europe that could be used to assist fighter jets protecting American bases or that would be used to extend the range of bombers involved in any possible strike on Iranian nuclear facilities. Fears of a wider war are growing among American officials as Israel presses the White House to intervene in its conflict with Iran. Other officials said that in the event of an attack, Iran could begin to mine the Strait of Hormuz, a tactic meant to pin American warships in the Persian Gulf.

MIDEAST (MNI): IAEA Confirms Iranian Centrifuge Production Sites Hit

The International Atomic Energy Agency (IAEA) posts on X: "The IAEA has information that two centrifuge production facilities in Iran, the TESA Karaj workshop and the Tehran Research Center, were hit. Both sites were previously under IAEA monitoring and verification as part of the JCPOA. At the Tehran site, one building was hit where advanced centrifuge rotors were manufactured and tested. At Karaj, two buildings were destroyed where different centrifuge components were manufactured." Centrifuges arranged in cascades are the key components that allow the enrichment of uranium from low-purity (used for civil nuclear power production) to high-purity weapons-grade.

US (BBG): US Plans to Ease Capital Rule Limiting Banks’ Treasury Trades

The top US bank regulators plan to reduce a key capital buffer by up to 1.5 percentage points for the biggest lenders after concerns that it constrained their trading in the $29 trillion Treasuries market. The Federal Reserve, Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency are focusing on what’s known as the enhanced supplementary leverage ratio, according to people briefed on the discussions. This rule applies to the largest US banks, including JPMorgan Chase & Co., Goldman Sachs Group Inc. and Morgan Stanley.

US (WSJ): Senate GOP’s Medicaid Cuts Mean New Trouble for Trump Megabill

Senate Republican leaders left members from both ends of the party unsatisfied with their version of President Trump’s “big, beautiful bill,” touching off a fast round of new negotiations to hit their self-imposed deadline of putting the bill on his desk by July 4. The tax and health portions of the measure, unveiled late Monday, would make it harder for states to shift Medicaid costs onto the U.S. government, but also give clean-energy companies more favorable tax treatment than under the bill that barely got through the House last month. Taken together, those changes caused friction within the party, pointing to the need for more revisions—or arm twisting from Trump—for Senate Majority Leader John Thune (R., S.D.) to drive the bill through his narrow 53-47 majority on schedule starting next week.

US (WSJ): New Megabill Estimate Sees Worsened Deficit Picture

Republicans’ tax-and-spending megabill would increase budget deficits by $2.8 trillion through 2034 after factoring in the projected economic growth the bill would create, leading to 15% more red ink than previously estimated, according to the Congressional Budget Office. The CBO’s analysis of the House-passed bill undercuts one of Republicans’ main arguments for the legislation. The bill’s authors have argued that critics are ignoring the economic boom that the tax cuts and President Trump’s other policies would create.

RIKSBANK (MNI): Riksbank Cuts 25bps, Sees Chance of Another Cut

The Riksbank cut its policy rate by 25 basis points to 2% at its June meeting and left the door open to taking the rate lower still. The June cut was seen as increasingly likely by analysts in recent weeks in light of soft activity data even though the Riksbank, after lowering the policy rate pretty rapidly from 4% last May to 2.25% in January, had previously signalled that 2.25% could be the trough. The Riksbank cut its growth and inflation forecasts in the June Monetary Policy Report and its rate forecast showed some chance of another 25bp cut this year.

EU/AUSTRALIA (BBG): Australian PM Says EU Trade Deal Is ‘Symbolically Important’

Expanding trade ties between Australia and the European Union would be “symbolically important” in an environment of rising protectionism, Prime Minister Anthony Albanese said Wednesday, as the two sides also plan talks on a defense agreement. Albanese told reporters he held trilateral discussions with European Commission President Ursula von der Leyen and Antonio Costa of the European Council on the sidelines of a Group of Seven summit in Canada.

ECB (MNI): Outlook Subject to Big Risks, Uncertainty - Panetta

The global macroeconomic outlook remains subject to substantial and difficult-to-quantify risks from U.S. trade policy and the potential escalation of the conflict between Israel and Iran, Bank of Italy Governor Fabio Panetta said in a speech on Wednesday. An era characterised by instability and shocks since the 2008 Global Financial Crisis has led central banks to adopt a more data-dependent approach, Panetta said.

CHINA (BBG): PBOC Head Imagines New World Currency Order After Dollar Era

People’s Bank of China Governor Pan Gongsheng laid out in the clearest terms yet his vision for the future of a new global currency order after decades of dollar dominance, predicting a more competitive system will take root in the years to come. “In the future, the global monetary system could continue to evolve toward a situation where a few sovereign currencies co-exist, compete and check and balance each other,” Pan said Wednesday in a keynote speech at the annual Lujiazui Forum in Shanghai.

CHINA (MNI): PBOC Unveils Moves to Liberalise Overseas Financing

MNI (Beijing) People’s Bank of China Governor Pan Gongsheng on Wednesday announced new measures to liberalise cross-border trade and investment, expand overseas financing, and further refine the central bank’s policy framework. Speaking at the 2025 Lujiazui Forum, Pan said the PBOC will promote the issuance of offshore bonds in pilot free trade zones to support high-quality firms investing abroad, particularly in Belt and Road countries. It will also upgrade Free Trade Accounts (FTAs) to better support cross-border trade and investment, he continued.

CHINA (MNI): China to Support Foreign Participation in Finance

MNI (Beijing) China will support foreign-funded companies to participate in more pilots of financial business in the country, especially in exclusive pension insurance and commercial pensions, said Li Yunze, director of the National Administration of Financial Regulation on Wednesday. Speaking at the Lujiazui Forum in Shanghai, Li said authorities will benchmark the relevant rules in the financial field in international high-standard economic and trade agreements to explore greater and wider opening up.

CHINA (MNI): Yuan to Remain Stable, QDII to Expand: SAFE's Zhu

MNI (Shanghai) China’s foreign exchange market will remain stable, with the yuan operating at a “reasonably balanced level,” said Zhu Hexin, head of the State Administration of Foreign Exchange, adding that a new round of investment quotas under the Qualified Domestic Institutional Investor (QDII) scheme will be granted to meet demand for overseas investment.

RUSSIA/UKRAINE (Telegraph): Putin Under Pressure to Declare War on Ukraine

When Ukraine smuggled dozens of drones into the back of freight trucks and launched a surprise attack on Vladimir Putin’s prized nuclear bombers, Russia’s most radical voices were furious. “Shock and outrage” is how one high-ranking Russian official described the mood in the Kremlin the day after the strike. Another Russian official told The Telegraph: “Like every thinking patriot, I took it as a personal tragedy.” The fury ran so deep in some quarters that there were renewed calls for Putin to “declare war” on Ukraine – a demand that may seem baffling to Western observers, given that the conflict is already Europe’s bloodiest since the Second World War.

RUSSIA/UKRAINE (WaPo): Russia Hits Kyiv With Deadliest Attack of the Year, G-7 Avoids Talk of Ukraine

At least 24 people, including an American citizen, were killed and 134 were injured in a massive overnight attack on Kyiv, marking one of the deadliest strikes on the Ukrainian capital this year as divisions in the Group of Seven nations kept mentions of the war to a minimum. The early-morning attack came as the situation in the Middle East prompted Trump to cut short his visit to the G-7 summit in Canada, where it had been expected that participants would discuss the possibility of harsher sanctions on Russia to push it toward a ceasefire.

INDIA (BBG): Modi Pushes Back Against Trump’s Claim on Pakistan Ceasefire

Indian Prime Minister Narendra Modi disputed President Donald Trump’s claims that trade deals were used to clinch a ceasefire with Pakistan during last month’s military conflict. Modi held a 35-minute call with Trump on Tuesday night in the US after the two leaders failed to meet in person at the Group of Seven meeting in Canada, India’s Foreign Secretary Vikram Misri said in a video statement. It was their first conversation since the four-day military strikes between India and Pakistan last month that brought the two neighbors close to war.

DATA

EUROZONE DATA (MNI): EZ HICP Revised 2 Hundredths Lower in May Final Print

- EUROZONE MAY FINAL HICP +0% M/M, +1.9% Y/Y

- EUROZONE MAY FINAL CORE HICP +0% M/M, +2.3% Y/Y

Rounded Eurozone HICP headline / core inflation was unrevised in the final May release. On an unrounded basis, headline came in 2 hundredths lower than flash at 1.90% (1.92% flash) after 2.17% in April. Core meanwhile was one hundredth lower than flash at 2.28% (2.29% flash, 2.75% in April). In terms of contributions vs April, services subtracted 33bp from headline this time - more

than the 24bp it added in April. The services category more than reversed April's unexpectedly firm print at 3.23%Y/Y (flash 3.24%), now coming in 22 hundredths softer than March (3.45% Y/Y) and also below where May consensus stood ahead of the flash data (that was around 3.5%).

UK DATA (MNI): Food, Core Goods Higher Than Expected, Services a Little Lower

- HEADLINE 3.36% Y/Y IN MAY (3.53% IN APRIL)

- CORE 3.54% Y/Y IN MAY (3.83% IN APRIL)

- SERVICES 4.68% Y/Y IN MAY (5.42% IN APRIL)

- NEIG 1.57% Y/Y IN MAY (1.08% IN APRIL)

- ENERGY -1.68% Y/Y IN MAY (-0.94% IN APRIL)

- FOOD, ALCOHOL, TOBACCO 4.68% Y/Y IN MAY (4.01% IN APRIL)

Food added 0.10ppt to headline CPI and core goods contributed around 0.14ppt on our calculations. The core goods impact means that the BOE was surprised 0.28ppt to the downside versus 0.59ppt to the downside last month. There wsa an increase in furniture and major household appliances costs with broad based increased across the rest of the category. This suggests an unwind of some Easter-related discounting in the category. We had noted the potential for upside to core goods. Overall, we think the MPC will view this as broadly in line with expectations (headline 0.00ppt surprise to BOE) but be concerned about the continued rise in food prices.

JAPAN DATA (MNI): Japan May Exports Post First Drop in 8 Months

- JAPAN POSTS JPY637.6 BLN TRADE DEFICIT IN MAY

- JAPAN MAY EXPORTS -1.7% Y/Y; APRIL +2.0%

Japan’s exports fell 1.7% y/y in May, the first decline in eight months, following a 2.0% gain in April, dragged down by falling shipments of automobiles and iron, and steel products due to U.S. tariffs, Ministry of Finance data showed Wednesday. Auto exports dropped 6.9% y/y in May after a 5.8% fall in April, following a front-loaded rise earlier this year. Iron and steel exports plunged 20.6%, worsening from April’s 12.3% drop.

JAPAN DATA (MNI): Core Machine Orders Dip in April, Weaker Exports May Weigh

- JAPAN APRIL CORE MACHINE ORDERS -9.1% M/M; MAR +13.0%

Japan April core machine orders fell sharply, but in line with market projections. We were down -9.1%m/m (-9.5% forecast and following a 13.0% gain in March). In y/y terms, we were slightly better than forecasts at +6.6% (+4.2% was projected, while 8.4% was the March outcome). Still, this comes ahead of trade headlines, with earlier data showing faltering export growth.

AUSTRALIA DATA (MNI): Westpac Lead Index Signals Slower Growth

The Westpac lead indicator fell 0.06% m/m in May after -0.01% but this resulted in the 6-month annualised rate falling to -0.08%, the weakest since September but importantly signalling that growth could ease to below trend over the second half of the year. The measure peaked in February and has been trending lower since as global uncertainty has risen and some domestic factors were also soft but Westpac believes these local "drags" are "temporary".

NEW ZEALAND DATA (MNI): Q1 Current Account Narrows on Strong Goods Exports

The Q1 non-seasonally adjusted current account deficit narrowed substantially to $2.32bn from a downwardly-revised $6.80bn but seasonally adjusted it was similar to Q4 at $5.55bn. This brought it to 5.7% of GDP down from 6.1%, the lowest since Q3 2021 and 3.5pp less than the Q4 2022 peak. The trade deficit narrowed to $1.22bn from $1.63bn, the lowest since Covid-impacted Q2 2021, due to a strong pickup in goods exports. Robust shipments in Q1 are likely to support GDP growth when it is released on Thursday.

FOREX: Vols See Support on Fed Meeting, Fraught Geopolitical Risk

- Front-end FX vols are seeing support this morning: EUR/USD overnight implied neared 20 points at one point as markets looked ahead to the Fed decision as well as continued instability in the Middle-east, as the scope for escalation grows and could include controlled energy flow through the Strait of Hormuz or possible US involvement to ensure the "unconditional surrender" of the Tehran regime.

- GBP saw some early support on the back of a 0.1ppt higher-than-expected UK CPI Y/Y print, helping GBP/USD add ~30 pips to overnight gains. EUR/GBP came under similar pressure, putting the cross back to the overnight lows of 0.8547. Gains were shallow, however, as services CPI came in slightly soft, leaving inflation broadly infitting with the BoE's forecasts at this stage. Markets continue to price just under 50bps of BoE easing by year-end.

- EUR/SEK rallied on the back of the Riksbank's 25bps rate cut. While the move was largely as expected, the bank made it clear that further easing could be forthcoming, with another cut this year likely. EUR/SEK was marked above 11.00 for the first time since early May, clearing the 11.0124 100-dma in the process.

- AUD is furtively outperforming early Wednesday, keeping AUD/USD inside the uptrend channel drawn off the late April lows. AUD is recouping some of this week's lost ground as enhanced geopolitical uncertainty countered any tailwind from better commodities prices. Australian jobs data is the next focal point, due Thursday.

- Weekly jobless claims data are due today, brought forward by one day thanks to Thursday's Juneteenth market holiday. The Fed decision follows, and while no change in headline policy is expected, the press conference will remain of interest as the Fed Chair comes under pressure from the White House for being "too slow" on easing monetary policy.

EGBS: Bunds See Light Support on Latest Iran Headline; Ranges Still Tight

Headlines noting that a televised message from the Iranian Supreme Leader will be aired “shortly” has provided light support to Bund futures, which are now +11 at 130.87. That brings Bunds to the top of today’s tight 34 tick intraday range. The move lower in Bunds from the June 13 high is still considered corrective for now, with key short-term support at 130.12 (June 5 low).

- German yields are up to 1bp lower, with the belly lightly outperforming. 20/30-year Bund supply was digested smoothly.

- 10-year EGB spreads to Bunds are biased wider, with Middle East tensions capping risk sentiment. The BTP/Bund spread is back to 96.5bps, from a multi-year low of 90bps last week.

- Eurozone final May HICP confirmed flash estimates at a rounded 1.9% Y/Y (vs 2.2% prior), with core also unrevised at 2.3% Y/Y (vs 2.7% prior).

- ECB’s Panetta unsurprisingly noted that the Israel-Iran conflict presents a risk to the outlook alongside US tariffs. His remarks were not market moving.

- Several ECB speakers are still scheduled today, but more focus will be on this afternoon’s US jobless claims data and the FOMC decision this evening.

GILTS: Off Lows, Curve Bull Steepens After CPI

Gilts stick to narrow ranges, fading any weakness that initially stemmed from the CPI data (slightly firmer-than-expected headline Y/Y, slightly softer than-expected services).

- We have suggested that the BoE is likely to view today’s data as in line with expectations, therefore it should have little net feedthrough into tomorrow’s BoE decision.

- Gilt futures stick within yesterday’s range, trading as low as 92.48 before recovering to ~92.65.

- The bullish technical conditions in the contract remain intact, initial support and resistance located at 92.23 and 93.13, respectively.

- Yields 0.5-2bp lower, curve bull steepens.

- Multi-week ranges in yields and on major curves intact.

- GBP STIRs see similar moves to the long end and trade little changed on the day.

- BoE-dated OIS pricing ~48bp of cuts through year-end, with the next 25bp step more or less fully discounted through the September MPC.

- SONIA futures -0.5 to +2.0.

- Terminal rate pricing, proxied by SFIU6 at present, sits at 3.48% after touching 3.415% last week.

- We still lean towards an August cut.

EQUITIES: Eurostoxx 50 Futures Close to Recent Lows, Remain Below 50-Day EMA

Eurostoxx 50 futures are trading closer to their recent lows. The latest pullback has resulted in a breach of the 50-day EMA at 5298.64. Price has also pierced 5255.00, the May 23 low. A clear break of both support points would signal a short-term top and highlight scope for a deeper retracement. This would open 5178.00, the May 6 low and 5081.16, a Fibonacci retracement. Initial resistance to watch is 5355.88, the 20-day EMA. The trend condition in S&P E-Minis remains bullish and the contract is holding on to the bulk of its recent gains. For now, the most recent pullback is considered corrective. The contract has pierced support at 6003.83, the 20-day EMA. A clear breach of this average would expose the 50-day EMA, at 5896.83. Key short-term resistance has been defined at 6128.75, the Jun 11 high.

- Japan's NIKKEI closed higher by 348.41 pts or +0.9% at 38885.15 and the TOPIX ended 21.4 pts higher or +0.77% at 2808.35.

- Elsewhere, in China the SHANGHAI closed higher by 1.404 pts or +0.04% at 3388.809 and the HANG SENG ended 269.61 pts lower or -1.12% at 23710.69.

- Across Europe, Germany's DAX trades higher by 13.74 pts or +0.06% at 23448.34, FTSE 100 higher by 13.63 pts or +0.15% at 8847.66, CAC 40 up 6.18 pts or +0.08% at 7689.91 and Euro Stoxx 50 up 1.42 pts or +0.03% at 5290.1.

- Dow Jones mini up 67 pts or +0.16% at 42295, S&P 500 mini up 16.25 pts or +0.27% at 6001.25, NASDAQ mini up 76.5 pts or +0.35% at 21807.

Time: 10:10 BST

COMMODITIES: Continuation Higher for WTI Futures Would Expose $80 Handle

WTI futures traded sharply higher last week and last Friday’s early rally marked an acceleration of the current bull phase. Price action is likely to remain volatile near-term, and from a technical standpoint, the trend is in an extreme overbought position. A continuation higher would expose the $80.00 handle. A firm support is noted $68.49, the Jun 13 low. A breach of this level would signal scope for a deeper retracement. A bullish theme in Gold remains intact and recent gains reinforce current conditions. Medium-term trend signals are bullish too - moving average studies are in a bull-mode position, highlighting a dominant uptrend. Resistance at $3435.6, the May 7 high, has been pierced. A clear break of this level would strengthen the uptrend and open $3500.1, the Apr 22 all-time high. Initial key support to monitor is $3271.7, the 50-day EMA.

- WTI Crude down $0.85 or -1.14% at $74.03

- Natural Gas down $0 or -0.1% at $3.848

- Gold spot down $2.86 or -0.08% at $3384.95

- Copper up $2.25 or +0.46% at $488.6

- Silver up $0.15 or +0.4% at $37.2493

- Platinum up $18.06 or +1.43% at $1281.92

Time: 10:10 BST

| Date | GMT/Local | Impact | Country | Event |

| 18/06/2025 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 18/06/2025 | 1230/0830 | *** | Housing Starts | |

| 18/06/2025 | 1230/0830 | *** | Jobless Claims | |

| 18/06/2025 | 1230/0830 | *** | Housing Starts | |

| 18/06/2025 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 18/06/2025 | 1500/1700 | ECB Lane At Macroprudential Conference | ||

| 18/06/2025 | 1515/1115 | BOC Governor speaks in Newfoundland. | ||

| 18/06/2025 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 18/06/2025 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 18/06/2025 | 1600/1200 | ** | Natural Gas Stocks | |

| 18/06/2025 | 1800/1400 | *** | FOMC Statement | |

| 18/06/2025 | 1800/2000 | ECB de Guindos at Osservatorio Permanente Giovani-Editori | ||

| 18/06/2025 | 2000/1600 | ** | TICS | |

| 19/06/2025 | 2245/1045 | *** | GDP | |

| 19/06/2025 | - | NorgesBank Meeting | ||

| 19/06/2025 | - | Swiss National Bank Meeting | ||

| 19/06/2025 | 0130/1130 | *** | Labor Force Survey | |

| 19/06/2025 | 0730/0930 | *** | SNB Interest Rate Decision | |

| 19/06/2025 | 0730/0930 | ECB's Lagarde On Economic and Financial Integration | ||

| 19/06/2025 | 0800/1000 | *** | Norges Bank Rate Decision | |

| 19/06/2025 | 0900/1100 | ** | Construction Production | |

| 19/06/2025 | 0945/1145 | ECB de Guindos On Eurozone Economic Outlook | ||

| 19/06/2025 | 1030/1230 | ECB Lagarde Keynote Speech At Economic Integration Conference | ||

| 19/06/2025 | 1100/1200 | *** | Bank Of England Interest Rate | |

| 19/06/2025 | 1100/0700 | *** | Turkey Benchmark Rate | |

| 19/06/2025 | 1100/1200 | *** | Bank Of England Interest Rate | |

| 19/06/2025 | - | ECB Cipollone At Eurogroup Meeting | ||

| 19/06/2025 | 1600/1800 | ECB Lagarde At Financi'Elles event |