-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI Markets Analysis: EURUSD Medium-Term Bulls Return

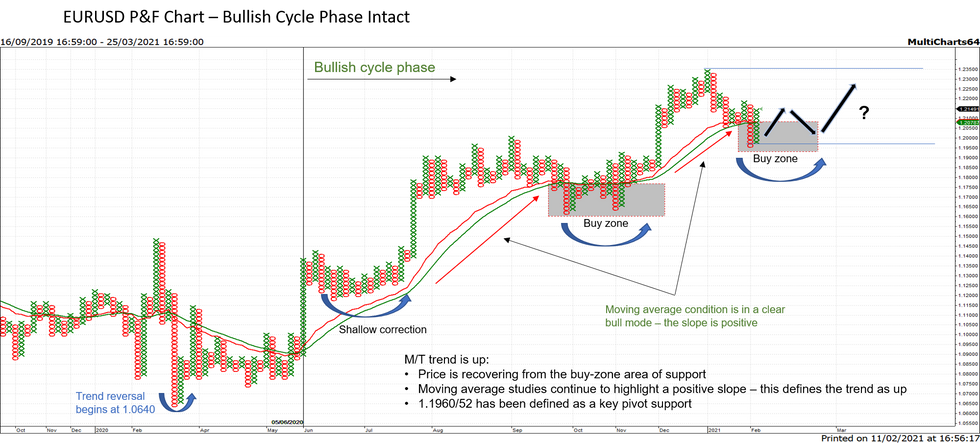

The current uptrend in EURUSD started in March 2020. In early June our medium-term trend tracker using a daily point and figure chart, confirmed a bullish trend condition. We will review this trend condition and importantly assess how this year's price action fits into the broader cycle.

The EURUSD chart highlights the uptrend that started March 2020 using a point and figure chart method. It highlights:

- A clear bullish price sequence of higher highs and higher lows - this is the definition of an uptrend.

- We apply a moving average study that attempts to identify the slope of the average. Two exponential moving averages are used, a primary EMA and a smoothed EMA of the first average. The position between the two determines whether the slope is either positive (an uptrend) or negative (a downtrend). Since June 2020, the slope has been positive and this defines the trend condition as bullish. The slope is unchanged at current price levels.

- To strengthen the trend condition, and because the direction is up, we attempt to identify price areas that are likely to represent a strong support and call these 'buy-zones'. This is the price area below the EMAs, when the trend is up. Entering a buys zone suggests that the price has entered an area where strong support exists and where demand interest will likely increase. If a trend recovers from the buy-zone, this development reinforces the underlying bullish conditions.

- There are two confirmed cycle trough periods in the trend so far:

- The period between mid-June and mid-July 2020. The price retracement did not enter the buy-zone on this occasion as a result of a shallow correction.

- The period between late September and early November 2020. Price did enter the buy-zone as part of a deeper correction, before recovering to resume the uptrend.

- This year, EURUSD has retraced from a high of 1.2349 to a low of 1.1952 between Jan 6 - Feb 5. Importantly, price recently entered the buy zone once it traded below 1.2070. This week has seen a relatively strong rebound and the pair is trading back above its two EMAs and has moved out of the buy-zone. The point and figure correction low, is 1.1960.

The recovery in EURUSD is the first indication the pair has completed its recent correction and not only is the short-term trend up, but this is potentially the early stages of a resumption of the broader uptrend.

- If correct, it suggests a return to the Jan high of 1.2349 and beyond to confirm a resumption of the uptrend.

- 1.2060 (P&F low) and 1.1952, Feb 5 low marks a key support zone and is a risk parameter for medium-term bulls. A break of this support would represent a concern for bulls however, the nature of the break will need to be evaluated to assess the overall threat to the trend.

Recent short-term developments:

- This week we highlighted the importance of a bullish engulfing reversal pattern on Feb 5. The pattern reinforces the short-term significance of the recovery off 1.1952. The chart below displays the condition on Feb 10.

- On Feb 3, we discussed the importance of an inverted head and shoulders reversal pattern in the USD Index (DXY). The pattern remains valid and highlights a bullish USD theme. However, we are monitoring the key support at 90.05, Jan 21 low. This is the base of the right shoulder. A break below this level would negate the recent reversal pattern and strengthen a USD bearish argument. The DXY chart highlights the pattern as it appeared on Feb 3.

To conclude, the medium term trend in EURUSD is up and price since Feb 5 provides the first signs of a reversal of this year's corrective pullback. If correct it suggests that the broader uptrend has resumed. 1.1960/52 is a key pivot support.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.