MNI ASIA MARKETS ANALYSIS: Cautious Risk-On Ahead Senate Vote

HIGHLIGHTS

- Treasuries look to finish lower Friday, ironically near steady to last Friday's close after a volatile week buffeted by global trade uncertainty tied to Trump's on/off tariff policies.

- Treasuries ticked lower with Bunds earlier after German budget deal headlines, extending lows after lower than expected UofM Sentiment (57.9 vs. 63.0) and projected inflations 1Y 4.9% vs. 4.3, 5-10Y 3.9% vs. 3.4%.

- Cautious risk sentiment gained late Friday as markets await Senate vote on GOP spending bill "H.R. 1968" to keep government open through September.

MNI US TSYS: Rates Near Lows, Stocks Bounce Ahead Senate Budget Vote

- Treasuries look to finish near session lows amid cautious rise in risk sentiment as markets awaited Senate vote on GOP spending bill "H.R. 1968" to keep government open through September.

- Sentiment measured by UofM another matter altogether: notably lower than expected as it slid to 57.9 (cons 63.0) in the preliminary March release after 64.7 in February, for the lowest since Nov 2022. It came with a sharp climb in inflation expectations, with the 1Y surprisingly jumping to 4.9% (cons 4.3) after 4.3 and the 5-10Y jumping to 3.9% (cons 3.4) after 3.5% for a thirty-two year high.

- Jun'25 Tsy 10Y futures trade -11 at 110-19, above initial technical support at 110-12.5/110-00 (Low Mar 6 / High Feb 7). Tsy 10Y yield 4.3121% last, curves flattening late: 2s10s -1.813 at 28.876, 5s30s -3.010 at 52.774.

- Stocks bounced off yesterday's six-month lows after NY Senator Schumer (D) said he would not block the GOP spending bill in order to avoid an imminent government shutdown.

- Strong rally for the Euro, as headlines suggested Germany have found a solution to the debt brake passage. EURUSD rose from around 1.0850 to 1.0912 following the news, falling short of most recent cycle highs which reside at 1.0947.

- Fed remains in Blackout until after next Wednesday's FOMC policy annc. Monday data focus on Retail Sales, Empire Manufacturing and NAHB Housing Market Index measures.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00278 to 4.31640 (-0.00897/wk)

- 3M -0.00423 to 4.29505 (-0.00370/wk)

- 6M -0.00401 to 4.19837 (+0.01341/wk)

- 12M -0.00489 to 4.01784 (+0.02417/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.30% (-0.01), volume: $2.462T

- Broad General Collateral Rate (BGCR): 4.29% (-0.01), volume: $960B

- Tri-Party General Collateral Rate (TCR): 4.29% (-0.01), volume: $938B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $105B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $287B

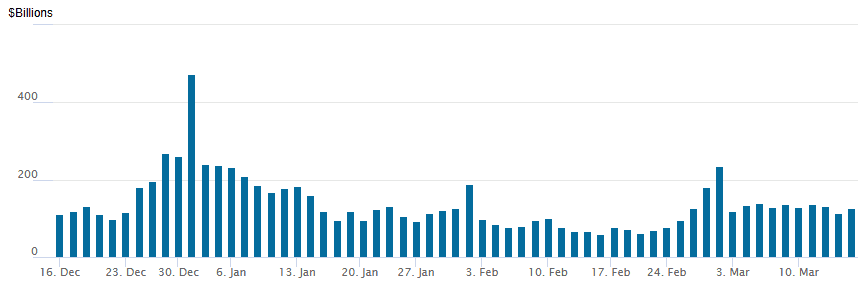

FED Reverse Repo Operation

RRP usage climbs to $126.234B this afternoon from $113.435B Thursday. Compares to $58.770B (lowest level since mid-April 2021) on February 14. The number of counterparties at 29.

US SOFR/TREASURY OPTION SUMMARY

Option desks reported robust two-way volumes in SOFR and Treasury option wings Friday, implied vol pressed by steady/varied straddle & strangle selling. Underlying futures remain weaker, near lows while projected rate cuts through mid-2025 are cooler vs. morning levels (*) as follows: Mar'25 at -.2bp (-1bp), May'25 at -8bp (-8.8bp), Jun'25 at -24bp (-25.2bp), Jul'25 at -33.2bp (-35bp).

SOFR Options: March options expire today

+4,000 SFRZ6 98.00 calls 80.5/4K ref 96.425

+5,000 SFRM7 96.00 calls 86.0 ref 96.385

+7,000 SFRH7 96.00 calls 84.0 ref 96.41

-20,000 SFRN5 96.25/96.50 call spds, 6.25-6.0 ref 96.185

+4,000 SFRU6 97.00 calls, 31.0 ref 96.435

-3,000 0QU5/0QZ5 96.00 put strip, 33.0

+13,000 0QM5 97.00 calls 5.5 over 0QJ5 96.87 calls

-5,000 SFRJ5 96.50 calls, 1.25 ref 95.94

+10,000 SFRH6 93.75/94.25 put spds, 0.75 ref 96.41

+1,000 3QM5 96.25 straddles 45.5

4,000 SFRU5 95.43/95.68 put spds vs. SFRZ5 95.62/96.12/96.43 broken put flys

3,500 0QM5 97.00/97.50 call spds ref 96.46

1,200 SFRM5 96.25/97.00 call spds ref 95.945

1,000 SFRK5 95.87/95.93 call spds vs. 95.75 puts

Treasury Options: April options expire next Friday

5,000 TYK5 112.5 calls, 24 ref 110-21.5

2,000 TYM5 104.5/110.5 put spds ref 110-21.5

-3,600 TYM5 110.5/111 strangles, 216 ref 110-23.5

-3,500 TYJ5 110.5/111.5 strangles vs. TYJ5 112.5/TYK5 114 call spd, 35 on package

Block, 8,000 FVJ5 107.5 puts, 10 vs. 107-23.75/0.35%

-8,000 TYM5 110.5 straddles, 233-232-231-230

+25,000 FVJ5 108.5 calls 4

+25,000 TYJ5 108/109 put spds 1 vs. 110-22.5/0.03% - adds to +50k yesterday

Block, +10,000 TYK5 110 put 42 vs. 110-21.5/0.38%

2,000 TYJ5 107.5/109 2x1 put spds ref 110-21

1,400 TYJ5 111.25/112/112.75 call flys ref 110-21.5

+6,000 wk3 FV 108 calls, 4-4.5

3,600 FVJ5 107.75 puts, 17 ref 107-24

2,400 TUJ5 103.5 puts, 7 ref 103-15.5

2,000 TYM5 108.5/110.5 2x1 put spds ref 110-25

-1,500 TYK5 111 straddles, 163 vs. 110-29/0.04%

-2,500 TUM5 105 calls, 4 ref 106-16

-2,000 TUK5 103.5 calls, 17.5 vs. 103-16/0.50%

1,500 TYJ5 108.5/109/110 broken put trees ref 110-28

MNI BONDS: EGBs-GILTS CASH CLOSE: Core Curves Twist Steepen For The Week

Bunds weakened Friday, underperforming Gilts.

- A below-consensus UK GDP reading saw core FI get off on the front foot.

- Bunds led a sell-off off in early afternoon European trade after the Greens, CDU/CSU and SPD reached an agreement on proposed fiscal expansion (there was little net reaction after the German constitutional court later rejected opposition attempts to block debt brake reforms).

- However yields would close the gap, descending steadilyl for the remainder of the session headed into the cash close - no discernable trigger.

- The German curve bear steepened on the day, with the UK's shifting lower mostly in parallel (slight outperformance in the belly).

- For the week, the German curve twist steepened (2Y -6bp, 10Y +4bp); the UK's likewise but to a lesser extent (2Y -2bp, 10Y +3bp).

- OATs lagged a broader fall in periphery/semi-core spreads (in which BTPs/GGBs outperformed). Fitch is scheduled to review France's sovereign rating after hours, with some expectations of a downgrade (current rating: AA-; Outlook Negative).

- The UK dominates next week's European events calendar with both the BOE decision (likely on hold, 0bp change is priced) and labour market data due on Thursday.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.2bps at 2.185%, 5-Yr is up 1.6bps at 2.502%, 10-Yr is up 2.1bps at 2.876%, and 30-Yr is up 2.7bps at 3.202%.

- UK: The 2-Yr yield is down 1bps at 4.182%, 5-Yr is down 1.3bps at 4.287%, 10-Yr is down 1.1bps at 4.666%, and 30-Yr is down 1.2bps at 5.269%.

- Italian BTP spread down 2.5bps at 112.3bps / French OAT down 1.1bps at 69.2bps

MNI EGB OPTIONS: Limited Trade Ahead Of The Weekend Includes Vol Buying

Friday's Europe rates/bond options flow included:

- RXJ5 127/126ps, bought for 29.5 in 9k. A one Week trade, expiry next Friday.

- ERZ5 98.00^, bought for 40 in 10k.

MNI FOREX: Cross/JPY Boosted, USDMXN Trades to Four-Month Low Below 20.00

- Friday’s session was characterised by a strong rally for the Euro, as headlines suggested Germany have found a solution to the debt brake passage. EURUSD rose from around 1.0850 to 1.0912 following the news, falling short of most recent cycle highs which reside at 1.0947.

- With the associated move higher for European yields, it is the low yielding JPY and CHF which have really felt the pinch, with EURJPY and EURCHF rising 0.7% and 0.55% respectively.

- Overall, there was considerably more optimism across global markets, as major equity indices rose around 1.5% on both sides of the Atlantic. This allowed the likes of AUD and NZD to outperform G10 peers. UK economic data out this morning surprised to the downside, with GDP surprisingly contracting in January while industrial and manufacturing production data came in well below forecast. GBP is notably softer as a result.

- Rengo pay tallies in Japan have again proved market moving - while unions are set to demand a faster pace of pay rises this year (5.46% from 5.28%), the final demand may turn out lower than many surveys had estimated - undermining the JPY. The firmer risk sentiment has seen the likes of AUDJPY and NZDJPY surge over 1%, entirely reversing yesterday’s misfortunes.

- Following the breach of key support on Thursday around 20.13, USDMXN has continued to grind lower during today’s session, and the clean break highlights the growing potential for a stronger reversal lower. The pair is 1% lower on the session as we approach the close, trading at the lowest level for four months, around 19.88. Below here, attention turns to the lows seen in the aftermath of the election results at 19.7618, while resistance moves down to 20.3851, the 50-day EMA.

- Activity data in China is scheduled on Monday’s, before US retail sales headlines the economic data calendar. Next week, will see a plethora of central bank decisions, including the Fed and BOJ.

MNI FX OPTIONS: Expiries for Mar17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E5.6bln), $1.0840-50(E790mln), $1.0900(E571mln)

- USD/JPY: Y146.90-15($1.2bln), Y149.00-15($1.1bln)

- GBP/USD: $1.3300(Gbp1.1bln)

- EUR/GBP: Gbp0.8435(E830mln)

MNI US STOCKS: Late Equities Roundup: Chip Stocks Leading, Awaiting Senate Vote

- Stocks are drifting near midday highs late Friday, awaiting word from the Senate as they vote on "H.R. 1968" -- Full-Year Continuing Appropriations and Extensions Act, 2025. Stocks had bounced off yesterday's six-month lows after NY Senator Schumer (D) said he would not block the GOP spending bill in order to avoid an imminent government shutdown.

- Currently, the DJIA trades up 625.95 points (1.53%) at 41444.63, S&P E-Minis up 104.5 points (1.89%) at 5632.25, Nasdaq up 416.9 points (2.4%) at 17720.3.

- Information Technology and Energy sectors continued to lead gainers in late trade, AI-tied demand helping semiconductor makers rally: Palantir Technologies +8.18%, Western Digital +6.19%, Micron Technology +5.55%, Super Micro Computer +5.22%, Adobe +4.45% and NVIDIA +4.08%.

- A broad based rally in the Energy sector led by oil and gas stocks: Targa Resources +4.15%, Coterra Energy +3.59%, Phillips 66 +3.28%, Schlumberger +3.08% and Diamondback Energy +2.99%.

- Broadline retailers weighed on the Consumer Staples sector in late trade: Kroger -2.03%, Kenvue -1.77%, Dollar Tree -1.50% and Dollar General -0.91%. Meanwhile, biotech and pharmaceuticals weighed on the Health Care Sector: Abbott Laboratories -2.69%, Bristol-Myers Squibb -2.45%, Regeneron Pharmaceuticals -2.21% and Gilead Sciences -1.91%.

MNI EQUITY TECHS: E-MINI S&P: (H5) Approaching The Next Key Support

- RES 4: 6178.75 High Dec 6 ‘24 and key resistance

- RES 3: 6166.50 High Jan 19

- RES 2: 5932.70 50-day EMA

- RES 1: 5675.00/5822.79 High Mar 12 / 20-day EMA

- PRICE: 5637.00 @ 1513 ET Mar 14

- SUP 1: 5509.25 Low Mar 13

- SUP 2: 5499.25 Low Sep 9 2024

- SUP 3: 5444.55 76.4% retracement of the Aug 5 - Dec 6 ‘24 bull leg

- SUP 4: 54000.00 Round number support

The trend condition in S&P E-Minis remains bearish and fresh cycle lows this week have reinforced current conditions. Moving average studies are in a bear-mode set-up highlighting a dominant downtrend Sights are on the next important support at 5499.25, the Sep 9 2024 low. Note that the short-term trend condition is oversold, a corrective bounce would allow this set-up to unwind. Firm resistance to watch is 5932.70, the 50-day EMA.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 17/03/2025 | 0900/1000 | ** | Italy Final HICP | |

| 17/03/2025 | 1215/0815 | ** | CMHC Housing Starts | |

| 17/03/2025 | 1230/0830 | * | International Canadian Transaction in Securities | |

| 17/03/2025 | 1230/0830 | *** | Retail Sales | |

| 17/03/2025 | 1230/0830 | ** | Empire State Manufacturing Survey | |

| 17/03/2025 | 1300/0900 | * | CREA Existing Home Sales | |

| 17/03/2025 | 1400/1000 | * | Business Inventories | |

| 17/03/2025 | 1400/1000 | ** | NAHB Home Builder Index | |

| 17/03/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 17/03/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 18/03/2025 | - | Bank of Japan Meeting | ||

| 17/03/2025 | - | FOMC Meetings with S.E.P. |