MNI ASIA OPEN: Spending Bill Passed, Focus Shifts to FOMC

EXECUTIVE SUMMARY

- MNI FED: MNI POV (Point Of View): Waiting Out Uncertainty

- BBG: US Averts Government Shutdown as Senate Passes GOP Spending Bill

- MNI US-RUSSIA: Trump Says Discussions With Putin Yesterday Were "Productive"

- MNI RUSSIA: Putin-'We See Some Progress' With The US

- MNI US DATA: 32-Year High In U.Mich Long-Term Consumer Inflation Expectations

US

MNI FED: MNI POV (Point Of View): Waiting Out Uncertainty

The FOMC will continue to exercise patience in policy setting at its March meeting, leaving the Fed funds target range on hold at 4.25-4.50% and making no changes to its formal rate guidance - as we write in our meeting preview.

- The updated quarterly economic projections will show higher inflation and weaker growth in 2025 compared with December's forecasts, in large part due to the impact of ongoing and expected future government policy shifts.

- The lack of conviction to resume the easing cycle comes in the context of significant government policy shifts posing arguably two-way risks to both the inflation and employment mandates, as well as mixed economic activity indicators and still-elevated inflation readings.

- This outlook is unlikely to result in any changes to the "Dot Plot" Fed funds rate forecast medians, which are likely to continue to show expectations for 2 rate cuts in 2025, and a further 2 in 2026.

- However, Chair Powell's press conference is likely to emphasize the uncertainty faced by the Committee as it navigates the months ahead, while also reiterating that the "current policy stance is well positioned to deal with the risks and uncertainties that we face in pursuing both sides of our dual mandate”.

NEWS

BBG: US Averts Government Shutdown as Senate Passes GOP Spending Bill

"The Senate passed a Republican spending plan, averting a US government shutdown, with Senate Democratic leader Chuck Schumer and a handful of other Democrats helping the Republican majority overcome a procedural obstacle."

BBG: Trump Launches Military Strikes on Houthi Fighters in Yemen

"President Donald Trump said he ordered military attacks against sites in Yemen controlled by the Iranian-backed Houthi militia after months of disruption to shipping lanes in the Red Sea."

MNI US-RUSSIA: Trump Says Discussions With Putin Yesterday Were "Productive"

US President Donald Trump has issued a statement on Truth Social noting that discussions with Russian President Vladimir Putin yesterday were "productive". His statement, which doesn't reveal if he had direct contact with Putin, likely refers to the meeting between Putin and Trump envoy Steve Witkoff in Moscow.

MNI RUSSIA: Putin-'We See Some Progress' With The US

State media reporting comments from Russian President Vladimir Putin regarding the prospect of peace talks and US President Donald Trump's earlier post on Truth Social. Asked on relations with the US, Putin says "We see some progress. Let's see what comes of it." Regarding Trump's request to spare the lives of allegedly encircled Ukrainian troops in the Kursk oblast of Russia, Putin says, 'In case they surrender we guarantee we will save their lives', but that 'Ukrainian authorities need to give the order to surrender'. Putin claims that Trump is 'doing everything' to restore ties with Russia'.

MNI EU-RUSSIA: Envoys Agree On Sanctions Rollover, But Hungary Gets Way w/3 Removed

Reuters reports that EU ambassadors have reached a unanimous agreement on rolling over sanctions on over 2,400 Russian individuals and entities. It also comes with the news that three individuals have been removed from the sanctions list.

MNI GERMANY: Delayed Budget Committee Meeting Could Stymie Karlsruhe-RND

As we noted shortly before the news of the CDU/CSU-SPD-Greens agreement on the debt brake reform/infrastructure fund broke (see 'GERMANY: CDU & SPD Factions To Hold Meetings Amid Efforts To Get Greens On Board', 1033GMT), the Bundestag Budget Committee's meeting today has been pushed back to 1700CET (1200ET, 1600GMT). This should allow the Committee to adopt a resolution recommendation on the amended bill that includes the details of the tripartite agreement that lawmakers will vote on next week.

MNI NETHERLANDS: PM Reaches Compromise In Warring Gov't: Abstention On ReArm Europe

Amid an intra-coalition disagreement over European Commission plans to utilise E150bln in loans for joint procurement of European-made military equipment, PM Dick Schoof has come up with the compromise that until the full details of the ReArm Europe plan are finalised, the Dutch gov't will abstain on any European Council vote related to the programme of loans.

MNI US TSYS: Rates Near Lows, Stocks Bounce Ahead Senate Budget Vote

- Treasuries look to finish near session lows amid cautious rise in risk sentiment as markets awaited Senate vote on GOP spending bill "H.R. 1968" to keep government open through September.

- Sentiment measured by UofM another matter altogether: notably lower than expected as it slid to 57.9 (cons 63.0) in the preliminary March release after 64.7 in February, for the lowest since Nov 2022. It came with a sharp climb in inflation expectations, with the 1Y surprisingly jumping to 4.9% (cons 4.3) after 4.3 and the 5-10Y jumping to 3.9% (cons 3.4) after 3.5% for a thirty-two year high.

- Jun'25 Tsy 10Y futures trade -11 at 110-19, above initial technical support at 110-12.5/110-00 (Low Mar 6 / High Feb 7). Tsy 10Y yield 4.3121% last, curves flattening late: 2s10s -1.813 at 28.876, 5s30s -3.010 at 52.774.

- Stocks bounced off yesterday's six-month lows after NY Senator Schumer (D) said he would not block the GOP spending bill in order to avoid an imminent government shutdown.

- Strong rally for the Euro, as headlines suggested Germany have found a solution to the debt brake passage. EURUSD rose from around 1.0850 to 1.0912 following the news, falling short of most recent cycle highs which reside at 1.0947.

- Fed remains in Blackout until after next Wednesday's FOMC policy annc. Monday data focus on Retail Sales, Empire Manufacturing and NAHB Housing Market Index measures.

OVERNIGHT DATA

MNI US DATA: 32-Year High In U.Mich Long-Term Consumer Inflation Expectations

- U.Mich consumer sentiment was notably lower than expected as it slid to 57.9 (cons 63.0) in the preliminary March release after 64.7 in February, for the lowest since Nov 2022.

- It came with a sharp climb in inflation expectations, with the 1Y surprisingly jumping to 4.9% (cons 4.3) after 4.3 and the 5-10Y jumping to 3.9% (cons 3.4) after 3.5% for a thirty-two year high.

- There are still clear political biases in these data, with Republican consumer expectations at 95.7 vs Democrat expectations at 28.2.

- This partisan issue was demonstrated throughout the inflation details as well, with 1Y expectations seen at 6.5% vs 0.1% for Democrats vs Republicans and 5-10Y at 4.6% vs 1.3%.

- That said, there was a notably increase in expectations for those identifying themselves as independents, with the 1Y at 4.4% after 3.7% in Feb and 3.1% in Jan, and the 5-10Y at 3.7% after 3.3% in Feb and 3.2% in Jan.

- This could be a sign that we could start seeing more distinct upward pressure in the NY Fed's consumer survey which as of February hasn’t shown anywhere near the same upward pressure.

MARKETS SNAPSHOT

Key market levels of markets in late NY trade:

DJIA up 632.7 points (1.55%) at 41444.2

S&P E-Mini Future up 105.25 points (1.9%) at 5632.75

Nasdaq up 412 points (2.4%) at 17712.92

US 10-Yr yield is up 4.4 bps at 4.3121%

US Jun 10-Yr futures are down 10.5/32 at 110-19.5

EURUSD up 0.0031 (0.29%) at 1.0883

USDJPY up 0.78 (0.53%) at 148.59

WTI Crude Oil (front-month) up $0.67 (1.01%) at $67.22

Gold is down $6.26 (-0.21%) at $2982.81

European bourses closing levels:

EuroStoxx 50 up 75.79 points (1.42%) at 5404.18

FTSE 100 up 89.77 points (1.05%) at 8632.33

German DAX up 419.68 points (1.86%) at 22986.82

French CAC 40 up 90.07 points (1.13%) at 8028.28

US TREASURY FUTURES CLOSE

3M10Y +4.542, 1.268 (L: -3.802 / H: 2.23)

2Y10Y -1.394, 29.295 (L: 28.666 / H: 34.096)

2Y30Y -2.796, 59.982 (L: 59.16 / H: 66.531)

5Y30Y -2.64, 53.144 (L: 52.677 / H: 57.633)

Current futures levels:

Jun 2-Yr futures down 4.375/32 at 103-13.25 (L: 103-12.875 / H: 103-17.625)

Jun 5-Yr futures down 9/32 at 107-21.5 (L: 107-21 / H: 107-30.5)

Jun 10-Yr futures down 10.5/32 at 110-19.5 (L: 110-19 / H: 110-31)

Jun 30-Yr futures down 15/32 at 116-22 (L: 116-13 / H: 117-07)

Jun Ultra futures down 15/32 at 122-0 (L: 121-14 / H: 122-18)

MNI US 10YR FUTURE TECHS: (M5) Support Remains Intact

- RES 4: 113-06 2.0% 10-dma envelope

- RES 3: 112-13 1.500 proj of the Jan 13 - Feb 7 - Feb 12 price swing

- RES 2: 112-01/02 High Mar 4 / 1.382 proj of Jan 13-Feb 7-12 swing

- RES 1: 111-25 High Mar 11

- PRICE: 110-23+ @ 1305 ET Mar 14

- SUP 1: 110-12+/110-00 Low Mar 6 & 13 / High Feb 7

- SUP 2: 109-30+ 50-day EMA and a key near-term support

- SUP 3: 109-13+ Low Feb 24

- SUP 4: 108-21 Low Feb 19

The trend needle in Treasury futures continues to point north and the recent shallow pullback appears corrective. A bull theme is reinforced by MA studies that are in a bull-mode condition, highlighting a dominant uptrend and positive market sentiment. Recent gains have resulted in a print above 111-22+, the Dec 3 ‘24 high. A clear breach of this level would open 112-02 and 112-13, Fibonacci projections. Firm support is at 110-00, the Feb 7 high.

SOFR FUTURES CLOSE

Mar 25 -0.008 at 95.70

Jun 25 -0.025 at 95.935

Sep 25 -0.060 at 96.150

Dec 25 -0.080 at 96.280

Red Pack (Mar 26-Dec 26) -0.09 to -0.075

Green Pack (Mar 27-Dec 27) -0.07 to -0.06

Blue Pack (Mar 28-Dec 28) -0.06 to -0.06

Gold Pack (Mar 29-Dec 29) -0.06 to -0.055

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00278 to 4.31640 (-0.00897/wk)

- 3M -0.00423 to 4.29505 (-0.00370/wk)

- 6M -0.00401 to 4.19837 (+0.01341/wk)

- 12M -0.00489 to 4.01784 (+0.02417/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.30% (-0.01), volume: $2.462T

- Broad General Collateral Rate (BGCR): 4.29% (-0.01), volume: $960B

- Tri-Party General Collateral Rate (TCR): 4.29% (-0.01), volume: $938B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $105B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $287B

FED Reverse Repo Operation

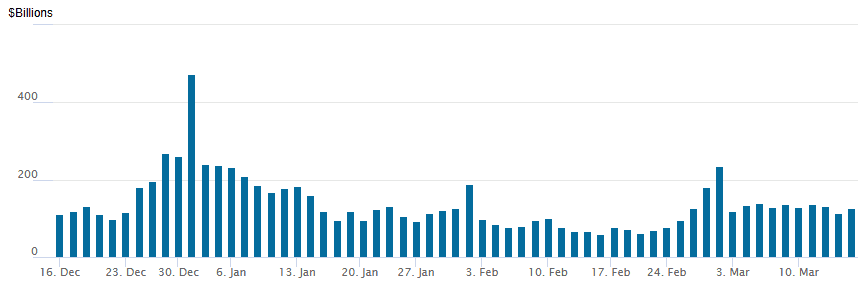

RRP usage climbs to $126.234B this afternoon from $113.435B Thursday. Compares to $58.770B (lowest level since mid-April 2021) on February 14. The number of counterparties at 29.

PIPELINE

03/14 No new corporate issuance Friday after $57.2B priced on the week

$13B Priced Thursday

03/13 $6B *World Bank 5Y SOFR+42

03/13 $2B *DBS $500M 3Y +42, $1B 3Y SOFR+60, $500M 5Y SOFR+65

03/13 $1.75B *Bank of Nova Scotia 3Y SOFR+56

03/13 $1.25B *Kommuninvest 2Y SOFR+31

03/13 $1B *OMERS Finance 5Y SOFR+65

03/13 $1B *Federal Home Loan 2Y +5.5

MNI BONDS: EGBs-GILTS CASH CLOSE: Core Curves Twist Steepen For The Week

Bunds weakened Friday, underperforming Gilts.

- A below-consensus UK GDP reading saw core FI get off on the front foot.

- Bunds led a sell-off off in early afternoon European trade after the Greens, CDU/CSU and SPD reached an agreement on proposed fiscal expansion (there was little net reaction after the German constitutional court later rejected opposition attempts to block debt brake reforms).

- However yields would close the gap, descending steadilyl for the remainder of the session headed into the cash close - no discernable trigger.

- The German curve bear steepened on the day, with the UK's shifting lower mostly in parallel (slight outperformance in the belly).

- For the week, the German curve twist steepened (2Y -6bp, 10Y +4bp); the UK's likewise but to a lesser extent (2Y -2bp, 10Y +3bp).

- OATs lagged a broader fall in periphery/semi-core spreads (in which BTPs/GGBs outperformed). Fitch is scheduled to review France's sovereign rating after hours, with some expectations of a downgrade (current rating: AA-; Outlook Negative).

- The UK dominates next week's European events calendar with both the BOE decision (likely on hold, 0bp change is priced) and labour market data due on Thursday.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.2bps at 2.185%, 5-Yr is up 1.6bps at 2.502%, 10-Yr is up 2.1bps at 2.876%, and 30-Yr is up 2.7bps at 3.202%.

- UK: The 2-Yr yield is down 1bps at 4.182%, 5-Yr is down 1.3bps at 4.287%, 10-Yr is down 1.1bps at 4.666%, and 30-Yr is down 1.2bps at 5.269%.

- Italian BTP spread down 2.5bps at 112.3bps / French OAT down 1.1bps at 69.2bps

MNI FOREX: Cross/JPY Boosted, USDMXN Trades to Four-Month Low Below 20.00

- Friday’s session was characterised by a strong rally for the Euro, as headlines suggested Germany have found a solution to the debt brake passage. EURUSD rose from around 1.0850 to 1.0912 following the news, falling short of most recent cycle highs which reside at 1.0947.

- With the associated move higher for European yields, it is the low yielding JPY and CHF which have really felt the pinch, with EURJPY and EURCHF rising 0.7% and 0.55% respectively.

- Overall, there was considerably more optimism across global markets, as major equity indices rose around 1.5% on both sides of the Atlantic. This allowed the likes of AUD and NZD to outperform G10 peers. UK economic data out this morning surprised to the downside, with GDP surprisingly contracting in January while industrial and manufacturing production data came in well below forecast. GBP is notably softer as a result.

- Rengo pay tallies in Japan have again proved market moving - while unions are set to demand a faster pace of pay rises this year (5.46% from 5.28%), the final demand may turn out lower than many surveys had estimated - undermining the JPY. The firmer risk sentiment has seen the likes of AUDJPY and NZDJPY surge over 1%, entirely reversing yesterday’s misfortunes.

- Following the breach of key support on Thursday around 20.13, USDMXN has continued to grind lower during today’s session, and the clean break highlights the growing potential for a stronger reversal lower. The pair is 1% lower on the session as we approach the close, trading at the lowest level for four months, around 19.88. Below here, attention turns to the lows seen in the aftermath of the election results at 19.7618, while resistance moves down to 20.3851, the 50-day EMA.

- Activity data in China is scheduled on Monday’s, before US retail sales headlines the economic data calendar. Next week, will see a plethora of central bank decisions, including the Fed and BOJ.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 17/03/2025 | 0900/1000 | ** | Italy Final HICP | |

| 17/03/2025 | 1215/0815 | ** | CMHC Housing Starts | |

| 17/03/2025 | 1230/0830 | * | International Canadian Transaction in Securities | |

| 17/03/2025 | 1230/0830 | *** | Retail Sales | |

| 17/03/2025 | 1230/0830 | ** | Empire State Manufacturing Survey | |

| 17/03/2025 | 1300/0900 | * | CREA Existing Home Sales | |

| 17/03/2025 | 1400/1000 | * | Business Inventories | |

| 17/03/2025 | 1400/1000 | ** | NAHB Home Builder Index | |

| 17/03/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 17/03/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 18/03/2025 | - | Bank of Japan Meeting | ||

| 17/03/2025 | - | FOMC Meetings with S.E.P. |