- MNI Fed Preview - May 2023: Analyst Outlook

- MNI INTERVIEW: Fed Must Do More Or Accept Long Path To 2%-ISM

- MNI FED WATCH: May Hike Brings Tightening Cycle Closer To End

- US: Volatile Prices Highlight ISM Surprise, With Activity Mixed

US

FED: A 25bp hike in May could mark the end of the Fed’s hiking cycle. With rates above 5%, and sticky inflation fears offset by the tightening effect of banking sector woes, the FOMC is likely to move to a meeting-by-meeting policy beyond May, while retaining a bias toward further policy firming.

- But with widespread expectations that the Fed will change its forward rate guidance to hint at an end to the hiking cycle, or even opening the door to cuts, there is a hawkish risk that guidance is left unchanged.

- There is a case for the Fed to pause at this meeting, but that would be likely to signal panic about the underlying health of the banking sector.

US: The Fed must keep raising interest rates to put inflation on track to meet its 2% target within a reasonable timeframe or accept a much longer path to its goal that could include stagnation in the manufacturing sector, according to Timothy Fiore of the Institute for Supply Management.

- "If they want this to go on for three or four years then they can continue what they are doing. If they want to get this over with inside of two years, then you've probably got to step it up," Fiore said of inflation reaching the Fed's 2% target. "It depends on their timing."

- Fiore, chair of the ISM Manufacturing Business Survey Committee, said this may not be positive for manufacturers. "This almost supports a stagnation prediction with prices growing and demand declining." Fed officials are signaling one more rate rise this week to a range of 5% to 5.25%, the highest since 2007. For more see MNI Policy main wire at 1308ET.

- Former U.S. central bank officials told MNI the FOMC could well retain a tightening bias even if the May hike is the committee's last, in a signal that officials are committed to holding borrowing costs high for some time barring a major financial crisis. Officials won't hesitate to restart them later in the year either if needed.

- Where futures traders are pricing in 50 bps in cuts by December, the FOMC is unlikely to pivot even if a recession takes hold this year because inflation remains persistently high, the former officials said.

- Policymakers are gauging the possible drag on credit from the recent bank sector stress, but the full extent of the fallout won't be known for months. The economy does appear to be slowing. First-quarter GDP cooled to 1.1%, below Wall Street expectations, and manufacturing surveys and consumer spending have been soft in April. For more see MNI Policy main wire at 1341ET.

- The biggest surprise - and driving the hawkish rates move - is the 4 point rise in Prices Paid to 53.2 (highest since July 2022), vs expectations for 49.0.

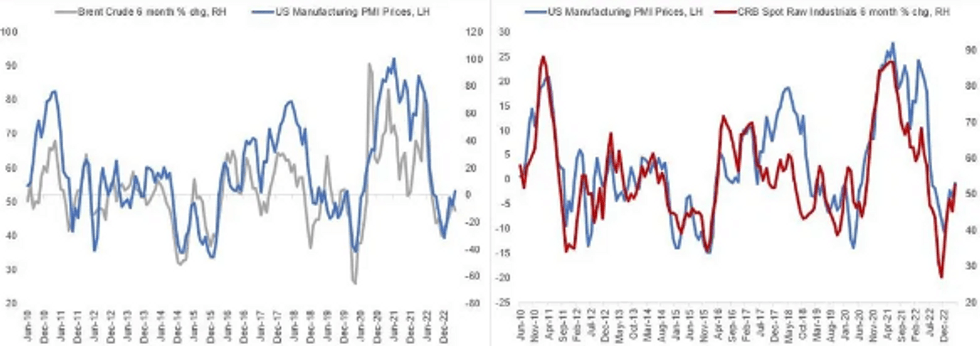

- We'd caution this is a volatile series that tends to track commodity prices as much as anything - so while important, it partly reflects a bounce from the sharp drop in commodity prices last year (Prices Paid bottomed at 39.4 in Dec when the 6-month % change in raw industrials and oil prices were dropping double digits - see chart). Though clearly, we're past the lows.

- It's still a weak overall figure, with the 5th consecutive month below the 48.7 mark that the ISM sees denoting overall economic contraction.

- Looking at activity, it's mixed. Employment went into expansionary territory for the first time since January (50.2, up from 46.9 prior). And new orders, while contractionary (45.7), has steadied out from January's lows, and production picked up for the 2nd consecutive month to 48.9. Backlogs and inventories fell further.

US TSYS: Curves Off Deeper Inversion

- Intermediate to long-end Treasury futures continue to gradually extend session lows, while yield curves bounce off deeper inversion after midday 2Y futures Block buy: 2s10s currently +1.978 at -56.670 vs. -64.490 low.

- This morning's data underscores a likely 25bp rate hike from the FOMC on Wednesday: April ISM Prices Paid climbs to 53.2, well over expected 49.0; S&P manufacturing PMI came out slightly lower than expected: 50.2 vs. 50.4 est, but gaining nonetheless vs. 49.2 in March.

- We'd caution this is a volatile series that tends to track commodity prices as much as anything - so while important, it partly reflects a bounce from the sharp drop in commodity prices last year (Prices Paid bottomed at 39.4 in Dec when the 6-month % change in raw industrials and oil prices were dropping double digits - see chart). Though clearly, we're past the lows.

- Otherwise, US markets remain generally quiet, light volumes with much of Europe out for May Day bank holiday, TYM3 just over 750k at the moment.

OVERNIGHT DATA

- US ISM APR MANUF PURCHASING MANAGERS INDEX 47.1

- US ISM APR MANUF PRICES PAID INDEX 53.2

- US ISM APR MANUF NEW ORDERS INDEX 45.7

- US ISM APR MANUF EMPLOYMENT INDEX 50.2

- US ISM APR MANUF PRODUCTION INDEX 48.9

- US ISM APR MANUF SUPPLIER DELIVERY INDEX 44.6

- US MAR CONSTRUCT SPENDING +0.3%

- US MAR PRIVATE CONSTRUCT SPENDING +0.3%

- US MAR PUBLIC CONSTRUCT SPENDING +0.2%

- US APR S&P MANUF PMI 50.2 (FLASH 50.4); MAR 49.2

MARKETS SNAPSHOT

- DJIA down 22.77 points (-0.07%) at 34074.17

- S&P E-Mini Future up 0.5 points (0.01%) at 4188.5

- Nasdaq down 16.1 points (-0.1%) at 12209.61

- US 10-Yr yield is up 14.8 bps at 3.57%

- US Jun 10-Yr futures are down 22/32 at 114-16.5

- EURUSD down 0.0049 (-0.44%) at 1.097

- USDJPY up 1.17 (0.86%) at 137.47

- WTI Crude Oil (front-month) down $1.06 (-1.38%) at $75.71

- Gold is down $7.78 (-0.39%) at $1982.18

US TREASURY FUTURES CLOSE

- 3M10Y +20.841, -145.168 (L: -167.594 / H: -144.526)

- 2Y10Y +2.201, -56.447 (L: -64.49 / H: -56.21)

- 2Y30Y +1.33, -32.186 (L: -40.728 / H: -31.784)

- 5Y30Y -0.374, 18.335 (L: 14.334 / H: 19.08)

- Current futures levels:

- Jun 2-Yr futures down 4.375/32 at 102-30.25 (L: 102-28.375 / H: 103-05.875)

- Jun 5-Yr futures down 12.5/32 at 109-11.25 (L: 109-10.5 / H: 109-30.5)

- Jun 10-Yr futures down 22/32 at 114-16.5 (L: 114-16 / H: 115-13.5)

- Jun 30-Yr futures down 1-30/32 at 129-23 (L: 129-20 / H: 131-26)

- Jun Ultra futures down 3-01/32 at 138-12 (L: 138-09 / H: 141-15)

US 10Y FUTURE TECHS: (M3) Bullish Outlook

- RES 4: 117-01+ High Mar 24 and bull trigger

- RES 3: 116-30 High Apr 5 / 6

- RES 2: 116-08 High Apr 12

- RES 1: 115-08+/30+ Intraday high / High Apr 26

- PRICE: 114-22 @ 1240ET May 1

- SUP 1: 114-18+/17+ 50-day EMA / Intraday low

- SUP 2: 113-30+ Low Apr 19 and key short-term support

- SUP 3: 113-23 50.0% retracement of the Mar 3 - 24 bull run

- SUP 4: 113-08+ Low Mar 15

Treasury futures maintain a bullish tone despite the recent pullback. The recovery on last Tuesday undermines a recent bearish theme and support at the 50-day EMA remains intact. The average intersects at 114-18+. A stronger resumption of gains would open 116-08, the Apr 12 high and expose the key resistance at 117-01+, the Mar 24 high. Key support is at 113-30+, the Apr 19 low. A break would reinstate the recent bearish theme.

SOFR FUTURES CLOSE

- Jun 23 -0.035 at 94.880

- Sep 23 -0.055 at 95.10

- Dec 23 -0.080 at 95.470

- Mar 24 -0.090 at 95.960

- Red Pack (Jun 24-Mar 25) -0.09 to -0.085

- Green Pack (Jun 25-Mar 26) -0.095 to -0.085

- Blue Pack (Jun 26-Mar 27) -0.12 to -0.10

- Gold Pack (Jun 27-Mar 28) -0.125 to -0.12

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01517 to 5.03387 (+.04818 total last wk)

- 3M +0.00797 to 5.08929 (+.01357 total last wk)

- 6M +0.00931 to 5.08888 (-.00877 total last wk)

- 12M +0.01696 to 4.82604 (-.07339 total last wk)

- Daily Effective Fed Funds Rate: 4.83% volume: $113B

- Daily Overnight Bank Funding Rate: 4.81% volume: $259B

- Secured Overnight Financing Rate (SOFR): 4.81%, $1.378T

- Broad General Collateral Rate (BGCR): 4.79%, $541B

- Tri-Party General Collateral Rate (TGCR): 4.79%, $530B

- (rate, volume levels reflect prior session)

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls back to $2,239.866B w/ 103 counterparties, compares to prior $2,325.479B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

FOREX: EURJPY Prints 150.96 High, Highest Since 2008

- Moves in currency markets on Monday continue to be dominated by the Japanese Yen, comfortably the weakest performer in G10 since Friday’s BoJ Monetary Policy decision. EURJPY has extended its recent rally above the 150.00 handle with the early 150.03 session low confirming the pivot significance.

- Bear flattening in the US treasury curve, aided by some firmer US ISM data (particularly the prices paid component) is providing a positive backdrop for cross/yen and with it, EURJPY continues to register at the highest levels since 2008 after breaking above the 2014 highs last week.

- Price action has confirmed a resumption of the technical uptrend and cancels recent short-term bearish threats. The move higher signals scope for a climb towards 151.00 and 152.00, the 1.382 Fibonacci projection of the Mar 20 - 21 - Apr 6 price swing. Moving average studies remain in a bull mode position, highlighting the uptrend.

- The USD index has held a moderate upward bias on Monday, rising 0.34% as of writing and underpinned by the only notable data point on Monday. For USDJPY, 137 capped the topside for much of the session, however, price has since reached a fresh high of 137.26, further paving the way for 137.91, the Mar 8 high and a key resistance.

- The Australian dollar is the strongest performer on Monday, with a notable 1.2% advance for AUDJPY, rising to the best levels since March 7 just above the 91.00 handle. This comes in the face off some weaker China PMI data overnight, which in turn has weighed on the offshore Yuan, down 0.4% against the USD.

- Central banks in focus this week with the RBA meeting kicking the week off on Tuesday. Attention then inevitably turns to Wednesday’s FOMC decision and the ECB on Thursday, before the US employment data to finish the week.

PIPELINE: $8.5B META Platforms 5Pt, $5B Comcast 4Pt Launced

Total of $21.55B corporate bonds to price Monday, Meta and Comcast leading:

- Date $MM Issuer (Priced *, Launch #)

- 05/01 $8.5B #Meta Platforms $1.5B 5Y +95, $1B 7Y +120, $1.75B 10Y +135, $2.5B 30Y +177, $1.75B 40Y +192

- 05/01 $5B #Comcast $1B 5Y +95, $1B 10Y +125, $1.6B 30Y +155, $1.4B 41Y +170

- 05/01 $3.25B #HCA Inc $1B 5Y +160, $1.25B 10Y +193, $1B 30Y +233

- 05/01 $1.75B #Georgia Power $750M 5Y +105, $1B 10Y +140

- 05/01 $800M #Northern States Power 30Y +135

- 05/01 $750M Hershey WNG, 5Y +70, 10Y +100

- 05/01 $750M #Avalon Holdings 5Y +300

- 05/01 $750M #Tractor Supply 10Y +175

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/05/2023 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 02/05/2023 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 02/05/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 02/05/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 02/05/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0800/1000 | ** |  | EU | M3 |

| 02/05/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 02/05/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 02/05/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 02/05/2023 | 1000/1200 | ** |  | IT | PPI |

| 02/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 02/05/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 02/05/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 02/05/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 02/05/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 02/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 03/05/2023 | 2245/1045 | *** |  | NZ | Quarterly Labor market data |

| 03/05/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |