-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Real Ylds Up Vs Nominals

US TSYS: Real Yields Climb Vs. Nominals

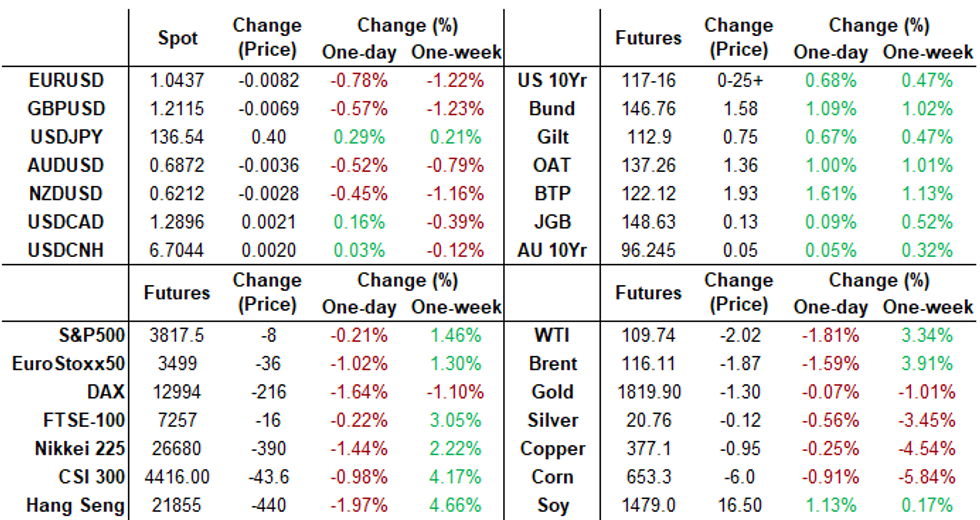

Rates trading near top end of the range after the bell, whippy first half trade gave way to better buying in the long end into midday - bonds trading sideways through the second half, USU2 +1-21 at 136-26. Despite the drop in nominal US yields, real yields sit at 69bps, up more than 10bps since early Monday levels and the highest since Mar-2019. Yield curves mixed after the bell, 2s10s -1.605 at 4.183, well off early 7.177 early high, 5s30s +1.365 at 5.776.

- Early domestic and foreign data in play. Rates gapped higher overnight following much weaker than expected German CPI for North Rhine (0.1% MoM; EST 0.9%; 7.5% YoY; EST 8.1%), blipped higher after prelim German CPI gained less than anticipated (+0.1% MoM vs. +0.4%).

- Tsys resumed march higher after Q1 GDP declines slightly more than expected (-1.6% vs. -1.5% est).

- Fed Chair Powell at ECB forum in Sintra: Hard to hike rates "without a hit to growth" or boosting unemployment. “There’s no guarantee that we can do that,” Powell said. “It’s something that’s going to be quite challenging.” The Fed raised rates by 75 basis points this month and has signaled substantial further increases to come.

- Cross asset: US$ extended on Tuesday’s bounce and the USD index has comfortably breached last week’s highs, rising a half a percent on the day.

- Crude oil prices are ending a three-session rally by sliding circa 2% despite US crude inventories falling by more than expected in EIA data, as growth concerns mount with Treasuries rallying solidly.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00057 to 1.57029% (-0.00585/wk)

- 1M +0.04700 to 1.71314% (+0.08043/wk)

- 3M +0.02671 to 2.27714% (+0.04271/wk) * / **

- 6M +0.06985 to 2.94671% (+.08014/wk)

- 12M +0.00628 to 3.61357% (+0.06886/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.27714% on 6/29/22

- Daily Effective Fed Funds Rate: 1.58% volume: $95B

- Daily Overnight Bank Funding Rate: 1.57% volume: $247B

- Secured Overnight Financing Rate (SOFR): 1.52%, $929B

- Broad General Collateral Rate (BGCR): 1.51%, $352B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $338B

- (rate, volume levels reflect prior session)

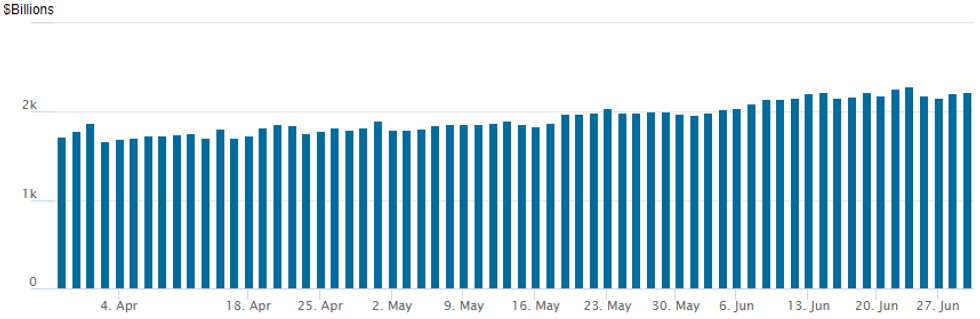

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,226.976B w/ 98 counterparties vs. $2,213.784B prior session. Compares to record high of $2,285.428B from Thursday June 23.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Midweek FI option volume continued to thin in the lead-up to the extended 4th of July holiday weekend (early 1300ET close Friday, Monday closed). Carry-over interest in downside puts continued (with one notable exception in SOFR options) fading the rally in underlying futures on the day.- Salient Eurodollar trade included buy of over 50,000 Dec 96.00/96.50 put spds at 26.0, while paper paid 12.5 for +5,000 short Aug 95.87/96.37 put spds around midday.

- Treasury options included carry-over buy of 8,500 TYQ 113/114 put spds, 4 vs 117-11 adding to +10,000 bought Tuesday, while Block buy of 7,500 USU2 137 puts, 303 vs. 136-24/0.50%.

- SOFR options upside insurance trade had paper buy 10,000 SFRZ2 97.50/97.75 call spds, 3.0 vs. 96.65/0.05%.

- Block, total 10,000 SFRZ2 97.50/97.75 call spds, 3.0 vs. 96.65/0.05%

- Block, 1,500 SFRQ2 97.12/97.25/97.50 call trees, 0.5

- 50,000 (10k Blocked) Dec 96.00/96.50 put spds, 26.0

- +5,000 short Aug 95.87/96.37 put spds, 12.5

- 6,000 Jul 95.75/96.25 put spds

- 3,000 Red Sep'23 100.12 calls, 1.5

- 3,000 Red Sep'23 100.25 calls, 2.0

- 3,000 Jun'23 100.12 calls, 1.5

- +8,500 TYQ 113/114 put spds, 4 vs 117-11 adds to +10k Tue

- Block, 7,500 USU2 137 puts, 303 vs. 136-24/0.50%

- +15,000 TYU 120/121 call spds, 1

- 2,000 TYU 114/115 put spds,

- 10,000 wk2 TY 113/114 put spds

EGBs-GILTS CASH CLOSE: Bobls Soar Amid Low German CPI And Risk-Off Move

Mixed Eurozone inflation readings ultimately resolved in a bullish outcome for Bunds Wednesday, boosted by equity weakness. Periphery EGB spreads tightened.

- Spanish June CPI unexpectedly hit a record high, but conversely, German inflation data came in much softer than expected (due in part to one-off factors).

- Ultimately the weak German inflation data translated into a strong close for core EGBs, with Bobl outperforming on the curve.

- Among much ECB speak (incl an MNI interview with Lithuania's Simkus), Lagarde said she was eyeing Friday's eurozone CPI data.

- Gilts outperformed with some bull steepening; contributing was incoming BoE MPC member Dhingra's comments that she eyed a "gradual approach" to tightening.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 11.9bps at 0.838%, 5-Yr is down 15bps at 1.283%, 10-Yr is down 10.9bps at 1.519%, and 30-Yr is down 9bps at 1.738%.

- UK: The 2-Yr yield is down 7.5bps at 2.041%, 5-Yr is down 6.7bps at 2.075%, 10-Yr is down 8bps at 2.385%, and 30-Yr is down 4.3bps at 2.669%.

- Italian BTP spread down 5bps at 188.2bps / Spanish down 2.5bps at 107.2bps

EGB Options: More Euribor Put Spread Buying Wednesday

Wednesday's Europe rates / bond options flow included:

- RXQ2 151.50/152.00cs, bought for 7 in 4k

- 0RU2 97.75/97.375/97.25 broken p fly, bought for 10.75 in 10k

- ERU2 99.625/99.375 ps, bought for 13.75 in 8k (50k in the past 2 weeks, buying back the bottom leg of condor)

- ERV2 98.00/97.75ps sold at 2.5

- ERZ2 98.50/98.25ps, bought for 7.25 in 4k

FOREX: Renewed USD Strength Picks Up Momentum, Fresh Cycle Highs For USDJPY

- The greenback extended on Tuesday’s bounce and the USD index has comfortably breached last week’s highs, rising a half a percent on the day.

- Despite the drop in nominal US yields, real yields sit at 69bps, up more than 10bps since early Monday levels and the highest since Mar-2019 when excluding the fervour just before and after the June FOMC, supporting the dollar in the process.

- Greenback gains were initially most evident against the Japanese Yen as USDJPY printed fresh cycle highs and in the process printed at the best levels since 1998. Despite being 50 pips off best levels of 137.00, the overall move resumes the primary uptrend and maintains the sequence of higher highs and higher lows.

- The focus shifts to 137.30, the 1.50 proj of the Feb 24 - Mar 28 - 31 price swing. Markets will remain on watch for any signs of overbought conditions, but with the RSI still sub-70 there's little sign the pair is running out of momentum at current levels.

- Early inflation data from Europe saw prompted EUR/USD to erase overnight losses to trade just above the 1.05 handle once more, but stopping short of the 1.0536 Asia session highs. This bounce met firm supply, with the pair then grinding consistently lower through the rest of the trading day and remains tied to the lows around 1.0445. Moving average studies still point south and further weakness would refocus attention on 1.0350, May 13 low and the bear trigger.

- It is also worth noting that EURCHF (-1.01%) is back below parity and has breached the YTD lows posted in March through 0.9972, the key support level. CHF strength follows the continued baking-in of rate hike expectations at the SNB, with SARON markets indicating expectations of further 50bps rate rises at both the September and December policy meetings. This would put year-end rates at +0.75%.

- Thursday brings the French flash inflation estimates for June, and euro area unemployment and German retail sales data for May. Chinese Manufacturing and Non-manufacturing PMI data is also due overnight. Core PCE Price Index data headlines the US docket before the release of the MNI Chicago Business Barometer.

FX: Expiries for Jun30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0400(E503mln), $1.0500(E619mln), $1.0550-60(E1.2bln), $1.0750-75(E1.2bln)

- EUR/GBP: Gbp0.8650(E702mln)

- USD/CAD: C$1.2750($1.5bln), C$1.3000($585mln)

- USD/CNY: Cny6.6700($1.6bln), Cny6.70($515mln), Cny6.7500($608mln), Cny6.8000($1.4bln)

Late Equity Roundup: Month End Approaching

Market depth has been fairly thin, whippy price action could be due to approaching month/half-year end portfolio repositioning interest - stay alert.- Major indexes continue to see-saw in narrow range in late FI trade, managing to hold modest gains w/Dow outperforming at the moment: DJIA +143.25 (0.46%) at 31087.97; Nasdaq +1.3 (0%) at 11182.2 while SPX eminis trading +2.5 (0.07%) at 3828.

- SPX leading/lagging sectors: Health Care sector continues to outperform (+1.65%) lead by equipment mfgs, pharmaceuticals and biotech; Consumer Staples (+0.75%) and Information Technology (+0.41%) follow. Laggers: After making strong gains Mon-Tue, Energy sector retraces with Crude reversing course (-2.75%), Exxon, Chevron, Conoco Phillips, Occidental all weaker. Followed by Real Estate (-1.05%), Materials (-0.70%) and Industrials (-0.54%).

- Dow Industrials Leaders/Laggers: United Health Group (UNH) outperforming +9.69 at 518.13, Goldman Sachs (GS) +5.98 at 305.47, Home depot (HD) +5.91 at 276.06, McDonalds (MCD) +5.91 at 248.74. Laggers: Caterpillar (CAT) -3.74 at 183.70, American Express AXP) -2.88 at 139.31 and Chevron (CVX) -2.24 at 147.70.

E-MINI S&P (U2): Corrective Cycle Remains In Play

- RES 4: 4308.50 High Apr 28

- RES 3: 4204.75 High May 31 and a key resistance

- RES 2: 4028.87 50-day EMA

- RES 1: 3950.00 High Jun 27

- PRICE: 3818.50 @ 1330ET June 29

- SUP 1: 3735.00/3639.00 Low Jun 23 / 17 and the bear trigger

- SUP 2: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

- SUP 3: 3500.00 Round number support

- SUP 4: 3384.75 0.764 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis maintains a positive short-term tone despite yesterday’s move lower. The contract traded higher last Friday to confirm an extension of the current bullish cycle. Price traded above the 20-day EMA and this opens the 50-day EMA, currently at 4028.87. The primary trend direction remains down though and a reversal lower would signal the end of the correction. This would also refocus attention on the bear trigger at 3639.00, the Jun 17 low.

COMMODITIES: Crude Oil Slides On Softer Growth Expectations

- Crude oil prices are ending a three-session rally by sliding circa 2% despite US crude inventories falling by more than expected in EIA data, as growth concerns mount with Treasuries rallying solidly.

- The White House has welcomed a major change in attitude from OPEC+ according to energy adviser Hochstein and is in talks with OPEC nations that have capacity whilst possibly reassessing more SPR releases after October. OPEC+ is expected to confirm an already agreed supply increase of 648k bpd in output for August.

- WTI is -2.1% at $109.39, holding onto a further dip just prior to settlement. Unwinding recent gains, it moves back closer to support at $105.6 (Jun 27 low).

- Brent is -1.9% at $115.75, moving closer to support at $111.26 (Jun 27 low) off an intraday high of $120.41.

- Gold is -0.1% at $1818.38, with the yellow metal in consolidation mode and moving closer to initial support at $1805.2 (Jun 14 low), clearance of which could open a bear trigger at $1787.0 (May 16 low).

- Elsewhere, Uniper SE has withdrawn its outlook for the year and is in bailout talks with the German government after Gazprom has curbed gas deliveries, being Germany’s top buyer of Russia gas.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/06/2022 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 30/06/2022 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 30/06/2022 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 30/06/2022 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 30/06/2022 | 0630/0830 | ** |  | CH | retail sales |

| 30/06/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/06/2022 | 0645/0845 | ** |  | FR | PPI |

| 30/06/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 30/06/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/06/2022 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 30/06/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 30/06/2022 | 0900/1100 | ** |  | EU | Unemployment |

| 30/06/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 30/06/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 30/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/06/2022 | 1330/1530 |  | EU | ECB Lagarde Speech at Simone Veil Pact | |

| 30/06/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 30/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 30/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 30/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/06/2022 | 1600/1200 | *** |  | US | USDA Acreage - NASS |

| 30/06/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.