EXECUTIVE SUMMARY

- MNI FedSpeak Takes Decidedly Hawkish Turn This Week

- MNI ISRAEL: Hamas 'Ready For Ceasefire', 'Waiting For Trump To Pressure Israel'

- MNI US DATA: Solid Retail Revisions And Auto Sales, But Soft Control Group

- MNI US DATA: Empire State Soars, Internals Solid

US

MNI FedSpeak Takes Decidedly Hawkish Turn This Week

FOMC speakers this week generally adopted a more cautious tone on rate cuts than expected. Most of the key commentary was delivered after Wednesday's CPI release, which while bringing below-expected sequential Core and Supercore data, combined with the PPI data Thursday to point to an acceleration in core PCE (albeit modest, to closer to 0.30% vs 0.25% in September).

- The "cumulative effect" of hawkish Fedspeak and the slight upside in core PCE from CPI/PPI (with a helping hand from solid initial jobless claims among other data) saw a significant shift in rate cut pricing. The December meeting appears to be "live", nearing 50/50 implied probability of a hold at one point Friday morning, versus closer to 20% at the start of the week. Cumulative pricing through end-2025 pared 8bp from the path this week: now 74bp of cuts is seen, vs 82bp prior. And there's now less than one full 25bp cut seen through the next two meetings (23bp total by the January FOMC).

- There were two major shifts in FOMC tone this week: one is that the very word "pause" was introduced as a possibility by a senior FOMC member and erstwhile dove (Kugler); the other is that there is growing concern over the implications of longer-end rates. We go into both shifts in detail in the following notes.

- Neutral rate-talk also dominated, and in a hawkish direction. We get the sense that last week's FOMC discussion included some estimates of the neutral rate (note the stir created by Dallas Fed's Logan yesterday over perhaps already having reached neutral), as well as starting to talk about the circumstances for slowing or ending the rate cut cycle (Powell at the press conference: "we reach a point where we slow the pace...it's something that we're just beginning to think about".)

- It's probably still the case that they are still in the early stages (we would characterize this in Fed parlance as "thinking about thinking about slowing rate cuts"), which means a December cut is the default.

- But some of the groundwork for a less dovish rate cut path appears to have been laid since the US election (the potentially hawkish implications of which, FOMC members didn't venture into).

| Meeting | Current FF Implieds (%), LH | Cumulative Change From Current Rate (bp) | Incremental Chg (bp) | End Of Last Week (Nov 08) | Chg Since Then (bp) |

| Dec 18 2024 | 4.43 | -15.3 | -15.4 | 4.41 | 1.4 |

| Jan 29 2025 | 4.35 | -22.8 | -7.5 | 4.32 | 2.9 |

| Mar 19 2025 | 4.21 | -37.1 | -14.3 | 4.17 | 3.5 |

| May 07 2025 | 4.13 | -45.0 | -7.9 | 4.09 | 3.6 |

| Jun 18 2025 | 4.02 | -55.8 | -10.8 | 3.98 | 4.5 |

| Jul 30 2025 | 3.96 | -62.3 | -6.5 | 3.91 | 4.4 |

| Sep 17 2025 | 3.90 | -68.0 | -5.7 | 3.85 | 5.2 |

| Oct 29 2025 | 3.87 | -71.5 | -3.5 | 3.81 | 6.0 |

| Dec 10 2025 | 3.84 | -74.4 | -2.9 | 3.77 | 6.7 |

NEWS

MNI BRIEF: Trade War To Increase Volatility Inflation -Panetta

An escalation in trade barriers between blocs would increase the volatility of output and inflation in world economies and trigger severe losses in efficiency and welfare, Bank of Italy Governor Fabio Panetta said on Friday. “Protectionism would not be as protective as it might seem, as blunt policies would inevitably be circumvented,” Panetta said, without mentioning U.S. President-elect Donald Trump's trade policy, and adding that bilateral restrictions would be channel products through third countries, increasing costs and reducing transparency.

MNI WHITE HOUSE: WSJ-Trump Considers Fox's Kudlow For Economic Policy Role

The Wall Street Journal reports that President-Elect Donald Trump is considering Fox Business host Larry Kudlow for a senior economic policy role according to people familiar with the matter. WSJ: "Kudlow met with Trump at Mar-a-Lago...late this week, the people said. Trump’s advisers see Kudlow as a contender to lead the National Economic Council and possibly the Treasury Department. [...] Kudlow, 77, served as NEC director for nearly three years, remaining in the role until the end of Trump’s time in office. He has kept in regular touch with Trump."

MNI EU-RUSSIA: Germany's Scholz Holds Call w/Putin-SZ

Germany's Suddeutsche Zeitung reports that Chancellor Olaf Scholz has held a phone call with Russian President Vladimir Putin. The call, believed to have lasted around an hour, is the first between the German and Russian leaders in nearly two years. Bloomberg reported a short time ago that the call was scheduled to take place today. Bloomberg: "The conversation comes at a critical time for Ukraine as the country braces for the third winter under attack from Russia, with large parts of the country’s energy infrastructure damaged or destroyed. Uncertainty over support from Western allies has also been growing ahead of Donald Trump’s return to the White House next year."

MNI ISRAEL: Hamas 'Ready For Ceasefire', 'Waiting For Trump To Pressure Israel'

Saudi-based Arab News posts on X: "Hamas says they are ready for a ceasefire and we are waiting for Trump to pressure Israel". These comments come a day after Hamas official Dr Basem Naim told Sky News that "Hamas says it is ready to secure a Gaza ceasefire deal "immediately" but claims it has not had any "serious proposals" from Israel in months."

MNI MIDEAST: Axios-Israel Strikes On Iran In Oct Destroyed Active Nuke Research Site

Axios reports that according to US and Israeli officials, the 25 October Israeli strikes on Iran destroyed an active nuclear weapons research facility. The Israeli strikes, in retaliation to an earlier Iranian missile barrage against Israel, were initially seen to be at the low-escalation end of the spectrum, targeting military sites. Indeed, the Taleghan 2 site at Parchin was according to previous reports believed to be inactive. However, the Axios story claims that "Israeli and U.S. intelligence began detecting research activity at Parchin earlier this year, including Iranian scientists conducting computer modeling, metallurgy and explosive research that could be used for nuclear weapons."

US TSYS

MNI US TSYS: Tsys Support Eases After Chicago Fed Goolsbee Bbg Comments

- Treasury futures drifted off late session highs Friday, curves maintaining steeper profiles (2s10s +4.081 at 12.718; 5s30s +4.585 at 30.552) as short end rates outpace long Bonds.

- Tsy Dec'24 10Y futures tapped 109-23.5 (+6) high, neared initial technical resistance above at 109-30.5/110-17.5 (High Nov 13 / 20-day EMA) before slipping to 109-14.5 at the moment. 10Y yield down to 4.4335% after climbing to 4.5007% high earlier, the first time above 4.5% since May 31 this morning.

- Fast two-way trade as Treasury futures see-sawed lower after higher than expected Retail Sales for October and up-revisions for prior. Meanwhile, import/export price indexes come out higher than expected, while Empire Mfg jumps to late 2021 levels.

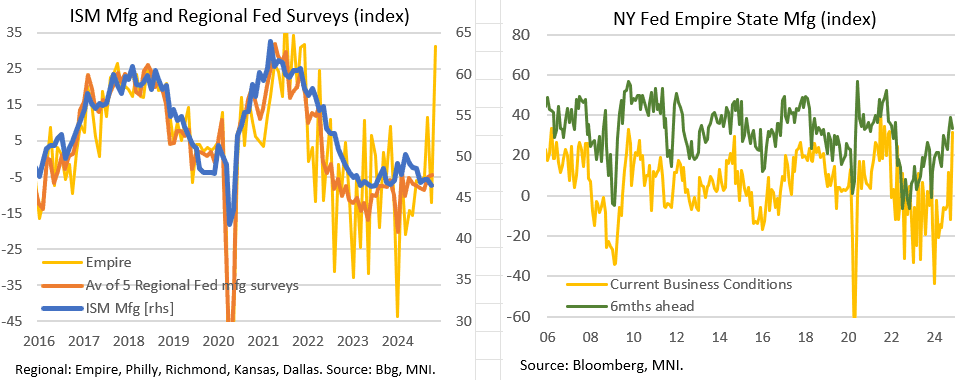

- The Empire data had very strong internals: new orders soared 38 points to 28.0, with shipments up 35 points to 32.5. Labor market conditions were "stable" (number of employees edging down, average workweek edging up). This is a figure consistent witan ISM Manufacturing survey above 60, though of course that seems unlikely given it's recently been stuck in contractionary (<50) territory.

- Treasury support eased after Chicago Fed Goolsbee said on Bbg TV that the "Fed may slow" the "pace of rate cuts as it nears neutral" and if the "current rate of inflation extended, it's too high". Next up: Richmond Fed Barkin is expected on Yahoo Finance at 1500ET.

OVERNIGHT DATA

MNI US DATA: Empire State Soars, Internals Solid

October's Empire State manufacturing survey was extraordinarily strong, printing 31.2 vs 0.0 expected and -11.9 prior.

- That reading is the highest since December 2021, and had very strong internals: new orders soared 38 poinst to 28.0, with shipments up 35 points to 32.5. Labor market conditions were "stable" (number of employees edging down, average workweek edging up). This is a figure consistent witan ISM Manufacturing survey above 60, though of course that seems unlikely given it's recently been stuck in contractionary (<50) territory.

- Survey responses were collected between November 4 and November 12 - it's unclear whether the index result is a reflection of the election results (which were known by Nov 6) somehow upwardly impacted the survey responses but there's no evidence of that having happened for previous November surveys.

- Price increases were "steady and modest" per the report, with prices paid at 27.8 (29.0 prior) and received at 12.4 (12.8 prior).

- As for the outlook, "Firms remained optimistic that conditions would continue to improve in the months ahead. After reaching a multi-year high last month, the index

for future business activity edged down six points to a still-high reading of 33.2, with half of respondents expecting conditions to improve over the next six months. Employment is expected to grow moderately. Capital spending plans continued to expand."

MNI US DATA: Solid Retail Revisions And Auto Sales, But Soft Control Group

Retail sales started Q4 on a stronger footing than expected, with revisions pointing to solid consumption dynamics. But growth was largely driven in October by auto sales, and a slightly soft sequential Control Group (GDP Input) reading and weak breadth of growth across categories took the sheen off the report.

- Headline retail sales accelerated unexpectedly to 0.4% M/M (vs 0.3% expected), with the beat even more impressive due to the prior month being revised up (to 0.8% M/M vs 0.4% initial). Ex-Auto/Gas sales were a little softer on the month than per survey, but that's after large upward revisions to prior too (0.1% vs 0.3% expected, but prior 1.2% vs 0.7% initial).

- However a weaker than expected sequential Control Group reading of -0.1% M/M (0.3% expected) takes the sheen off slightly, even if prior was revised up to 1.2% from 0.7% initial. It suggests a more solid Q3 than previously expected, with higher levels of activity going into Q4 - though likewise that could hurt the sequential growth comparison for the Q4 data. 3M/3M annualized control group was a very solid 4.6% in October, though that's a deceleration from 5.7% in October (ie Q3) - that could prove slightly diminished given higher-than-expected CPI in October as well (retail sales are reported nominally).

- Category-by-category, breadth in retail activity was not strong: motor vehicles/parts - the largest category of retail sales - accelerated as had been expected, up 1.6% vs 0.2% prior. Electronics stores were the only other category to accelerate from September. Multiple categories saw contraction, including furniture, department stores, clothing, sporting goods,health/personal care, and miscellaneous store retailers.

- That could point to some hurricane impact, but as the Census Bureau notes in their methodology: "While a few individual firms can report large increases or decreases in their sales because of the effects of weather related events, this additional variation is not typically large enough to substantially affect the reliability of the published estimates."

MARKETS SNAPSHOT

Key market levels of markets in late NY trade:

DJIA down 271.24 points (-0.62%) at 43479.11

S&P E-Mini Future down 82.75 points (-1.38%) at 5895.5

Nasdaq down 433.7 points (-2.3%) at 18673.98

US 10-Yr yield is down 1 bps at 4.4256%

US Dec 10-Yr futures are down 1/32 at 109-16.5

EURUSD down 0.0003 (-0.03%) at 1.0527

USDJPY down 2.01 (-1.29%) at 154.26

WTI Crude Oil (front-month) down $1.75 (-2.55%) at $66.95

Gold is down $3.54 (-0.14%) at $2561.54

European bourses closing levels:

EuroStoxx 50 down 38.68 points (-0.8%) at 4794.85

FTSE 100 down 7.58 points (-0.09%) at 8063.61

German DAX down 52.89 points (-0.27%) at 19210.81

French CAC 40 down 42.17 points (-0.58%) at 7269.63

US TREASURY FUTURES CLOSE

3M10Y +1.264, -8.602 (L: -11.613 / H: -1.613)

2Y10Y +3.811, 12.448 (L: 8.54 / H: 15.124)

2Y30Y +6.153, 29.926 (L: 23.304 / H: 32.992)

5Y30Y +4.282, 30.249 (L: 25.18 / H: 32.418)

Current futures levels:

Dec 2-Yr futures down 0.875/32 at 102-20.75 (L: 102-16.5 / H: 102-22.75)

Dec 5-Yr futures down 1/32 at 106-18.25 (L: 106-06.5 / H: 106-23)

Dec 10-Yr futures down 1/32 at 109-16.5 (L: 108-30 / H: 109-23.5)

Dec 30-Yr futures down 9/32 at 116-9 (L: 115-11 / H: 116-21)

Dec Ultra futures down 16/32 at 122-18 (L: 121-19 / H: 123-04)

MNI US 10YR FUTURE TECHS: (Z4) Southbound

- RES 4: 112-22 High Oct 16 and a key short-term resistance

- RES 3: 111-23 50-day EMA

- RES 2: 111-14+ High Oct 25

- RES 1: 109-30+/110-17+ High Nov 13 / 20-day EMA

- PRICE: 109-00 @ 14:38 GMT Nov 15

- SUP 1: 108-18+ 1.236 proj of the Oct 1 - 10 - 16 price swing

- SUP 2: 108-03 1.382 proj of the Oct 1 - 10 - 16 price swing

- SUP 3: 108-00 Round number support

- SUP 4: 107-23 2.0% 10-dma envelope

A bear cycle in Treasuries remains in play- today’s extension and this week’s fresh cycle lows, reinforce a bearish theme. Note that moving average studies are in a bear-mode set-up too, highlighting a clear downtrend. Sights are on 108-18+ next, a Fibonacci projection. Further out, the focus is on 108-00. Initial firm resistance is unchanged at the 20-day EMA. The average is at 110-17+.

SOFR FUTURES CLOSE

Dec 24 -0.040 at 95.545

Mar 25 -0.040 at 95.785

Jun 25 -0.030 at 95.965

Sep 25 -0.020 at 96.060

Red Pack (Dec 25-Sep 26) -0.015 to -0.005

Green Pack (Dec 26-Sep 27) -0.005 to steadysteady0

Blue Pack (Dec 27-Sep 28) steadysteady0 to steadysteady0

Gold Pack (Dec 28-Sep 29) -0.01 to -0.005

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00003 to 4.61045 (-0.00603/wk)

- 3M +0.00574 to 4.49113 (-0.02504/wk)

- 6M +0.00618 to 4.39191 (-0.00916/wk)

- 12M -0.00211 to 4.24243 (+0.02371/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.58% (-0.01), volume: $2.177T

- Broad General Collateral Rate (BGCR): 4.57% (-0.01), volume: $827B

- Tri-Party General Collateral Rate (TGCR): 4.57% (-0.01), volume: $800B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.58% (+0.00), volume: $107B

- Daily Overnight Bank Funding Rate: 4.58% (+0.00), volume: $286B

FED Reverse Repo Operation

RRP usage falls back under $200B to $172.400B this afternoon from $214.509B Thursday. Compares to $144.243B on Tuesday, November 5 -- the lowest since May 6, 2021. The number of counterparties holds steady at 51.

MNI PIPELINE: Corporate Issuance Roundup: $52.65B Total for Week

No new US$ corporate issuance Friday after $7.4B total priced Thursday, $52.65B total for the week - well over estimated $35B for the wk

- Date $MM Issuer (Priced *, Launch #)

- 11/14 $1.45B *Consolidated Edison WNG $350M 3Y SOFR+52, $450M +10Y +70, $650M +30Y +95

- 11/14 $1.25B *Dominion Energy 30.5NC10.25 6.625%

- 11/14 $1B *El Salvador 30Y 9.65%

- 11/14 $1B *SocGen PerpNC5.5 8.125%

- 11/14 $750M *Ares Strategic Income +3Y +165

- 11/14 $700M *Singapore Power 5Y +45

- 11/14 $500M *Zions WNG 11NC10 +240

- 11/14 $750M *Natwest PerpNC10 7.30%

MNI BONDS: EGBs-GILTS CASH CLOSE: Gilts, Bunds Close Flat On The Week

Gilts outperformed Bunds slightly Friday, though both instruments finished the week relatively flat.

- The session started with a constructive tone, with core EGBs/Gilts aided by an uptick in US Treasuries overnight. UK GDP data was a little softer than expected but didn't have much tangible impact.

- EGBs weakened to the session's worst levels in afternoon trade. The retracement came as TTF gas prices hit the highest levels in a year after Austria's OMV confirms Russia's Gazprom is set to suspend deliveries on November 16.

- While they recovered, aided by a down-leg in equities, EGBs would underperform Gilts on the day. The German curve bear flattened, with the UK's bull steepening. Gilt yields closed the week modestly higher, with Bund yields modestly lower.

- Periphery EGB spreads closed mostly tighter, with 10Y BTPs closing within 120bp of Bunds.

- ECB's Cipollone was typically dovish, commenting that Q3 Euro GDP may have been flattered by Paris Olympics effects.

- Next week's schedule is highlighted by November flash PMIs, with UK CPI hitting next Wednesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2bps at 2.122%, 5-Yr is up 0.8bps at 2.176%, 10-Yr is up 1.5bps at 2.356%, and 30-Yr is up 0.8bps at 2.574%.

- UK: The 2-Yr yield is down 2.4bps at 4.399%, 5-Yr is down 1.7bps at 4.328%, 10-Yr is down 1.2bps at 4.471%, and 30-Yr is up 0.5bps at 4.924%.

- Italian BTP spread down 0.6bps at 119.8bps / Spanish down 0.6bps at 70.1bps

MNI FOREX: USD/JPY Rally Undermined by Softer Stocks

- GBP proved to be the poorest performer in G10 through the Friday close, extending the losing streak for GBP/USD on both a daily and a weekly basis. A seventh consecutive week of losses for the pair outstrips the duration of the sell-off that followed both the Brexit referendum as well as the onset of the COVID pandemic in 2020 - the last longer weekly losing streak came in 2010, where 8 consecutive lower weekly closes made for a total loss of 923 pips (vs. 741 pips in seven weeks of losses this year).

- JPY gained against all others, helping USD/JPY return back below the Y155.00 as part of corrective weakness posted off the November high. For now, the underlying bull trend remains intact, but Friday's price action proves it won't be one-way, however near-term weakness could provide opportunity for those pursuing a buy-on-dips strategy.

- While US yields rose across the curve on solid economic data, softer equity markets undermined USD/JPY, particularly in light of Powell's hawkish comments on Thursday evening, in which he noted the near-term strength of the US economy - thereby reducing the odds of a further rate cut in December.

- Focus across the coming week turns to the UK CPI print - ahead of which markets price only a small chance of a further 25bps rate cut in December - as well as the Canadian and Japanese equivalent. Central bank decisions include Turkey, Hungary and South Africa.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 18/11/2024 | 0815/0915 | ECB's De Guindos speech at 27th Euro Finance Week | ||

| 18/11/2024 | 1000/1100 | * | Trade Balance | |

| 18/11/2024 | 1300/1400 | ECB's Lane lecture on Inflation Expectations | ||

| 18/11/2024 | 1315/0815 | ** | CMHC Housing Starts | |

| 18/11/2024 | 1330/0830 | * | International Canadian Transaction in Securities | |

| 18/11/2024 | 1500/1000 | ** | NAHB Home Builder Index | |

| 18/11/2024 | 1500/1000 | Chicago Fed's Austan Goolsbee | ||

| 18/11/2024 | 1630/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 18/11/2024 | 1630/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 18/11/2024 | 1830/1930 | ECB's Lagarde on economic and human challenges | ||

| 18/11/2024 | 2100/1600 | ** | TICS | |

| 19/11/2024 | 0030/1130 | RBA Minutes |