-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI Global Morning Briefing

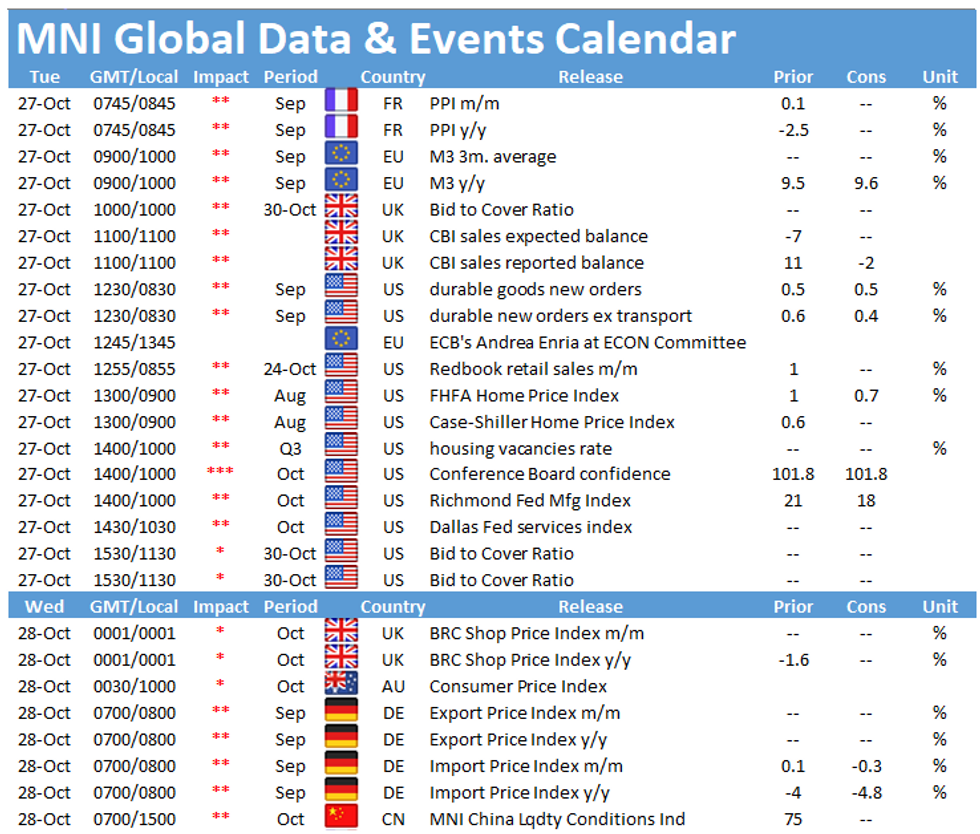

The main data events to follow on Tuesday include the CBI distributive trades survey at 1100GMT, followed by the US durable goods orders at 1330GMT and US consumer confidence at 1400GMT.

CBI reported sales expected to decline

Markets are looking for a decline of retail sales to -2 in October, down from 11 recorded in September. Retail sales in September grew at the fastest rate since April 2019 and were mainly driven by groceries. Retailers of household furniture and hardware & DIY goods also fared particularly well. September's report emphasized the divergence between the different sectors. While household furniture, DIY & hardware and groceries have performed better than expected, clothing and footwear sales continue to be severely affected by the pandemic as people continue to work from home. Covid-19 cases are rising and stricter restrictions have been put in place in several parts of the country, which weighs mainly on the service and retail trade sector.

US durable goods order seen rising again in September

New orders of U.S. durable goods likely rose 0.5% in September after a 0.5% increase in August. Excluding transportation, durable goods new orders should rise 0.4% in September following a stronger 0.6% gain in August. Demand for durable goods is slowing, analysts say, and improvement seen earlier in the recovery is likely to remain muted.

US consumer confidence forecast to stagnate

Consumer sentiment in the US rose sharply in September due to an improvement in household's assessment of the current situation as well as the short-term outlook. The index increased to 101.8, up from 86.3 reported in August. Nevertheless, the indicator remains below pre-pandemic levels according to The Conference Board. In October, markets expect the consumer sentiment to remain broadly unchanged at 101.7. However, Covid-19 cases continued to rise in October which poses a downside risk to consumer confidence going forward.

The events calendar throws up a quiet schedule with the only currently scheduled highlight being ECB's Andrea Enria speaking at ECON Committee of the European Parliament.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.