-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessOtto (OTTOGR; unrated) 4.3Y SLB Background on co (Private, owned by the Otto's)

MIN. €250 4.3Y SLB IPT 6%a (eqv. MS+313)

**Coming well wide...but may be warranted. After a look at the co we are left with more questions than answers. Original €300m 26s that have been tendered down trade at Z+70 (issued in late 2019 at MS+240).

This is a €15b revenue company that is still privately owned by one family (a number of which are listed Forbes billionaires). Obvious ownership risk on that but mgmt annual reports are comprehensive. Our issue is not with balance sheet but on profitability of its largest platforms segment (e-commerce) - target for that is to be breakeven next year. There is some legacy businesses that may have done the legwork in the past but fading now (see MyToys store closures & shift away from catalogue). It has left Financial services, which is small 7% of group revenue, carrying 62% of group EBITDA. We are also a tad confused by the fact it has had Moody's rate its SLB framework but not its bonds...Our worries are poor WC movements (platform business only one-third 3P) and/or capex in hopes of driving future profitability dragging FCF back into negative like it did in FY22. No leverage targets.

Platforms Business (€6.2b/41% of revenue, EBIT-€375, EBITDA -€8m)

- This is effectively it's e-commerce arm - it says it is the 2nd largest for online sales in Germany. Under that it has two platforms; 1) Otto (https://www.otto.de/) at €4b in revenues & ABOUT YOU (https://www.aboutyou.com/) which is €1.9b in revenues.

- From the platforms it makes money on 1) sale of products with first-party relationships (1P, i.e. it is the retailer with wholesale supplier), 2) commissions on marketplace with third-party (3P, no inventory/WC risk) and 3) services including logistics, insurance, customer support, analytics etc. Platform has operating leverage and asset light.

- It says 3P is growing and now 1/3 of volume being down. It says marketplace will be opened to partners from EU after this year (currently on German VAT ID can be onboarded).

- It says €175m impairment charge on ABOUT YOU dragged on income measures further down, but we'd note even headline revenue was down 4.5% in Platforms (its pointing to macro weakness).

- Guidance is for this to go EBIT break even in FY24/25 (12m to Feb 25).

- Sells its own brands as well as licensed brands through e-commerce & physical stores. Online share it says is 63% here. Main companies are Crate&Barrel (Premium furniture & home equip), Bonprix (mix of items in affordable) & Witt-Gruppe (Fashion in mid-range).

- Multi-channel that buy & sell products belonging to their own and 3rd party brands. Difference to above is tad unclear. Companies underneath it include myToys, Baur, Otto Austria & Manufactum.

- We see it closed all of its stores in Mytoys earlier last year and went to offering products only on otto.de, see here.

- Includes EOS group which it says is one of the leading investors & experts in technology-based processing of non-performing receivables. It also has other co's that help in "receivables management".

- It has minority stakes in Hanseatic Bank (25%) and Cofidis Group (20%) which specialise in consumer credit.

- By far the highest margin segment for it. and alongside brand concepts segment, the only profitable one (on EBITDA/EBIT).

- Logistic services which is where it started (mail-order). Does warehousing and distribution under Hermes.

- This segment can drive considerable capex - in FY23 totaled €170m

Publicly it reports annually with sporadic updates on certain divisions between that. We have no issue with its detail in annual reports.

- On earnings, we effective ignore "cash EBITDA" and take reported EBITDA which is running at a 5% margin (was 3.6% last year). FCF conversion on this was high last year (at 92%/€689m) but seems dependent on WC swings & capex. FY22/23 had -€1b WC and +€300m more in Capex (at €800m) drive FCF to -€1.2b.

- We see it 3.7x net and 4.5x gross against reported EBITDA & on its "cash EBITDA" (adj.) it reports net 2.0x/gross 2.5x.

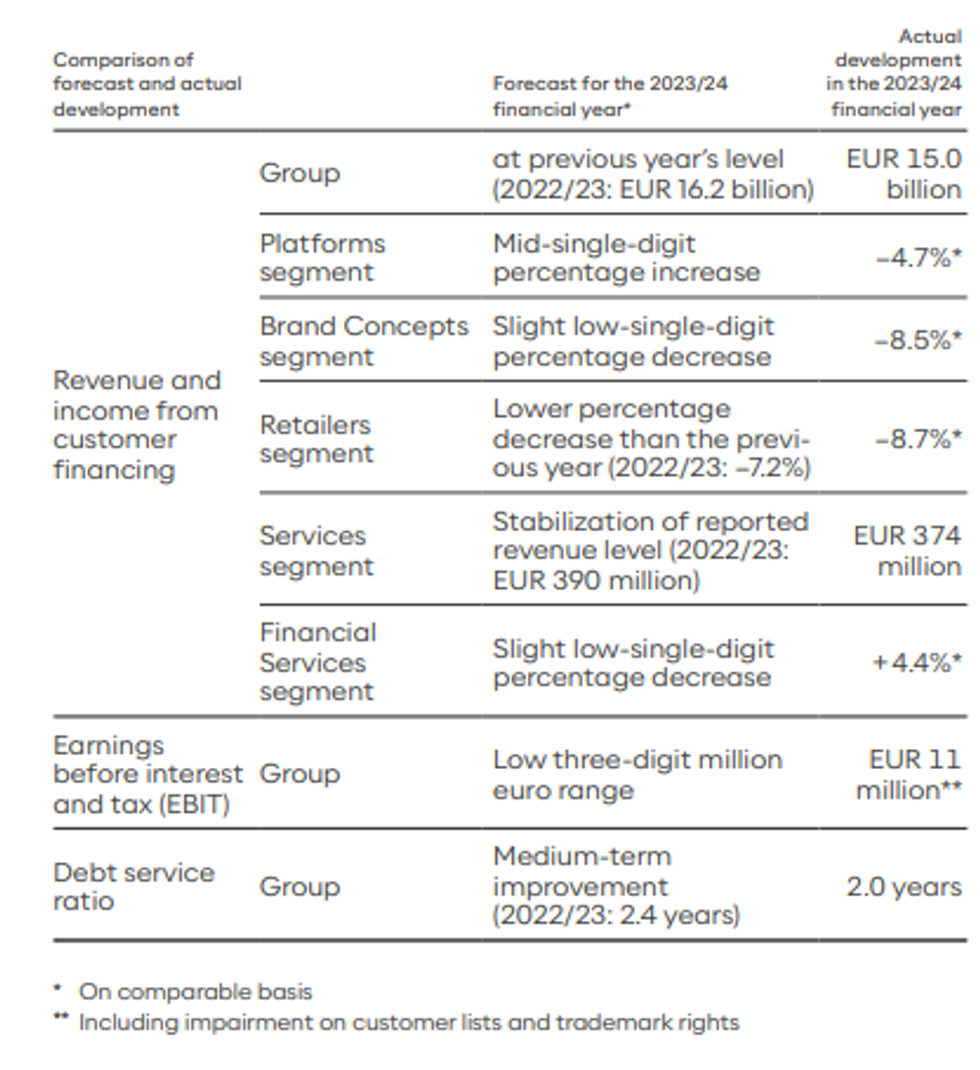

- In FY23/24 annual report it has a very table on forecasts made vs. actuals (below). It has no explicit target for its adj. net debt leverage figure. It recorded an improvement from 2.4x to 2.0xyoy.

- It does target group equity ratio of "at least 25%" - in FY23 it was 33.8%, little changed yoy & leaves headroom.

- Break down on debt; gross €3.4b and includes €1.6b in bank facilities, €1b in leases & €700m in bonds. Cash & eqv.s of €0.7b leaves net €2.7b.

- Note it has noted "break-up of the euro area" as a risk that would have a "relevant impact if it were to occur" - we only see Europe exposure ex. Germany at 25%, rest in Germany (57%) and US (18%).

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.