August 21, 2024 02:17 GMT

August Exports On Solid Footing, Country Detail Shows Double Digit Y/Y Pace

SOUTH KOREA

South Korea's first 20-days of trade data for August showed continued improvement in export growth. We rose 18.5% y/y for the first 20-days. There was no day count effect, with daily average exports up 18.5% y/y as well.

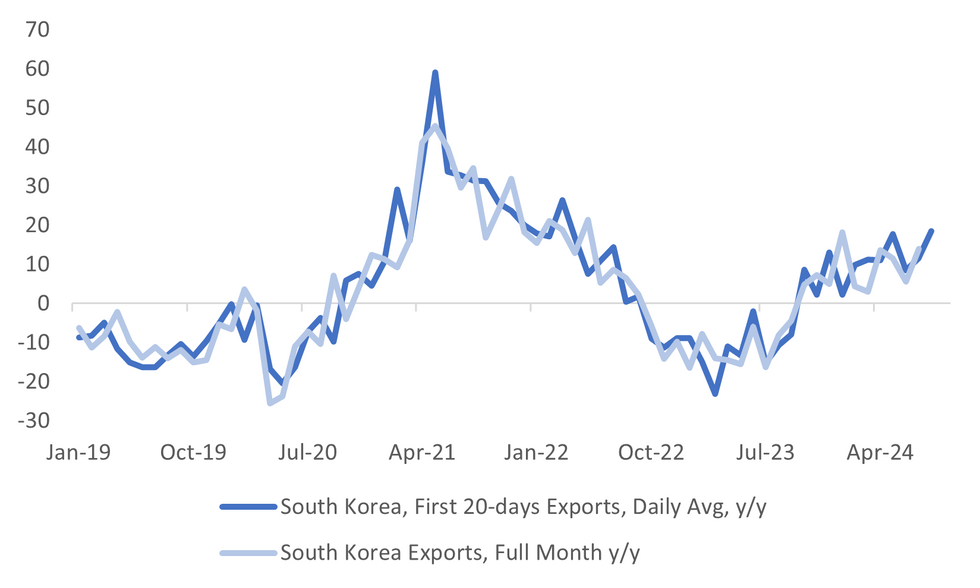

- The first chart below plots this daily average export growth y/y, versus full month export growth. It points to further improvement for the whole of August. The first 20-days print of August was the strongest outcome since March 2022.

- The detail showed chip exports at 42.5% y/y, versus 57.5% in July. Vehicle exports were up to, +7.9%y/y (prior 1.8%), while ships surged to 79%y/y from -49.1% prior.

- Exports to the US rose 18%y/y, from 13.4% prior, while to China we saw 16.3%y/y, down slightly from July's 20.4% pace. Exports to the EU were also firm in y/y terms.

- Imports were 10.1%y/y for the first 20-days, versus 14.2% y/y prior. The trade deficit was -$1.47bn, but this does tend to improve in the final 10days of the month.

- The resilient export trend should given the BoK comfort that a rate cut tomorrow is not needed in the near term to boost the growth outlook.

Fig 1: South Korea Export Trend Improved Further In August

Source: MNI - Market News/Bloomberg

Keep reading...Show less

216 words