-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY0.8 Bln via OMO Thursday

MNI: PBOC Sets Yuan Parity Higher At 7.1712 Thurs; -1.19% Y/Y

MNI BRIEF: China Feb LPR Remains Unchanged

MNI BRIEF: Aussie Jan Unemployment At 4.1%, 44k Jobs Created

Booking.com (BKNG; A3, A-; S) {BKNG US Equity}

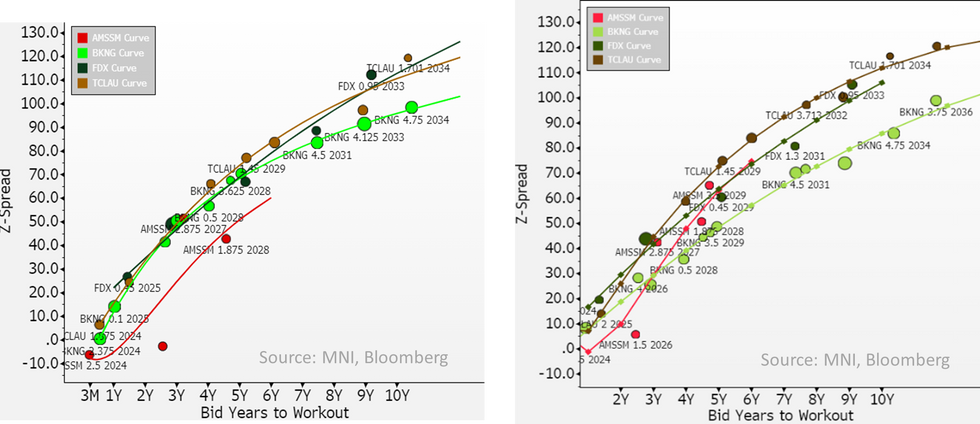

Curve screens fair to us now after a ~20bp rally over the last month (including against close comp's). Next event of interest for us is 1Q24 earnings in early May - we are keen to hear mgmt's take on any impact from Italian regulators' & any updates on Spain regulator draft fine. Cash lines strong 2-5bps tighter today.

- BKNG has always screened wide to us - not a new phenomena for it but we are starting to see some signs of that finally reversing.

- It came to primary in late Feb, we liked the name then but markets didn't take it well - secondary selling off +7-11bp on €2.7b/4-part deal. It was then trading well wide of 2-notch lower close comp Amadeus (Baa2, BBB) & in-line with FedEx and Transurban (which we included solely to highlight the size of the reverse yankee discount). Its since moved firmly tighter to all 3 - before and after below.

- As we've highlighted there is some overhanging uncertainty on the draft Spain regulator (CNMC) fine for ~$530m which it said it would appeal & any fines on recently launched investigation from Italian competition watchdog (AGCM) - fines unlikely to impact BS ($13b cash on hand & $7b/yr in FCF) but changes to business practices could. Company reports 1Q24 results on 2nd of May - we expect it to comment on Italian investigation then.

- Curve screens fair to us now and as we've mentioned before we see better opp's in certain tenors; on the 34's the equal rated & short-tenor Wesfarmers/WESAU 33's that only gives away -2bps screens cheaper (likely on single Aussie issuer discount) - it does seem to trade - & on the newly issued 44's, ABIBB 44's are only -4bps inside/screening more value.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.