-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessCNH Rides Stronger China Asset Performance

USD/CNH stayed heavy post the Asia close, despite a firmer USD tone against the majors. The pair saw support sub the 6.8800 level, but rebounds above 6.8900 drew selling interest. We last tracked around the 6.8880 level. The pair is below the 200-day EMA (6.8896), but remains above the simple 200-day MA for now (6.8709). The CNY NEER is now back above 126.00 (J.P. Morgan Index), which is fresh highs since early November 2022.

- Continued China asset optimism is spurring CNH outperformance. Yesterday saw 12.75bn yuan of net inflows to mainland stocks via the stock connect in HK. This was the strongest daily net inflow since mid November last year.

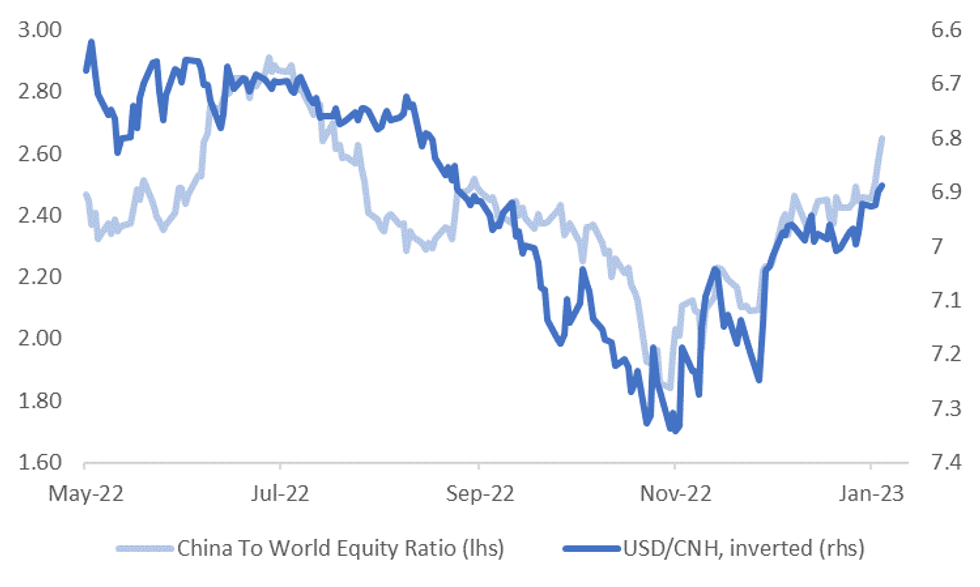

- During US trading the Golden Dragon index rose a further 1.61%, defying weaker US equity market sentiment. The index is now up close to 14% since the start of the year. The chart below plots the ratio of China to global equities, against USD/CNH (which is inverted).

- Further support for the housing sector via lower mortgage rates for first home buyers (if house prices drop for 3 straight months) was announced. This measure was first introduced in September last year. A cap on real estate commissions is also aimed at boosting housing demand.

- The local data calendar is quiet, with FX reserves data due tomorrow, while aggregate financing data for December should print at some stage next week.

Fig 1: USD/CNH Versus China/World Equity Ratio

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.