-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessCons. Conf. Returns To Pre-Pandemic Levels, Gov't Sought Advice On Rent Controls

NZD/USD failed to cling onto its initial gains Wednesday and slid in the second half of the Asia-Pac session, extending losses in Europe. A recovery in the greenback weighed on the pair, amid firmer U.S. Tsy yields & month-end flows.

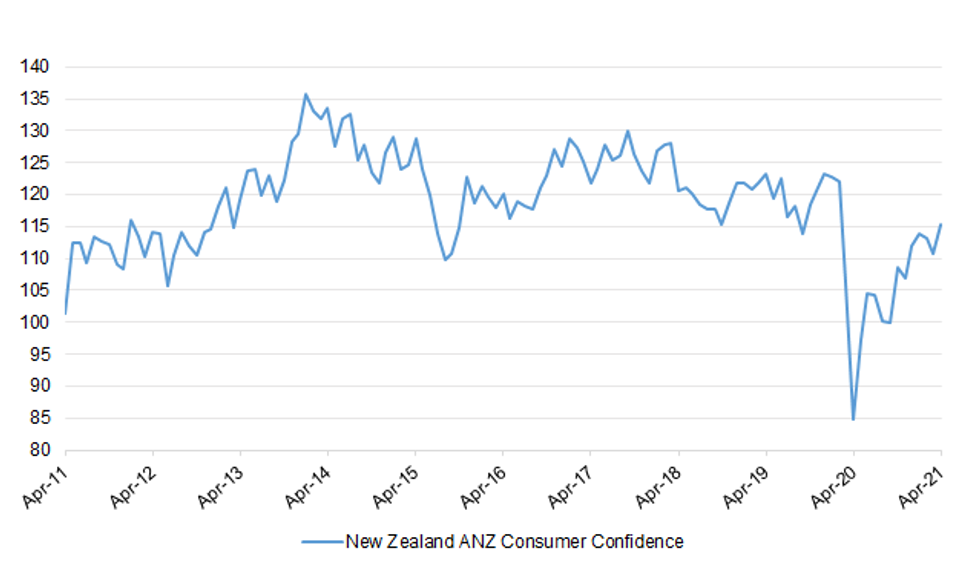

- New Zealand's ANZ Consumer Confidence Index rose 4.2% M/M to 115.4 in April from 110.8 recorded in March. The index returned to pre-pandemic levels, but still sits below its historical average of ~120. Inflation expectations rose 0.7pp to +4.7%. ANZ commented that "the economy will find it harder to grow from there, but will muddle through."

- Interest.co.nz reported that the gov't asked Housing & Urban Development Ministry for advice on implementing temporary rent controls, if the recently announced housing policy package sends rents higher.

- Next week will be a busy one in New Zealand. Quarterly labour market report & the RBNZ's Financial Stability Report will be published on Wednesday, with building permits & flash ANZ Business Confidence coming up on Thursday.

- NZD/USD last trades at $0.7242, little changed on the day, and the rate seems poised for a fifth straight weekly gain. A break above yesterday's high of $0.7287 would shift focus to Mar 2 high of $0.7307. Conversely, a dip through Apr 22 low of $0.7146 would open up Apr 19 low of $0.7122.

Fig. 1: New Zealand ANZ Consumer Confidence

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.