-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Markets Limited As COVID Headlines Dominate

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* U.S. PAUSES ELI LILLY'S TRIAL OF COVID ANTIBODY TREATMENT OVER SAFETY CONCERNS (CNBC)

* UK GOVERNMENT SCIENTIFIC ADVISERS URGE TWO-WEEK LOCKDOWN (FT)

* NETHERLANDS IMPOSES 'PARTIAL' LOCKDOWN TO CONTAIN SPREAD OF CORONAVIRUS (FRANCE 24)

* DECEMBER NEXT STEP ON BOE'S NEGATIVE RATE PATH (MNI)

* RBNZ'S HAWKESBY: NOT BLUFFING ON PROSPECT OF NEGATIVE RATES (BBG)

Fig. 1: U.S. 30-Year Tsy Yield (%)Source: MNI - Market News/Bloomberg

Fig. 1: U.S. 30-Year Tsy Yield (%)Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Two of the UK government's leading scientific advisers say thousands of deaths from coronavirus could be avoided before Christmas if a two week "circuit breaker" lockdown is imposed over the school half-term break, an intervention that puts new pressure on Boris Johnson to order tougher restrictions. Graham Medley, who sits on the Scientific Advisory Group for Emergencies, and Matt Keeling, a member of the Scientific Pandemic Influenza Group on Modelling, will release their findings in a joint paper on Wednesday. (FT)

CORONAVIRUS: Boris Johnson will consider a "circuit breaker" lockdown if his tier system fails to work after Sir Keir Starmer increased the pressure on him by calling for new national restrictions. Government sources said the Prime Minister could order a two-week closure of pubs, restaurants and some other businesses if measures brought in on Wednesday in Covid hotspots do not reverse the spread of the virus. A decision will be taken toward the end of next week, ahead of the half-term holiday for state schools which begins on Oct 26 and would mark the start of any temporary lockdown. One option under consideration is for regional circuit breakers, which might be preferred by the Prime Minister after he likened a second national lockdown to a "nuclear deterrent". One senior source said the chances of a circuit breaker were "at least 80 per cent". (Telegraph)

CORONAVIRUS: Northern Ireland is set to become the first full region of the UK to impose a "circuit breaker" lockdown. Tighter restrictions will be in place for four weeks - with schools closing for two of them, Sky News understands. (Sky)

CORONAVIRUS: Tory MPs had already served notice that they were bitterly opposed to the 10pm curfew for pubs and restaurants. For days, they have been denouncing it in Commons debates. But when it came to a vote on the controversial lockdown measure, 42 Conservative MPs - plus two tellers - voted against it, in a show of strength and bigger-than-expected rebellion. Boris Johnson comfortably won the vote, by 299 votes to 82, with 23 Labour MPs led by Jeremy Corbyn also defying Sir Keir Starmer and voting with the Conservative rebels against the government. (Sky)

BREXIT: The U.K. and European Union are locked in talks over a deal on their future relationship with each daring the other to blink just two days before Boris Johnson's deadline for abandoning the negotiations expires. Neither side believes the other has offered enough for talks to reach a conclusion, with the British government deriding the EU for its hard-line stance on fisheries and the EU calling for the U.K. to cede ground in other key areas such as business subsidies. The deadlock is set to continue on Wednesday when Johnson and European Commission President Ursula von der Leyen discuss the impasse on a video call. (BBG)

BREXIT: Angela Merkel has warned the European Union that it must be more realistic in accepting Britain's negotiating position in fishing and trade talks ahead of tomorrow's critical summit of leaders. The German chancellor said Brussels had to accept that any deal must be in the interests of the UK and the EU. (The Times)

BREXIT: French Foreign Minister Jean-Yves Le Drian says a no-deal Brexit looks "very likely" at this point, based on the state of negotiations between the U.K. and the EU. (BBG)

BREXIT: Industry leaders have accused the government of launching an "outrageous" blame game over Brexit after a minister claimed that many companies had adopted a "head in the sand" approach to preparation. (The Times)

BOE: MNI INSIGHT: December Next Step On BOE's Negative Rate Path

- The Bank of England could provide results of its consultation into the effects of negative rates on the banking system in its Financial Stability Report due Dec. 10, setting the stage for further Monetary Policy Committee discussion of the matter the following week, MNI understands.

FDI: Boris Johnson's government is drawing up plans for a radical new law that would give ministers power to unravel foreign investments in U.K. companies -- potentially casting major doubt on deals that have already been concluded -- to stop hostile states gaining control over key assets. The National Security and Investment Bill is in the final stages of drafting and could be published later this month, according to people familiar with the matter who spoke on condition of anonymity because the subject is sensitive. It aims to cover deals in sectors such as defense and critical infrastructure, and will make provisions to protect sensitive intellectual property. (BBG)

EUROPE

NETHERLANDS: The Netherlands will return to a "partial lockdown" on Wednesday, Dutch Prime Minister Mark Rutte said, closing bars and restaurants as it battles to control the coronavirus in one of Europe's major hotspots. (France 24)

US

CORONAVIRUS: The US averaged more than 50,000 new coronavirus cases a day on a rolling seven-day basis on Tuesday for the first time since mid-August, with 16 states reporting their highest mean levels of daily infections since the start of the pandemic. (FT)

FED: MNI POLICY: Fed Won't Take Punch Bowl Away if Jobs Lag - Daly

- The Federal Reserve will do all it can to bring about full employment including a wider array of workers suffering amid economic inequality being made even worse by the pandemic, San Francisco President Mary Daly said Tuesday. "In the absence of sustained 2% inflation or emerging risks, such as to financial stability, we will not take the punch bowl away while so many remain on the economic sidelines," she said in the text of a speech to the University of California-Irvine.

FED: Directors at all 12 of the Federal Reserve's regional reserve banks favored holding the discount rate at 0.25% in meetings through Sept. 10. "Overall, directors continued to express uncertainty about the implications of the pandemic for the economic outlook," said minutes of the directors' discount-rate meetings released Tuesday in Washington. (BBG)

ECONOMY: MNI EXCLUSIVE: US Wages Under Pressure As Fiscal Aid Dwindles

- U.S. wages are likely to fall faster as government support for individuals and households under the CARES Act evaporates and a faster-than-expected jobs market recovery shows signs of slowing, labor market experts told MNI.

FISCAL: Senate Majority Leader Mitch McConnell (R-Ky.) issued a statement on Tuesday saying that the Senate's "first order of business" when it returns on Oct. 19 will be to vote on "targeted relief for American workers," including new funding for the small business Paycheck Protection Program (PPP). House Democrats, Senate Republicans and the Trump administration are still very far apart on key elements of a relief deal, and any push for smaller, more targeted legislation is more of a political maneuver than any thing else. (Axios)

FISCAL: In a contentious interview with CNN's Wolf Blitzer, House Speaker Nancy Pelosi (D-Calif.) reiterated that she is not prepared to accept the White House's $1.8 trillion proposal for the next round of federal coronavirus aid legislation. (Forbes)

CORONAVIRUS: New York City is seeing a levelling of cases in its controversial "red zones" subject to higher restrictions to head off a surge in coronavirus infections, the mayor said on Tuesday. (FT)

CORONAVIRUS: Chicago on Tuesday added four US states to the city's emergency travel order requiring travellers returning from them to undergo a 14-day quarantine. City health officials added Indiana, North Carolina, Rhode Island and New Mexico. (FT)

CORONAVIRUS: Dr. Anthony Fauci, the nation's top infectious disease expert, said President Donald Trump's rapid recovery from Covid-19 poses a challenge for health officials attempting to convey the seriousness of coronavirus to Americans, STAT News reported. (CNBC)

POLITICS: More than 10.6 million voters across the U.S. have cast their ballots in the November election as of Tuesday morning, according to data from the U.S. Elections Project. With exactly three weeks until Election Day, early voting turnout both in-person and via mail is far outpacing that of 2016. By October 16 of the last presidential election, only about 1.4 million voters had cast a ballot. (CNBC)

POLITICS: President Donald Trump asked the Supreme Court on Tuesday to block lower court rulings that would give the Manhattan District Attorney's office access to years of his income tax returns. (CNBC)

EQUITIES: Apple Inc. unveiled its latest range of iPhones, a product line that Wall Street expects will kick off a new cycle of sales growth for the world's largest technology company. (BBG)

OTHER

GLOBAL TRADE: Amazon will not be affected by the new digital services tax but small traders who use its online marketplace will be penalised, HMRC has admitted. (The Times)

U.S./CHINA: The United States will continue to consult closely with its Asian allies, including South Korea, on ways to deter China's medium-range missile capabilities, a special U.S. envoy for arms control said Tuesday. The remarks from Marshall Billingslea, presidential envoy for arms control, came about two weeks after he traveled to South Korea and Japan for such discussions. (Yonhap)

CORONAVIRUS: Eli Lilly's late-stage trial of its leading monoclonal antibody treatment for the coronavirus has been paused by U.S. health regulators over potential safety concerns, the company confirmed to CNBC on Tuesday. "Safety is of the utmost importance to Lilly. We are aware that, out of an abundance of caution, the ACTIV-3 independent data safety monitoring board (DSMB) has recommended a pause in enrollment," a spokeswoman Molly McCully told CNBC. "Lilly is supportive of the decision by the independent DSMB to cautiously ensure the safety of the patients participating in this study." (CNBC)

CORONAVIRUS: The pause on Johnson & Johnson's coronavirus vaccine research study due to an adverse reaction by one of the participants is "quite common" in vaccine clinical trials, Health and Human Services Secretary Alex Azar told "Varney & Co." on Tuesday. (Fox)

CORONAVIRUS: Moderna Inc said on Tuesday Canada's health ministry will review its experimental COVID-19 vaccine in real time, becoming the third vaccine maker to be accepted by the country for the process that may speed up approval. (RTRS)

CORONAVIRUS: The US National Institute of Allergy and Infectious Diseases on Tuesday launched a study to identify Covid-19 drugs and therapies in late-stage clinical development that should be given larger trials. (FT)

AUSTRALIA: The NSW government has slammed the brakes on easing more restrictions, as the state records another 11 locally transmitted cases of the coronavirus. Premier Gladys Berejiklian announced 13 new cases, two of which were diagnosed in hotel quarantine, telling reporters, "This is the most concerned we've been since that first incident when the Victorian citizen came up, infected his colleagues and went for a drink at a hotel." "Our state is on the verge of being where it was when we had the first seeding incident from Victoria," she said. Nine of the new cases are linked to the emerging cluster at a Lakemba GP clinic, which now numbers 12 cases in total. All are household contacts of known cases. (AAP)

AUSTRALIA/CHINA: Treasurer Josh Frydenberg comments on Australia- China relationship at Citigroup Inc. conference in Sydney Wednesday. "In terms of the bilateral relationship with China, it's vitally important to us, and indeed to China. It's a mutually beneficial relationship". "Our iron ore is underpinning their economic growth". (BBG)

RBNZ: New Zealand's central bank is not bluffing when it says it may resort to negative interest rates, Assistant Governor Christian Hawkesby said. "It's not a game of bluff," Hawkesby told a Citigroup conference in Sydney via video link on Wednesday. He was responding to a suggestion that the Reserve Bank is only using the threat of negative rates to exert downward pressure on the kiwi dollar and has no intention of actually using them. (BBG)

SOUTH KOREA: South Korea's central bank kept its key interest rate steady at a record low Wednesday as it is assessing the impact of the protracted coronavirus outbreak on the economy while monitoring rising housing prices. The Bank of Korea (BOK) said it will keep its accommodative policy stance as uncertainty about the growth path remains high amid the COVID-19 pandemic, signaling that there will be no change in the policy rate for the time being. In a unanimous decision, the BOK's monetary policy board froze the benchmark seven-day repo rate, called the base rate, at 0.5 percent for the third straight time. (Yonhap)

SINGAPORE: Singapore's central bank kept monetary policy unchanged Wednesday as expected, while the economy showed signs of gradual recovery with the aid of a massive fiscal stimulus push. The Monetary Authority of Singapore, which uses the exchange rate as its main policy tool rather than a benchmark interest rate, kept the slope of the currency band at 0%, and left the width and center unchanged, it said in a statement Wednesday. (BBG)

TAIWAN: The White House is moving forward with more sales of sophisticated military equipment to Taiwan, telling Congress on Tuesday that it will seek to sell MQ-9 drones and a coastal defensive missile system, five sources familiar with the situation said. These possible sales follow three other notifications first reported by Reuters on Monday that drew China's ire in the run-up to the Nov. 3 U.S. election. (RTRS)

MEXICO: Mexico's economy is performing close to the central bank's most optimistic scenario of an 8.8% contraction in 2020, Governor Alejandro Diaz de Leon said in remarks made in English on Tuesday. Inflation is keeping Mexico's interest rates above emerging market peers, Diaz said in an IMF panel hosted by UBS. (BBG)

BRAZIL: Brazil's central bank forward guidance tool on rates depends on the country going back to a fiscal consolidation regime, central bank Director of Foreign Affairs Fernanda Nechio said. (BBG)

RUSSIA: Moscow has denied a Trump administration official's claims that Washington has an agreement in principle for a new nuclear arms control deal with Russia, dealing a blow to the campaign's efforts to score foreign policy wins ahead of next month's presidential election. (FT)

SOUTH AFRICA: Finance Minister Tito Mboweni has asked Parliament for a week's delay for the Medium-Term Budget Policy Statement. (Daily Maverick)

G20: The G20 major economies will agree to extend a coronavirus debt service freeze for poor countries for at least six months beyond the end of 2020 and adopt a common approach to longer-term debt actions, a draft communique seen by Reuters showed on Tuesday. In the draft, finance ministers and central bankers from the Group of 20 countries said they would carry out a review in April on whether a further six-month extension was needed. (RTRS)

OIL: Russian President Vladimir Putin and Saudi Crown Prince Mohammed bin Salman discussed the current situation in the energy markets during a telephone call, the Kremlin said in a statement on Tuesday. During the call, they stressed the importance of continuing joint work, including in the OPEC+ format, the Kremlin added. (RTRS)

OIL: Gulf of Mexico operators shut 805,965 b/d, or 43.6%, of crude oil production following Hurricane Delta, BSEE says in notice. (BBG)

OIL: U.S. shale oil output is expected to decline by 123,000 barrels per day (bpd) in November, the biggest drop since May, to about 7.69 million bpd, the U.S. Energy Information Administration (EIA) said in a monthly forecast on Tuesday. Overall output is expected to drop for the third straight month and is expected to decline in most of the seven major shale formations in November. (RTRS)

CHINA

CORONAVIRUS: China's Qingdao said it has taken more than 5.6 million samples in less than two days after the city reported a new cluster of infections on Sunday. While the total number of cases stands at only 12, the government aims to test the entire city of 9.5 million people within five days. (BBG)

POLICY: Chinese President Xi Jinping on Wednesday welcomed foreign countries to participate more in the reform, opening up and development of China's special economic zones. (Xinhua)

PBOC: The PBOC is likely to roll over maturing MLFs with additional injections while keeping rates unchanged on Thursday, according to Securities Daily citing Wang Qing, the chief analyst with Golden Credit Rating. The added liquidity is to help commercial banks that have been forbidden to attract deposits through offering higher returns, Wang said. The PBOC will likely keep the MLF rate unchanged as the economy is already recovering, Wang said. CNY200 billion in MLF will mature on Friday, the Daily said. (MNI)

ECONOMY: China should tackle unemployment and create more jobs through direct aids to businesses and protecting vulnerable groups such as students, migrant workers and people in difficulties, the Economic Information Daily, run by the official Xinhua News Agency, said in a commentary. The number of new jobs added in the first 8 months of 2020 was down 20.6% y/y, and the unemployment rate in August ticked up 0.4% y/y, the Daily reported citing the National Bureau of Statistics. China will enforce policies such as fiscal and tax support and optimize the business environment to provide direct support to industries heavily impacted by the pandemic, the newspaper said. (MNI)

PROPERTY: Chinese real estate developers recorded the highest sales for the year in September even as authorities tightened regulations and financing conditions, China Securities Journal said citing Zhang Dawei, chief analyst with Centalin Property. (MNI)

AUTOS: China's commercial and passenger vehicle sales are likely to increase in Q4 due to consumption policy measures, increasing investment, and new product releases, the 21st Business Herald reported on Wednesday citing the China Association of Automobile Manufacturers. (MNI)

OVERNIGHT DATA

JAPAN AUG, F INDUSTRIAL OUTPUT -13.8% Y/Y; FLASH -13.3%

JAPAN AUG, F INDUSTRIAL OUTPUT +1.0% M/M; FLASH +1.7%

JAPAN AUG CAPACITY UTILIZATION +2.9% M/M; JUL +9.6%

AUSTRALIA OCT WESTPAC CONSUMER CONFIDENCE INDEX 105.0; SEP 93.8

AUSTRALIA OCT WESTPAC CONSUMER CONFIDENCE +11.9% M/M; SEP +18.0%

This is an extraordinary result. The Index has now lifted by 32% over the last two months to the highest level since July 2018. The Index is now 10% above the average level in the six months prior to the pandemic. Such a development must be attributable to the response to the October Federal Budget; ongoing success across the nation in containing the COVID-19 outbreak; and the expectation that the Reserve Bank Board is likely to further cut interest rates at its next meeting on November 3. Since 2010 we have conducted a post Budget question in the survey to assess the response of households to the Budget announcement. Over that period, the net balance of respondents who assessed that the Budget would 'improve their finances' was –29%, a clear majority expecting measures to adversely affect their finances. We have never seen a Budget response that showed a net positive balance – until now. For this Budget we saw a net positive balance of 9.5% indicating that a clear majority of respondents assessed that the Budget would 'improve their finances'. (Westpac)

CHINA MARKETS

PBOC NET DRAINS CNY50BN VIA OMOS

- The People's Bank of China (PBOC) skipped open market operations on Wednesday. This resulted in a net drain of CNY50 billion given the maturity of CNY50 billion of reverse repos, according to Wind Information.

- The liquidity in the banking system is at a reasonable and ample level, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1875% at 09:16 am local time from the close of 2.0443% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 40 on Tuesday, flat from the close of Monday. A higher index indicates increased market expectations for tighter liquidity.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7473 on Wednesday, compared with 6.7296 set on Tuesday.

MARKETS

SNAPSHOT: Markets Limited As COVID Headlines Dominate

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 24.37 points at 23628.65

- ASX 200 down 5.849 points at 6189.9

- Shanghai Comp. down 18.021 points at 3341.729

- JGB 10-Yr future up 5 ticks at 151.99, yield down 0bp at 0.030%

- Aussie 10-Yr future up 1.0 tick at 99.160, yield down 0.9bp at 0.839%

- U.S. 10-Yr future -0-01 at 139-05+, yield up 0.17bp at 0.729%

- WTI crude down $0.12 at $40.08, Gold up $4.88 at $1896.42

- USD/JPY down 5 pips at Y105.43

- U.S. PAUSES ELI LILLY'S TRIAL OF COVID ANTIBODY TREATMENT OVER SAFETY CONCERNS (CNBC)

- UK GOVERNMENT SCIENTIFIC ADVISERS URGE TWO-WEEK LOCKDOWN (FT)

- NETHERLANDS IMPOSES 'PARTIAL' LOCKDOWN TO CONTAIN SPREAD OF CORONAVIRUS (FRANCE 24)

- DECEMBER NEXT STEP ON BOE'S NEGATIVE RATE PATH (MNI)

BOND SUMMARY: Core FI Happy To Hold Tight Ranges In Asia

Marginal reversals of Tuesday's moves in e-minis and Tsys have placed modest pressure on the Tsy space in Asia-Pac dealing, although ranges generally remain tight. T-Notes last -0-01+ at 139-05, with the contract holding a 0-02+ range. Curve has seen a marginal round of twist steepening.

- JGB futures couldn't better the overnight high in the Tokyo morning, hitting the lunchbreak +6 vs. settlement levels, again struggling for any real traction above 152.00. 5s outperformed in cash trade, with swaps wider vs. JGBS across the curve as the swap curve twist steepened. The BoJ left the size of its 1-10 Year Rinban ops unchanged, with the following offer/cover ratios: 1-3 Year: 2.53x (prev. 2.01x), 3-5 Year: 2.35x (prev. 3.50x), 5-10 Year: 3.44x (prev. 1.97x).

- Average yields at the ACGB May 2032 auction priced ~0.4bp through prevailing mids at the time of supply (based on BBG pricing), with the cover ratio firming to 4.4424x, despite the uptick in auction size, representing a solid round of demand. We have run through the auction supportive factors on numerous occasions in recent times and also touched on some key supportive matters ahead of our auction preview. Space still holds to narrow ranges, with YM -1.0 and XM +1.0, as the curve twist flattens.

BOJ: 1-10 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.19tn of JGB's from the market, sizes unchanged from previous operations:

- Y420bn worth of JGBs with 1-3 Years until maturity

- Y350bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

AUSSIE BONDS: The AOFM sells A$2.5bn of 1.25% 21 May '32 Bond:

The Australian Office of Financial Management (AOFM) sells A$2.5bn of the 1.25% 21 May 2032 Bond, issue #TB158:

- Average Yield: 0.9241% (prev. 1.0098%)

- High Yield: 0.9250% (prev. 1.0125%)

- Bid/Cover: 4.4424x (prev. 2.7200x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 88.8% (prev. 58.4%)

- bidders 58 (prev. 35), successful 17 (prev. 20), allocated in full 8 (prev. 12)

EQUITIES: E-Minis Chip Away At Tuesday's Losses, Asia Unchanged To Lower

The major regional equity indices were a touch lower to unchanged during Wednesday trade, on the back of a negative lead from Wall St., while e-minis chipped away at Tuesday's losses, with tech outperforming again. A reminder that the fiscal deadlock in DC, worry surrounding the safety of some of the COVID-19 treatment trials and some micro idiosyncrasies weighed on U.S. equities on Tuesday.

- Chinese President Xi's address re: reform surrounding the Greater Bay area and further opening up of the economy has just got underway, with the Hang Seng marginally outperforming its major regional counterparts ahead of the address after yesterday's weather induced closure.

- Nikkei 225 -0.1%, Hang Seng unch., CSI 300 -0.5%, ASX 200 -0.1%.

- S&P 500 futures +14, DJIA futures +89, NASDAQ 100 futures +71.

OIL: WTI Holding Above $40.00, Just

WTI and Brent held to tight ranges in Asia-Pac hours, both shedding ~$0.10 vs. settlement levels, with the former hovering just above $40.00. This comes after the benchmarks added ~$0.75 apiece on Tuesday, shaking off the impetus from a negative session for the U.S. equity space.

- Positive indications surrounding Chinese crude demand (import data and comments from Saudi Aramco) helped the bid yesterday, although some have suggested that Chinese import demand is expected to plateau, given crude inventory levels in China.

- OPEC's downgrade of its oil demand forecast for both 2020 and 2021 didn't really change much.

- We also saw the UAE's Energy Minister re-affirm the OPEC+ production outlook, while Russian President Putin & Saudi crown Prince MbS stressed the importance of the OPEC+ pact in a phone call.

- Elsewhere, U.S. Gulf production continues to tick back online, with Tuesday's BSEE estimate pointing to ~44% of Gulf production being shut in.

- Weekly API inventory estimates will hit later today.

GOLD: Back Below $1,900/oz, Lines In Sand Well Defined

A firmer USD coupled with an uptick in U.S. 5- & 10-Year real yields applied pressure to bullion on Tuesday, pushing spot back below $1,900/oz, before settling into a narrow range in Asia-Pac hours, to last deal unchanged, just above $1,890/oz. Key support and resistance remain well defined.

FOREX: Antipodeans Register Gains During A Limited Asia Session

It wasn't the most eventful session, with the opening remarks of a much awaited speech from Chinese Pres Xi proving rather unimpressive. Xi touched on several familiar talking points, tipping hat to China's "dual circulation" strategy, stressing Beijing's willingness to promote Hong Kong's & Macau's integration with mainland China and pledging to advance the reform and opening up of the Greater Bay area. USD/CNH stuck to a very tight range, with an in-line PBoC fix offering no material impetus, and the rate heads for the London session biased marginally lower.

- The Antipodeans were the best performers in G10 space, albeit NZD got some brief hiccups when RBNZ Asst Gov Hawkesby said that New Zealand's central bank wants to "go hard, go early" on policy. His comments revealed little new, basically echoing the message from RBNZ Chief Economist Ha from a few days back, and NZD didn't take much time to recover. AUD may have been supported by a continued surge in Westpac Consumer Confidence, attributed to the optimistic reception of the Federal Budget.

- Spot USD/KRW popped higher at the re-open, but more than erased early gains and slid into negative territory, printing its worst levels since Apr 2019. The BoK left its policy settings unchanged, as expected by virtually all analysts, while Gov Lee said that it's not the time to adopt QE and reiterated the central bank's readiness to intervene in FX markets if needed.

- Under the microscope today we have U.S. PPI, EZ industrial production, as well as comments from numerous speakers from the Fed, ECB, BoC, BoE & Riksbank.

FOREX OPTIONS: Expiries for Oct14 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1750(E1.2bln), $1.1885-1.1900(E828mln)

- USD/JPY: Y104.95-105.00($835mln), Y105.15-20($1.2bln), Y105.50-55($750mln), Y105.75-80($641mln), Y106.00($1.4bln), Y106.19-20($1.3bln), Y106.45-50($660mln), Y107.25($750mln)

- AUD/USD: $0.7175-80(A$549mln)

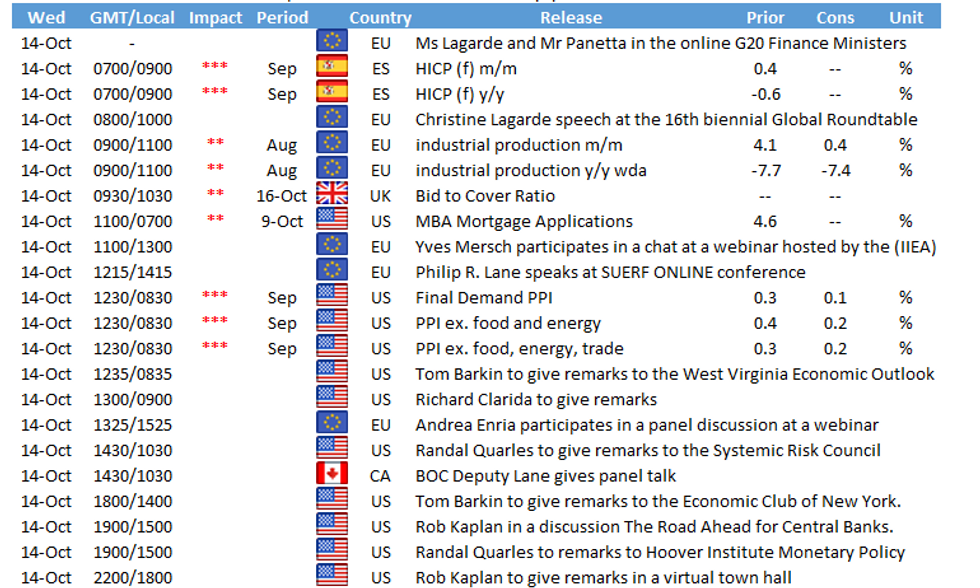

UPTODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.