August 15, 2024 13:08 GMT

Core Retail Sales Momentum Picking Up

US DATA

DataHomepagemarkets-real-timeFixed Income BulletsData BulletBulletMarketsEmerging Market NewsForeign Exchange Bullets

July's advance retail sales report showed that the recent unexpected pickup in consumer momentum continues.

- June retail sales came in well above expectations at 1.0% M/M (0.4% expected, -0.2% prior rev from 0.0%). The core readings also impressed, with slight upward revisions (on an unrounded basis): ex-auto sales rose 0.4% (vs 0.1% expected, 0.5% prior rev up 0.1pp), with ex-auto/gas up 0.4% (0.2% expected, 0.8% prior) and the key Control Group up 0.3% (0.1% expected, 0.9% prior).

- Touching briefly on the sectoral dynamics, the beat was driven by a sharp rebound in motor vehicle sales (+3.6% vs -3.4% prior), which is the largest single retail category, with food/beverage and food services/drinking places, and general merchandise store sales all accelerating. Those helped offset a large slowdown in the 2nd largest category, nonstore retail (+0.2% from +2.2% prior).

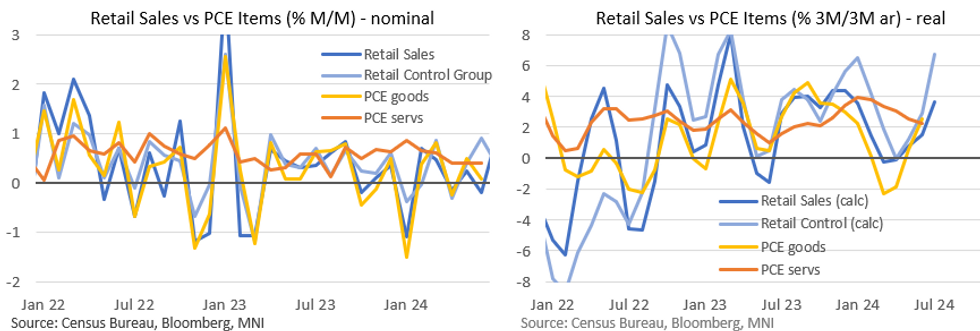

- With the month-to-month figures remaining volatile, we would point to the bigger picture which is that core retail sales momentum is picking up again - the 3M/3M annualized rate of Control Group retail sales growth (which is an input into GDP) is now running at 4.9%, the strongest since November 2023, even as inflation has diminished (remember retail sales are a nominal and not real series).

- A rough calculation of "real" CPI goods-deflated Control Group retail sales growth puts that measure of momentum closer to 6.7%, the strongest since Q1 2023, and up from 0.0% in April.

- While the latter may overstate the case for consumer strength, Control Group retail sales continue to grow at a near-4.0% Y/Y nominal pace, vs Y/Y inflation of closer to 3%.

- As such a consumer slowdown does not appear to be imminent as we go through Q3.

285 words