May 30, 2024 15:22 GMT

EC Survey Signals Stalling Of Core Goods HICP Disinflation

EUROZONE DATA

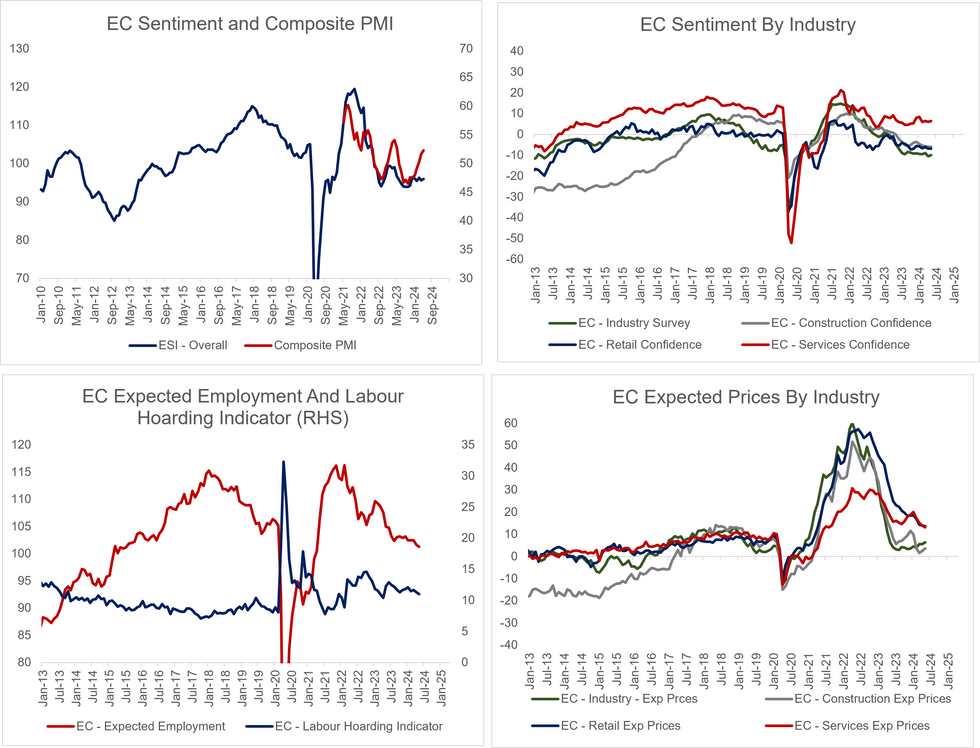

Eurozone Economic Confidence, form the EC’s consumer and business survey, was 96.0 in May, broadly in line with the consensus of 96.1 and above April’s 95.6. As such, there remains some divergence between this survey and the composite PMI, which improved to 52.3 in May in the flash release.

- Consumer confidence confirmed flash estimates at -14.3 (vs -14.7 prior).

- Industry confidence improved to -9.9 (vs -10.4 prior), after the flash manufacturing PMI also rose to its firmest since February 2023 in May.

- Services confidence was 6.5 (vs 6.1 prior), after the May flash PMI was steady at 53.3.

- Retail confidence was steady at -6.8, while construction confidence softened a tenth to -6.0.

- Services and retail expected prices softened in May, while industry expected prices rose to 6.4 (vs 5.6 prior). This is consistent with the view that core goods HICP disinflation will stall in the coming months, and potentially drift higher as base effects fade.

- Expected employment remained above the series’ long-run average at 101.3 (vs 101.6 prior), while the labour hoarding indicator fell 3 tenths to 11.0.

188 words