-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessIndonesia Sees Record Daily Increase In Covid-19 Cases, Will Lower Palm Oil Export Levy

Spot USD/IDR reopened on a softer footing, absorbing the impact of the greenback's sell-off seen after the closing bell on Monday. The rate has advanced since and last trades -10 figs at IDR14,418.

- The rate is establishing itself above its 50-DMA and bulls look for a jump above May 3 high of IDR14,475, followed by Apr 28 high of IDR14,518. Conversely, a dip through the aforementioned 50-DMA at IDR14,386 would expose the 200-DMA at IDR14,357.

- USD/IDR 1-month NDF last +7 figs at IDR14,472, with bulls looking for gains past yesterday's high of IDR14,578. Bears keep an eye on the nearby 50-DMA at IDR14,412.

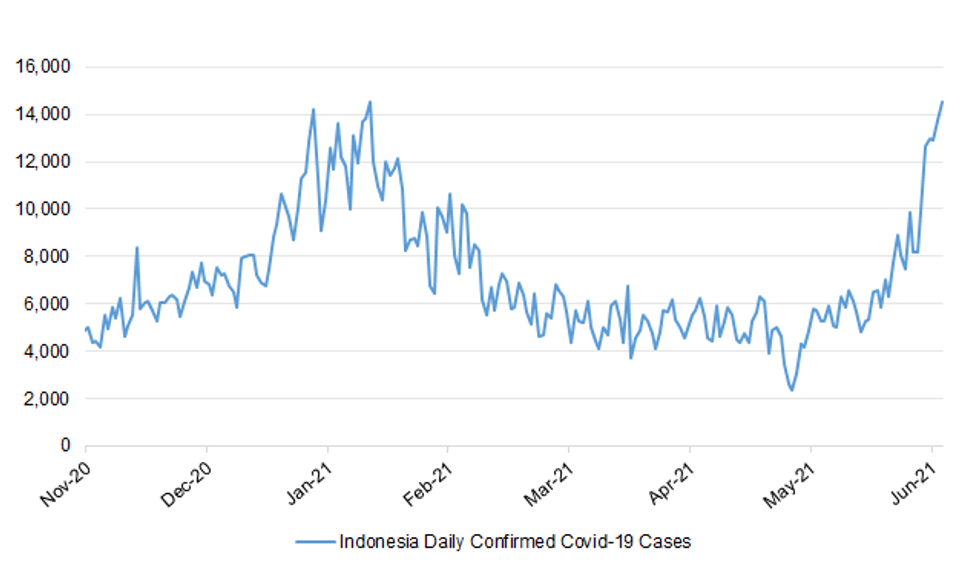

- The daily nationwide count of new Covid-19 infections rose to a record. The 14,536 cases detected on Monday pushed the total case count above 2mn. Econ Min Hartarto announced new restrictions in areas mostly affected by the virus, despite calls by exports to implement a wider lockdown.

- Indonesian Trade Min Lufti said that the gov't is drafting rules which would lower the export levy on palm oil, while FinMin Indrawati noted that the maximum levy on the commodity will be cut to $175/ton from $255/ton. In Monday's interview with BBG, Lufti added that Indonesia's exports of crude palm oil and its derivatives may rise 9-10% this year. Palm oil futures slipped in Kuala Lumpur on Monday after the plan was revealed.

- FinMin Indrawati told the regional representative council that the budget deficit was equivalent to IDR219.3tn or 1.32% of GDP as of May.

- The Indonesian data docket is virtually empty this week.

Fig. 1: Indonesia Daily Confirmed Covid-19 Cases

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.