May 17, 2024 14:08 GMT

Leading Index Misses, Stocks See First Negative Contribution Since October

US DATA

Metals bulletEM BulletHomepagemarkets-real-timeCommoditiesEmerging Market NewsEnergy BulletsBulletMarketsFixed Income BulletsForeign Exchange Bullets

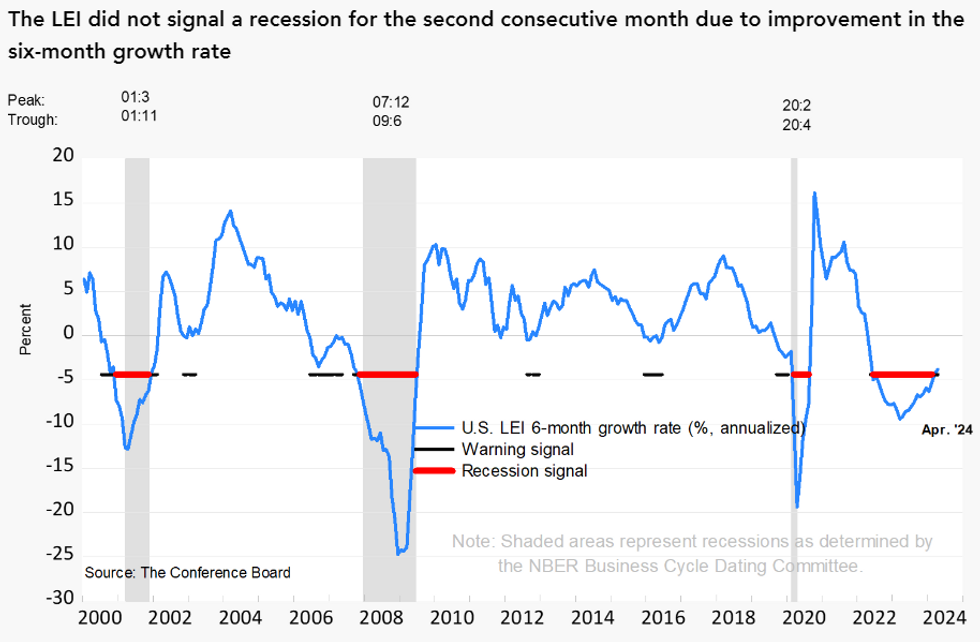

- The Conference Board leading indicator fell by more than expected in April, -0.6% M/M (cons -0.3) after -0.3% in March.

- From the press release (see here): “Deterioration in consumers’ outlook on business conditions, weaker new orders, a negative yield spread, and a drop in new building permits fueled April’s decline. In addition, stock prices contributed negatively for the first time since October of last year.”

- “While the LEI’s six-month and annual growth rates no longer signal a forthcoming recession, they still point to serious headwinds to growth ahead. Indeed, elevated inflation, high interest rates, rising household debt, and depleted pandemic savings are all expected to continue weighing on the US economy in 2024.”

- “As a result, we project that real GDP growth will slow to under 1 percent over the Q2 to Q3 2024 period.”

Source: Conference Board

Source: Conference Board

151 words