-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

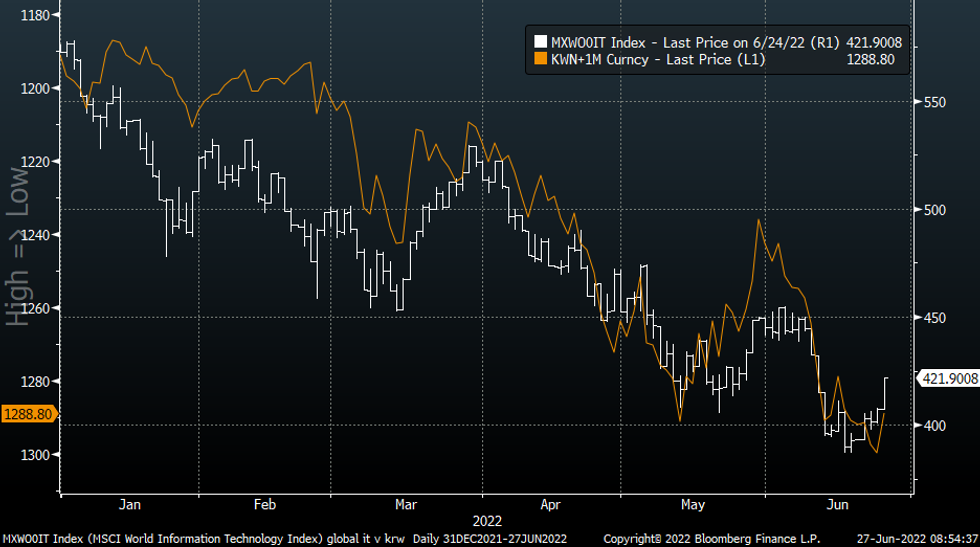

Free Access1 month USD/KRW Back Sub 1290

1 month USD/KRW dipped further post the Asia close on Friday. We moved back sub 1290, closing at 1288.80 in NY. Note spot closed onshore on Friday at 1298.40, so expect some catch up to the downside in early trading today.

- The lead for Korean equities is positive today, with tech shares surging in US trading on Friday. The SOX rose close to 4.45%. The MSCI IT index gained 3.60%.

- We noted on Friday the won was lagging the equity rebound. The Kospi rose 2.26%, while the Kosdaq surged 5% during Friday’s session. Offshore investors bought $268.6mn of local shares. Net outflows for the week were still close to $1bn though.

- Whilst the won has played some catch up with equities we could extend further if onshore sentiment remains positive, the chart below is 1 month USD/KRW NDF against the MSCI IT index (note USD/KRW is inverted on the chart).

- The data calendar is quiet. We are still waiting for May retail sales/department store sales data. Consumer confidence prints tomorrow.

- Finance Minister Choo Kyung-ho stated in an interview yesterday that inflation may reach 6% in coming months. The Energy Minister will announce at 3pm today local time whether or not power prices will rise, although the Finance Minister stated a rise is inevitable.

- South Korean President Yoon will meet with US President Biden and Japan Prime Minister Kishida on Wednesday in Spain as part of the NATO summit.

Fig 1: USD/KRW & MSCI IT Performance

Source: MNI- Market News/Bloomberg

Source: MNI- Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.