-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Corporate Supply Pipeline

US Treasury Auction Calendar

MNI ASIA MARKETS ANALYSIS, Tsy 50% Bounce Off Huge Early Sale

US TSY SUMMARY: Yields Recede After Making New Highs

Large range for Tsys after Bonds lead a steep sell-off early Wed, talk of negative convexity selling while stops triggered, exacerbating early move that accelerated after NY open. Rates recovered appr half the move by noon after making new high yields before 1000ET (10YY 1.4337%; 30YY 2.2910%) while yld curves extend bear steepening (5s30s 166.984). Fed systems crashed late, gradual recovery.

- Early sell-off not data related, though 1000ET Jan new-home sales better than exp at 923,000 vs. 856,000 est, and Fed Chair Powell repeated his Tue's Senate Banking Comm performance. More likely due to ongoing reflation trade theme the unexpected strength of which caught some off guard (tight stops).

- Other Fed Speak: Gov Brainard largely repeated much of the Fed leadership's recent thinking about QE, inflation and the labor market in a speech at Harvard today; VC Clarida's Comments Echo Powell Dovishness.

- Large Eurodollar Green pack Block 7k -0.045, likely swap related buyer, spds seeing decent tightening across the curve, particularly in 10s-30s, payer unwinds on the sell-off in rates.

- Overall heavy volumes as March/June Tsy futures roll climbed over 80% completion. Tsys dipped briefly after US Tsy $61B 5Y Note auction tailed: high yld of 0.621% (0.424% last month) vs. 0.615% WI; 2.24 bid/cover.

- Massive off ratio 2s5s steepener block: June instead of March (former takes lead Friday)

- +28,815 TUM 110-14.5, buy through 110-14.38 post time offer at 1037:39ET

- -40,569 FVM 124-25, sell through 124-26.75 post-time bid

- The 2-Yr yield is up 1.4bps at 0.125%, 5-Yr is up 4.1bps at 0.6069%, 10-Yr is up 4.1bps at 1.3824%, and 30-Yr is up 5.4bps at 2.234%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00037 at 0.08013% (+0.00200/wk)

- 1 Month -0.00313 to 0.11450% (-0.00095/wk)

- 3 Month +0.00225 to 0.18975% (+0.01450/wk) ** (Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00437 to 0.19938% (+0.00438/wk)

- 1 Year -0.00663 to 0.27800% (-0.00850/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $212B

- Secured Overnight Financing Rate (SOFR): 0.01%, $917B

- Broad General Collateral Rate (BGCR): 0.01%, $376B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $344B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, $3.601B accepted vs. $8.517B submission

- Next scheduled purchases:

- Thu 2/25 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 2/26 1010-1030ET: Tsy 0Y-2.25Y, appr 12.825B

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- -Block 17,000 Green Sep 91 puts, 9.5

- -3,000 short Dec95/96/98/100 call condors, 7.75

- -4,000 Blue Jun 92/93 call spds, 1.5

- +10,000 Blue Jun 92/95 call strip 5.0

- +5,000 Green Jun 92/95/96 3x2x1 put flys, 5.0

- +10,000 Blue Mar 85/88/90 put flys, 0.5

- Block -10,000 Blue Mar 88 puts, 3.0

- +5,000 Blue Jun 82/85/87 put flys, 3.25

- +30,000 short Dec 93/96 put spds 2.5 over 98 calls vs. 99.675/0.44%

- -10,000 Green Dec 88/90/92/93 put condors, 3.0

- -5,000 TYJ 136 calls, 5 vs. 135-05.5/0.11%

- +4,000 TYJ 134.5/135.5 1x2 call spds, 10

- +5,000 TYJ 135 calls, 18

- +2,000 TYJ 135/135.5/136 call flys, 4

- 5,000 TYJ 134 straddles, 122-125

- +2,800 TYM 137 calls, 13

- +2,500 TYK 135/136 call spd,s 17

- +2,000 TYK 134 straddles, 155

- +2,000 TYK 132/133.5 put spds, 24

- scale seller -11,000 FVJ 124 puts, 5-6.5

- 1,000 TYJ 133.5/134.25 3x2 put spds, 15 net

- +4,500 TYJ 134.5/135.5/136.5 1x3x2 call flys, 7

- -1,600 TYJ 134.25/135/135.75 call flys, 9

- -1,600 TYJ 133 puts, 23

- 4,500 FVK 123.25/124.5/124.75 broken put trees, 0.0

- Block, 10,000 TYJ 135.5/136 call spds, 4 vs. 133-30/0.06%

- Overnight trade

- Block, +20,000 FVJ 124.5/125.5 put over risk reversals, 3, adds to +20k for 1 Blocked last Friday

BONDS/EGBs-GILTS CASH CLOSE: Gilts Underperform...Again

Gilts underperformed once again, with long-end yields moving higher in both Germany and the UK. 10-Yr UK yields hit widest vs Bunds since Dec 2019. Periphery spreads widened despite a broadly constructive risk-on atmosphere.

- Germany's Merkel appeared to lay the groundwork for longer lockdown restrictions due to virus mutations. In data, French Feb business/manufacturing confidence missed expectations; Q4 German GDP was revised up.

- Today's comments by BOE officials including Bailey (who noted that economic scarring from the pandemic will be limited) and Haskel (who sees downside econ risks, and is open to more stimulus) did little to move markets. Thursday sees ECB's Lane, de Guindos, de Cos speaking.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is unchanged at -0.682%, 5-Yr is up 0.5bps at -0.61%, 10-Yr is up 1.1bps at -0.304%, and 30-Yr is up 1.4bps at 0.209%.

- UK: The 2-Yr yield is down 1bps at 0.032%, 5-Yr is down 0.6bps at 0.278%, 10-Yr is up 1.3bps at 0.732%, and 30-Yr is up 4.9bps at 1.377%.

- Italian BTP spread up 3.2bps at 99.1bps / Spanish spread up 1.6bps at 69.5bps

OPTIONS/EUROPE SUMMARY: Downside And Steepeners In Euribor

Wednesday's options flow included:

- RXJ1 170p, sold at 40 and 38 in 2k

- RXJ1 170.50/169.00 1x1.5 put spread bought for 28.5 in 4k (earlier)

- IKJ1 151.00c, bought for 30 in 1.3k (underlying IKM1 is 149.17)

- ERH1 100.50c, sold at 3.25 in 20k (ref 100.53)

- 3RK1 100.25/100.12ps vs 0RK1 100.50/100.37ps, bought the blue for 1.25 in 4.5k

- 3RQ1 100.25/100.125 put spread vs 0RQ1 100.50/100.375 put spread, buys the blue for 2.25 in 2k

- LU1 99.87/100.00/100.12c fly, bought for 4.75 in 5k

- 0LM1 100/99.87ps 1x2 with 0LU1 99.87/99.75ps 1x2, sell the ones at half in 6.4k

- 2LU199.75/99.50ps 1x2, bought for 1.5 in 1k

- 2LU1 99.00 put (v 99.555) with 2LZ1 98.875 put (v 99.485), bought the strip for 5.5 in 10k

- 2LZ1 99.375/99.125 put spread bought up to 7 in 5k (v 99.505)

- 2LZ1 99.25/99.00 put spread bought for up to 5.25 (v 99.50) in 5k

- 3LZ1 98.875/98.50 put spread bought for 6.5 in 5k

- 3LH1 99.75/99.62ps vs 2LH1 99.87/99.75ps, sold the blue at 1 in 4.25k

- 3LM1 98.75 (v 99.34, 7d) bought for 1.75 in 8.5k

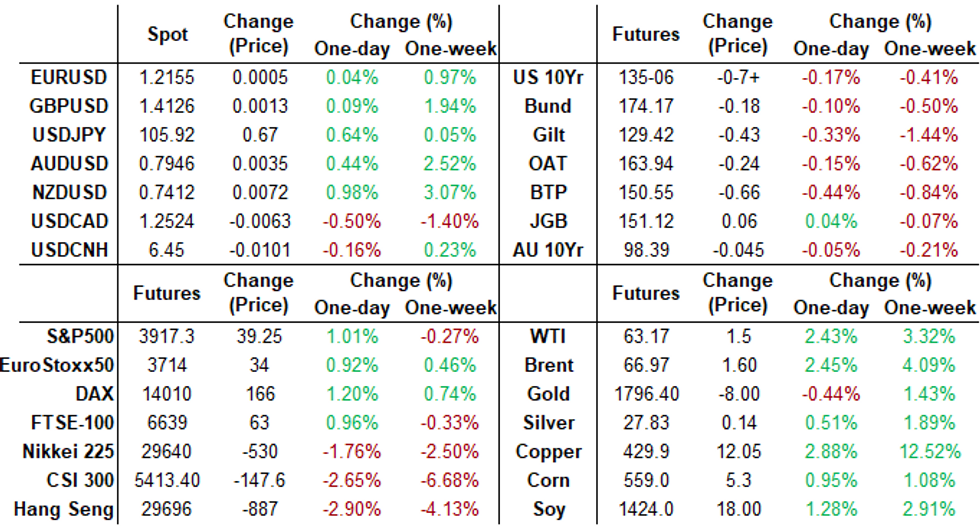

FOREX: Commodity Surge Fuels NOK, AUD Strength

The reflationary cycle persisted Wednesday, with commodity contracts from copper to crude all registering fresh cycle highs. This helped boost commodity-tied currencies into the Wednesday close, prompting NOK, AUD and CAD to outperform. The longevity of the commodity rally was backed up by the move back above the $50/bbl mark for across the WTI futures curve.

- The reflationary theme bled from commodities in haven FX, with both JPY and CHF trading particularly poorly despite the unimpressive showing from equity markets.

- Early strength in GBP faded into the Wednesday close, as markets heeded the sharp overbought technical conditions. This prompted GBP to eye a middling finish despite hitting new multi-year highs against the EUR and USD early Wednesday.

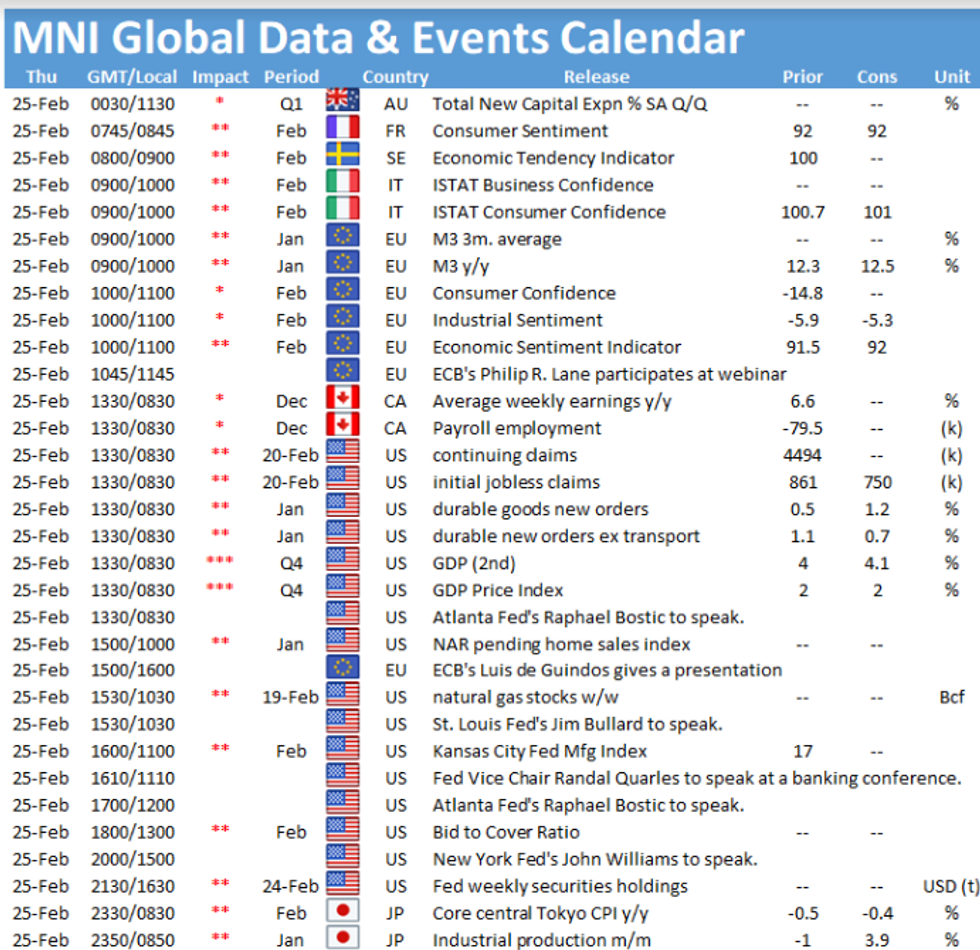

- Focus Thursday turns to weekly US jobless claims numbers, GDP data for Q4, durable goods orders and pending home sales. The speaker schedule includes ECB's Lane, de Cos and de Guindos and Fed's Bostic, Bullard, Quarles and Williams.

FX OPTIONS: Expiries for Feb25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E863mln), $1.2095-05(E771mln), $1.2130-50(E1.2bln)

- USD/JPY: Y104.25-30($775mln), Y105.00($623mln), Y105.40-50($541mln), Y106.65-80($718mln)

- EUR/GBP: Gbp.0.8600(E891mln)AUD/USD: $0.7910(A$1.1bln)

- NZD/USD: $0.7400(N$1.1bln)

- USD/CAD: C$1.2624-25($1.0bln), C$1.2750-60($1.0bln)

- USD/CNY: Cny6.4685-00($575mln), Cny6.7295($1.25bln)

- USD/TRY: Try7.00($955mln-USD puts), 7.10($1.5bln-USD puts), Try7.25($1.0bln-USD puts)

PIPELINE: $8B NTT Finance 5Pt Jumbo Launched

- Date $MM Issuer (Priced *, Launch #)

- 02/24 $8B #NTT Fin: $1.5B 2Y +25, $1B 3Y +35, $3B 5Y +57, $1.5B 7Y +60, $1B 10Y +70

- 02/24 $5B *KFW 3Y +0

- 02/24 $2B *ADB 10Y +11

- 02/24 $1.8B Post Holdings 10.5NC5.5

- 02/23 $1.25B #Bank of Nova Scotia $950M 5Y +47, $300M 5Y FRN SOFR+54.4

- 02/24 $1B Fortinet WNG 5Y +80a, 10Y +115a

- 02/23 $750M #Bank of New Zealand 5Y +52

- 02/24 $750M #Bharti Airtel 10.25Y +187.5

EQUITIES: Stocks Bounce, Reinforcing 50-DMA as Key Support

Equity markets across Europe and the US firmed nicely Wednesday, extending the late bounce seen in US indices on Tuesday. This reinforces the importance of the 50-dma in the e-mini S&P at 3795.96 as support, which underpinned price action nicely this week.

- In the S&P 500, energy and industrials led gains, reflecting the surge in commodities prices as crude oil and copper hit new 2021 cycle highs. Utilities were the sole sector in the red.

- Reflecting the reflationary theme, travel names including United Airlines, Boeing and Norwegian Cruise Lines were among the top performers, with oil refiners also trading particularly well.

- Volatility traded heavy, reflecting in the lower VIX, which remains well within range of the lowest levels seen after the beginning of the COVID crisis in March last year.

COMMODITIES: Oil, Copper Extend Gains

- The reflationary cycle persevered, with the Bloomberg Commodity Index rising 1.04% to it's best levels since October 2018.

- Both WTI and Brent crude futures, shrugged off a largely telegraphed 1.29mln barrel inventory build to extend through Tuesday's best levels. Supportive factors included a big drop off in refinery utilization (likely due to Texas cold snap), with no material drop in implied demand. Prices have consolidated towards the top end of the days range, both up ~2.4% for the session.

- Copper prices surging again, continuing to make fresh highs since 2011. HG1 futures now above 430 and are currently up 3.3% on the session. With momentum studies bullish (but overbought) and moving average signals also pointing north, further gains are likely near-term. $442.60, the 3% Upper Bollinger Band, appears to have provided some resistance, but a clear through here opens up the 2011 highs of 464.95 longer-term.

- Precious metals: A bout of USD strength, correlated to a weak open for US equities, led a sharp move lower in both gold and silver. Spot gold dropped over 1% before recovering half of the move to rest just shy of $1800. Spot silver lost over 2% but was underpinned around the $27.25/30 area which has continued to support prices this week. Silver had a more impressive relative recovery and resides up 0.5% for the day.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.