-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Corporate Supply Pipeline

US Treasury Auction Calendar

MNI ASIA MARKETS ANALYSIS: Getting Comfortable With Tapering

US TSYS: Yields Up, Risk-On, Getting Comfortable With Tapering

Decent overall trade volume by Fri's close with TYZ1>1.6M, as markets continue to price in a taper annc for the November FOMC. Meanwhile, support for bonds evident since Wed's policy annc evaporated, yield curves rebounding: 5s30s nearly 10bps off late Wed's lows as it tapped 103.145bp high Friday.- Limited react to Aug new home sales +1.5% to 0.740M SAAR; July new home sale up-revised to 0.729M SAAR. Major focus on Fri October 8 Sep employ data two weeks from now as a prerequisite for Nov FOMC taper annc.

- Session headlines from KC Fed George did not covering new ground, but reiterated tapering asset purchases sooner rather than later as better, Bbg:

- HAVE LONG WAY TO GO, STIMULUS FROM OUR POLICY TO LINGER

- STARTING TAPER PROCESS IS IMPORTANT, NEED FLEXIBILITY

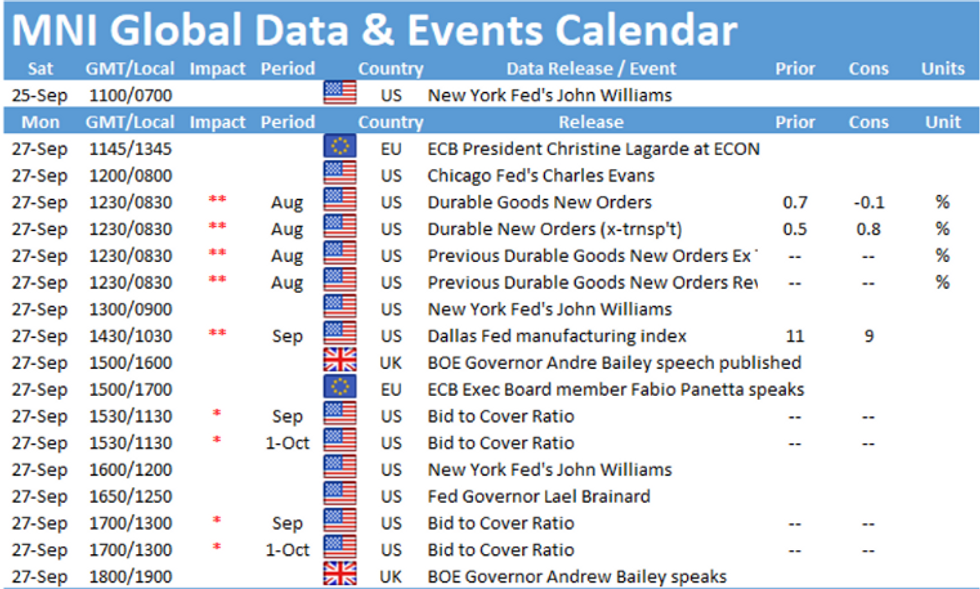

- With month end fast approaching, next week's Tsy auctions jammed into the first half of the week: $82B total 13- and 26W bills Monday in addition to $60B 2Y and $61B 5Y notes on Monday.

- Incoming supply generated some pre-auction short sets, while October Tsy serial options expiry generated two-way hedging as 10s and 30s close to pinning strikes in USV 161 and TYV 132 strikes.

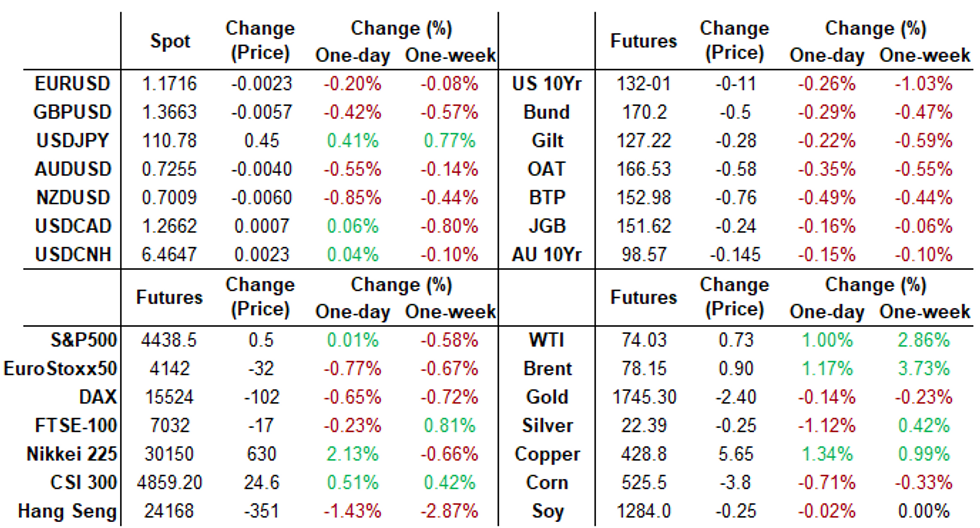

- The 2-Yr yield is up 1.3bps at 0.2736%, 5-Yr is up 0.7bps at 0.955%, 10-Yr is up 2.8bps at 1.4578%, and 30-Yr is up 4.6bps at 1.9854%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00062 at 0.07250% (+0.00175/wk)

- 1 Month -0.00087 to 0.08513% (+0.00162/wk)

- 3 Month +0.00000 to 0.13225% (+0.00838/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00038 to 0.15538% (+0.00312/wk)

- 1 Year +0.00063 to 0.22963% (+0.00525/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07% volume: $264B

- Secured Overnight Financing Rate (SOFR): 0.05%, $878B

- Broad General Collateral Rate (BGCR): 0.05%, $370B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $350B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $20.032B submission

- Next scheduled purchases

- Mon 9/27 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Tue 9/28 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Wed 9/29 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Thu 9/30 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Fri 10/01 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: Reverse Repo Operations

NY Fed reverse repo usage recedes after setting five consecutive record highs: 1,313.657B from 78 counter-parties today vs. Thursday's record $1,352.483B.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- 2,500 Green Mar 98.56 puts, 14.0

- +7,500 Blue Nov 98.75 calls, 2.5 vs 98.42/0.14%

- +20,000 Red Dec 99.12/99.25/99.37 put flys, 1.0

- +2,000 Blue Dec 97.87/98.12/98.37 put flys, 4.5

- 1,500 Blue Nov 98.00/98.12/98.25/98.37 put condors

- Overnight trade

- +10,000 Green Nov 99.00/99.06 strangles, 23

- +3,000 Green Oct 99.00 calls, 2.0 vs. 98.845/0.10%

- -4,000 TYZ 132 straddles, 155

- -4,000 TYZ 130/134 strangles, 36 vs. 132-29.5/0.05%

- 5,000 TYX 131.5/TYZ 130.5 put spds, 3

- 4,400 USX 160 puts, 50

- 5,000 wk2 TY 131.25/131.5/132 broken put flys

- Overnight trade

- Block, +5,000 TYX 130.5/130.5 put spds 2 over TYX 133.5 calls

FOREX: Risk Appetite Capped, High Beta FX Edges Lower

- The greenback trimmed Thursday's losses to close back toward the upper end of the week's range Friday, keeping the USD Index within range of the bull trigger at the mid-August high of 93.73. Friday saw modest risk-off trade, with equities edging lower on the back of further concerns surrounding China's property development giant Evergrande. USD bondholders were yet to receive a payment due on Thursday, potentially triggering the grace period and default process.

- The risk off tone worked against growth proxies and high beta FX, pressing AUD and NZD to the bottom of the G10 pile. AUD/USD faded back toward the week's lowest, keeping the bearish theme intact and targeting the bear trigger at 0.7220.

- Focus in the coming week turns to thew fallout from the German elections, MNI Chicago Business Barometer data as well as the ISM and UMich releases.

FOREX: Expiries for Sep27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750-65(E1.3bln), $1.1800(E685mln)

- USD/JPY: Y109.85-00($1.1bln)

- GBP/USD: $1.3740-50(Gbp564mln)

- AUD/USD: $0.7330-40(A$630mln)

- USD/CAD: C$1.2875($750mln)

PIPELINE: $1.3B NatWest 2Pt Launched

Sole issuer NatWest on the day puts total corporate and supra-sovereign debt issuance over $24B for the week.

- Date $MM Issuer (Priced *, Launch #)

- 09/24 $1.3B #NatWest $1B 5Y +65, $300M 5Y FRN/SOFR+76

EQUITIES: Stocks Edge Lower into Friday Close, With Profit-Taking Adding Some Weight

- Stock markets on both sides of the pond ebbed lower into the Friday close, with profit-taking and consolidation putting a lid on the S&P500. Markets sat just below the week's highs into the closing bell, but still held a decent gain on the week, despite fears surrounding China's Evergrande weighing on sentiment.

- The latest reports suggested the Chinese government could be stepping in to ensure housing projects started by the troubled developer are built, stemming the risk of an immediate halt to economic activity. Nonetheless, US-based bondholders were without receipt of a payment due from the company on Thursday, possibly triggering the grace period that comes ahead of default.

- The real estate sector undermined the S&P500, slipping close to 1% while energy and financials extended the week's rally.

- Across Europe, France's CAC-40 and the EuroStoxx50 led losses, edging lower by just under 1% apiece.

COMMODITIES: WTI Strikes Sept High, Narrows in On Bull Trigger

- Energy markets traded solidly Friday, shrugging off the generally sluggish feel in equity and riskier asset markets. WTI crude futures topped Thursday's best levels to print a new September high of $73.93/bbl. This keeps WTI within striking distance of the bull trigger at $74.23 last printed in late July.

- Primary drivers remain the expected tightness of the energy market across Winter, with a number of sell-side firms flagging the risks to prices should a colder-than-expected season drive energy demand and thereby prices higher.

- Gold and silver prices were more mixed, with silver slipping while gold managed to print minor gains. Gold initially traded heavy on broad greenback strength before a spell of buying around the 4pm fix drove metals higher. Ongoing concerns around China real estate giant Evergrande also helped assist a safe haven bid, with US-based bond holders yet to receive a payment due Thursday, triggering a grace period and possibly the beginning of the default process. Initial firm resistance remains at $1787.40, the Sep 22 high. A break here would ease current bearish pressure.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.