-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

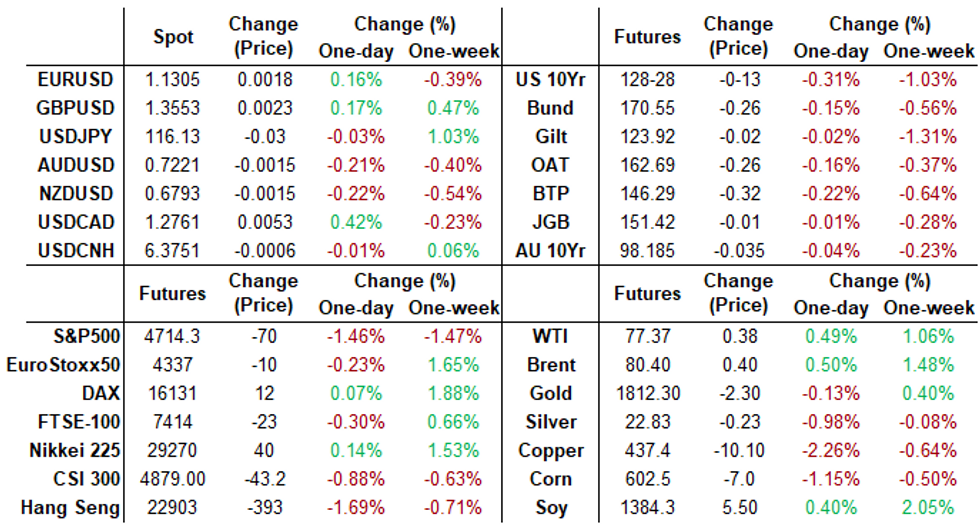

Free AccessMNI ASIA MARKETS ANALYSIS: Hawkish Dec FOMC Minutes

US TSYS: Treasuries See Large Bear Flattening On FOMC Minutes

- Cash Tsy yields are up 7+bps across the short-end and belly following the FOMC minutes flagging a chance of earlier and faster rate hikes, with runoff starting soon after deemed possible by some participants.

- 2Y yields are +7.0bps at 0.830%, 5Y +7.5bps at 1.433%, 10Y +5.6bps at 1.704% and 30Y -+2.0bps at 2.085%.

- TYH2 is down 0-14+ at 128-17 having reached a low of 128-25+. It has cleared 128-30+ (Nov 26 low) and opened the key support of 128-22+ (Nov 22 low).

- Tomorrow: Weekly jobless claims (overshadowed by large ADP beat today and with payrolls on Fri) and then ISM services for Dec and durable goods for Nov at 1000ET. Price pressures are of particular interest for ISM after costs in today’s PMI reached a new series high.

- NY Fed buy-op: TIPS 7.5Y-30Y, appr $925M (1120ET).

- Issuance: $50B 4W, $40B 8W bill auctions.

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N -0.00215 at 0.07014% (+0.00576/wk)

- 1 Month -0.00171 to 0.10200% (+0.00075/wk)

- 3 Month +0.00957 to 0.22557% (+0.01644/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00286 to 0.34000% (+0.00125/wk)

- 1 Year +0.00671 to 0.59629% (+0.01316/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $252B

- Secured Overnight Financing Rate (SOFR): 0.04%, $976B

- Broad General Collateral Rate (BGCR): 0.05%, $348B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $325B

- (rate, volume levels reflect prior session)

- Tsy 7Y-10Y, $2.401B accepted vs. $9.538B submission

- Tsy 22.5Y-30Y, $1.801B accepted vs. $3.469B submission

- Next scheduled purchases:

- Thu 01/06 1100-1120ET: TIPS 7.5Y-30Y, appr $0.925B

- Fri 01/07 1010-1030ET: Tsy 0Y-2.25Y, appr $9.325B

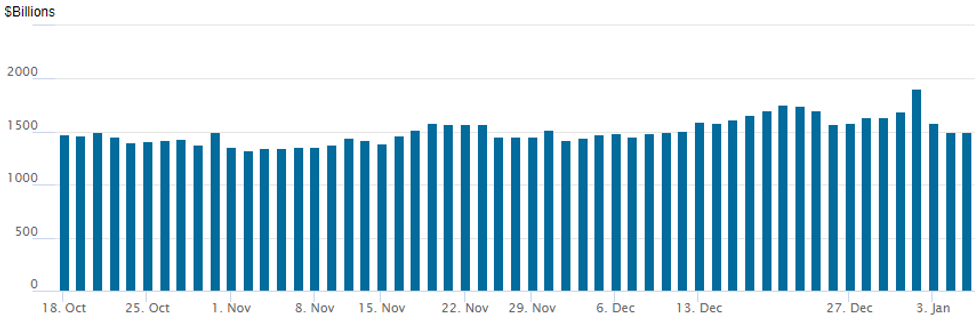

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage continues to recede: $1,492.787B (69 counterparties) vs. $1,495.692B on Tuesday.

All-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +4,000 Mar 99.56/99.68/99.75 1x3x2 call flys, 2.25

- 4,400 short Jan 99.00/99.18 call spds

- 4,000 Sep 99.12/99.75 put spds

- 5,000 Jun 99.25/99.50 2x1 put spds, 6.5

- -40,000 short Mar 98.50/98.62 put spds, 3.75, unwind vs. 98.75/0.10%

- 3,000 Jun 99.00/99.50 put spds

- -2,500 Jun 99.25 puts, 5.0 more tied to Jun 99.00/99.25/99.50 put flys

- 2,500 Sep 99.25 puts, 20.5

- 2,800 Green Jan 98.00/98.50 strangles

- 10,000 Sep 98.25 puts

- 4,100 TYG 132.5 calls, 1

- +15,000 TYG 127.5 puts, 5, ref: 129-10

- 5,500 TYG 127 puts, 15

- 3,000 TYG 129.5/130/130.5 call trees, 4

- 1,500 FVH 118.25/119/119.5/120 put condors

EGBs-GILTS CASH CLOSE: Supply The Day's Focus

Bunds and Gilts traded largely in ranges Wednesday, perhaps biding time ahead of events out of the US (Fed Minutes after hours and jobs report Friday). Curves traded mixed overall.

- In the meantime, supply was a big theme on the day.

- Plenty of syndication activity: Italy headlined, selling E7bln of 30Y BTP; Slovenia sold E1.75bln of 4 and 40-year bonds. And in auctions, Germany allotted E3.1bln in Bund and Spain E5.7bln in bonds.

- Italy underperformed Spain and Portugal, with more bear steepening in the BTP curve.

- In data, services PMIs were on the soft side; Italy Dec CPI was in line.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.7bps at -0.62%, 5-Yr is down 1.3bps at -0.431%, 10-Yr is up 3.8bps at -0.084%, and 30-Yr is up 0.5bps at 0.262%.

- UK: The 2-Yr yield is down 0.6bps at 0.762%, 5-Yr is up 0.4bps at 0.917%, 10-Yr is up 0.2bps at 1.087%, and 30-Yr is down 1bps at 1.202%.

- Italian BTP spread down 1.8bps at 131.9bps / Spanish down 3bps at 68.2bps

EGB Options: Smattering Of Spreads (And Mostly Downside)

Wednesday's Europe rates / bonds options flow included:

- RXG2 171.50/171.00 ps sold at 30 in 8.5k

- RXH2 170/169ps,1x1.5 bought for 1 in 3k and 1.5 in 1k

- OEG2 132.50 put bought for 5.5 in 5k

- OEG2 133.50/133.75 call spread bought for 6.5 in 2.45k

- 2RH2 100.50c, bought for 0.25 in 4k

FOREX: Equities Weakness Following Fed Minutes Prompts US Dollar Recovery

- On Wednesday, the dollar was seen broadly weaker as commodities gained and equities held their ground following a large beat in the December US ADP employment change.

- EURUSD had extended gains back above the 1.13 mark, slowing edging to session highs of 1.1346.

- However, with the Fed discussing faster rate liftoff on inflation risk and the minutes of December meeting indicating some discussion of tapering MBS faster than Treasuries, the US dollar reacted positively as US equity indices came under selling pressure.

- EURUSD gave up around 35 pips to trade below 1.1310, with particular weakness seen in risk proxies where the likes of AUD and CAD fell over 0.5% to fresh session lows post the release.

- Overall, the US dollar index remains 0.1% lower on the day but is higher for the week as we approach the December NFP report on Friday.

- Of note, EURGBP is approaching a key support at 0.8333, which when flipped represents 1.2000 in GBP/EUR. While a psychologically significant pivot point, corporate interest ahead of and at this GBP/EUR level bolsters the potential short-term support and medium-term implications of a break below. For reference, there has been just one weekly close below this level since mid-2016 and therefore should be closely monitored in the upcoming trading sessions.

- Tomorrow in Europe, markets will see preliminary German CPI data before Friday’s Eurozone HICP flash estimate. In the US, ISM Services PMI will headline the docket.

FX: Expiries for Jan06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1210-25(E2.1bln), $1.1265-75(E1.9bln), $1.1300(E1.4bln), $1.1330-50(E1.0bln), $1.1425(E598mln)

- USD/JPY: Y113.45-55($1.8bln), Y114.75-00($1.3bln), Y115.50-65($1.1bln)

- AUD/USD: $0.7200-20(A$639mln)

- USD/CAD: C$1.2780-90($796mln)

- USD/CNY: Cny6.40($651mln)

EQUITIES: Stocks Stagnate as Rally Hits Pause

- Wall Street indices were mixed Wednesday, with the S&P 500 drifting into negative territory, led lower by tech stocks as the NASDAQ dropped over 1%. The Dow Jones was the standout performer, inching to a fresh record thanks to rallies in Honeywell, IBM and Caterpillar stock.

- The e-mini S&P followed Asia-Pac stocks lower during overnight hours, following underperformance in Hong Kong's Hang Seng Index, that led to a negative opening bell. Real estate and tech names led the weakness, countering modest strength across materials and energy stocks.

- European trade was more mixed, with Germany's DAX, Italy's FTSE-MIB higher while Spain's IBEX-35 and the UK's FTSE-100 lagged.

COMMODITIES: Oil Price Boosted By Kazakhstan Unrest

- Crude oil futures have climbed 1.6-1.8% today to new post-Omicron highs. A large part of this appears to have been on Kazakhstan unrest and the impact this could have on production, with price rises concentrated in shorter-dated contracts.

- A smaller than expected drawdown in weekly US crude inventories saw a brief dip lower but this was quickly reversed.

- WTI is +1.8% at $78.4, clearing resistance at $77.44 (76.4% retracement of Oct-Dec downleg) and opening $78.59 (Nov 24 high).

- Brent is +1.6% at $81.3, clearing two resistance levels today with next eyed at $83.11 (Nov 10 high).

- Gold meanwhile has bounced 0.6% to $1824.7. Monday's high of $1831.9 and 1780.6, the channel base drawn from the Aug 9 low, mark the key short-term directional triggers.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/01/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 06/01/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 06/01/2022 | 0700/0800 | ** |  | DE | manufacturing orders |

| 06/01/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/01/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 06/01/2022 | 1000/1100 | ** |  | EU | PPI |

| 06/01/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 06/01/2022 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 06/01/2022 | 1330/0830 | ** |  | US | trade balance |

| 06/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/01/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/01/2022 | 1500/1000 | ** |  | US | factory new orders |

| 06/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 06/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 06/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 06/01/2022 | 1630/1130 |  | US | San Francisco Fed's Mary Daly | |

| 06/01/2022 | 1815/1315 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.