-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Employment Insight, Sep'24: Cooler But Not Sharply So

MNI BRIEF: EU Exposure To Global Trade Break "High" - Draghi

MNI ASIA MARKETS ANALYSIS: How Much Hot CPI Priced In Already?

US TSYS

- Both Eurodollar and Treasury futures trade well off midmorning lows to near late overnight highs in late NY trade -- before Wed's Dec CPI.

- First half trade was more carry-over bear-bias trade in-line with Fed speakers (Bostic, Mester and George) and dealers calling for 3-4 rate hikes in 2022 (JPM and GS see 4), first hike in March, faster balance sheet drawdown, quantitative tightening later in second half of 2022.

- On/Off inversion: Eurodlr Greens (Mar'24-Dec'24) are current inflection point where current tighter policy opinions falter, differing opinions on if/when hikes stop, chances of easing or resumption of accommodation priced back in.

- Rates rebounded late morning with less aggressive tone from Fed Chair Powell at his Senate nomination hearing that ran through noon.

- Huge 2Y Block: +20,570 TUH2 108-23.75, buy through 108-23.37 post-time offer at 1313:37ET. Print comes on heels of debate over short end reaction to a "hot" CPI figure tomorrow, (0.4% est vs. 0.8% previous).

- Given heavy short end selling last week as market aggressively prices in first rate hike in March, another above consensus read for the inflation figure unlikely to induce further selling in the short end (re: .50bp hike in March).

- Treasury futures gain slightly but still holding inside range after $52B 3Y note auction (91282CDS7) small stop: 1.237% high yield vs. 1.239% WI; 2.47x bid-to-cover vs. 2.43x in Dec.

- Indirect take-up climbed to 61.65% vs. last month's year high of 52.17%, while direct bidder take-up falls off 1+ year highs last couple auctions to 15.51% (18.01% Dec). Primary dealer take-up recedes to 22.84% vs. 29.81% in Dec, well under the 5M average of 28.06%

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N +0.00000 at 0.07743% (+0.00472/wk)

- 1 Month +0.00900 to 0.11300% (+0.00771/wk)

- 3 Month +0.00614 to 0.24443% (+0.00829/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00314 to 0.38614% (+0.00971/wk)

- 1 Year +0.01871 to 0.69557% (+0.03386/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $267B

- Secured Overnight Financing Rate (SOFR): 0.05%, $919B

- Broad General Collateral Rate (BGCR): 0.05%, $351B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $336B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.601B accepted vs. $3.280B submission

- Tsy 4.5Y-7Y, $4.501B accepted vs. $14.155B submission

- Next scheduled purchases:

- Tue 01/11 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B

- Wed 01/12 1100-1120ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 01/13 1010-1030ET: Tsy 2.25Y-4.5Y, appr $6.325B

- Thu 01/13 1500ET: Updated NY Fed Operational Purchase Schedule

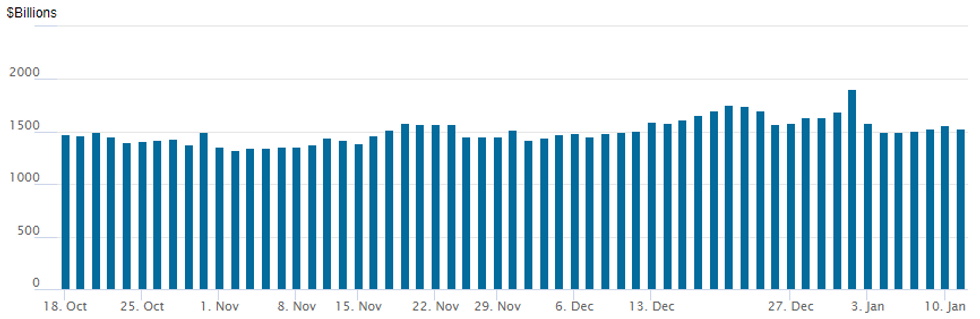

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,527.020B (77 counterparties) vs. $1,560.421B on Monday.

All-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +10,000 Dec 98.00/98.18 put spds, 2.0

- +10,000 short Mar 98.12/98.31/98.50 put flys, 3.5

- +5,000 short Mar 99.00/99.12/99.25 call flys, 0.5

- +2,000 Jun 99.06/99.25 2x1 put spds, 1.25

- +2,000 Green Jun 97.75/97.62/97.87 put flys, 5.75

- +5,000 Mar 99.56/99.62/99.68 put flys, 2.25

- Overnight trade

- Block, +40,000 Green Feb 97.62 puts, 1.5

- +6,000 May 99.06/99.25 put spds 2.25 over 99.50/99.68 call spds

- 2,500 USH 160 calls, 31

- 3,000 USG 153.5/154.5 put spds

- 6,000 TYG 126.25/127 put spds, 4

- 3,000 TYG 128.5 calls, 18 after

- 3,000 TYG 128.25/128.5/128.75 call flys, 4

- 2,000 TYJ 126/127.5 put spds

- 3,500 FVG 119.5 calls

- 2,500 USH 156 calls, 142

- Overnight trade

- Block, +45,000 TYH 127 puts, 21-22

- Block, +20,000 FVG 119.25 puts, 8

- Block, +5,500 TYH 129 calls, 32 vs. 128-12.5/0.38%

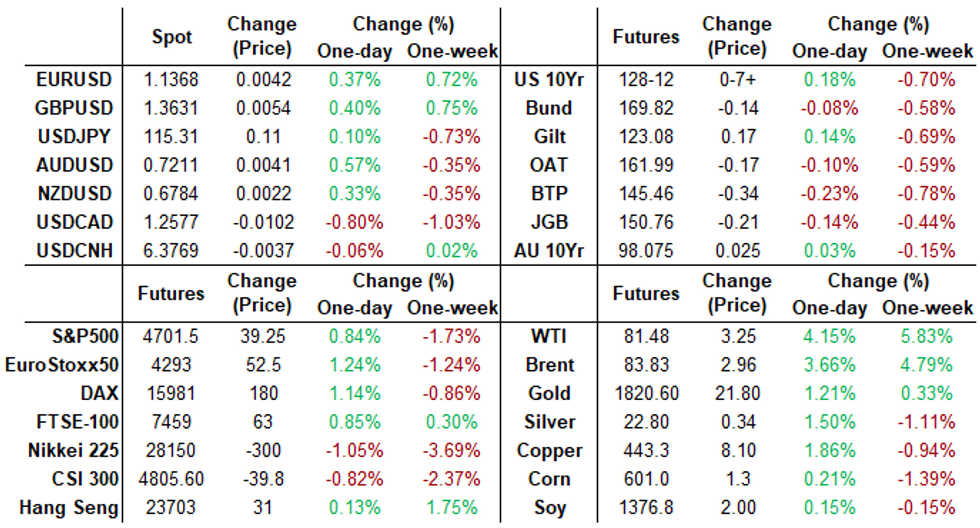

FOREX: Softer Greenback, CAD and NOK Outperform As Crude Prices Surge

- Both the Canadian dollar and the Norwegian Krona were the main G10 beneficiaries on Tuesday as buoyant commodity prices underpinned demand.

- Crude oil futures have risen well over 3% and both WTI and Brent are currently testing the October highs, providing some fresh impetus for CAD and NOK bulls.

- USDCAD has made headway below the 1.26 handle, marking the fourth consecutive session of lower lows for the pair. A clear break of both 1.2621 as well as 1.2608 (Dec8 low) strengthens the bearish case to initially target 1.2546 (61.8% retracement of the Oct - Dec rally).

- Overall, the US dollar has weakened amid the improving global risk sentiment. The dollar index (DXY) has fallen 0.4% and is within close proximity of the late November lows around 95.50 as we approach tomorrows CPI data.

- The greenback weakness comes in the face of growing sell-side adjustments to Fed rate hike expectations with several analysts now predicting four hikes in 2022.

- EURUSD, GBPUSD and NZDUSD have all moved in line with the weaker dollar and AUDUSD (+0.6%) has edged back above the 0.72 handle and traders will eye a potential close above the 50-day MA which intersects at 0.7216. Key short-term resistance is unchanged at 0.7278, the Dec 31 high.

- The weaker dollar and firmer equity/commodity markets provided a strong environment for emerging market FX. The South African Rand gained close to one percent, however, the major gains were seen in LatAm with both the BRL and COP surging around 1.5%.

- Chinese CPI/PPI is scheduled overnight before the week’s main event of US CPI will be released at 1330GMT/0830ET.

FX: Expiries for Jan12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1275-85(E618mln), $1.1300-05(E2.4bln), $1.1400(E542mln)

- USD/JPY: Y112.90-10($784mln), Y113.50-70($1.2bln), Y115.50($638mln), Y116.00-05($750mln)

- GBP/USD: $1.3595-00(Gbp797mln)

- EUR/GBP: Gbp0.8494-00(E1.2bln)

- USD/CAD: C$1.2690($1.0bln), C$1.2750-60($1.2bln), C$1.2790($1.8bln)

- USD/CNY: Cny6.4500($1.3bln)

EQUITIES: Stocks Stable After Monday Volatility

- Equity markets traded on a far more stable footing Tuesday, with all three major US markets in the green following the London close. Tech and growth-led names recovered some poise, with the NASDAQ outperforming the likes of the S&P500 and Dow Jones.

- This put the consumer discretionary and tech sectors at the top of the pile - in a reversal of the early Monday trading pattern - although gains were outstripped by energy names, as oil & gas explorers benefited from the rally in crude prices.

- The e-mini S&P managed to consolidate back above the 50-dma, which has provided solid support in recent weeks - helping markets turn to focus to the next upside levels at last week's 4715.75 and the YTD highs of 4808.25.

COMMODITIES: Brent Clears Major Resistance As Powell Resists A Hawkish Surprise

- Crude oil prices have jumped circa 3.5% today after Powell stuck to the message of the prepared remarks for the Senate hearing of his nomination, with no hawkish surprises.

- Brent is +3.6% at $83.77, clearing major resistance of $83.69 (Oct 10 high) as it next eyes the $84 round number resistance and then $84.5 (1.382 proj of the Dec 2-9-20 price swing). Support is seen at $78.36, the 20-day EMA.

- The most active strikes in the Mar’22 contract today have been $85/bbl calls and $90/bbl calls.

- WTI is +3.9% at $81.3. Resistance is seen at $81.73 (Nov 10 high) after which it opens major resistance at the Oct 25 high of $82.13. Support is materially lower at $75.54 (20-day EMA).

- Gold meanwhile is up +1% at $1820.1, clearing initial resistance of $1811.6 (Jan 6 high) with the next level $1849.1 (Nov 22 high). Support had previously been seen at the base of a bull channel drawn from the Aug 9 low that intersects at $1784.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/01/2022 | 1000/1100 | ** |  | EU | industrial production |

| 12/01/2022 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 12/01/2022 | 1330/0830 | *** |  | US | CPI |

| 12/01/2022 | 1415/1415 |  | UK | BOE Cunliffe at Crypto Fin Conference | |

| 12/01/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 12/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 12/01/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/01/2022 | 1700/1200 | ** |  | US | USDA GrainStock - NASS |

| 12/01/2022 | 1700/1200 | *** |  | US | USDA Winter Wheat |

| 12/01/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/01/2022 | 1800/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/01/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 12/01/2022 | 1900/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.