-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Ylds Surge, Eqs Sag to Mid-Dec Lows

EXXECUTIVE SUMMARY

- MNI INTERVIEW: CoreLogic Sees US Shelter CPI At 7% By Yearend

- FED: Wells Fargo: Runoff To Begin In October, Reach $100B/Month Pace

US

US: Owners' equivalent rent, which makes up 40% of core U.S. CPI, will likely double to 7% by December based on current single-family home rental price trends, CoreLogic chief economist Frank Nothaft told MNI on Tuesday.

- That would keep core CPI elevated at around 4% by year-end if every other component fell back to 2%, he said. Alternatively, if one assumes all other components registered zero, core CPI would still be running just under 3% on the acceleration in the rent measure alone.

- Because a typical lease lasts a year, only a sliver of the BLS's monthly sample of rent prices has seen a recent adjustment to market rental rates. A regression analysis found that the rental price figure known as OER lags CoreLogic's single-family rent index by about 12 months.

- "The OER data will adjust but very gradually," Nothaft said. For more, see MNI Policy main wire at 1344ET.

- This will take the form of a passive runoff with securities maturing up to a monthly cap: initially $25B ($20B Tsy, $5B MBS), increasing by $10B Tsy/$5B MBS per month from Nov 2022 through Mar 2023 to a terminal monthly cap of $100B ($70B Tsy / $30B MBS).

- This is on the hawkish end of expectations and would be double the previous cycle's terminal runoff pace of $50B, but Wells Fargo notes that when scaled to the Fed's asset growth, roughly equivalent.

- This pace would bring the Fed balance sheet from ~$9T to a little below $7T by end-2024, or around 24.4% GDP - which Wells Fargo says represents the same level as in mid-2015.

- "We think the most likely outcome is for upward pressure on long-term Treasury yields, but only moderately so", pencilling in an end-2023 10Y Tsy yield of 2.35%.

US TSYS: Late Options/Futures Round-Up

Tuesday return from from extended MLK holiday weekend saw deceivingly heavy Eurodollar/Treasury futures and options volumes. Large volumes kicked off Monday evening during early Asian hours as Globex re-opened.

- Implied vols traded firmer as underlying futures continued to confirm tighter policy expectations through year (Reds-Blues -0.080 to 0.130 after the bell), put skews remain rich to corresponding out-of-the-money calls.

- Couple examples included scale buyer of over 75,000 TYH 126 puts from 14-17, while Eurodollar options saw buy of 36,000 Jun 99.00 puts at 5.0 before the open.

- Not so subtle changes in Eurodollar futures in longer expirys: Eurodollar Whites (EDH2-EDZ2) are pricing in four .25bp quarterly hikes starting in March while longer dated option positioning are starting to target Jun, Sep and Dec expirys.

- Curve synthetic of note: paper sold -20,000 Green Feb/Blue Feb 97.75 put spd, Blues sold over, for net credit of 1.25 on the conditional bear flattener.

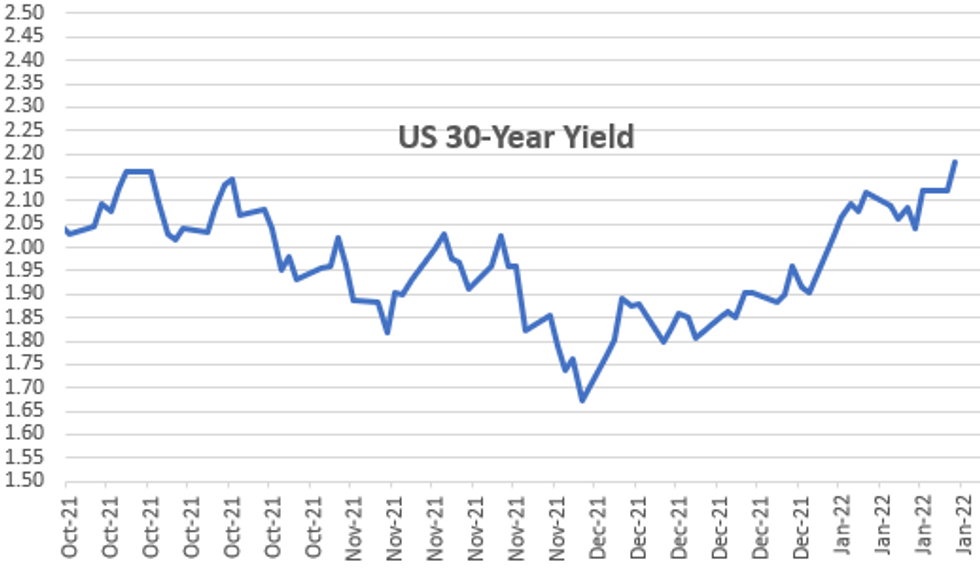

- The 2-Yr yield is up 7.4bps at 1.0404%, 5-Yr is up 9bps at 1.6478%, 10-Yr is up 8.4bps at 1.8681%, and 30-Yr is up 6.2bps at 2.1834%.

OVERNIGHT DATA

- US NY FED EMPIRE STATE MFG INDEX -0.7 JAN

- US NY FED EMPIRE MFG NEW ORDERS -5.0 JAN

- US NY FED EMPIRE MFG EMPLOYMENT INDEX 16.1 JAN

- US NY FED EMPIRE MFG PRICES PAID INDEX 76.7 JAN

- US NAHB HOUSING MARKET INDEX 83 IN JAN

- US NAHB JAN SINGLE FAMILY SALES INDEX 90; NEXT 6-MO 83

- CANADA DEC HOME STARTS -22% TO 236,106 ANNUALIZED PACE

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 504.99 points (-1.41%) at 35404.05

- S&P E-Mini Future down 77.25 points (-1.66%) at 4577.25

- Nasdaq down 331.1 points (-2.2%) at 14561.59

- US 10-Yr yield is up 8 bps at 1.8645%

- US Mar 10Y are down 25/32 at 127-13

- EURUSD down 0.0082 (-0.72%) at 1.1326

- USDJPY down 0.01 (-0.01%) at 114.62

- WTI Crude Oil (front-month) up $2.12 (2.53%) at $85.94

- Gold is down $4.09 (-0.22%) at $1815.17

- EuroStoxx 50 down 44.32 points (-1.03%) at 4257.82

- FTSE 100 down 47.68 points (-0.63%) at 7563.55

- German DAX down 161.16 points (-1.01%) at 15772.56

- French CAC 40 down 67.81 points (-0.94%) at 7133.83

US TSY FUTURES CLOSE

- 3M10Y +6.879, 172.357 (L: 166.42 / H: 173.074)

- 2Y10Y +1.038, 82.359 (L: 76.231 / H: 83.28)

- 2Y30Y -1.142, 113.964 (L: 107.263 / H: 116.126)

- 5Y30Y -2.951, 53.302 (L: 49.398 / H: 56.149)

- Current futures levels:

- Mar 2Y down 4.75/32 at 108-15.25 (L: 108-14.12 / H: 108-18.12)

- Mar 5Y down 16.25/32 at 119-0.25 (L: 118-31 / H: 119-14.75)

- Mar 10Y down 27/32 at 127-11 (L: 127-09.5 / H: 128-01.5)

- Mar 30Y down 1-20/32 at 153-23 (L: 153-16 / H: 155-01)

- Mar Ultra 30Y down 2-16/32 at 186-01 (L: 185-24 / H: 188-13)

US 10YR FUTURE TECHS (H2) Resumes Its Downtrend

- RES 4: 129-29+ 50-day EMA

- RES 3: 129-09 20-day EMA

- RES 2: 128-27 High Jan 13

- RES 1: 128-01+ Intraday high

- PRICE: 127-11 @ 20:36 GMT Jan 18

- SUP 1: 127-09.5 Intraday low

- SUP 2: 127-07 2.236 proj of the Dec 20 - 29 - 31 price swing

- SUP 3: 127-00 Round number support

- SUP 4: 126-26+ 2.50 proj of the Dec 20 - 29 - 31 price swing

Treasuries have started the week on a softer note, breaking lower and clearing support at 127-30, Jan 10 low. The move confirms a resumption of the underlying downtrend and clears the way for weakness towards 127-07 next, a Fibonacci projection. Moving average studies remain in a bear mode condition, highlighting the current trend direction. On the upside, a firm short-term resistance has been defined at 128-27, Jan 13 high.

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.040 at 99.530

- Jun 22 -0.080 at 99.180

- Sep 22 -0.085 at 98.920

- Dec 22 -0.085 at 98.645

- Red Pack (Mar 23-Dec 23) -0.08 to -0.075

- Green Pack (Mar 24-Dec 24) -0.11 to -0.09

- Blue Pack (Mar 25-Dec 25) -0.13 to -0.115

- Gold Pack (Mar 26-Dec 26) -0.13 to -0.12

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N -0.00371 at 0.07029% (-0.00371/wk)

- 1 Month +0.00071 to 0.10371% (+0.00042/wk)

- 3 Month +0.00600 to 0.25400% (+0.01271/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01172 to 0.42986% (+0.03486/wk)

- 1 Year +0.02029 to 0.78700% (+0.06129/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $260B

- Secured Overnight Financing Rate (SOFR): 0.05%, $874B

- Broad General Collateral Rate (BGCR): 0.05%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $333B

- (rate, volume levels reflect prior session)

Citing technical difficulties, NY Fed's scheduled buy-operation of Tsy 4.5Y-7Y, appr $6.025B at 1030ET has been postponed to Tuesday, adding the issue "does not impact any other operations scheduled for today." Operations desk annc'd plan to "purchase approximately $40 billion over the monthly period from 1/14/22 to 2/11/22" vs. $60B prior as QE winds down. Updated schedule as of last week:

- Next scheduled purchases:

- Wed 01/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B vs. $4.525B prior

- Thu 01/20 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Fri 01/21 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B vs. $9.325B prior

- Tue 01/25 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B vs. $1.525B prior

- Pause for FOMC policy annc on Jan 26

- Thu 01/27 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Mon 01/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

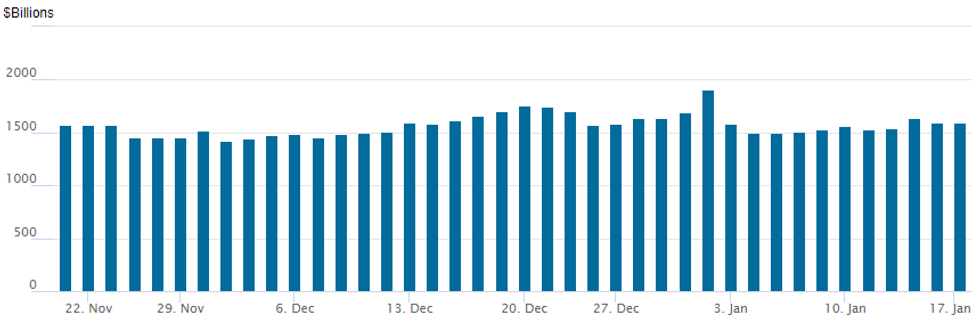

FED Reverse Repo Operation

NY Ferderal Reserve/MNI

NY Fed reverse repo usage recedes to $1,597.137B (79 counterparties) Tuesday from $1598.887B last Friday -- still well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $5.5B Citigroup, $3.5B JP Morgan Debt Issuance

Generating some decent rate-lock selling in 3s and 10s, $5.5B Citigroup 3Pt lead the session's high-grade corporate debt issuance, $3.5B JP Morgan close second; Hyundai priced earlier.

- Date $MM Issuer (Priced *, Launch #)

- 01/18 $5.5B #Citigroup $2B 4NC3 +67, $500M 4NC3 SOFR, $3B 11NC10 +118

- 01/18 $3.5B #JP Morgan 11NC10 +110

- 01/18 $700M *Hyundai Capital $400M 3.25Y +87, $300M 5Y +97

- 01/18 $1.3B Caisse des Depots et Consignations (CDC) 3Y SOFR+22

- 01/18 $Benchmark CADES 10Y social +50a

- 01/18 $Benchmark NWB +2Y SOFR+29

- 01/18 $Benchmark Islamic Rep of Pakistan 7Y Sukuk investor calls

EGBs-GILTS CASH CLOSE: UK Short-End Underperforms

Bunds pared early losses but Gilt yields diverged and continued rising into the cash close Tuesday for another session of underperformance.

- Better-than-expected UK jobs data added to the BoE hiking narrative and the short-end sold off; 2 year yields at the highest since October 2018. 10Y yields hit the highest since May 2019.

- Attention turns squarely to UK CPI data Wednesday.

- The German short end easily outperformed, in tandem with a EUR fall.

- Periphery EGB yields all widened, partly on waning risk appetite (equities lower), partly on supply: Italy conducted a specialist tap operation, while Greece announced a mandate for a new 10Y bond. The UK, Germany, and Belgium (syndication) also issued.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.9bps at -0.57%, 5-Yr is down 0.3bps at -0.344%, 10-Yr is up 0.7bps at -0.018%, and 30-Yr is up 1.4bps at 0.279%.

- UK: The 2-Yr yield is up 3.2bps at 0.867%, 5-Yr is up 2.9bps at 1.024%, 10-Yr is up 3.1bps at 1.217%, and 30-Yr is up 3.2bps at 1.329%.

- Italian BTP spread up 1.7bps at 133.5bps / Greek up 2bps at 164.7bps

FOREX: Firm USD Bounce Amid Weakness In Equities

- The US dollar index is firmly in the green on Tuesday, rising close to a half a percent. The index has now eroded the majority of the sell-off late last week and importantly has risen back above the previous support level of 95.50.

- The Euro has been the largest victim of the renewed optimism for the greenback. EURUSD (-0.66%) has significantly fallen back below last week’s meaningful resistance at 1.1383/86. Additionally, EURUSD has continued to grind through short-term support at 1.1358, the 20-day EMA, another bearish development. EUR's status as most liquid funding currency remains a key driver with Fed rate hikes driving sentiment.

- GBP, AUD, NZD and CHF all lost ground broadly in line with the magnitude of the DXY adjustment. The Swedish Krona also took a plunge, dropping 1.3% against the USD as rising political uncertainty acts as an additional headwind.

- Outperforming currencies included the Canadian dollar and Japanese Yen which remained broadly unchanged for the session. The former was largely supported by continued buoyancy of crude futures (WTI extending above $85) and the JPY was relatively in favour due to the 1.5% declines seen in major equity indices.

- Inflation data is due for both the UK and Canada tomorrow which will be key data points before the live central bank meetings over the following fortnight.

- In terms of speakers, Bank of England Governor, Andrew Bailey, is due to testify, along with BOE Deputy Governor Jon Cunliffe, on the Bank of England Financial Stability Report before the Treasury Select Committee.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/01/2022 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 19/01/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 19/01/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 19/01/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 19/01/2022 | 0900/1000 | ** |  | EU | EZ Current Acc |

| 19/01/2022 | 0930/0930 | * |  | UK | ONS House Price Index |

| 19/01/2022 | 1000/1100 | ** |  | EU | construction production |

| 19/01/2022 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 19/01/2022 | 1330/0830 | *** |  | CA | CPI |

| 19/01/2022 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 19/01/2022 | 1330/0830 | *** |  | US | housing starts |

| 19/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 19/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.