-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 10YY Climb to 2Y Highs

US TSYS: Late Options/Futures Round-Up

Tuesday return from from extended MLK holiday weekend saw deceivingly heavy Eurodollar/Treasury futures and options volumes. Large volumes kicked off Monday evening during early Asian hours as Globex re-opened.

- Implied vols traded firmer as underlying futures continued to confirm tighter policy expectations through year (Reds-Blues -0.080 to 0.130 after the bell), put skews remain rich to corresponding out-of-the-money calls.

- Couple examples included scale buyer of over 75,000 TYH 126 puts from 14-17, while Eurodollar options saw buy of 36,000 Jun 99.00 puts at 5.0 before the open.

- Not so subtle changes in Eurodollar futures in longer expirys: Eurodollar Whites (EDH2-EDZ2) are pricing in four .25bp quarterly hikes starting in March while longer dated option positioning are starting to target Jun, Sep and Dec expirys.

- Curve synthetic of note: paper sold -20,000 Green Feb/Blue Feb 97.75 put spd, Blues sold over, for net credit of 1.25 on the conditional bear flattener.

- The 2-Yr yield is up 7.4bps at 1.0404%, 5-Yr is up 9bps at 1.6478%, 10-Yr is up 8.4bps at 1.8681%, and 30-Yr is up 6.2bps at 2.1834%.

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N -0.00371 at 0.07029% (-0.00371/wk)

- 1 Month +0.00071 to 0.10371% (+0.00042/wk)

- 3 Month +0.00600 to 0.25400% (+0.01271/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01172 to 0.42986% (+0.03486/wk)

- 1 Year +0.02029 to 0.78700% (+0.06129/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $260B

- Secured Overnight Financing Rate (SOFR): 0.05%, $874B

- Broad General Collateral Rate (BGCR): 0.05%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $333B

- (rate, volume levels reflect prior session)

Citing technical difficulties, NY Fed's scheduled buy-operation of Tsy 4.5Y-7Y, appr $6.025B at 1030ET has been postponed to Tuesday, adding the issue "does not impact any other operations scheduled for today." Operations desk annc'd plan to "purchase approximately $40 billion over the monthly period from 1/14/22 to 2/11/22" vs. $60B prior as QE winds down. Updated schedule as of last week:

- Next scheduled purchases:

- Wed 01/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B vs. $4.525B prior

- Thu 01/20 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Fri 01/21 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B vs. $9.325B prior

- Tue 01/25 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B vs. $1.525B prior

- Pause for FOMC policy annc on Jan 26

- Thu 01/27 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Mon 01/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

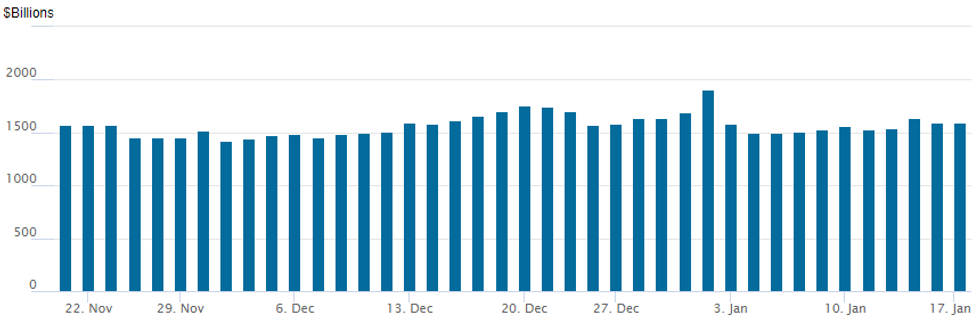

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,597.137B (79 counterparties) Tuesday from $1598.887B last Friday -- still well off all-time high of $1,904.582B on Friday, December 31.EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -10,000 Mar 99.56/99.68 call spds, 3.5 vs. 99.53/0.18%

- -20,000 Green Feb/Blue Feb 97.75 put spd, Blues sold over, 1.25 net bear flattener

- Overnight trade

- 9,500 Jun 99.18/99.25 call spds

- 10,000 Sep 98.93/99.06 put spds

- 10,000 short Feb 98.31/98.43/98.56 put trees

- 10,000 Apr 99.06/99.25 3x2 put spds

- 36,000 Jun 99.00 puts, 5

- 2,270 TYH2 126.5/127/127.5 5x5x1 put tree

- Update, over 75,000 TYH 126 puts from 14-17, 17 last

- +33,000 FVH 119.25 calls, 27.5 ref: 119-05.25

- Overnight trade

- 25,000 FVH 119 puts, 25

- >60,000 TYG 127 puts, mostly 6

- 2,600 FVG 120.25 calls, 0.5

- 15,500 FVH 118.5 puts, 12.5

- 19,500 FVH 119 puts, 24.5

- Blocks, 12,000 TYH 124.5/125.5 put spds, 5 vs. 127-24/0.06% from 0757:41 to :49ET.

- Block, 10,000 FVG 119.25 puts, 18 vs 119-01.75/0.50%

- Block, 5,000 TYG 128.5 puts, 50 vs. USH2 at 154-10 (Monday evening cross)

EGBs-GILTS CASH CLOSE: UK Short-End Underperforms

Bunds pared early losses but Gilt yields diverged and continued rising into the cash close Tuesday for another session of underperformance.

- Better-than-expected UK jobs data added to the BoE hiking narrative and the short-end sold off; 2 year yields at the highest since October 2018. 10Y yields hit the highest since May 2019.

- Attention turns squarely to UK CPI data Wednesday.

- The German short end easily outperformed, in tandem with a EUR fall.

- Periphery EGB yields all widened, partly on waning risk appetite (equities lower), partly on supply: Italy conducted a specialist tap operation, while Greece announced a mandate for a new 10Y bond. The UK, Germany, and Belgium (syndication) also issued.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.9bps at -0.57%, 5-Yr is down 0.3bps at -0.344%, 10-Yr is up 0.7bps at -0.018%, and 30-Yr is up 1.4bps at 0.279%.

- UK: The 2-Yr yield is up 3.2bps at 0.867%, 5-Yr is up 2.9bps at 1.024%, 10-Yr is up 3.1bps at 1.217%, and 30-Yr is up 3.2bps at 1.329%.

- Italian BTP spread up 1.7bps at 133.5bps / Greek up 2bps at 164.7bps

EGB Options: Significant Bund Put Spread Buying

Tuesday's Europe rates / bond options flow included:

- OEH2 131.75/131.25/131.00 broken put fly, bought for 6 in 1.5k

- RXH2 166 put bought for 16.5 in 10k

- RXH2 166.00/165.50 put spread bought for 4 in 10k. Hearing short cover

- RXH2 168/166ps 1x2, bought for 17 in 1k

- RXH2 165/164ps, bought for 3 in 1.25K (also bought for 4 in 5k)

- ERU3 vs ERH3 100.37c calendar, sold the Sep at half in 50k

- 3RM2 99.62/99.75/99.87c ladder, bought for 0.75 in 2k

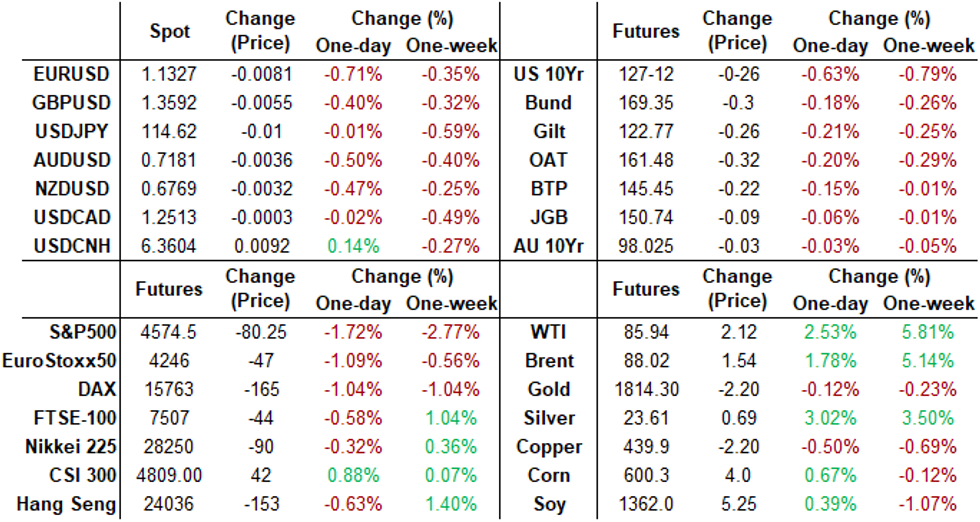

FOREX: Firm USD Bounce Amid Weakness In Equities

- The US dollar index is firmly in the green on Tuesday, rising close to a half a percent. The index has now eroded the majority of the sell-off late last week and importantly has risen back above the previous support level of 95.50.

- The Euro has been the largest victim of the renewed optimism for the greenback. EURUSD (-0.66%) has significantly fallen back below last week’s meaningful resistance at 1.1383/86. Additionally, EURUSD has continued to grind through short-term support at 1.1358, the 20-day EMA, another bearish development. EUR's status as most liquid funding currency remains a key driver with Fed rate hikes driving sentiment.

- GBP, AUD, NZD and CHF all lost ground broadly in line with the magnitude of the DXY adjustment. The Swedish Krona also took a plunge, dropping 1.3% against the USD as rising political uncertainty acts as an additional headwind.

- Outperforming currencies included the Canadian dollar and Japanese Yen which remained broadly unchanged for the session. The former was largely supported by continued buoyancy of crude futures (WTI extending above $85) and the JPY was relatively in favour due to the 1.5% declines seen in major equity indices.

- Inflation data is due for both the UK and Canada tomorrow which will be key data points before the live central bank meetings over the following fortnight.

- In terms of speakers, Bank of England Governor, Andrew Bailey, is due to testify, along with BOE Deputy Governor Jon Cunliffe, on the Bank of England Financial Stability Report before the Treasury Select Committee.

FX: Expiries for Jan19 NY cut 1000ET (Source DTCC)

- USD/JPY: Y114.50-55($585mln), Y115.00($512mln)

- AUD/USD: $0.7245-50(A$535mln)

EQUITIES: Stocks Slide With Energy Leading Downside

- Asian markets closed weaker: Japan's NIKKEI closed down 607.87 pts or -2.13% at 27937.81 and the TOPIX ended 43.14 pts lower or -2.17% at 1941.33. China's SHANGHAI closed down 38.762 pts or -1.07% at 3593.602 and the HANG SENG ended 447.77 pts lower or -1.93% at 22744.86.

- European equities are sharply lower, with the German Dax down 328.53 pts or -2.12% at 15206.59, FTSE 100 down 111.01 pts or -1.53% at 7146.52, CAC 40 down 109.26 pts or -1.58% at 6796.55 and Euro Stoxx 50 down 69 pts or -1.66% at 4092.74.

- U.S. futures continue to slide, with the Dow Jones mini down 448 pts or -1.27% at 34804, S&P 500 mini down 63 pts or -1.37% at 4547, NASDAQ mini down 241.5 pts or -1.53% at 15546.5.

COMMODITIES: WTI Sees Highest Settlement Since 2014

- Crude oil prices have whipsawed today but WTI still settled nearly 2% up on a day of equities sliding and Treasuries selling off on Fed hike expectations plus weak Goldman earnings.

- Prices were boosted by a Houthi rebel drone attack on a key oil facility in Abu Dhabi whilst continued Russia-Ukraine tensions add to pressures.

- OPEC meanwhile kept its 2022 world oil demand growth forecast steady at 4.2mbpd with total consumption at 100.8mbpd.

- WTI settled +1.9% at $85.43. Resistance is seen at $86 followed by $87.86 (2.00 proj of the Dec 2-9-20 price swing) whilst support is seen at $83.5 (Jan 17 low).

- Brent is +1.6% at $87.82, with resistance eyed at $88.7 (1.764 proj of the Dec2-9-20 price swing) and support at $85.54 (Jan 14 low).

- Gold has dipped -0.2% at $1815.4 and keeps the same resistance of $1831.9 (Jan 3 high) and support at $1800.2 (Jan 11 low).

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/01/2022 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 19/01/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 19/01/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 19/01/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 19/01/2022 | 0900/1000 | ** |  | EU | EZ Current Acc |

| 19/01/2022 | 0930/0930 | * |  | UK | ONS House Price Index |

| 19/01/2022 | 1000/1100 | ** |  | EU | construction production |

| 19/01/2022 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 19/01/2022 | 1330/0830 | *** |  | CA | CPI |

| 19/01/2022 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 19/01/2022 | 1330/0830 | *** |  | US | housing starts |

| 19/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 19/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.