-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: De-Risking Ahead Thu's NATO Summit

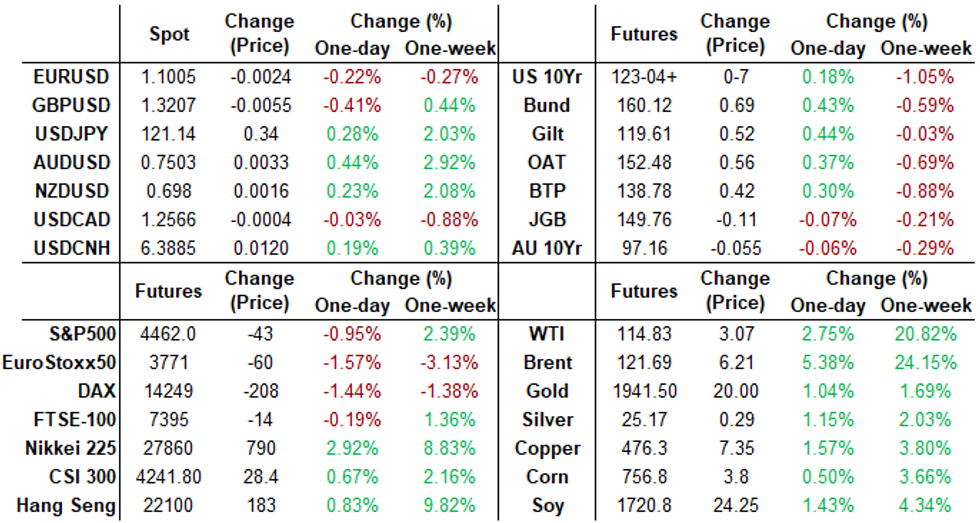

US TSYS: Fed Jawboning Losing It's Charm?

Tsy futures finished strong Wednesday after trading weaker since Friday, 30YY down to 2.4980% from 2.6392% overnight (highest since Aug 2019) despite continued hawkish Fed-speak.- Cleveland Fed President Loretta Mester said Wednesday she was confident markets can handle both a more aggressive interest rate increase in May and the start of balance sheet shrinkage. SF Fed Daly conceded the Fed may hike interest rates half a percentage point at its next meeting in May.

- Markets appeared to be de-risking ahead Thu's NATO address by Pres Biden, risk-off after National Security Advisor Sullivan: said "U.S. WILL UNVEIL NEW RUSSIA SANCTIONS: TARGET POLITICAL FIGURES, OLIGARCHS, ENTITIES, Bbg at the summit.

- Tsy futures holding gains after strong $16B 20Y note auction reopen (912810TF5) trades through with 2.651% high yield vs. 2.662% WI; 2.72x bid-to-cover vs. last month's 2.44x.

- Thursday Data Roundup: More Fed speak, weekly claims, durables, 10Y TIPS auction. Fed speak resumes:

- MN Fed Kashkari eco-outlook, no text, moderated Q&A at 0830ET

- Fed Gov Waller on housing mkt, text, moderated Q&A, 0910ET

- Chicago Fed Evans, eco/mon-pol outlook, text, Q&A, 0950ET

- Atl Fed Bostic moderated discus minority participation in economics, 1100ET

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00128 at 0.32871% (+0.00000/wk)

- 1 Month +0.00171 to 0.45657% (+0.01000/wk)

- 3 Month +0.01200 to 0.96571% (+0.03171/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00514 to 1.38971% (+0.10214/wk)

- 1 Year -0.00171 to 2.01086% (+0.22443/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $76B

- Daily Overnight Bank Funding Rate: 0.32% volume: $254B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.28%, $931B

- Broad General Collateral Rate (BGCR): 0.30%, $361B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $353B

- (rate, volume levels reflect prior session)

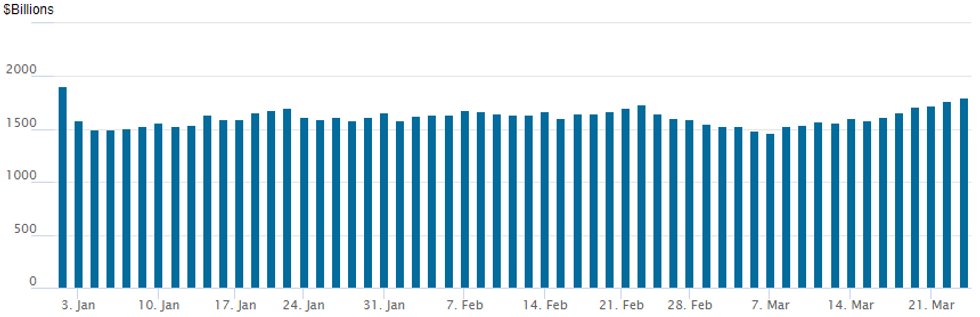

FED Reverse Repo Operation, Second Highest on Record

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new second highest on record at $1,803.186B w/ 88 counterparties vs. $1,763.183B prior session -- still well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Treasury option volume surged Wednesday, primarily bullish plays in 5- and 10Y options with a combination of tactical/directional trades (5- and 10Y Calls) and unwinds (5Y put sales) looking for underlying futures to pare back some of the week's sell-off.- Salient trade included scale buy of over 30,000 FVK 116/117.25 1x2 call spreads from 8.0 to 9.5 and block buy of 10,000 wk1 TY 122.75/123.25/123.75 call flys, 5 vs. 122-31/.05%.

- Eurodollar option volume, lacking all session, surged in late trade with 280,000 condor roll package: +35,000 Dec 97.12/97.37/97.62/97.87 put condors vs. -35,000 Dec 97.50/97.75/98.00/98.25, 1.5 net db. Earlier in the session, paper did buy some Blue June 98.50/99.00 call spds at 1.25.

- 10,000 short Aug 97.00/97.25 put spds

- Block, 2,500 SFRU2 98.50/98.75 put spds, 19.0

- Block, +8,000 SFRM2 98.50/98.75 put spds, 10.5 vs. 98.695/0.25%

- +35,000 Dec 97.12/97.37/97.62/97.87 put condors vs.

- -35,000 Dec 97.50/97.75/98.00/98.25, 1.5 net db

- +10,000 Blue Jun 98.50/99.00 call spds, 1.25

- +15,000 short Sep 96.50/97.50 put over risk reversals, 0.5 vs. 97.00/0.56%

- 6,000 TYJ 126.5 straddles

- 9,500 FVK 114.5/115.5 put spds, 30

- Block, 10,000 wk1 TY 122.75/123.25/123.75 call flys, 5 vs. 122-31/.05%

- 5,000 TYK 122.5/124.5 1x2 call spds, 25

- 2,000 TYM 124/125 put spds, 52

- Over +30,000 FVK 116/117.25 1x2 call spds, 8-9.5

- 2,000 TYM 121/122.5 put spds, 33

- Block, -10,000 FVK 115.5 puts, 54.5

- 8,000 TYM 125 calls, 34-37

- 5,000 TYJ 124.5/TYK 123 put calendar spds, 41

- Overnight trade

- +5,000 TYK 123 calls, 58 vs. 122-25

- +5,000 FVM 112.5/114 put spds, 22 ref 114-28

- -9,500 FVK 117/117.75 put spds, 44.5 ref: 115-01.75

- over 12,800 FVK 114.25 puts, 30.5

- Blocks total -15,000 FVK 115.75 puts, 5k each at 115.5, 113, 108

EGBs-GILTS CASH CLOSE: Gilts Get A Remit Boost

GIlts easily outperformed Bunds Wednesday as UK debt remit plans came in at the very low end of expectations alongside the government's Spring Statement.

- The overall theme in European FI was a reversal of Tuesday's price action, with Bund and Gilt yields closing at/near the lows.

- Though it was a generally risk-off session, with equities dipping, periphery spreads mostly held in (BTP/Bund flat, Spain a little tighter).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.8bps at -0.253%, 5-Yr is down 3.1bps at 0.192%, 10-Yr is down 3.9bps at 0.466%, and 30-Yr is down 5.3bps at 0.619%.

- UK: The 2-Yr yield is down 6.5bps at 1.35%, 5-Yr is down 6bps at 1.402%, 10-Yr is down 8.1bps at 1.627%, and 30-Yr is down 7.4bps at 1.848%.

- Italian BTP spread up 0.1bps at 151.8bps / Spanish down 1.1bps at 90.4bps

EGB Options: Large Condors And Ladders

Wednesday's Europe rates / bond options flow included:

- DUK2 111.00/110.90/110.80/110.70 put condor bought for 1.75 in 10k

- ERH3 99.50/99.625/100.00c ladder, bought for -1.75 (receive) in 20k

FOREX: NOK Hits Cycle High as Focus Switches to Rate Path

- GBP was Wednesday's poorest performer, reversing a large portion of the strength seen across the Tuesday trading day. Having found resistance at the 1.33 handle overnight, the pair promptly reversed, settling either side of the 1.32 handle after the London close. The break higher earlier in the week strengthens the current bull cycle and signals scope for a climb towards the 50-day EMA at 1.3349. This EMA is seen as a key short-term resistance.

- JPY traded poorly across Asia-Pac hours, resulting in a new cycle high print at Y121.41. This confirms a resumption of the uptrend and strengthens bullish conditions. The focus shifts to 121.69 next, the Jan 29 2016 high, but there are increasing signs of discomfort at the BoJ, but its options for addressing the depreciation are narrowing as downside risks to the economy grow, leaving it to rely on verbal intervention in concert with the Ministry of Finance, MNI understands.

- Elsewhere, a return higher for oil prices worked in favour of commodity tied currencies, pushing the likes of CAD and NOK to the top of the G10 leaderboard. WTI and Brent crude futures added close to 5% apiece as markets watched an unexpectedly large draw in DoE crude oil reserves, twinned with Russia's renewed demands that 'hostile' countries must pay for Russian gas in RUB, rather than the pre-agreed foreign currencies.

- USD/NOK broke below the early February lows in response, putting the pair nearer to the January YTD low at 8.6293, which marks the first key downside level. Moves come ahead of Thursday's rate decision, at which Norges Bank are seen tightening policy rates and indicating a faster pace of tightening in the coming 24 months.

- Focus Thursday turns to rate decisions from the Swiss, Norwegian, South African and Mexican central banks, all of which are coming under pressure from accelerating domestic inflation rates. Weekly US jobless claims data also crosses as well as preliminary March PMI numbers. Central bank speakers include Fed's Bullard, Kashkari, Waller, Evans and Bostic as well as ECB's Elderson & Schnabel and BoE's Mann.

FX: Expiries for Mar24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0950-70(E1.1bln), $1.1000-20(E615mln), $1.1065-70(E544mln), $1.1100(E1.2bln)

- GBP/USD: $1.3150-60(Gbp1.3bln)

- USD/CAD: C$1.2650($1.1bln), C$1.2800($2.1bln)

EQUITIES: Late Equity Roundup -- Weaker, But Still Near 5W Highs

Stock indexes extended session lows after the FI close Wednesday after SPX eminis climbed to the highest levels since Feb 10 overnight (4514.00) and breach of round number resistance late Tue.

- Earlier bid stalled as focus turns from hawkish Fed speak to Geopol-risk ahead Pres Biden NATO address Thu. Indeed, de-risking accelerated late after National Security Advisor Sullivan said U.S. WILL UNVEIL NEW RUSSIA SANCTIONS: TARGET POLITICAL FIGURES, OLIGARCHS, ENTITIES, Bbg at Thu's summit.

- Currently, SPX emini -45.75 (-1.02%) at 4458.75 -- still well above key support of 4352.15, the 20-day EMA. Flipside: key resistance at 4514.75 (High Mar 22) followed by 4578.50 (High Feb 9).

- Dow trades -362.03 (-1.04%) at 34445.65, and Nasdaq -164.1 (-1.2%) at 13947.16.

- SPX leading/lagging sectors: Strong support for Energy sector (+2.46%) w/ crude holding gains: WTI +$5.70 at $114.97. Energy equipment +3.65%

- Utilities sector (+0.68) with gas, electric and water sub-sectors outperforming.

- Laggers: Health Care (-1.47%) dragged down by equipment mfgs (-1.85%), pharmaceuticals (-1.17%). Financials (-1.4%)

- Dow Industrials Leaders/Laggers: Tech shares strong, Apple (AAPL) gaining 2.51 at 171.33; Chevron (CVX) climbs +2.81 to 166.90 on higher crude.

- Laggers: Home Depot (HD) extends sell off -12.94 at 316.79.

- RES 4: 4730.50 High Jan 1

- RES 3: 4663.50 High Jan 18

- RES 2: 4578.50 High Feb 9 and a key resistance

- RES 1: 4514.75 High Mar 22

- PRICE: 4479.25 @ 13:32 GMT Mar 23

- SUP 1: 4352.15 20-day EMA

- SUP 2: 4129.50/4094.25 Low Mar 15 / Low Feb 24 and a bear trigger

- SUP 3: 4055.60 Low May 19 2021 (cont)

- SUP 4: 4029.25 Low May 13 2021 (cont)

COMMODITIES: Oil Prices Firm On Supply And Demand Pincer

- Oil prices are up strongly today as a major Black Sea terminal faces weeks of disruption after storm damage and US crude inventories dropped. More recently, there has been a further boost on the headline that the Iran deal is “neither imminent nor certain”.

- WTI is +5.2% at $114.97, through first resistance at $113.35 and next opening $118.34 (76.4% retracement of the Mar 7-15 downleg).

- The most active strikes in the May22 contract have been $130/bbl calls.

- Brent is +5.5% at $121.86, also above first support from Mar 22 high of $119.48 and next eyeing $123.01 (61.8% retracement of Mar 7-16 downleg).

- Gold is +1.02% at $1941.38 as bonds rally after recent sell-offs on Fed hiking fears. Resistance remains at $1954.7 (Mar 15 high) and support at $1895.3 (Mar 15 low).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/03/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/03/2022 | 0105/2105 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/03/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/03/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/03/2022 | 0830/0930 |  | CH | SNB interest rate decision | |

| 24/03/2022 | 0830/0930 | *** |  | CH | SNB policy decision |

| 24/03/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/03/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/03/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 24/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/03/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/03/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/03/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/03/2022 | 0930/1030 |  | EU | ECB Elderson at IIEA Webinar | |

| 24/03/2022 | 1030/1030 |  | UK | Bank of England Financial Policy Report | |

| 24/03/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 24/03/2022 | - |  | EU | ECB Lagarde at European Council Meeting | |

| 24/03/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 24/03/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 24/03/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 24/03/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/03/2022 | 1230/0830 |  | US | Minneapolis Fed's Neel Kashkari | |

| 24/03/2022 | 1300/1300 |  | UK | BOE Mann Panels Institute of International Finance event | |

| 24/03/2022 | 1300/1400 |  | EU | ECB Elderson in Panel at LSE | |

| 24/03/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/03/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/03/2022 | 1350/0950 |  | US | Chicago Fed's Charles Evans | |

| 24/03/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 24/03/2022 | 1500/1100 |  | US | Atlanta Fed's Raphael Bostic | |

| 24/03/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 24/03/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 24/03/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 24/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 24/03/2022 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

| 25/03/2022 | 2330/0830 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.