-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - AUD/JPY Finds Bottom on China News

MNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI ASIA MARKETS ANALYSIS: The Power of Fed Speak

US TSYS: The Power of Fed Speak

Rates finished broadly lower Tuesday, near second half lows after hawkish Fed rhetoric initially weighed heavily on the long end, yield curves steepening on net, 2s10s dis-inverting to +4.042 from -3.125 low. 30YY climbed from around 2.50% prior to Fed Gov Brainard to 2.596% session high.- In short, Fed Gov Brainard and KC Fed George delivered one-two punch to markets midmorning on the importance of keeping inflation contained by raising rates methodically and starting draw balance sheet draw down as soon as May.

- Given Brainard's dovish credentials, she makes a notable mention of legendary hawk Fed Chair Paul Volcker in the first paragraph...then again, she also mentions Arthur Burns under whose leadership inflation soared.

- On tightening: "It is of paramount importance to get inflation down... accordingly, the Committee will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting."

- Lacking on the data front, Wednesday focus on afternoon release of March FOMC minutes:

- US Data/Speaker Calendar (prior, estimate)

- Apr-6 0700 MBA Mortgage Applications (-6.8%, --)

- Apr-6 0930 Philly Fed Harker on economic outlook

- Apr-6 1400 March FOMC minutes

- The 2-Yr yield is up 8bps at 2.5017%, 5-Yr is up 13.8bps at 2.6887%, 10-Yr is up 14.6bps at 2.5413%, and 30-Yr is up 11.1bps at 2.5674%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00143 at 0.32614% (-0.00115/wk)

- 1 Month +0.01743 to 0.44600% (+0.00843/wk)

- 3 Month -0.00243 to 0.96657% (+0.00457/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.01785 to 1.47486% (-0.01428/wk)

- 1 Year +0.02643 to 2.22786% (+0.05629/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $78B

- Daily Overnight Bank Funding Rate: 0.32% volume: $254B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $940B

- Broad General Collateral Rate (BGCR): 0.30%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $319B

- (rate, volume levels reflect prior session)

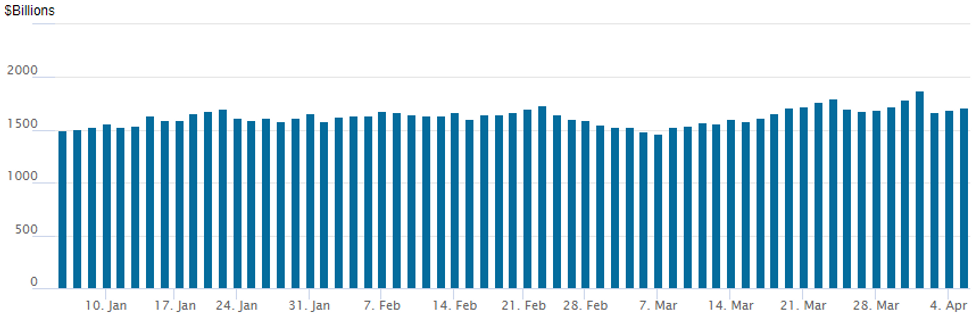

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 1,710.834B w/ 86 counterparties from prior session 1,692.936B. Compares to all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Hawkish one-two punch messaging from Fed Gov Brainard and KC Fed George this morning weighed heavily on underlying rate futures, spurring pick up in low delta puts and structured put spreads as futures priced in rate hikes out the curve (belly underperformed).- Slower to pick up compared to Treasury options, Eurodollar option volumes surged in the second half. Salient trade: ongoing bid for short May limited downside put fly -- looking for Red Jun'22 underlying to price in more rate hikes from current level of 96.56 -- targeting 96.06: +20,000 short May 95.93/96.06/96.31 put flys, 4.0 ref 96.56.

- Late Blocks: total 30,000 Jun 97.75/97.87/98.187 put trees vs. 98.31/98.50 2x1 put spd, 2.0-2.5 net credit package.

- Treasury options saw better put buying in 5s and 10s including weekly midcurves in the latter: +10,000 wk2 TY 120.5/121 put spds, 9, 5,000 wk2 TY 120/120.75 put spds, 9 and 9,000 TYK 120/120.5 put spds, 9.

- Block, 10,000 Jun 97.75/97.87/98.187 put trees vs. 98.31/98.50 2x1 put spd, 2.5 net credit package at 1421:39ET

- Block, another 20,000 Jun 97.75/97.87/98.187 put trees vs. 98.31/98.50 2x1 put spd, this time at 2.0 net credit package at 1447:57ET

- Update, total +20,000 short May 95.93/96.06/96.31 put flys, 4.0

- +5,000 Sep 96.50 puts, 5.0

- +5,000 Dec 96.25/96.50/97.00 broken put flys, 12.5 vs. 97.105/0.10%

- 2,500 Sep 97.00/97.25/97.50 put flys

- +5,000 Sep 97.00/97.25/97.50 put flys, 3.5

- Overnight trade

- 8,300 May 98.31/98.37 put spds

- +15,000 TYK 121 calls, 49-50 vs. 120-29/0.48%

- +6,000 TYM 122 calls, 51 vs. 120-28/0.37%

- 2,000 TYM 119/120 put spds

- 10,000 wk2 TY 120.5/121 put spds, 9

- 5,000 wk2 TY 120/120.75 put spds, 9

- 9,000 TYK 120/120.5 put spds, 9

- 5,000 TYM 123 calls, 33

- 4,000 FVK 114/114.5 1x2 call spds, 0.5

- 3,000 FVK 113/113.25 put spds, 3.5

- 3,000 TYM 120 puts, 44

- Overnight trade

- 3,000 wk2 US 144/145 put spds, 3

- 6,000 TYK 121.75 calls, 45

- 2,000 TYM 120/121 put spds 14 over TYN 124/125 call spds

- 2,300 TYM 120.5 puts, 50 ref 121-23

- Blocks, total 5,000 FVK 114/FVM 113.25 2x3 put spds, 40.5

- Block, 5,000 FVM 113.25 puts, 34.5

EGBs-GILTS CASH CLOSE: Macron Malaise Sinks BTPs

European bond yields rose sharply Tuesday with periphery EGBs particularly badly hit, with a combination of Fed tightening prospects and political risk contributing to the weakness.

- Concern that a Macron victory in the French presidential election is no longer clear-cut pushed BTP spreads significantly wider. 10Y Italy/Germany rose 8.4bp, closing on the session high (and widest since March 11).

- Fed Gov Brainard's hawkish-leaning comments in the afternoon spurred a sell-off in Treasuries, with Bunds and Gilts following suit.

- Gilt and Bund yields widened more or less in parallel, with the exception of UK short-end underperformance.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.1bps at -0.022%, 5-Yr is up 9.8bps at 0.443%, 10-Yr is up 10.8bps at 0.614%, and 30-Yr is up 9.4bps at 0.729%.

- UK: The 2-Yr yield is up 9.3bps at 1.459%, 5-Yr is up 9.2bps at 1.479%, 10-Yr is up 10.7bps at 1.654%, and 30-Yr is up 9.7bps at 1.766%.

- Italian BTP spread up 8.4bps at 164.8bps / Spanish up 4bps at 98.6bps

EGB Options: Huge Bobl Put Spread Unwind Continues

Tuesday's Europe rates/bond options flow included:

- OEM2 127.50/126.50 1x1.5 put spread sold at 9.5 in 2.5k. Hearing unwinding position - this was sold Monday as well. Recall, this was bought at 11.5/12.0/12.5 last week in 40k.

- DUK2 110.30 put bought for 7 in 8.65k. Hearing short cover

- DUM2 111.20/112.50 call spread bought for 6 in 5k

- ERM3 100.25/100.00 put spread sold at 21.5 in 2k

- ERZ2 100.50 call bought for 1 in 5k

- FVM2 113.25 puts 5.0K lot blocked at 0-34+

FOREX: Fed Rhetoric Prompts Greenback Spike, AUD Maintains Gains

- The greenback staged a firm turnaround during US hours on Tuesday, largely fuelled by hawkish Fed rhetoric. Lael Brainard’s speech expecting “the balance sheet to shrink considerably more rapidly than in the previous recovery” underpinned a firm USD recovery from the lows of the day.

- Price action immediately weighed on EUR/USD, trading through the overnight lows and extending below touted support at 1.0945, the Mar28 low. The recent failure at 1.1185, Mar 31 high and more importantly, the inability to remain above the 50-day EMA (breached last week), highlights a developing bearish threat, signalling scope for a deeper sell-off and immediate focus is on 1.0898, the Mar 14 low.

- USD/JPY also received a bump higher, putting the rate comfortably back above the Y123.00 handle in a move that gathered momentum throughout the session.

- The risk-off tone filtered through to the EM basket with popular longs such as the Brazilian Real unwinding around 1.5% and USDMXN following suit by narrowing the gap with the 20.00 mark.

- Currencies that may have been expected to feel the pinch a bit more include AUD, NZD and CAD, all residing in positive territory for the session. A lot of this can be explained by the sharp overnight weakness in Euro crosses and the continued pressure on the single currency managing to consolidate said weakness.

- EURAUD especially sits 1.25% lower on the day after breaking horizontal support drawn off the mid-2017 lows at 1.4424, and prices now at the lowest levels since late April 2017 - narrowing the proximity with the 2017 cyclical low of 1.3627.

- Treasury Secretary Yellen is due to testify on the global financial system before the House Financial Services Committee, in Washington DC tomorrow before the release of the March FOMC meeting minutes at 1900BST/1400ET.

FX: Expiries for Apr06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0935-55(E2.5bln), $1.1000(E1.1bln), $1.1035-41(E665mln)

- USD/JPY: Y121.00-10($670mln), Y121.75-80($752mln)

- USD/CAD: C$1.2500($598mln)

- USD/CNY: Cny6.4000($1.4bln)

EQUITIES: Late Equity Roundup: Weaker But Off Lows

Stocks headed for a weaker close, but off Tuesday's midday lows after hawkish Fed rhetoric weighed more heavily on rates than equity markets.

- In short, Fed Gov Brainard and KC Fed George delivered one-two punch to markets midmorning on the importance of keeping inflation contained by raising rates methodically and starting draw balance sheet draw down as soon as May. Neither directives new but 30YY surged from around 2.50% prior to 2.596% session high.

- S&P eminis currently trading -64.5 (-1.41%) at 4513.25 -- ESM2 outlook remains bullish as long as futures remain above 4457.40 50-day EMA. Breach opens up key support of 4320.25 Low Mar 17. Meanwhile, Dow Industrials currently trade -318.84 (-0.91%) at 34602.07, Nasdaq -351.1 points (-2.4%) at 14182.24.

- SPX leading/lagging sectors: Utilities sector pared back earlier gains to +0.54% lead by electricity providers (2s10s curve dis-inversion helping cool energy related recession concerns); Health Care Sector still outperforming but off earlier highs at +0.15% lead by equipment mfgs and pharmaceuticals.

- Laggers: Consumer Discretionary (-2.46%) outpaced Information Technology (-2.32%) latter weighed down by semiconductors.

- RES 4: 4800.00 High Apr 1 and the bull trigger

- RES 3: 4730.50 High Jan 1

- RES 2: 4663.50 High Jan 18

- RES 1: 4633.44 76.4% retracement of the Jan 4 - Feb 24 downleg

- PRICE: 4577.75 @ 1530ET Apr 5

- SUP 1: 4457.40 50-day EMA

- SUP 2: 4320.25 Low Mar 17

- SUP 3: 4129.50/4094.25 Low Mar 15 / Low Feb 24 and a bear trigger

- SUP 4: 4055.60 Low May 19 2021 (cont)

The S&P E-Minis outlook remains bullish and the most recent pullback is considered corrective. Bullish conditions have been reinforced by the recent break above both the 20- and 50-day EMAs. Furthermore, resistance at 4578.50, Feb 9 high has been cleared. This opens, 4663.50, the Jan 18 high. Initial firm support is at 4449.97, the 50-day EMA. A clear break of this average would be seen as a bearish development.

COMMODITIES: Oil Prices Edge Lower As Largely Unfazed By G7 Sanctions

- Oil prices have edged lower on the G7 announcement of new sanctions on financial institutions and state-owned enterprises plus all new investments in Russia, with prices having already increased sharply yesterday in anticipation.

- Earlier in the day, EC President von der Leyen said that the EU is proposing to ban most Russian ships and trucks from entering the bloc, as well as Russian coal imports, and will also push ahead with a debate on targeting Russian oil.

- WTI is -0.6% at $102.7, neither troubling support is seen at $97.78 (Apr 1 low) nor resistance at $108.75 (Mar 30 high) nor support is seen at $98.44 (Mar 29 low).

- The most active strikes in the May’22 contract have by far been $115/bbl calls.

- Brent is -0.3% at $107.2, with resistance at $112.28 (Mar 30 high) and support at $102.19 (Mar 29 low).

- Gold is -0.6% at $1920.9, declining with the rise in Treasury yields after the Fed’s Brainard indicated the Fed will continue tightening policy ‘methodically’ and that it could shrink the balance sheet at a rapid pace as soon as May. Support remains the bear trigger of $1890.2 (Mar 29 low) whilst resistance is seen at $1966.1 (Mar 24 high).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/04/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 06/04/2022 | 0600/0800 | ** |  | DE | manufacturing orders |

| 06/04/2022 | 0700/0900 |  | EU | ECB VP de Guindos speaks | |

| 06/04/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/04/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/04/2022 | 0900/1100 | ** |  | EU | PPI |

| 06/04/2022 | 0900/1100 |  | EU | ECB Schnabel Panel Moderation at ECB/EC Conference | |

| 06/04/2022 | 0900/1100 |  | EU | ECB Exec Board member Fabio Panetta speech | |

| 06/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/04/2022 | 1145/1345 |  | EU | ECB Philip Lane panel appearance | |

| 06/04/2022 | 1330/0930 |  | US | Philadelphia Fed's Patrick Harker | |

| 06/04/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 06/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 06/04/2022 | 1800/1400 | * |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.