-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EUR Vols Surge Ahead of US CPI

MNI China Daily Summary: Wednesday, December 11

MNI ASIA MARKETS ANALYSIS: Debt Deal Optimism

- BIDEN: I BELIEVE WE'LL COME TO AN AGREEMENT,

- MNI: Fitch Puts US On Negative Ratings Watch

- MNI: DBRS Morningstar Places United States Under Review With Negative Implications

- MCCARTHY SAYS SOME ISSUES OUTSTANDING ON DEBT DEAL, Bbg

- ECB RATES SHOULD REACH PEAK IN NEXT THREE MEETINGS: VILLEROY, Bbg

- RICHMOND FED BARKIN: U.S. IS STILL AT TAIL END OF PANDEMIC DISLOCATION TO THE ECONOMY - Reuters

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS: Markets Roundup: Debt Deal Optimism After US AAA Rating Warning

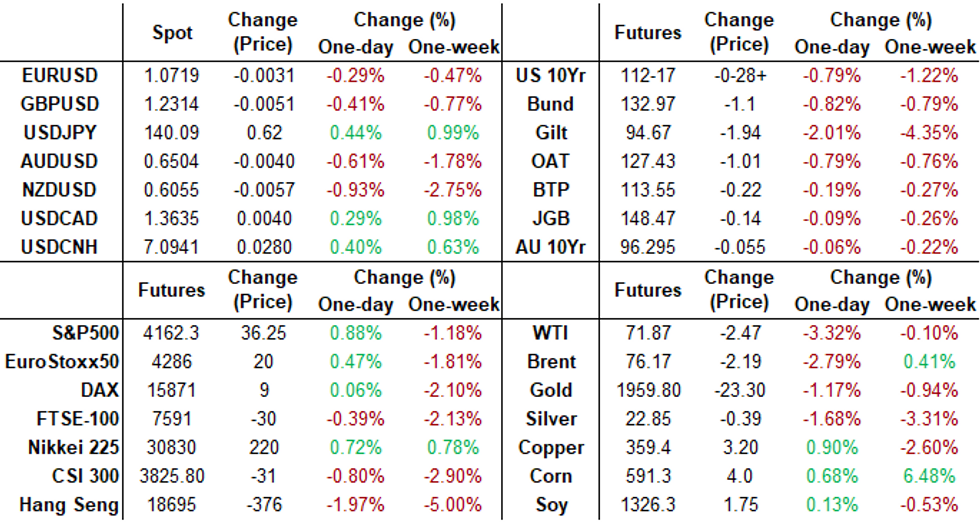

Treasury futures traded steadily weaker since late morning amid generally positive word from debt ceiling negotiators that a deal can be agreed upon by as early as tomorrow.- Treasury 10Y futures finishing near late session lows at 112-16.5 after breaching several levels of support: next focus on 111-31 76.4% retracement of the Mar 2 - 24 rally. At the moment, 10Y yield has climbed .0774 to 3.8193%, highest in two weeks. Curves extended inversion, 2s10s falling to -73.245, the lowest since March 15.

- Overnight volatility: rates surged overnight, reacting to negative ratings watch warnings from agencies Fitch and DBRS Morningstar if the US defaults on their debt obligations. House speaker McCarthy quick to respond with optimism that a deal can be struck in time.

- Fast two-way post data: Treasury futures trading lower after weekly claims came out less than expected (229k 245k est; claims 1.8M est), GDP higher than expected (+1.3% vs. 1.1% est).

- More notable upside revisions came from other domestic demand (non-resi investment and government) plus a sizeable boost in changes in inventories (albeit still dragging -2.1pp annualized on the quarter), offset by the previous boost from net trade being revised away (latest contribution exactly 0.00pps).

- Reminder, Friday sees early close ahead Monday's Memorial Day Holiday, Floor closes at 1300ET, Globex at 1600ET. Markets closed Monday, Globex re-open at 1700ET.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.02499 to 5.13579 (+.04206/wk)

- 3M +0.03373 to 5.22528 (+.06181/wk)

- 6M +0.03801 to 5.23818 (+.09165/wk)

- 12M +0.03133 to 5.00248 (+.12482/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00100 to 5.06286%

- 1M +0.01914 to 5.16000%

- 3M +0.03871 to 5.46314% */**

- 6M +0.03200 to 5.56414%

- 12M +0.08886 to 5.62257%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.46314% on 5/25/23

- Daily Effective Fed Funds Rate: 5.08% volume: $126B

- Daily Overnight Bank Funding Rate: 5.07% volume: $279B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.401T

- Broad General Collateral Rate (BGCR): 5.03%, $587B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $578B

- (rate, volume levels reflect prior session)

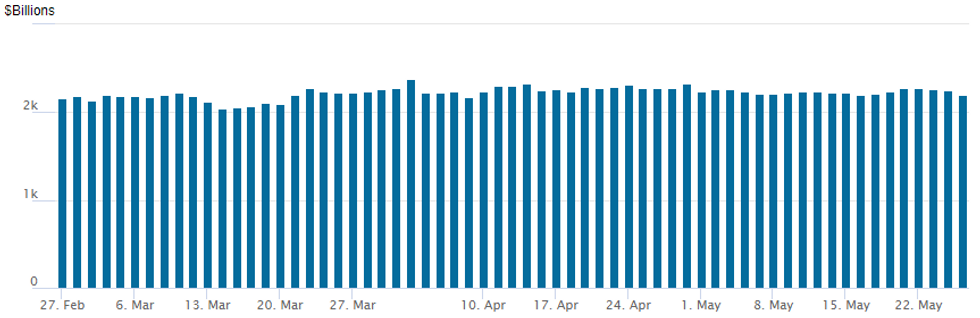

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls to $2,197.638B w/ 106 counterparties, compares to prior $2,250.709B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Better call and call structure flow in SOFR and Treasury options carried over from overnight, change for the former after more consistent put trade over the last two sessions.- SOFR Options:

- Block, 20,000 SFRZ3 94.00/95.00 2x1 put spds, 25.0 net vs. 95.105 to -.11/0.20%

- Block, 5,000 SFRU3 93.75/94.25/94.75 put flys, 13.0 ref 94.815

- Block, 4,000 SFRM3 94.75/94.81 put spds, 3.75 ref 94.72

- 2,500 SFRH3 96.06/96.43 call spds ref 95.63

- 9,000 OQM3 96.12 puts, 24.0 ref 96.07

- 1,000 SFRN3 94.50/94.75 put spds vs. SFRQ3 94.75/94.87 put spds

- Block, 6,000 OQU3 98.00 calls, 6.5 ref 96.44

- Block, 4,000 OQM3 95.50/95.75 3x2 put spds, 6.5

- Block, 3,000 SFRV3 95.25/95.62 call spds, 10.0 ref 95.18

- 2,000 SFRV3 95.25/95.75/96.25 call flys ref 95.195

- 2,000 SFRM3 94.87/94.93 call spds ref 94.74

- over 27,500 SFRZ3 97.00 calls ref 95.165 to -.18

- Treasury Options:

- 7,400 TYM3 113 puts, 12

- 1,000 FVM3 108 puts, 6.5

- 5,100 TYM3 114 calls, 3 ref 113-06.5

- 3,300 wk3 TY 116/117/118 call flys

- Block/screen, 17,000 FVM3 110.75 calls .5

- Block/screen 20,000 FVM 111.25 calls, both .5

- 5,000 TYN3 117/119/120 broken call flys, ref 113-29

- 1,100 USU3 143 calls, 18 ref 126-23

EGBs-GILTS CASH CLOSE: Gilts Remain Under Pressure

Gilts dropped sharply and underperformed for another session Thursday, as the implications of April's high UK CPI reading continued to be digested.

- The UK curve bear flattened once again, with weakness focused on the 2-5Y segment as another 18bp of hikes were added to the implied BoE path (that' 65bp this week).

- Bunds weakened as well, with modest yield rises accelerating just ahead of the cash close, though with no apparent trigger (10Y jumped 3bp in the last 25 minutes of the session).

- Adding to the bearish tone was apparent progress on the US debt limit impasse, which pushed Treasury yields and the USD higher.

- ECB commentary (including Knot, Villeroy, and Nagel) wasn't impactful, and revised GDP numbers showing Germany falling into technical recession had little bearing either.

- Periphery spreads traded mixed, moving in Bunds' favour (despite the latter's sell-off) just before the cash close.

- UK retail sales data highlights the docket first thing Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.8bps at 2.902%, 5-Yr is up 6.2bps at 2.531%, 10-Yr is up 5bps at 2.522%, and 30-Yr is up 3.7bps at 2.664%.

- UK: The 2-Yr yield is up 18.4bps at 4.556%, 5-Yr is up 19.2bps at 4.328%, 10-Yr is up 16bps at 4.374%, and 30-Yr is up 10.6bps at 4.65%.

- Italian BTP spread up 1bps at 187.6bps / Greek down 4.3bps at 138.4bps

EGB Options: Quieter Session For Rates Options

Thursday's Europe rates / bond options flow included:

- ERH4 97.00/97.50/98.00c fly, bought for 3.5 in 4k

FOREX: NZD Extends Post-RBNZ Weakness, USDJPY Pierces 140.00 Handle

- Overall greenback strength continues to prevail across currency markets with the USD index extending its winning streak to four sessions, up 0.35% on Thursday. The index is now roughly 3.25% off the May lows as the greenback reasserts itself against its G10 counterparts.

- NZD remains at the bottom of the G10 pile, showing good downside momentum following the significant moves following the RBNZ on Wednesday. Price is now through the year’s lows which turns the focus to the psychological 0.60 mark, a good pivot dating back to September last year.

- USDCNH has touched another fresh year-to-date high as the pair settles above the 7.09 amrk amid the general greenback appreciation and ongoing concerns over domestic growth. State-owned Chinese media outlets have once again pushed back on the idea of further sharp depreciation pressures for the yuan, with analysts cited in the report continuing to point to China’s positive economic fundamentals and expectations surrounding the end of the Fed’s easing cycle

- Japanese yen weakness has also once again been consistent over the course of the US session with USDJPY steadily moving higher since the release of US data. Bullish conditions remain intact, and a fresh trend high reinforces the current theme. The 140.01 high print as of writing places the pair at the highest level since November 23, 2022.

- With 140.00 the next obvious psychological barrier to overcome, major resistance does not come in until 140.62, the bull channel top drawn from the Jan 16 low.

- Tokyo Core CPI highlights the APAC docket on Friday before UK retail sales for April hit the wires. Attention will then turn to US Core PCE Price index data, durable goods, personal income and U/Mich sentiment figures.

FX Expiries for May26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650-65(E2.8bln), $1.0696-00(E913mln), $1.0765(E639mln), $1.0785-00(E2.7bln), $1.0865-80(E1.7bln), $1.0900(E1.6bln)

- USD/JPY: Y139.00($530mln), Y140.00($995mln)

Equities Roundup: Nvidia Buoys Broad Swath of Tech Stocks

Stocks are trading higher in the second half, SPX and Nasdaq stocks outperforming Dow Industrials as tech-shares surged. Currently, S&P E-Mini futures are up 43 points (1.04%) at 4168.5; Nasdaq up 241.3 points (1.9%) at 12724.75; DJIA up 21.43 points (0.07%) at 32820.71.- SPX levels recovered after testing the 50-day EMA support at 4124.40 Wednesday, . A continuation higher would refocus attention on initial key resistance at 4227.25, the May 19 high. Clearance of this hurdle would resume the uptrend that started on Mar 13.

- It's nice to see something other than debt-ceiling negotiations (albeit themselves sounding more positive over a resolution) as shares of Nvidia surged over 25% on the back of positive sales for graphics processors and AI chips.

- Leading laggers: Information Technology shares lead the rally, following Nvidia's outperformance, Monolithic Power (MPWR) gained +17%, Synopsys +11% and Advanced Micro Devoices (AMD) +10.3%. Communication Services and Real Estate sectors were distant second and third place.

- Leading laggers: Energy sector shares underperformed, paring early week gains as crude prices reversed (WTI -2.72 at 71.62), Utilities, Health Care and Consumer Staples sectors were not far behind.

E-MINI S&P TECHS: (M3) Corrective Bear Cycle Still In Play

- RES 4: 4288.00 High Aug 19 2022

- RES 3: 4244.00 High Feb 2 and a medium-term bull trigger

- RES 2: 4231.00 High Feb 3

- RES 1: 4227.25 High May 19

- PRICE: 4157.00 @ 1435ET May 25

- SUP 1: 4114.00 Low May 24

- SUP 2: 4062.25 Low May 4 and key support

- SUP 3: 4052.50 Low Mar 30

- SUP 4: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

S&P E-minis traded lower Wednesday and this resulted in a test of the 50-day EMA at 4124.40. A clear break of this average would highlight a stronger short-term reversal and expose 4062.25, the May 4 low and a key support. Price has recovered today. A continuation higher would refocus attention on initial key resistance at 4227.25, the May 19 high. Clearance of this hurdle would resume the uptrend that started on Mar 13.

COMMODITIES: Oil Slumps As Traders Test OPEC Resolve Ahead Of June Meeting

- Crude oil has slumped today, first moving lower after Russia suggested OPEC are unlikely to adjust targets at the upcoming Jun 3-4 meeting according to Deputy Prime Minister Novak and with an added headwind from a steadily appreciating US dollar.

- That said, JP Morgan joins other banks in stating that OPEC+ is ‘making good on its promise’ to cut supplies based on its voluntary cuts announced April 2.

- Separately, a volatile tanker market is making physical traders increasingly cautious about buying cargoes according to Bloomberg as US crude deliveries to Europe has seen daily tanker earnings swing between $21k-$88k in the last month.

- WTI is -3.4% at $71.79 off a low of $70.98 that moved closer to support at $69.39 (May 15 low). In contrast to the day’s sizeable downward pressure, the day’s most active strikes for the CLN3 have been at $85/bbl and $80/bbl strikes.

- Brent is -2.9% at $76.11 off a low of $75.10 vs support at $73.49 (May 15 low).

- Gold is -0.7% at $1943.74 off a post strong US data low of $1939.39 that moved closer to testing $1934.3 (Mar 22 low).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/05/2023 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 26/05/2023 | 0130/1130 | ** |  | AU | Retail Trade |

| 26/05/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 26/05/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 26/05/2023 | 0600/0800 | ** |  | SE | PPI |

| 26/05/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/05/2023 | 0740/0940 |  | EU | ECB Lane Panels Dubrovnik Econ Conference | |

| 26/05/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 26/05/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 26/05/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/05/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 26/05/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/05/2023 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 26/05/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.