-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Pressed Ahead GDP

- Treasuries reverse post-7Y note auction bounce, finish near lows

- Month-end duration extensions, stronger stocks add to rise in Treasury yield

- Mixed US data offered little support ahead Wednesday GDP, PCE metrics

US TSYS Yields Resume Climb Ahead Midweek GDP/PCE Metrics

- Tsys holding near session lows after the bell, extending session lows in the second half after briefly posting gains on decent $42B 7Y note auction (91282CKC4) stop: 4.327% high yield vs. 4.330% WI; 2.58x bid-to-cover vs. 2.57x last month.

- Additional factors helping rise in Tsy yields (10Y +.0296 at 4.3091%), month end extensions (0.11%), and stocks making a late session comeback (SPX Eminis at 5090.25).

- Fast two-way trade reported after lower than expected Durable Goods Orders (-6.1% vs. -5.0% est); ex-Trans (-0.3% vs. 0.2% est, prior down revised to -0.1% from 0.5%). Cap Goods Orders Nondef Ex Air in line with 0.1% est while prior was down-revised to -0.6% from 0.2%.

- Additional data: FHFA house prices increased by less than expected in Dec, 0.1% M/M (cons 0.3) after 0.31% M/M, its softest monthly print since Jan’23. Conf. Board consumer confidence saw a sizeable miss in February, falling to 106.7 (cons 115.0) after a downward revised 110.9 (initial 114.8).

- Mar'24 10Y futures currently -2 at 109-17.5 vs. 109-15 low. The trend direction in Treasuries is unchanged and remains down with the contract trading closer to its recent lows. Price has pierced 109-17, 50.0% of the Oct - Dec bull cycle. A clear break of this retracement would strengthen the bearish condition and signal scope for an extension towards 108-19+, the 61.8% Fibonacci level. On the upside, initial firm resistance is seen at 110-24+, the 50-day EMA.

- Look ahead, Wednesday data calendar includes GDP, PCE, Wholesale/Retail Inv, Fed Speak.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00226 to 5.32626 (+0.00213/wk)

- 3M +0.00535 to 5.34316 (+0.01259/wk)

- 6M +0.01353 to 5.29249 (+0.01898/wk)

- 12M +0.02286 to 5.09384 (+0.02141/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.739T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $670B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $658B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $98B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $281B

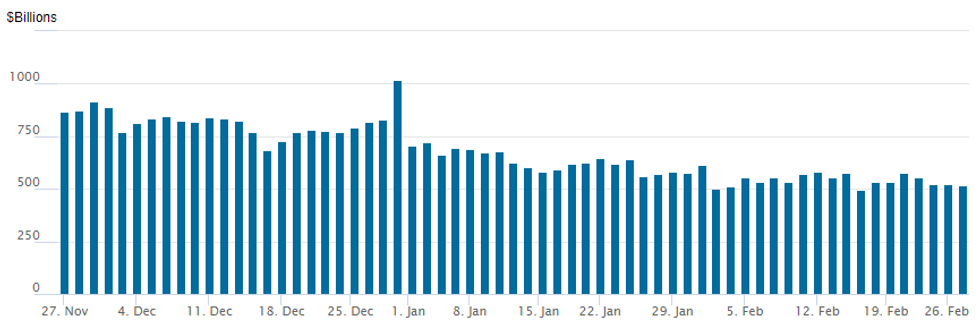

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage recedes to $519.725B vs. 524.959B Monday; compares to $493.065B on Thursday, Feb 15 -- the lowest since early June 2021 .

- Meanwhile, the latest number of counterparties at 84 from 81 Monday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

Early mixed SOFR option trade segued to much better upside call structures Tuesday, fading mildly weaker underlying futures. Surprising few Tsy option volumes on the day. Projected rate cut pricing reversed early gains: March 2024 chance of 25bp rate cut currently -2.7% w/ cumulative of -0.07bp at 5.322%; May 2024 at -16.4% vs. -18.9% earlier w/ cumulative -4.8bp at 5.281%; June 2024 -52% from -56.9% earlier w/ cumulative cut -17.7bp at 5.151%. First full cut priced in at July w/cumulative -30.1bp at 5.028%. Fed terminal at 5.33% in Feb'24.

- +20,000 SFRU4 94.81/94.87/95.31/95.37 call condors 2.25 ref 95.16

- -5,000 0QM4 96.62/96.87/97.00 call flys, 2.5 ref 9600

- -8,000 SRJ4 94.75/94.87/95.00 iron flys, 9.5 ref 94.87

- -5,000 SRZ4 96.25/96.87/97.50 call flys, 3.5 ref 9547.5

- -5,000 SFRU4 95.00/95.12 put spreads, 6.5

- Pit/screen/Block +40,000 SFRM4 95.25/95.50/95.75 call flys, 0.75

- +2,000 SFRM4 94.75 puts, 7.5 ref 94.875/0.33%

- -20,000 SFRJ4 94.62/94.75/94.87/95.00 call condors 6.75-6.50

- Block, 10,000 SFRM4 93.5/94.00/94.5 put flys, 1.25 net vs. 94.905/0.08%

- Block, 15,000 SFRM4 96.00/96.37 call spds, cab

- +19,000 SFRM4 94.87 / 0QM4 96.50 call spds, 0.5

- 3,500 SFRJ4 94.81 puts, ref 94.88

- Block/screen, 20,000 SFRM4 95.00/95.25/95.50 call flys, 2.5-2.75

- 6,750 SFRH4 94.68/94.75 call spds ref 94.6725

- Block, +5,000 SFRU4 94.87/95.12 put spreads 5.0 over SFRZ4 96.25/96.75 call spds

- Block, +5,000 SFRU4 94.93/95.06 put spreads 3.5 over SFRU4 95.50/95.62 call spds

- 4,000 0QH4 95.87/96.12/96.25 1x3x2 call flys ref 95.76

- 1,250 0QJ4 96.50/96.75 call spds vs. 2QM4 95.00/95.50/96.00 put fly

- 2,000 SFRZ4 96.00/96.25 call spds vs. 2QZ4 97.00/97.25 call spd

- 4,000 SFRM4 94.75 puts ref 94.875

- 2,000 SFRZ4 97.50/98.00 call spds ref 95.48

- over 5,600 TYK4 108 puts, 27 last

EGBs-GILTS CASH CLOSE: Weakness Continues As Supply Weighs Again

UK and German yields rose for a second consecutive session Tuesday, with Gilts underperforming Bunds.

- Supply was again the theme, capping nascent gains throughout the morning, with early trade subdued and well within prior sessions' ranges.

- Hedging activity associated with EGB syndications (Slovenia 10Y for E3bln, France 30Y for E8bln, both on the high end of expectations) priced by early afternoon saw Gilts and Bunds head to session lows, recovering only briefly as US consumer confidence data came in weaker than expected.

- BoE's Ramsden gave away little on his monetary policy outlook in a speech today ("looking for more evidence about how entrenched [key indicators of inflation] persistence will be and therefore about how long the current level of Bank Rate will need to be maintained"

- Yields closed on the highs (10Y Gilts at the highest closing yield since late November). The German curve finished bear steeper, with the UK's bear flattening. Periphery spreads closed mixed, with BTPs and GGBs outperforming with modest tightening to Bunds, and Spanish/Portuguese spreads unchanged.

- Wednesday's schedule includes Eurozone confidence data, with central bank appearances including ECB's Muller and BOE's Mann. The focus remains on Euro inflation Thursday and Friday, however.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.4bps at 2.928%, 5-Yr is up 1.9bps at 2.472%, 10-Yr is up 2.4bps at 2.464%, and 30-Yr is up 3.3bps at 2.607%.

- UK: The 2-Yr yield is up 3.7bps at 4.349%, 5-Yr is up 3.8bps at 4.082%, 10-Yr is up 3.4bps at 4.196%, and 30-Yr is up 2.1bps at 4.658%.

- Italian BTP spread down 1.4bps at 143.8bps / Spanish down 0.1bps at 89.2bps

EGB Options: Large Euribor Downside Features Tuesday

Tuesday's Europe rates/bond options flow included:

- RXJ4 131.50p, bought for 75.5 in 2k

- RXJ4 134.50/135.50/136.50c fly bought for 6.5 in 8k

- ERM4 96.50/96.25/96.00 put fly bought for 9.5 - 10 in 20k

- ERM4 96.25/96.37/97.00 broken c ladder, bought for 4.5 in 6k

- SFIZ4 96.00/96.50cs, sold at 10.25 in 5k

FOREX G10 Currencies Registering Minimal Adjustments As US PCE Awaited

- Very narrow ranges for major currency pairs on Tuesday, with the likes of EURUSD and GBPUSD continuing to operate in the middle of their 30 pip daily ranges. The early shift lower for US yields moderately weighed on the greenback and saw USDJPY try lower towards session lows of 150.12. However, a 5bp retracement for the US 2-year saw USDJPY rise back above 150.55 as we approach the APAC crossover.

- No change for the USDJPY trend outlook which remains bullish, and the latest pause appears to be a bull flag formation. A resumption of the trend would pave the way for a climb towards 151.91/95, the Nov 13 ‘23 high and the Oct 1 ‘22 high and major resistance. On the downside, initial firm support lies at 149.41, the 20-day EMA. A break would signal scope for a correction towards 148.01, the 50-day EMA.

- Plenty of focus on the overnight RBNZ decision and potential impact on NZD. The Bank’s mandate change coupled with NZ domestic data flow has led to some calling for a resumption of the hiking cycle, although this isn’t our Asia-Pac team’s base case.

- The NZD is marginally less susceptible to a hawkish ‘surprise’ than NZ rates given already long positioning (per CFTC data), although there has seemingly been some reduction in longs ahead of the event.

- NZD/USD levels to watch: Resistance: 22 Feb high ($0.6218), Support: 15 Feb low ($0.6080).

- AUD/NZD levels to watch: Support: ’24 low/’23 low (NZD1.0570/60), Resistance: Feb 20 high/20-day EMA (NZD1.0649/1.0655).

- Wednesday’s APAC session is also highlighted by Australian CPI which precedes the RBNZ decision. In the US, focus turns to the second reading of Q4 GDP on Wednesday before Thursday’s January PCE deflator. European inflation readings will start to cross from Thursday.

Late Equities Roundup: Off Lows, Utilities, Comm Services Leading

- Stocks are inching off session lows, Dow still lagging Nasdaq in late Tuesday trade. Still inside relatively narrow session ranges, DJIA trades down 115.26 points (-0.3%) at 38955.34, S&P E-Minis up 5.5 points (0.11%) at 5085.75, Nasdaq up 59.5 points (0.4%) at 16035.83.

- Leading Gainers: Utilities and Communication Services sectors outperformed in the second half, electric and multi-energy providers buoyed the former: after beating earnings and raising their dividend by 25% - Constellation Energy surged by +14.86%, AAEP a distant second +3.40% while Public services Enterprises gained 2.95%.

- Media and entertainment shares supported the Communications sector: Netflix +2.27%, Match Group +1.68%, Disney +1.10%.

- Laggers: Energy and Consumer Staples sectors underperformed late, oil and gas shares continued to weigh on the former: Hess Corp -3.45%, Chevron -1.96% -- both pressed on headlines that Chevron's $53B deal to buy Hess was in question with a potential bid challenge from Exxon (+0.12%).

- Food and beverage shares weighed on the Consumer Staples sector: JM Smuckers -4.01% despite despite beating earnings estimates and giving and upbeat outlook, Kellanova -1.68%, General Mills -1.52%.

- Looking ahead: corporate earnings after the close include: California Resources, Devon Energy, Agilent Technologies, Vizio, First Solar, eBay and Beyon Meat.

E-MINI S&P TECHS: (H4) Bullish Outlook

- RES 4: 5171.37 3.0% Bollinger Band

- RES 3: 5170.86 2.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 5137.13 2.0% 10-dma envelope

- RES 1: 5123.50 High Feb 23 and bull trigger

- PRICE: 5086.00 @ 1510 ET Feb 27

- SUP 1: 5000.90 20-day EMA

- SUP 2: 4889.03/4866.000 50-day EMA / Low Jan 31 and key support

- SUP 3: 4702.00 Low Jan 5

- SUP 4: 4594.00 Low Nov 30

The trend condition in S&P E-Minis remains bullish following last week’s gains and pullbacks are considered corrective. The move higher continues to highlight the fact that corrections remain shallow - a bullish signal. Support to watch is 5000.90, the 20-day EMA. A clear break of this EMA would signal potential for a deeper retracement towards the 4866.00 key support, Jan 31 low. A resumption of gains would open vol-band based resistance at 5137.13.

COMMODITIES Crude Futures Rise Amid OPEC Cuts Speculation

- Crude prices have jumped to their highest levels in a week, driven by comments from Reuters’ sources that OPEC+ is considering extending voluntary output cuts into Q2 and could keep them in place until the end of the year. WTI APR 24 is up 1.6% at 78.83$/bbl.

- Recent gains in WTI futures still appear corrective at these levels and key short-term resistance at $79.09, the Jan 29 high, remains intact. Clearance of this level would alter the picture and highlight a bullish development. A break would open $81.70, a Fibonacci retracement.

- Shipping giant Maersk has warned that ongoing disruptions to flows through the Red Sea could drag into H2 2024, causing heavy congestion and delays for US bound goods, according to Reuters.

- Oil markets remain rangebound this year despite Middle East risks and Red Sea shipping attacks because of limited impact on supplies so far according to RBC Capital’s Head of Commodity Strategy Helima Croft in an interview with CNBC.

- Worth noting a decent bounce in iron ore on Tuesday but most highlighting that it's likely to be a relief rally rather than a major shift in sentiment. Market participants remain concerned over demand for raw materials in China.

- Very little movement in precious metals in line with the narrow ranges for the USD index on Tuesday as market participants await US PCE inflation on Thursday.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/02/2024 | 0030/1130 | *** |  | AU | CPI Inflation Monthly |

| 28/02/2024 | 0030/1130 | *** |  | AU | Quarterly construction work done |

| 28/02/2024 | 0100/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 28/02/2024 | 0700/0800 | ** |  | SE | PPI |

| 28/02/2024 | 0700/1500 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 28/02/2024 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/02/2024 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/02/2024 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 28/02/2024 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 28/02/2024 | 1100/1200 |  | EU | ECB's Lagarde and Cipollone in G20 and CB Governors meeting | |

| 28/02/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 28/02/2024 | 1330/0830 | * |  | CA | Current account |

| 28/02/2024 | 1330/0830 | * |  | CA | Payroll employment |

| 28/02/2024 | 1330/0830 | *** |  | US | GDP |

| 28/02/2024 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/02/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 28/02/2024 | 1530/1530 |  | UK | BOE's Mann at FT future forum event 'The economic outlook..' | |

| 28/02/2024 | 1700/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 28/02/2024 | 1715/1215 |  | US | Boston Fed's Susan Collins | |

| 28/02/2024 | 1745/1245 |  | US | New York Fed's John Williams | |

| 29/02/2024 | 2350/0850 | * |  | JP | Retail sales (p) |

| 29/02/2024 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.