-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Commodity Weekly: Oil Markets Assess Trump Impact

MNI Gas Weekly: Winter Weather Takes the Driver's Seat

MNI ASIA MARKETS ANALYSIS: Tsys Softer Ahead Nov Jobs Data

- MNI US: White House Refuses To Rule Out Reapplication Of Sanctions On Venezuela

- MNI US: House To Vote On Biden Impeachment Inquiry Next Week

- BOEING SIGNALS TWO-MONTH DELAY TO 737 PRODUCTION RAMP-UP: RTRS

- SPEAKER JOHNSON WON'T BACK ANY NEW STOPGAP BILLS: POLITICO

- Manheim Used Vehicle Value Index Falls 2.1% to 205 MoM

US TSYS Markets Roundup: Inside Range, Tsys Pare Midday Gains Ahead NFP

- Treasury futures drifted off midday highs, holding to a narrow session range amid robust two-way trade ahead Friday's November employment data.

- Tsys saw delayed bid this morning after in-line weekly jobless claims data spurred buying/short covering: Initial Jobless Claims comes out in-line with expectations: 220k vs. 220k est, 219k prior revised from 218k), Continuing Claims lower than expected: 1.861M vs. 1.910M est, 1.925M prior/revised.

- Mar'24 10Y futures currently trading 111-03 last, -1.5 vs. 111-09.5 intraday high. Initial technical support well below at 109-16.5 20-day EMA. Curves steeper but off highs (3M10Y +2.133 at -128.917; 2Y10Y +1.625 at -47.473).

- Desks looking for FX tie-in after Japanese Yen extended rally overnight amid hawkish rate hike expectations from the BOJ on December 18. No obvious headline as $/Yen below 142.0 briefly vs. 147.30 overnight high.

- Focus remains on tomorrow's employment data for November after this week's lower than expected JOLTS and ADP data rekindled early 2024 rate cut projections. Bloomberg consensus sees nonfarm payrolls growth of 186k in November, up from the 150k in October owing to a 38k fewer striking workers meaning strike adjusted gains should trend lower.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00843 to 5.35739 (+0.01073/wk)

- 3M -0.00830 to 5.37183 (-0.00340/wk)

- 6M -0.00848 to 5.30158 (-0.03932/Wk)

- 12M -0.00289 to 5.02927 (-0.08914/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (-0.01), volume: $1.707T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $609B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $596B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $103B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $253B

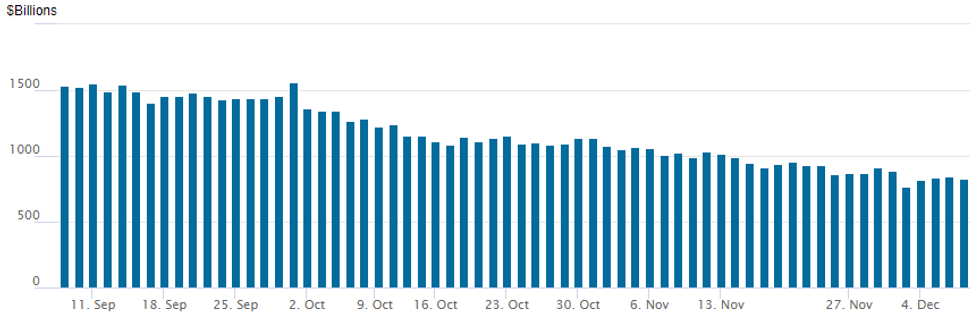

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage recedes to $825.734B w/ 83 counterparties vs. $846.498B yesterday. Operation usage fell to the lowest level since early July 2021 of $768.543B on December 1. Usage fell below $1T for the first time since August 2021 last on November 9 ($993.314B).

SOFR/TREASURY OPTION SUMMARY

Mixed SOFR and Treasury options segued to better bullish call/put positioning ahead Friday's headline employment data for November. Underlying futures off lows after retreating from new 3M highs in TYH4 overnight (111-09.5). Short end outperforming as rate cut projections for 2024 firm up slightly: December flat at 5.333%, January 2024 cumulative -3.7bp at 5.293%, March 2024 chance of rate cut at -56.2% vs. -55.2% this morning with cumulative of -17.7bp at 5.152%, May 2024 back up to -74.2% vs. -69.1% this morning, cumulative -36.3bp at 4.967%. Fed terminal at 5.33% in Feb'24.- SOFR Options: (continued interest in early 2024 rate cut hedging via flys after some 80k bought covering more aggressive cuts in Jan and April SOFR expirys late Wednesday)

- Block, 6,350 SFRF4 94.68/94.75/94.93/95.00 call condors, 3.5 ref 94.89

- +6,500 SFRM4 95.12/95.25/95.37/95.50 call condors, 1.5

- Blocks, 10,000 0QH4 97.25/97.75 call spds, 4.5-5.0 ref 96.255

- Blocks, total 30,500 SFRF4 94.62/94.75 put spds from 1.75-2.0 ref 94.88 to -.895

- +36,000 SFRH4 94.75/94.87/95.00 call flys 1.25-0.75 ref 94.88

- 14,000 SFRH4 94.75/94.87 2x1 put spds ref 94.865

- 15,000 SFRZ3 94.62 puts, 1.5 ref 94.63

- 2,000 2QZ3 96.56/96.75/96.93 call flys

- 2,500 0QZ3 96.00/96.12/96.25/96.37 call condors ref 95.93

- 2,000 SFRM4 94.50/94.75/97.87 put trees ref 95.22

- Treasury Options: (myriad smaller trades from TYF 107.5 puts to 113.5 calls)

- 12,300 wk3 TY 113.5/114/114.5 call trees ref 111-01

- +8,000 wk3 TY/TYF4 109 put spds 6

- -22,500 TYF4 106.5/108.5 put spds 6 ref 110-30.5 to -29.5

- -7,000 TYF 116/118 call spds 1 vs. 110-27.5

- 2,000 FVF 109/109.5/110 call trees ref 107-16

- 20,000 wk3 10Y 110/112 strangles 43 ref 110-26 (expire Dec 15)

- 6,000 TYF4 108.25 puts, 8 ref 110-26 to -26.5

- 9,000 TYF4 109 puts, 13 last

- 4,000 TYF4 108/108.5/109 put flys, 5 ref 110-25

- 10,500 TYF4 110 puts, 33 ref 110-25.5

- 6,000 TYF4 112/113 call spds, 17 ref 111-03

EGBs-GILTS CASH CLOSE: Gilts Underperform As Rally Steadies Out

European yields were little changed Thursday, a contrast to the large rally in the previous two sessions, with Gilts underperforming Bunds.

- The session began with global core FI on the back foot, as Japanese yields spiked on senior BoJ officials implying they were eyeing an exit to negative rate policy.

- A weak German industrial production report helped yields reverse lower, though the rally had mostly petered out by midday.

- Afternoon trade was mixed, with US jobs data not really moving the needle, ahead of Friday's key US employment report.

- Periphery EGB spreads reversed early tightening and closed modestly wider, led by Greece.

- Friday's session brings a fairly limited European schedule, with an appearance by ECB's Muller and German final inflation the early highlights.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.4bps at 2.596%, 5-Yr is down 2.8bps at 2.137%, 10-Yr is down 0.9bps at 2.191%, and 30-Yr is up 2.9bps at 2.402%.

- UK: The 2-Yr yield is up 2.3bps at 4.517%, 5-Yr is up 2.7bps at 4.029%, 10-Yr is up 2.5bps at 3.968%, and 30-Yr is up 1.1bps at 4.46%.

- Italian BTP spread up 1.1bps at 174.6bps / Greek up 2bps at 118.3bps

EGB Options: Bund Downside Features Thursday

Thursday's Europe rates / bond options flow included:

- Weekly RX 134/133ps, bought for 20 in 2k (US nonfarm payrolls play)

- RXG4 133/130 put spread vs. 137/140 call spread ppr receives 16 to buy put spread on 3K

- SFIM4 95.30/50/60 broken c fly, bought for 4 in 3k.

- ERM4 96.375/96.25/96.00 put ladder sold at 1 in 5k

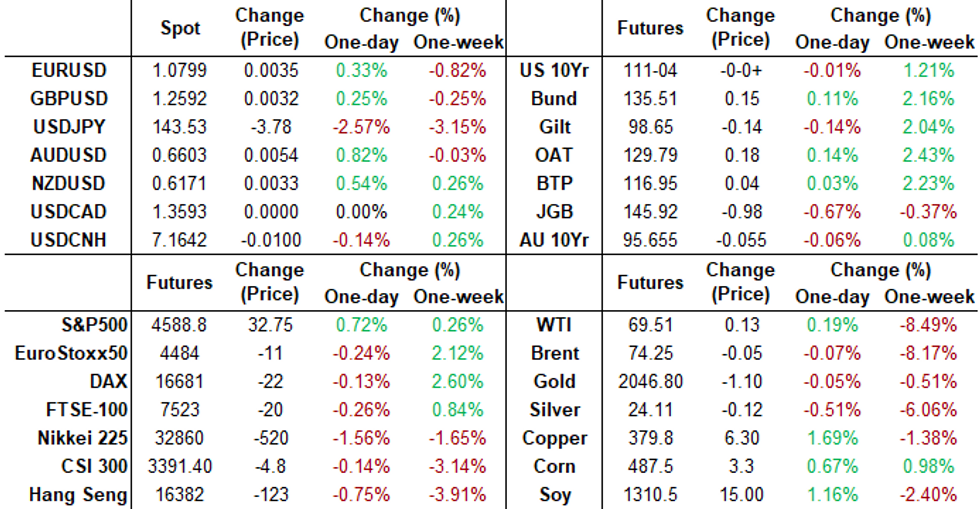

FOREX USDJPY Declines 2.65%, Briefly Trades Below 142.00 Amid Ongoing BOJ Speculation

- Thursday’s moves in currency markets were dominated by the Japanese Yen strength. Initial JPY demand was triggered by the cumulative effect of appearances from BoJ's Himono and Ueda, both of which strongly suggested that the BoJ are already considering how to exit NIRP once economic conditions justifying a policy switch are met. A poorly received longer-end JGB auction added to the early JPY impetus.

- Throughout the session, JPY dips remained shallow, and the path of least resistance remained lower for USDJPY as markets continued to speculate over the BOJ and liquidity was tested ahead of tomorrow’s US employment report. Session ranges were already notable through to the Europe close with USDJPY breaching below 144.50 from an overnight high of 147.32. However, a sharp bout of further weakness for the pair was triggered as the sell-off gathered momentum, with a confluence of technical levels being breached amid very thin trade. Bloomberg recorded the low as 141.71, an impressive 3.8% from the day’s peak, before markets stabilised and USDJPY came to rest around 143.50, still down 2.65% on the session.

- In a day dominated by the JPY volatility in currency markets, the greenback broadly traded on the backfoot with some softer US data assisting the USD weakness. This has prompted the DXY to unwind the majority of the week’s climb, declining around 0.65% on the session.

- More constructive price action for the major equity benchmarks have underpinned the likes of AUD and NZD, which have also performed well. AUDUSD has risen back above 0.6600 after overnight lows closely matched the previous breakout zone around 0.6525.

- All focus for global markets will be on tomorrow’s US non-farm payrolls release. Bloomberg consensus sees nonfarm payrolls growth of 186k in November, up from the 150k in October owing to a 38k fewer striking workers meaning strike adjusted gains should trend lower.

FX Expiries for Dec08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E502mln), $1.0745-50(E2.1bln), $1.0785-00(E1.9bln), $1.0845-50(E1.0bln), $1.0900(E1.6bln)

- USD/JPY: Y145.00($1.1bln), Y145.45-50($832mln), Y146.00($900mln), Y146.50($830mln), Y148.00($1.7bln)

- AUD/USD: $0.6595-00(A$698mln)

- USD/CAD: C$1.3575($1.8bln), C$1.3590-10($1.3bln), C$1.3685($530mln)

- USD/CNY: Cny7.1810($1.4bln)

Late Equity Roundup: High-Tech Leads Session Gains

- Stocks continued to drift higher in late trade after in-line weekly jobless claims data spurred buying/short covering ahead of Friday's headline employment data. At the moment, DJIA is up 72.33 points (0.2%) at 36128.11, S&P E-Mini futures up 33.25 points (0.73%) at 4589.25, Nasdaq up 181 points (1.3%) at 14328.29.

- Leading gainers: Communication Services, Information Technology and Consumer Discretionary sectors outperformed, interactive media supporting the former with Google +5.61% after successful launch of Gemini - competing against OpenAI’s ChatGPT, while Meta gained 3.13% and Live Nation gained 2%. IT sector supported by semiconductor stocks rebound from late Wednesday selling: AMD +9.6% (positive reaction to competitive AI chips vs. Nvidia), ON Semiconductor +3.73%, Qorvo +3.38%. Meanwhile hotels/resorts outpaced automakers to take lead in the Discretionary sector: Airbnb +4.23, Expedia +3.32%, Norwegian Cruise Line +3.2%.

- Laggers: Energy, Health Care and Utilities sectors underperformed, with Haliburton (-2.05%) and Schlumberger (-1.77%) weighing on the former. Pharmaceuticals weighed on the Health Care sector: Gilead -1.65%, Merck -1.43%, Moderna -1.17%. Meanwhile, Electricity and LP/Gas shares weighed on Utilities: Constellation -1.49%, First Energy -0.85%, PPL Corp -0.65%.

E-MINI S&P TECHS: (Z3) Trend Needle Continues To Point North

- RES 4: 4700.00 Round number resistance

- RES 3: 4685.25 High Jul 27 and the bull trigger

- RES 2: 4644.75 High Aug 2

- RES 1: 4607.75 High Dec 1

- PRICE: 4573.00 @ 14:19 GMT Dec 7

- SUP 1: 4518.67 20-day EMA

- SUP 2: 4457.00 50-day EMA

- SUP 3: 4420.25.25 Low Nov 14

- SUP 4: 4354.25 Low Nov 10

A bullish theme in S&P e-minis remains intact and the contract continues to trade closer to its recent highs. Since the October 27 reversal, corrections have been shallow - this is a bullish signal. Note too that moving average studies are in a bull-mode position, highlighting positive market sentiment. A resumption of gains would signal scope for a climb towards 4644.75, the Aug 2 high. Initial support lies at 4518.67, the 20-day EMA.

COMMODITIES WTI Briefly Taps July Support, Gold Only Modestly Gains From USD Weakness

- Crude prices have struggled for direction today, mostly consolidating yesterday’s slide although WTI did see a clearance of support at an early July low.

- Iraq has renewed its support for the OPEC+ and commitment to voluntary reduction, Deputy PM for Energy Affairs and Oil Minister Hayyan Abdul Ghani said according to the Iraqi News Agency.

- Chinese crude oil imports fell to 42.45mn tons in November, down from 48.97mn tons in October and the lowest monthly level since April, customs data showed.

- Russian Urals crude has fallen back below the G7 price cap of $60/bbl for the first time since July, according to Argus.

- WTI is near unchanged at $69.36, with a low of $68.84 briefly clearing support at $69.09 (Jul 3 low) before bouncing. It opens $67.28 (June 23 low).

- Brent is -0.3% at $74.11 off a low of $73.70 that remained above support at $73.50 (Jul 6 low).

- Gold is +0.2% at $2029.8, seeing relatively little intraday boost from the USD sliding with JPY strength. Resistance is still seen at $2072.7 (50% retrace of Dec 4-5 downleg).

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/12/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 08/12/2023 | 0700/0800 | ** |  | SE | Private Sector Production m/m |

| 08/12/2023 | 0730/0830 |  | EU | ECB's De Guindos participates in ECOFIN meeting | |

| 08/12/2023 | 0930/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 08/12/2023 | 1330/0830 | *** |  | US | Employment Report |

| 08/12/2023 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 08/12/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/12/2023 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.