-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN - Not The New Year Resolution You Were Looking For

EXECUTIVE SUMMARY

- House Votes On 25th Amendment Resolution Tuesday 1930ET

- MNI POLICY: Fed Won't Hit Inflation Bar For 2 Years- Rosengren

- FED: Cleveland's Mester: No Need To Change Policy If 2021 Goes As Expected

- MNI INTERVIEW: Chicago Fed Economist Sees Low Inflation Decade

- MNI INTERVIEW: Canada's CAD100B Stimulus Is Overkill-Conf Bd

- MNI EXCLUSIVE: Eurogroup To Meet Ex-US Treasury Sec Summers

- U.S. TO REQUIRE COVID TESTS FOR ALL INTERNATIONAL VISITORS: DJ

- ONTARIO DECLARES SECOND PROVINCIAL EMERGENCY ON COVID-19 SPIKE, Bbg

- FED BOSTIC: ECONOMY CAN'T MOVE FORWARD UNTIL HEALTH ISSUES RESOLVED, Bbg

- YELLEN CONFIRMATION HEARING IS PLANNED FOR JAN. 19, Bbg

- TRUMP SAYS WE WANT NO VIOLENCE, NEVER VIOLENCE," cites plans for second impeachment for "CAUSING TREMENDOUS ANGER" Bbg

US

US: 25Th Amendment, Timing of tonight's 25th Amendment resolution vote:

- House expected to convene at 1930ET tonight. How smoothly/quickly things proceed after that is anyone's guess.

FED: Boston Fed President Eric Rosengren said Tuesday he does not expect the U.S. economy to reach a sustained 2% inflation rate over the next two years despite employment gains, implying the Fed will continue to maintain very accommodative interest rates.

- Over the medium term Rosengren expects a decline in the unemployment rate and a "robust recovery starting in the second half of this year." The economy is supported by elevated household savings, favorable financial conditions, and a resilient housing market, he said. For more see MNI Policy Mainwire at 1310ET.

FED: Cleveland Fed Pres Mester comments in a speech "Moving Toward a Broad-Based Sustainable Economic Recovery in the U.S." that are largely in line with what she said a few days ago - basically looking for a weak H1 and a strong H2 and no change in policy.

- Re the latter, she is looking for the Fed to begin tapering next year, though could be pulled forward to 2021 if the economy develops more strongly than she expects. Likewise, she wouldn't be in favor of easing policy if H1 economic weakness develops as expected.

- The most salient paragraph in terms of policy expectations: " It is consistent with my view that based on my current outlook and assessment of risks around the outlook, it will be appropriate for monetary policy to be patiently accommodative. A slowdown in the economy in the first part of the year along the lines I am expecting would not require a change in monetary policy so long as the medium-run outlook remains intact. Nor would the strengthening in growth I expect to see later this year necessitate a change in our policy stance because I expect that the economy will still be far from our employment and inflation goals."

- "This is going to be a decade in which wages and inflationary pressures are likely to be moderate," he said in an interview, citing his new research on job market slack that seeks to resolve the low-inflation puzzle that stumped policymakers during the last economic recovery.

US/EU: Eurozone finance ministers are set for a briefing from former U.S. Treasury Secretary Larry Summers at the Jan 18 Eurogroup meeting, MNI understands, as they look for clues as to how President-elect Joe Biden will rebuild relations with Europe and drive fiscal policy to rebuild the economy in the wake of the Covid-19 pandemic.

CANADA

BOC: Canada has already deployed enough deficit spending for the economy to rebound as vaccines roll out later this year, potentially making the plan for another CAD100 billion of stimulus unnecessary, government adviser and Conference Board of Canada chief economist Pedro Antunes told MNI.

- Gross domestic product should return to pre-pandemic levels around the end of this year, led by consumers flush with cash from past government relief payouts, he said in a phone interview. Assuming vaccines are widely delivered in the third quarter, as the government projects, jobs should also recover and help compensate weakness in exports and business investment, according to a new forecast he published Tuesday.

OVERNIGHT DATA

MNI: US BLS: JOLTS OPENINGS RATE 6.527M IN NOV

MNI: US BLS: JOLTS QUITS RATE 2.2% IN NOV

US REDBOOK: JAN STORE SALES -2.6% V DEC THROUGH JAN 09 WK

US REDBOOK: JAN STORE SALES +2.1% V YR AGO MO

US REDBOOK: STORE SALES +2.1% WK ENDED JAN 09 V YR AGO WK

MARKET SNAPSHOT

- DJIA up 84.23 points (0.27%) at 31090.95

- S&P E-Mini Future up 3.5 points (0.09%) at 3795.25

- Nasdaq up 29 points (0.2%) at 13065.15

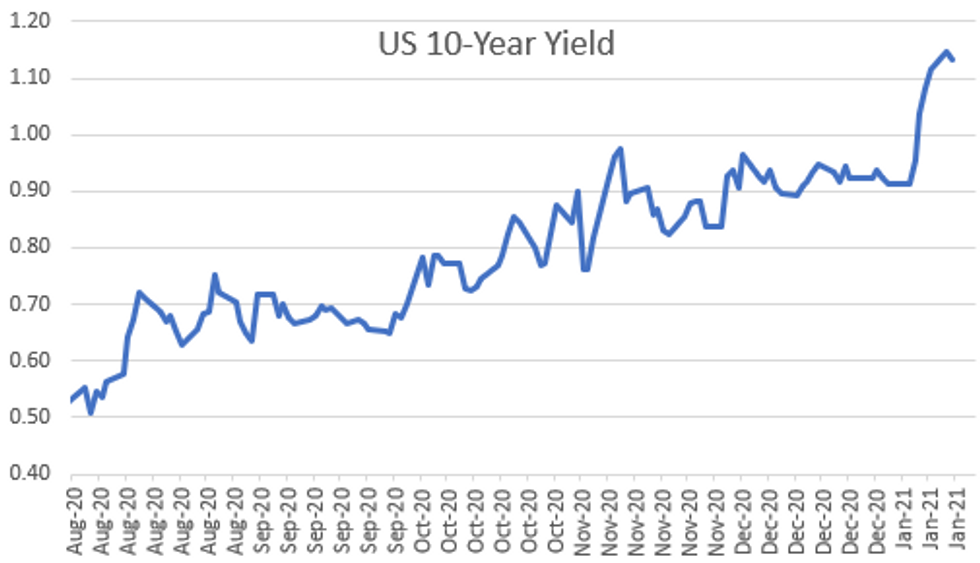

- US 10-Yr yield is down 0.8 bps at 1.1376%

- US Mar 10Y are down 1.5/32 at 136-12

- EURUSD up 0.0051 (0.42%) at 1.2202

- USDJPY down 0.46 (-0.44%) at 103.8

- WTI Crude Oil (front-month) up $0.88 (1.68%) at $53.13

- Gold is up $9.07 (0.49%) at $1852.82

European bourses closing levels:

- EuroStoxx 50 down 8.49 points (-0.23%) at 3612.13

- FTSE 100 down 44.37 points (-0.65%) at 6754.11

- German DAX down 11.6 points (-0.08%) at 13925.06

- French CAC 40 down 11.46 points (-0.2%) at 5650.97

US TSY SUMMARY:

Rates traded largely weaker by the closing bell, Treasury futures well off midmorning lows amid deceptively heavy over all volumes, TYH1 over 1.86M after the bell.

- Another low data-risk session, rates buffeted by ongoing political headline risk and global Covid case surge. House convening Tuesday evening at 1930ET to vote on the 25th amendment resolution to remove Trump from office after last Wed's violent siege in DC Capitol. CAD$ hit after headline "ONTARIO HEALTHCARE IS `ON THE BRINK OF COLLAPSE" while vaccine rollout remains slow.

- Not a lot of correlation between rates and stocks, Tsys ignored a late morning sell-off in equities, while both asset classes traded off lows into late trade. Position squaring, short covering noted in second half. Huge +30k TYH1 Block buy 136-11 helped spur move.

- Tsys rallied after strong 10Y Auction Re-Open: $38B 10Y note auction re-open (91282CAV3) drew 1.164% high yield (0.951% last month) vs. 1.172% WI; 2.47 bid/cover (2.33 previous).

- The 2-Yr yield is unchanged at 0.1449%, 5-Yr is down 0.2bps at 0.5042%, 10-Yr is down 0.8bps at 1.1376%, and 30-Yr is up 0.2bps at 1.8854%.

US TSY FUTURES CLOSE

Futures trading weaker after the bell are well off mid-morning lows amid robust volumes (TYH1>1.8M). Better position squaring in second half, strong rebound after 10Y auction re-open traded through. Yield curves mixed, off mildly steeper levels.

- 3M10Y -1.782, 104.456 (L: 104.286 / H: 109.927)

- 2Y10Y -1.332, 98.385 (L: 98.214 / H: 103.285)

- 2Y30Y -0.443, 172.992 (L: 172.566 / H: 176.093)

- 5Y30Y -0.006, 137.58 (L: 136.014 / H: 138.318)

- Current futures levels:

- Mar 2Y down 0.25/32 at 110-13.625 (L: 110-13.125 / H: 110-13.875)

- Mar 5Y down 0.5/32 at 125-16 (L: 125-11.25 / H: 125-16.75)

- Mar 10Y up 0.5/32 at 136-14 (L: 136-01 / H: 136-14.5)

- Mar 30Y down 2/32 at 168-9 (L: 167-11 / H: 168-12)

- Mar Ultra 30Y down 5/32 at 204-2 (L: 202-19 / H: 204-09)

US EURODOLLAR FUTURES CLOSE

Futures trading steady/mixed after the bell, well off early session lows to at/near top end of session range. Lead quarterly EDH1 bounced back to steady despite 3M LIBOR set' +0.00925 to 0.23375% (+0.00937/wk).

- Mar 21 steady at 99.815

- Jun 21 steady at 99.820

- Sep 21 -0.005 at 99.805

- Dec 21 -0.005 at 99.765

- Red Pack (Mar 22-Dec 22) -0.01 to +0.005

- Green Pack (Mar 23-Dec 23) steady to +0.005

- Blue Pack (Mar 24-Dec 24) -0.005 to +0.005

- Gold Pack (Mar 25-Dec 25) steady

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00100 at 0.08588% (-0.00087/wk)

- 1 Month +0.00125 to 0.12600% (+0.00087/wk)

- 3 Month +0.00925 to 0.23375% (+0.00937/wk)

- 6 Month -0.00262 to 0.24763% (+0.00113/wk)

- 1 Year -0.00125 to 0.32563% (-0.00400/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $55B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $146B

- Secured Overnight Financing Rate (SOFR): 0.09%, $964B

- Broad General Collateral Rate (BGCR): 0.07%, $360B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $332B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchases

- Tsy 4.5Y-7Y, $6.001B accepted vs. $19.996B submission

- Next scheduled purchases:

- Wed 1/13 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Thu 1/14 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 01/14 Next forward schedule release at 1500ET

PIPELINE: $19.69B High-Grade Debt To Price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 01/12 $5B *KFW 5Y +3

- 01/12 $5B #CADES 10Y +23

- 01/12 $3B BPCE $1.75B 5Y +60, $1.25B 11NC10 +115

- 01/12 $2.09B #Rep of Colombia $790M 10Y tap 2.8%, $1.3B 40Y +210

- 01/12 $1.75B *Zurich Insurance Co 30.25NC10.25 3.0%

- 01/12 $1.5B *MuniFin 5Y +8

- 01/12 $750M #Aviation Capital 5Y +165

- 01/12 $600M #Pacific Life 7Y +62

- 01/12 $Benchmark Nippon Life investor call

- On tap for Wednesday:

- 01/13 $Benchmark Japan Bank Int Cooperation (JBIC) 10y +29A

- 01/13 $Benchmark Ontario 5Y +20a

FOREX: Sterling Shines In Soggy Session

GBP traded well following a speech from BoE governor Bailey who highlighted the difficulties and uncertainties when it comes to negative interest rates. Bailey stated that while there "nothing to stop" the imposition of negative interest rates, there would be lots of issues including complicating the outlook for the banking sector. Markets read these comments as a firm indication that the MPC are still well away from seriously considering NIRP, resulting in markets pushing out rate cut expectations and boosting GBP in the process. GBP/USD showed above $1.36.

- Elsewhere, price action was less directional. The USD resumed recent weakness despite an uptick in US yields and a modest steepening in the curve. Meanwhile, haven currencies weakened, keeping JPY & CHF on the backfoot while AUD, and commodity-tied FX advanced.

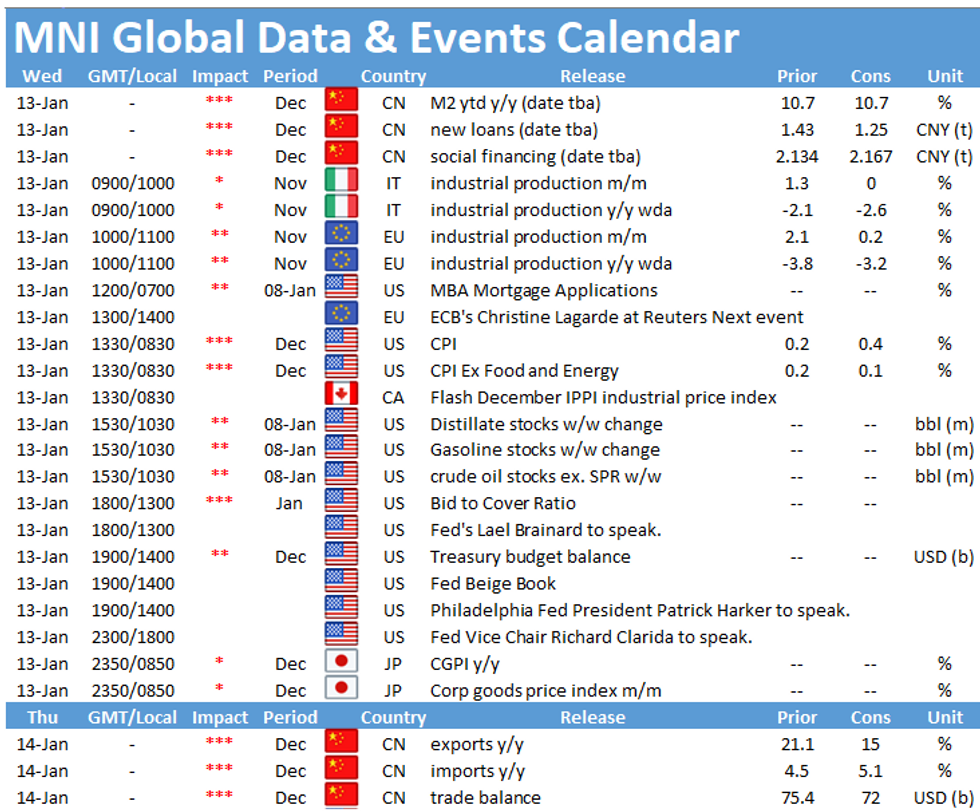

- Focus Wednesday turns to Italian, Eurozone industrial production and the US CPI report for December. More central bank speak is due to cross, with ECB's Lagarde, Villeroy and Bullard, Brainard, Harker and Clarida of the Fed are all scheduled.

EGBs-GILTS CASH CLOSE: BTP Spds Widen On Politics

Big supply, political risk and pushback on UK negative rates saw weakness across the FI space Tuesday. Main theme was supply: UK, Netherlands, Austria, Belgium (syndication) all issued today.

- BoE's Bailey noted "lots of issues" w negative rates in the UK, which weakened the short-end.

- BTP spreads widened the most since in more than 2 months amid rumblings of a collapse in the ruling Italian coalition.

- Supply theme continues Wednesday w Spain set to syndicate new 10-Yr and Germany, Portugal and the UK all hold auctions. Also Weds, ECB's Villeroy and Lagarde speak, and we get IT and EZ industrial production data.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.8bps at -0.691%, 5-Yr is up 2.8bps at -0.688%, 10-Yr is up 2.8bps at -0.468%, and 30-Yr is up 2.5bps at -0.065%.

UK: The 2-Yr yield is up 4bps at -0.077%, 5-Yr is up 4.4bps at 0.012%, 10-Yr - UK: The 2-Yr yield is up 4bps at -0.077%, 5-Yr is up 4.4bps at 0.012%, 10-Yr is up 4.3bps at 0.352%, and 30-Yr is up 2.5bps at 0.928%.

- Italian BTP spread up 5.8bps at 111.8bps / Spanish up 2.4bps at 57.8bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.