-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Curve Steeper Ahead of JOLTS

MNI US OPEN - Censure Motion Against France Gov't Due Today

MNI ASIA OPEN: Yellen, Better As Tsy Sec Than Fed Chair?

EXECUTIVE SUMMARY

- MNI BRIEF: Yellen Says 'Time to Go Big' In Confirmation Hearing

- MNI BRIEF: US to Combat 'Illegal' China Trade Practices-Yellen

- MNI SOURCES: ECB Dec Forecasts Stand, Signs Of Discord Ahead

- MNI: YELLEN: I BELIEVE IN MARKET DETERMINED FX RATES

- MNI: YELLEN: WANT TO GAUGE MARKET INTEREST IN 50-YEAR BOND

- TSY NOMINEE YELLEN: CHINA CLEARLY MOST IMPORTANT STRATEGIC COMPETITOR OF U.S., Reuters

- YELLEN: U.S. NEEDS TO TAKE ON CHINA'S ABUSIVE PRACTICES, Bbg

- U.S. DECLARES CHINA COMMITTING `GENOCIDE' ON UIGHURS: NYT

- STATE DEPT. DECLARATION SEEN AS TRUMP'S LAST CHINA ACTION: NYT

- MERKEL REACHES DEAL TO EXTEND GERMAN LOCKDOWN UNTIL FEBRUARY 14, Bbg

US

US TSY: Janet Yellen, Joe Biden's nominee for Treasury Secretary, said Tuesday the President-elect's USD1.9 trillion fiscal plan was key to getting the economy back on track.

- "Right now, with interest rates at historic lows, the smartest thing we can do is act big," Yellen told the Senate Finance Committee. "Without further action we risk a longer and more painful recession now and more scarring of the economy later."

- "China is undercutting American companies by dumping products, erecting trade barriers and giving illegal subsidies to corporations. It has been stealing intellectual property and engaging in practices that give it an unfair technological advantage," Yellen told the Senate Finance Committee. "These practices, including China's low labor and environmental standards, are practices that we are prepared to use the full array of tools to address," she said.

EUROPE

ECB: The European Central Bank's December staff growth and inflation projections remain in play despite surging Covid infections and fresh lockdowns, eurosystem sources told MNI, though one official's concerns over the length of time government spreads could be artificially compressed even as credit standards tighten may point to potential disagreements ahead.

- While no monetary policy decisions are likely at Thursday's Governing Council meeting, officials expressed continued unease over the euro exchange rate and mentioned discussions over when to wind down the ECB's Pandemic Emergency Purchase Programme as a potential source of future friction.

OVERNIGHT DATA

MNI Chicago Business Barometer Revised To 58.7 from 59.5 in Dec- The Chicago Business Barometer was revised down 0.9 points in December as the result of the seasonal adjustment recalculation, while in aggregate, the Barometer was revised lower by 0.1 point to 48.9 in 2020.

- Growth was revised down in Q4, but revised up in Q2. In Q1 and Q3 the Barometer was unchanged.

- July saw the largest upward revision, with the Barometer revised up 1.1 points to 53.0 from its initial estimate of 51.9, while October recorded the biggest downward revision, lower by 1.0 point to 60.1.

- Overall, 2020 data from the Chicago survey saw minor revisions.

- However, the strong impact of the pandemic on activity along with uncertainty about the path of economic recovery and its final influence on the trend component may lead to stronger revisions in the future.

CANADIAN NOV MANUFACTURING SALES -0.6% MOM

CANADA NOV FACTORY INVENTORIES +0.8%; INVENTORY-SALES RATIO 1.62

CANADA NOV WHOLESALE SALES +0.7%; EX-AUTOS +1.2%

NOV WHOLESALE INVENTORIES -0.6%: STATISTICS CANADA

MARKETS SNAPSHOT

- DJIA up 142.35 points (0.46%) at 30952.53

- S&P E-Mini Future up 32.75 points (0.87%) at 3794.75

- Nasdaq up 205.2 points (1.6%) at 13203.69

- US 10-Yr yield is up 0.7 bps at 1.0903%

- US Mar 10Y are up 2.5/32 at 136-30

- EURUSD up 0.0049 (0.41%) at 1.2126

- USDJPY up 0.2 (0.19%) at 103.89

- WTI Crude Oil (front-month) up $0.61 (1.17%) at $52.99

- Gold is down $1.69 (-0.09%) at $1839.60

- EuroStoxx 50 down 7.25 points (-0.2%) at 3595.42

- FTSE 100 down 7.7 points (-0.11%) at 6712.95

- German DAX down 33.29 points (-0.24%) at 13815.06

- French CAC 40 down 18.66 points (-0.33%) at 5598.61

US TSY SUMMARY

Futures holding firmer levels across the curve, narrow range after futures surged to new session highs in late morning trade.

- Driver debatable as former Fed Chair/Tsy Sec nominee Yellen testified at confirmation hearing: targeting China as main competitor, talked abusive practices and `GENOCIDE' ON UIGHURS. Yellen positively eyes 50Y Bond to extend duration/raise $, Yld curves spiked but finishing off highs.

- Futures extended session highs as Yellen said US not "seeking weaker $", equities pared gains (ESH1 +14.0). Prop and real$ acct selling int strength as levels receded slightly; yield curves mildly steeper for most part.

- But futures reverse support after Yellen discusses extending duration to 50Y Bond, would "be pleased to look at issue". Yld curves moving steeper as long end support evaporated briefly. Countdown to Pres-elect Biden inauguration at 1200ET Wed.

- Additional flow tied to multiple bill auctions, while supra-sovereign US$ debt issuers resumed

- The 2-Yr yield is down 0.4bps at 0.129%, 5-Yr is down 0.3bps at 0.447%, 10-Yr is up 0.7bps at 1.0903%, and 30-Yr is up 0.6bps at 1.8388%.

US TSY FUTURES CLOSE

Futures holding firmer levels across the curve, narrow range after futures surged to new session highs in late morning trade. Yld curves off highs:

- 3M10Y +0.599, 100.834 (L: 100.834 / H: 103.9)

- 2Y10Y +0.947, 95.59 (L: 95.358 / H: 97.82)

- 2Y30Y +0.885, 170.492 (L: 169.949 / H: 172.818)

- 5Y30Y +0.919, 139.059 (L: 137.937 / H: 140.086)

- Current futures levels:

- Mar 2Y up 0.375/32 at 110-14.75 (L: 110-14 / H: 110-14.75)

- Mar 5Y up 2/32 at 125-25 (L: 125-19.75 / H: 125-25.25)

- Mar 10Y up 3/32 at 136-30.5 (L: 136-21 / H: 136-31.5)

- Mar 30Y up 6/32 at 169-0 (L: 168-10 / H: 169-08)

- Mar Ultra 30Y up 22/32 at 205-28 (L: 204-12 / H: 206-05)

US EURODOLLAR FUTURES CLOSE: Short End Anchored

Futures trading steady to mildly weaker in the short end, mildly higher in Reds-Golds -- near second half highs. Lead quarterly EDH1 see-sawing around steady to -0.005 even after 3M LIBOR set -0.00037 to 0.22363% (+0.00025/wk).

- Mar 21 steady at 99.820

- Jun 21 -0.005 at 99.825

- Sep 21 -0.005 at 99.815

- Dec 21 steady at 99.785

- Red Pack (Mar 22-Dec 22) steady to +0.010

- Green Pack (Mar 23-Dec 23) +0.010 to +0.015

- Blue Pack (Mar 24-Dec 24) +0.005 to +0.010

- Gold Pack (Mar 25-Dec 25) +0.010 to +0.015

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00150 at 0.08513% (-0.00150/wk)

- 1 Month -0.00138 to 0.12950% (+0.00000/wk)

- 3 Month -0.00037 to 0.22363% (+0.00025/wk)

- 6 Month +0.00013 to 0.23588% (-0.01225/wk)

- 1 Year +0.00062 to 0.31300% (-0.00963/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $64B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $150B

- Secured Overnight Financing Rate (SOFR): 0.08%, $887B

- Broad General Collateral Rate (BGCR): 0.05%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $321B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $4.966B submission

- Next scheduled purchases:

- Wed 1/20 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Thu 1/21 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 1/22 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

PIPELINE

Supra-Sovs US$ Issuance Continues To Outpace Domestic Names Sidelined Into Earnings; $132.69B/month.

- Date $MM Issuer (Priced *, Launch #)

- 01/19 $3.51B #Wells Fargo PerpNC5 3.9%

- 01/19 $2.25B #Chile $750M 2032 tap +87, $1.5B 40Y +127

- 01/19 $1.5B #Credit Agricole 6NC5 fix/FRN

- 01/19 $1.25B #BNP Paribas 20Y +118

- 01/19 $1B #Bank of Montreal 6NC5 +50

- 01/19 $750M #Air Lease Corp 3Y +72

- 01/19 $1.5B Hilton Domestic 11NC5.5

- 01/19 $1.3B Howard Hughes Corp 8NC3, 10NC5

- 01/19 $Benchmark SK Innovations 3Y +150a, 5Y +175a

- 01/19 $Benchmark Rep of Turkey 5Y 5.25%a, +10Y 6.25%a

- Up next:

- 01/20 $Benchmark Asia Infrastructure Inv Bank (AIIB) 5Y +8a

- 01/?? $Benchmark EBRD 5Y

- 01/?? $Benchmark Gazprom 8Y

FOREX: Yellen Supports Risk-On, USD, Yen Weaker

As was expected, incoming Treasury Secretary Janet Yellen supported the risk-on sentiment evident in markets from the off. Yellen talked up the requirement to "act big" on COVID-19 stimulus, and also allayed fears of any imminent requirement to raise taxes as the economy recovers. This prompted EUR/USD to bounce back above the 50-dma at 1.2093, hitting the week's best levels in the process at 1.2145.

- Scandi currencies are among the best performers, with NOK, SEK outstripping gains seen elsewhere. The single currency also traded well, helping EUR/JPY clock the first positive session in 8.

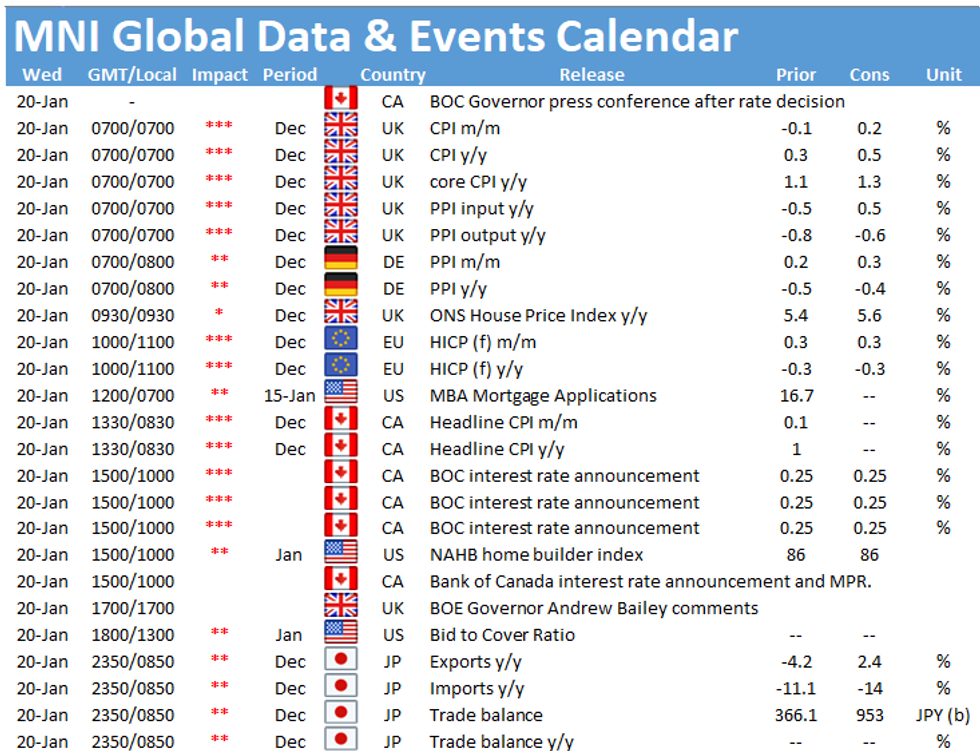

- Focus Wednesday turns to UK, Eurozone and Canadian inflation numbers for December and the Bank of Canada rate decision. The BoC are seen keeping rates unchanged at 0.25%. BoE's Bailey is also scheduled to speak.

EGBs-GILTS CASH CLOSE: BTPs Outperform As Conte Seen Safe

BTPs outperformed Tuesday, while Bunds and Gilts rallied late in the afternoon, following US Tsys. Supply today saw strong demand.

- BBG citing sources that PM Conte may receive an outright majority in the Senate confidence vote later today (with some abstentions helping the arithmetic) pushed 10-Yr BTP spreads vs Bunds to lowest close since Jan 13. Vote expected well after hours.

- Otherwise the story of the day was supply: Finland (E1bn), UK (GBP6.5bn 2046 syndication), France (E7bn 50-Yr). Additionally, local press reported Greece raised E2bn in 30-Yr private placement.

- UK inflation data the early focus Wednesday; ECB coming Thursday. Closing Cash Levels/10-Yr Bond Spreads vs Bunds:

- Germany: The 2-Yr yield is up 0.8bps at -0.707%, 5-Yr is up 0.1bps at -0.716%, 10-Yr is up 0.1bps at -0.526%, and 30-Yr is up 0.1bps at -0.114%.

UK: The 2-Yr yield is up 1bps at -0.127%, 5-Yr is up 0.8bps at -0.041%, 10-Yr - UK: The 2-Yr yield is up 1bps at -0.127%, 5-Yr is up 0.8bps at -0.041%, 10-Yr is up 0.2bps at 0.289%, and 30-Yr is down 0.3bps at 0.859%.

- Italian BTP spread down 4.4bps at 111.4bps / Spanish down 1bps at 59.5bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.