-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI ASIA OPEN: S&Ps Crater -3.29% After Fed Holds Steady

EXECUTIVE SUMMARY

- FED: NO CHANGE TO INTEREST RATE FORWARD GUIDANCE

- FED: LEAVES QE AT $120B PER MONTH; $80B TREASURY, $40B MBS

- FED: FEB 2, 9 WILL BE LAST TERM REPO OPS

- FED: WILL KEEP DAILY AFTERNOON REPO OPS

- MNI POLICY: Fed Says Economy Has Slowed, Maintains QE and Rate

- MNI BRIEF: Brussels Gives Equivalence To U.S. CCPs

- MNI EXCLUSIVE: Interview W Senior IMF Official On Global Outlook

- MNI EXCLUSIVE: Eurozone To Decide 2022 Fiscal Stance By June

- ECB OFFICIALS SAID TO SEE MARKETS UNDERESTIMATING RATE-CUT ODDS

- MADRID HALTS VACCINATION FOR AT LEAST 2 WEEKS: EL MUNDO - bbg

US

FED: FOMC Makes No Changes To Policy, Guidance; 1M Term Repo Operations To End- The FOMC made no changes to its policy settings Wednesday, as expected, leaving rates in a 0%-0.25% and pledging to buy at least USD120 billion in assets a month until substantial further progress toward the Fed's dual mandate. The vote was unanimous.

- "The pace of the recovery in economic activity and employment has moderated in recent months, with weakness concentrated in the sectors most adversely affected by the pandemic."

- Added vaccinations to "The path of the economy will depend significantly on the course of the virus, including progress on vaccinations."

- No other changes to statement and no mention of fiscal policy

- In a sign of greater market stability, the New York Fed will no longer offer regularly-scheduled one-month term repo operations after Feb. 9

- New Fed Governor Chris Waller voted for the first time

- Reaffirmed longer run framework with no changes

FED: The Federal Reserve said Wednesday the economy's momentum has slowed in recent months and progress partly depends on the pace of Covid-19 vaccinations, while keeping guidance on QE worth USD120 billion per month and near-zero interest rates.

- "The pace of the recovery in economic activity and employment has moderated in recent months, with weakness concentrated in the sectors most adversely affected by the pandemic," the Federal Open Market Committee said in its post-meeting statement

US/EU: Central counterparties, or clearing houses, will be able to apply for recognition by European regulators after Brussels accepted an equivalence decision recognizing the U.S. Securities and Exchange Commission regime as equivalent to EU rules, the Commission said Wednesday. Once accepted bt the European Securities and Markets Authority (ESMA), the CCPs will be able to offer clearing services across the EU.

- "This decision is a significant first step in the process of recognizing US CCPs registered with the US Securities and Exchange Commission in the European Union," said Mairead McGuinness, Commissioner responsible for Financial Services.

EUROPE

EU: Eurozone finance ministers will determine the bloc's most appropriate fiscal stance for 2022 by June, which could be crucial for the eventual decision on when to reimpose the strict limits on public debt included in the Stability and Growth Pact, EU officials told MNI.

- It had previously been expected that the general escape clause of the Stability and Growth Pact could be deactivated at the end of 2021, but concerns are mounting over a possible double-dip recession this year amid a sluggish vaccine rollout and tightened Covid restrictions.

EU COMMISSION: Health Commissioner Speaks On AstraZeneca Vaccine Supply

European Health Commissioner Stella Kyriakides speaking in a press conference on vaccines: "We reject the logic of 'first-come-first-served'. That may work at the neighborhood butchers but not in a contract."

- 'There's no hierarchy of the four production plants named in the advanced purchase agreement. Two are in the EU and two are located in the UK.'

- "In our contract it is not specified any country, or the UK, has priority because it signed earlier. If this was the case AstraZeneca should've proposed a clause...acknowledging that they would prioritize for example deliveries to the UK."

- "EU is not imposing an export ban on vaccines and is not restricting export of vaccine to third countries." Says the EU only wants transparency on vaccine exports.

- EU actions currently a major concern in the UK. Fear that either AZ vaccine doses could be diverted from UK plants to EU or that EU could halt the supply of Pfizer vaccines to the UK, both of which would damage UK chances of hitting its vaccination targets.

UK: PM Johnson confirms in COVID-19 statement to the House that a 10-day hotel quarantine will come in for those traveling to the UK from 'hotspot' countries.

- Also says that schools will reopen from 8 March at the earliest, rather than after the mid-February half term break as had been indicated at the start of lockdown.

- With schools being the first part of an easing of lockdown this essentially confirms that the UK's current lockdown will last for at least an additional three weeks beyond the 15 February target for vaccinating the most vulnerable in the UK.

SPAIN: El Mundo reports that Madrid have suspended their vaccination program for first doses by "at least" two weeks, with the regional government attributing the decision to the reduction of the number of vials of vaccine received.

OVERNIGHT DATA

Dec Durable Goods New Orders Far Below Expected- U.S. durable goods new orders rose 0.2% in December, falling below expectations for a gain of 1.0%. That followed a revised 1.2% increase in November (prev +1.0%).

- Orders of transportation equipment fell 1.0% in December, with nondefense aircraft and parts orders down 51.8% and defense aircraft orders down 5.0%. Motor vehicle and parts orders rose 1.4% in December.

- Excluding transportation, new orders were up 0.7% when forecasts had called for an increase of 0.5%.

- Capital goods new orders were down 2.5%, with nondefense capital down 2.0% and defense capital goods orders down 5.3%.

- US MBA: MARKET COMPOSITE -4.1% SA THRU JAN 22 WK

- US MBA: REFIS -5% SA; PURCH INDEX -4% SA THRU JAN 22 WK

- US MBA: UNADJ PURCHASE INDEX +16% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 2.95% VS 2.92% PREV

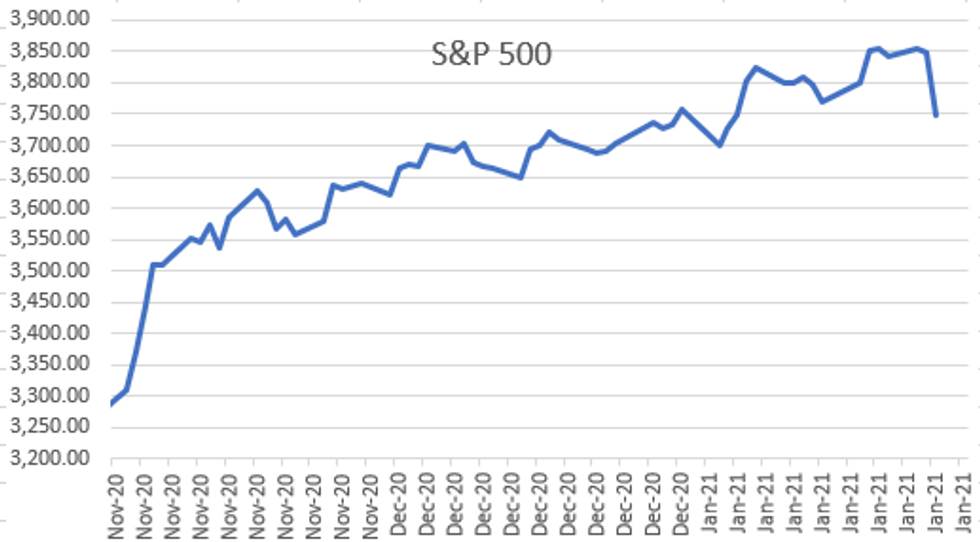

MARKET SNAPSHOT

Key market levels in late trade:

- DJIA down 633.87 points (-2.05%) at 30303.17

- S&P E-Mini Future down 126.5 points (-3.29%) at 3716

- Nasdaq down 355.5 points (-2.6%) at 13270.6

- US 10-Yr yield is down 2.5 bps at 1.0093%

- US Mar 10Y are up 5.5/32 at 137-17.5

- EURUSD down 0.0046 (-0.38%) at 1.2114

- USDJPY up 0.48 (0.46%) at 104.11

- WTI Crude Oil (front-month) down $0.02 (-0.04%) at $52.58

- Gold is down $9.61 (-0.52%) at $1841.47

- EuroStoxx 50 down 56.45 points (-1.57%) at 3536.38

- FTSE 100 down 86.64 points (-1.3%) at 6567.37

- German DAX down 250.53 points (-1.81%) at 13620.46

- French CAC 40 down 63.9 points (-1.16%) at 5459.62

US TSY SUMMARY: Early Risk-Off Sees Sub 1% 10YY; Fed On Hold

Rates trade firmer after the bell -- but well off midmorning session highs, even after equities trade broadly weaker, near late session lows (ESH1 -93.0).

- Chair Powell Q&A ongoing covers broad subject range: racial equality root of employ mandate, housing bounce ephemeral, signs of stronger H2, Fed not out of tools.

- Rates had held narrow range/near highs in 4+ hour lead-up to FOMC annc., break lower late. Not much of a react to steady FOMC policy annc, patient Fed view on inflation, ending term repo ops, too soon to consider tapering QE, econ recovery tied to progress in vaccines/getting virus spd under control.

- Early risk-off on headlines re: EU concern over Astrazeneca vaccine supply.

- On Tsy futures rally to session highs, 10YY dropped below 1.0% to 0.9992% for first time since Jan 6 after spending much of 2020 between 0.90%-0.55%. Robust volumes on muted risk appetite, TYH1 >750k (>100k on initial move) off of ECB headlines re: officials say markets underestimate chances of rate cuts.

- The 2-Yr yield is down 0.2bps at 0.1191%, 5-Yr is up 0.4bps at 0.4129%, 10-Yr is down 1.4bps at 1.0212%, and 30-Yr is down 0.4bps at 1.7865%.

MONTH-END EXTENSIONS: UPDATED Barclays/Bbg Extension Estimates

Forecast summary compared to the avg increase for prior year and the same time in 2020. TIPS -0.16Y; Govt inflation-linked, 0.23. Note Agencies extend duration from 0.12 prelim to 0.16.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.09 | 0.09 | 0.07 |

| Agencies | 0.16 | 0.06 | -0.03 |

| Credit | 0.09 | 0.09 | 0.09 |

| Govt/Credit | 0.09 | 0.09 | 0.07 |

| MBS | 0.06 | 0.06 | 0.07 |

| Aggregate | 0.08 | 0.08 | 0.08 |

| Long Gov/Cr | 0.09 | 0.09 | 0.05 |

| Iterm Credit | 0.1 | 0.08 | 0.09 |

| Interm Gov | 0.09 | 0.08 | 0.07 |

| Interm Gov/Cr | 0.09 | 0.08 | 0.08 |

| High Yield | 0.11 | 0.08 | 0.09 |

US TSY FUTURES CLOSE: Late Bounce As Equities Crater

Futures bounce off closing levels as equities crater (ESH1 -133 at one point), techs punished (TSLA, FB both -6%, AAPL -2.5%). Tsy futures still off midmorning highs when 10YY went sub 1% briefly (0.9992%L). Current levels:

- 3M10Y -2.282, 94.086 (L: 92.565 / H: 96.715)

- 2Y10Y -2.143, 89.019 (L: 88.37 / H: 92.523)

- 2Y30Y -1.962, 164.796 (L: 164.44 / H: 168.779)

- 5Y30Y -2.145, 135.889 (L: 135.73 / H: 138.923)

- Current futures levels:

- Mar 2Y up 0.25/32 at 110-15.625 (L: 110-15.25 / H: 110-16)

- Mar 5Y up 2.25/32 at 126-0.75 (L: 125-29.5 / H: 126-02.5)

- Mar 10Y up 5.5/32 at 137-17.5 (L: 137-09 / H: 137-20.5)

- Mar 30Y up 23/32 at 170-19 (L: 169-20 / H: 170-25)

- Mar Ultra 30Y up 1-7/32 at 208-11 (L: 206-24 / H: 208-24)

US EURODOLLAR FUTURES CLOSE

Mostly firmer, near session highs, Reds underperforming. Lead quarterly EDH1 inched higher after 3M LIBOR set' -0.00700 to 0.21150% (-0.00375/wk).

- Mar 21 +0.005 at 99.825

- Jun 21 +0.010 at 99.840

- Sep 21 +0.005 at 99.825

- Dec 21 +0.005 at 99.795

- Red Pack (Mar 22-Dec 22) steady to +0.005

- Green Pack (Mar 23-Dec 23) steady to +0.010

- Blue Pack (Mar 24-Dec 24) +0.015 to +0.020

- Gold Pack (Mar 25-Dec 25) +0.020 to +0.025

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00088 at 0.08375% (-0.00250/wk)

- 1 Month -0.00500 to 0.12250% (-0.00225/wk)

- 3 Month -0.00700 to 0.21150% (-0.00375/wk)

- 6 Month +0.00150 to 0.23450% (-0.00150/wk)

- 1 Year -0.00075 to 0.31150% (-0.00075/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $213B

- Secured Overnight Financing Rate (SOFR): 0.03%, $926B

- Broad General Collateral Rate (BGCR): 0.02%, $354B

- Tri-Party General Collateral Rate (TGCR): 0.02%, $321B

- (rate, volume levels reflect prior session)

- No buy Wednesday due to FOMC annc

- Next scheduled purchases:

- Thu 1/28 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/29 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Fri 01/29 Next forward schedule release at 1500ET

PIPELINE: $10.95B 7-Eleven 8-Part Jumbo Leads

- Date $MM Issuer (Priced *, Launch #)

- 01/27 $10.95B #7-Eleven 8-part jumbo: $1.5B 1.5NC.5 FRN SOFR +45, $1.25B 2NC1 +55, $2.25B 3NC1 +65, $1.25B 5Y +60, $1B 7Y +65, $1.7B 10Y +80, $750M 20Y +100, $1.25B 30Y +105

- 01/27 $4.5B *ADB 5Y +5

- 01/27 $800M *Liberty Mutual investor 40NC5 4.3%

- 01/?? $Benchmark IDB 5Y +5a

FOREX: USD Firms Pre-Fed, Powell Says Little To Soften Blow

The greenback out-traded all others Wednesday, with the bulk of the move coming ahead of the Fed rate decision. Another ECB sources story added weight to EUR/USD, with Bloomberg reporting that the ECB are agreed on pushing back against market expectations that the bank will not cut key interest rates further. The headlines added extra weight to the EUR, which slipped to 1.2059 and in close proximity to the 2021 low at 1.2054.

- The Fed decision was unchanged - as expected - and despite Powell stressing that any talk of policy exit at present is premature, the USD remained strong and equities suffered. This worked against growth proxy currencies, with AUD, NZD and NOK all slipping.

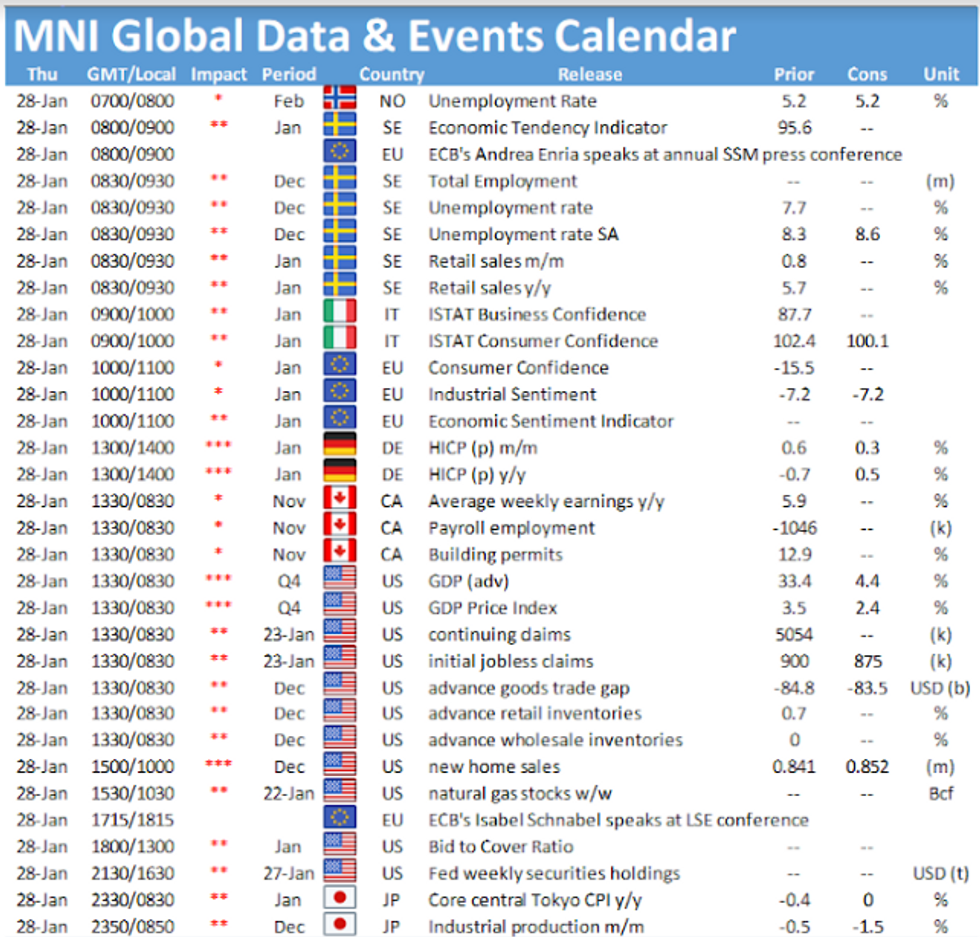

- Focus Thursday turns to weekly jobless claims numbers, regional German CPIs and the advance reading of Q4 US GDP. ECB's Schnabel is due to speak.

EGBs-GILTS CASH CLOSE: A Session That Had It All

Wednesday's risk-off session had it all, from large supply (incl syndications from Greece, Austria, Slovenia), to diplomatic intrigue over COVID vaccines pitting the EU against supplier AstraZeneca.

- But the highlight was a BBG report mid-afternoon citing unnamed officials as saying the ECB have agreed to push back on market rate cut skepticism.

- That pushed Bunds and Gilts to session highs, with peripheries largely keeping pace. However the move has since retraced and we are only slightly stronger in the UK and German curves.

- Attention turns to the US Federal Reserve decision after hours.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 1.8bps at -0.741%, 5-Yr is down 1.7bps at -0.751%, 10-Yr is down 1.3bps at -0.546%.

- UK: The 2-Yr yield is up 0.7bps at -0.131%, 5-Yr is up 0.8bps at -0.055%, 10-Yr is up 0.4bps at 0.269%, and 30-Yr is down 0.6bps at 0.832%.

- Italian BTP spread up 2.1bps at 120.1bps / Spanish up 1.4bps at 62bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.