-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessRESEND: MNI ASIA OPEN - Heavy Month End Duration Shedding

EXECUTIVE SUMMARY

- MNI EXCLUSIVE: Fed SEP Must Show Sustained Inflation For Hikes

- MNI INTERVIEW: US Unemployment +5% For Next 3 Years-Fed Fellow

- MNI BRIEF: Easy Money Widens Racial Income Gap: NY Fed Paper

- US DATA: MNI Chicago Business Barometer Hits 30-Month High in Jan

- PFIZER CEO: HIGH POSSIBILITY FUTURE VARIANT WILL ELUDE VACCINES, Bbg

US

US: Unemployment will take at least three years to decline under 5% with higher-educated workers now facing pressures the rest of the job market saw at the start of the pandemic, Washington University professor and St. Louis Federal Reserve research fellow Yongseok Shin told MNI.- Labor market tightness in November was nearly identical for both college-educated workers and workers with a high school education or less, according to a NBER study co-authored by Shin. Not only has that never happened before, it's "startling" because most of the jobs lost since the onset of the Covid-led recession have been lower-wage, lower-skill positions, he said.

- "In some sense you could say that everybody's suffering equally," he said in an interview. "That's what's very unique about this recession."

- The Fed's quarterly three-year forecasts include outlooks for inflation, growth and employment, and this Summary of Economic Projections would need to point to consistently above-target inflation as the committee seeks to solidly anchor inflation expectations around 2%, they said.

- "We show that, although a more accommodative monetary policy increases employment of black households more than white households, the overall effects are small," according to a new paper co-authored by New York Fed Assistant Vice President Moritz Shularick. "Over multi-year time horizons, the employment effects are substantially smaller than the countervailing portfolio effects."

OVERNIGHT DATA

US Dec Personal Income Above Expected U.S. personal income in December increased 0.6%, above expectations for a 0.1% gain. November personal income was revised down to -1.3% (prev -1.1%). That was mainly driven by increases in government social benefits, compensation, and personal divided income, the BEA said.- December PCE fell 0.2% following a revised 0.7% drop in November (prev -0.4%).

- The PCE price index was up 0.4% in December after an unrevised flat reading in November. From a year earlier, the PCE price index rose 1.3%.

- The core PCE price index increased 0.3% in December, and was up 1.5% from one year ago.

- U.S. DEC. PCE PRICE INDEX RISES 1.3% Y/Y; EST. 1.2%

- U.S. DEC. PCE PRICE INDEX RISES 0.4% M/M; EST. 0.3%

- U.S. DEC. REAL PERSONAL SPENDING FALLS 0.6% M/M; EST. -0.6%

- U.S. DEC. PERSONAL INCOME RISES 0.6% M/M; EST. 0.1

- Core PCE prices +0.3052 unrounded ; headline + 0.4253%

MNI Chicago Business Barometer Hits 30-Month High in Jan

MNI CHICAGO BUSINESS BAROMETER 63.8 JAN VS 58.7r DEC

MNI CHICAGO: PRODUCTION SHOWED LARGEST M/M INCREASE; AT 3-YEAR HIGH

MNI CHICAGO: EMPLOYMENT RECORDED BIGGEST M/M DROP

MNI CHICAGO: ORDER BACKLOGS AT 23-MONTH HIGH

- The Chicago Business Barometer rose to 63.8 in Jan after a downwardly revised reading of 58.7 in Dec.

- Jan's reading is the highest level since July 2018. It was a second consecutive gain and beat market expectations looking for a downtick.

- Among the main five indicators, Production (71.3) saw the largest monthly gain followed by New Orders (66.2). Employment (43.4) recorded the biggest decline.

- Production rose to a 3-year high in Jan, while New Orders rose to the highest level since Nov 2018. Order Backlogs increased to a 23-month high of 60.1, but Supplier Deliveries slipped to 69.9.

- Supplier Deliveries remain elevated, however, with firms continuously noting logistical issues. Inventories shifted above the 50-mark for the first time since May, rising to 55.1.

- MICHIGAN JAN. FINAL CONSUMER SENTIMENT AT 79; EST. 79.4

- US NAR DEC PENDING HOME SALES INDEX 125.5 V 125.9 IN NOV

- CANADA NOV GROSS DOMESTIC PRODUCT +0.7% MOM

- CANADA NOV GOODS INDUSTRY GDP +1.2%, SERVICES +0.5%

- CANADA REVISED OCT GROSS DOMESTIC PRODUCT +0.4% MOM

- CANADA DEC INDUSTRIAL PRICES +1.5% MOM; EX-ENERGY +0.9%

- CANADA DEC RAW MATERIALS PRICES +3.5% MOM; EX-ENERGY +1.0%

MARKET SNAPSHOT

Key late session market levels:- DJIA down 434.68 points (-1.42%) at 30174.23

- S&P E-Mini Future down 48.5 points (-1.28%) at 3731.5

- Nasdaq down 192.2 points (-1.4%) at 13147.15

- US 10-Yr yield is up 4.6 bps at 1.091%

- US Mar 10Y are down 8/32 at 137-0

- EURUSD up 0.0013 (0.11%) at 1.2135

- USDJPY up 0.47 (0.45%) at 104.71

- WTI Crude Oil (front-month) down $0.05 (-0.1%) at $52.31

- Gold is up $5.46 (0.3%) at $1848.45

- EuroStoxx 50 down 75.6 points (-2.13%) at 3481.44

- FTSE 100 down 118.69 points (-1.82%) at 6407.46

- German DAX down 233.06 points (-1.71%) at 13432.87

- French CAC 40 down 111.31 points (-2.02%) at 5399.21

US TSY SUMMARY

Tsy mostly weaker after the bell, short end outperforming, yield curves broadly steeper as January draws to an end (2s30s +6.1bp; large midmorning block buy +17,733 TUH at 110-15.75). Heavy volumes on late month end flow drew better selling instead of extending duration, approximate volumes in last 5 minutes of trade: TYH1 175k, USH1 35k, 115k FVH1 and 30k TUH.

- Prior to the sell-off, Tsys pared losses -- headed back to pre-open levels when futures gapped higher on J&J effectiveness headlines. J&J bump didn't last long: follow-up headline notes slightly higher effectiveness in US of 72% and "shot's immunity likely to ramp up over time" Bbg.

- Second-half support from falling equities (ESH1 -67.0) w/energy sector (refiners, extractors, etc) leading losses. Desks also pointed out risk negative headline: "PFIZER CEO: HIGH POSSIBILITY FUTURE VARIANT WILL ELUDE VACCINES," Bbg added to risk-off tone.

- Heavy buying in Eurodollar front end, Whites through Reds were +0.010-0.015 for much of day scaled back slightly late. Note 3M LIBOR -0.00312 to 0.20188% (-0.01337/wk) ** 3M New record Low vs. 0.20488% on 11/20/20

- The 2-Yr yield is down 0.2bps at 0.1152%, 5-Yr is up 1.6bps at 0.443%, 10-Yr is up 4.6bps at 1.091%, and 30-Yr is up 5bps at 1.8545%.

MONTH-END EXTENSIONS: FINAL Barclays/Bbg Extension Estimates

Forecast summary compared to the avg increase for prior year and the same time in 2020. TIPS -0.16Y; Govt inflation-linked, 0.23.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.09 | 0.1 | 0.07 |

| Agencies | 0.16 | 0.05 | -0.03 |

| Credit | 0.09 | 0.12 | 0.09 |

| Govt/Credit | 0.09 | 0.1 | 0.07 |

| MBS | 0.06 | 0.08 | 0.07 |

| Aggregate | 0.08 | 0.09 | 0.08 |

| Long Gov/Cr | 0.09 | 0.09 | 0.05 |

| Iterm Credit | 0.1 | 0.1 | 0.09 |

| Interm Gov | 0.09 | 0.09 | 0.07 |

| Interm Gov/Cr | 0.09 | 0.09 | 0.08 |

| High Yield | 0.11 | 0.12 | 0.09 |

US TSY FUTURES CLOSE

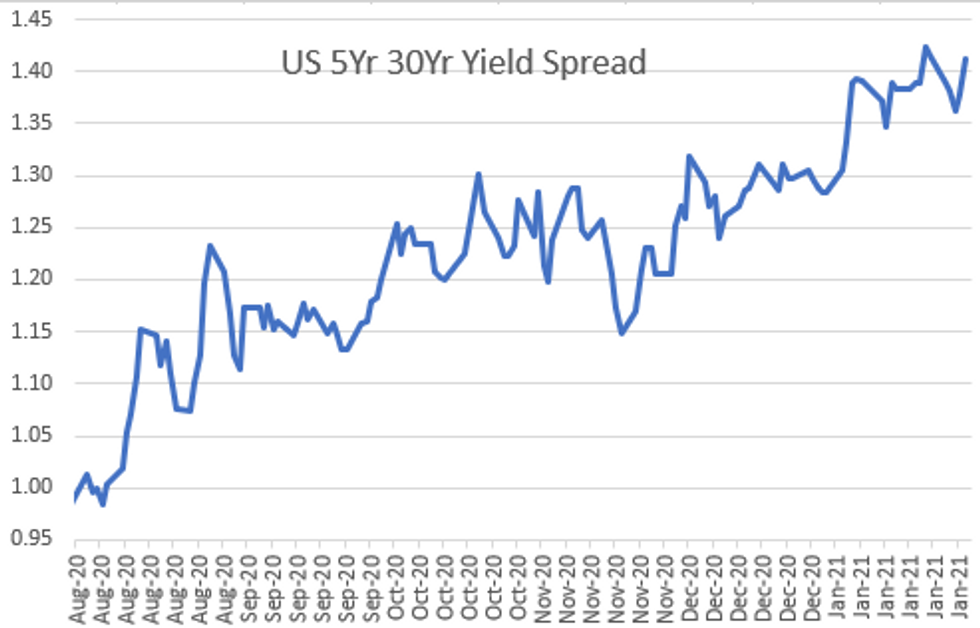

Tsy futures finished weaker Friday, late bout of heavy duration selling across the curve tempered second half efforts to rebound. Yield curves bear steepening back to mid-January multi-year highs.

- 3M10Y +4.856, 102.927 (L: 97.139 / H: 104.38)

- 2Y10Y +4.176, 96.73 (L: 91.875 / H: 98.241)

- 2Y30Y +4.167, 172.515 (L: 167.234 / H: 174.935)

- 5Y30Y +2.629, 140.207 (L: 136.831 / H: 141.872)

- Current futures levels:

- Mar 2Y up 0.5/32 at 110-15.875 (L: 110-15.25 / H: 110-16)

- Mar 5Y down 1/32 at 125-28.75 (L: 125-26.25 / H: 125-31)

- Mar 10Y down 6/32 at 137-2 (L: 136-28.5 / H: 137-10.5)

- Mar 30Y down 20/32 at 168-30 (L: 168-13 / H: 169-29)

- Mar Ultra 30Y down 29/32 at 205-9 (L: 204-05 / H: 207-00)

US EURODOLLAR FUTURES CLOSE

Futures trading steady/mixed, Whites through Reds outperforming. Lead quarterly EDH1 well bid after 3M LIBOR set -0.00312 to 0.20188% (-0.01337/wk) ** 3M New record Low (vs. 0.20488% on 11/20/20).

- Mar 21 +0.010 at 99.835

- Jun 21 +0.010 at 99.845

- Sep 21 +0.010 at 99.835

- Dec 21 +0.010 at 99.80

- Red Pack (Mar 22-Dec 22) +0.005 to +0.010

- Green Pack (Mar 23-Dec 23) -0.01 to +0.005

- Blue Pack (Mar 24-Dec 24) -0.035 to -0.015

- Gold Pack (Mar 25-Dec 25) -0.05 to -0.035

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00050 at 0.07875% (-0.00750/wk)

- 1 Month -0.00338 to 0.11950% (-0.00525/wk)

- 3 Month -0.00312 to 0.20188% (-0.01337/wk) ** 3M New record Low vs. 0.20488% on 11/20/20

- 6 Month +0.00312 to 0.22325% (-0.01275/wk)

- 1 Year +0.00038 to 0.31113% (-0.00112/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $67B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $195B

- Secured Overnight Financing Rate (SOFR): 0.04%, $906B

- Broad General Collateral Rate (BGCR): 0.03%, $363B

- Tri-Party General Collateral Rate (TGCR): 0.03%, $325B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $5.569B submission

Updated NY Fed operational purchase schedule, $40.2B from 2/01-2/11: - Mon 2/01 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Tue 2/02 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 2/03 1100-1120ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 2/04 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 2/05 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

- Mon 2/08 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Tue 2/09 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Wed 2/10 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 2/11 1010-1030ET: TIPS 2.25Y-4.5Y, appr $8.825B

- Thu 02/11 Next forward schedule release at 1500ET

PIPELINE: January High-Grade Issuance Over $227B

January finishing with $227.55B high-grade debt issuance

- Date $MM Issuer (Priced *, Launch #)

- 01/?? $Benchmark IDB 5Y +5a

- $8B Priced Thursday; $41.5B/wk

- 01/28 $5B *JP Morgan $2B 6NC5 fix/FRN +62, $3B 11NC10 fix/FRN +90

- 01/28 $1.5B *Cargill $500M 3Y +25, $500M 5Y +40, $500M 10Y +65

- 01/28 $1.5B *Airport Authority HK $900M 10Y +65, $600M 30Y +80

FOREX: AUD Weakness Pervades as Equity Selling Sets In

JPY started the session comfortably the poorest performer in G10, with USD/JPY's break of the bear channel downtrend the latest driver. Into the US close, however, equity selling set in, extending the S&P500's weakness to well over 2%, pulling the rug out from under growth-proxies and commodity-tied FX.

- This pressured AUD nicely, which underperformed most others. Nonetheless, markets failed to press AUD/USD through the Thursday lows thanks to a mixed USD. A break through the Thursday low at $0.7592 would expose the 50-dma open the lowest levels since late December for the pair.

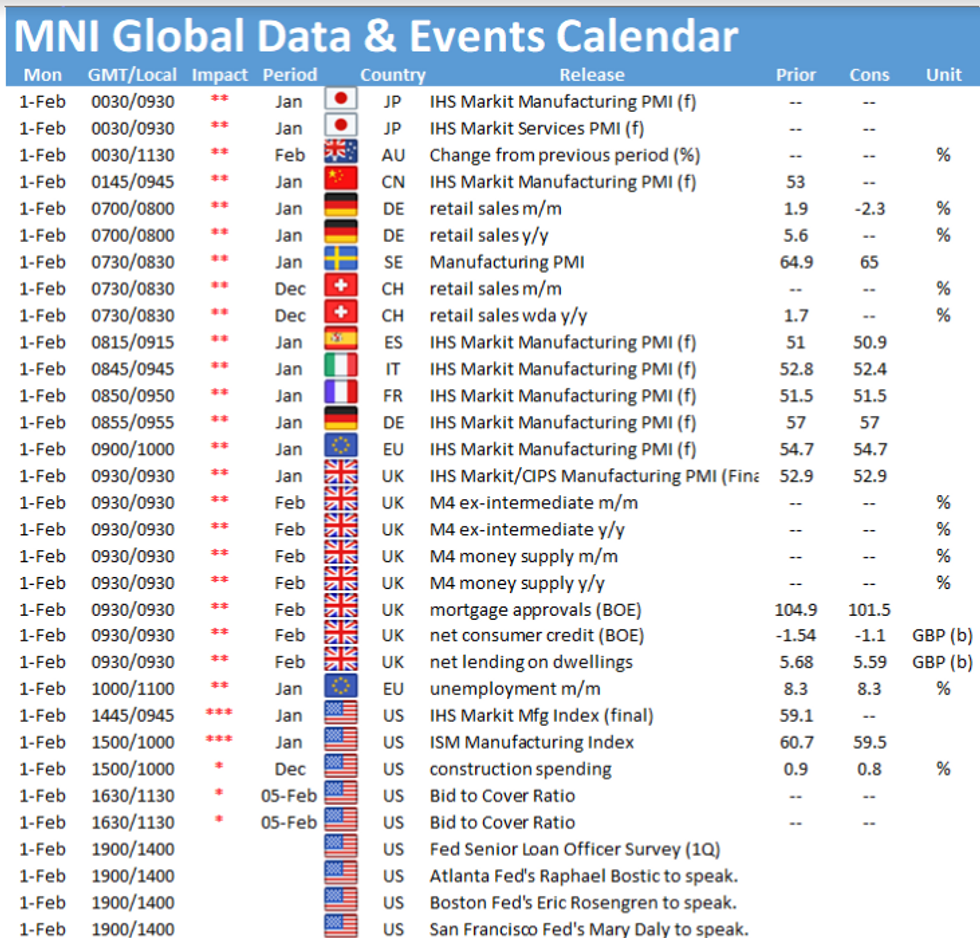

- Focus in the coming week turns to the ISM and NFP data for January as well as rate decisions from the Australian, UK and Indian central banks.

EGBs-GILTS CASH CLOSE: Weak End To The Month

Gilts weakened and the German curve bear steepened to highest levels since September (5s30s) in the last session of January.

- Mixed-to-positive news from JnJ's vaccine efficacy data, pushback from Rtrs Sources and Makhlouf on ECB rate cut prospects, and strong Q4 European GDP readings lent bearish tone, even as equities headed lower.

- Italian spreads drifted off early tight levels on headlines that Salvini urged Pres Mattarella to call early elections. Though not particularly surprising, it brought snap election risk back to the forefront just ahead of the weekend. Headlines that 5-Star would back Conte helped spreads down later.

- Next week's schedule highlighted by the Bank of England decision.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 1.2bps at -0.733%, 5-Yr is up 1.7bps at -0.735%, 10-Yr is up 2.1bps at -0.518%, and 30-Yr is up 2.4bps at -0.077%.

- UK: The 2-Yr yield is up 0.7bps at -0.106%, 5-Yr is up 1.4bps at -0.028%, 10-Yr is up 4bps at 0.327%, and 30-Yr is up 4.7bps at 0.897%.

- Italian BTP spread down 1.4bps at 116.1bps/ Spanish up 0.4bps at 61.6bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.