-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Corporate Supply Pipeline

US Treasury Auction Calendar

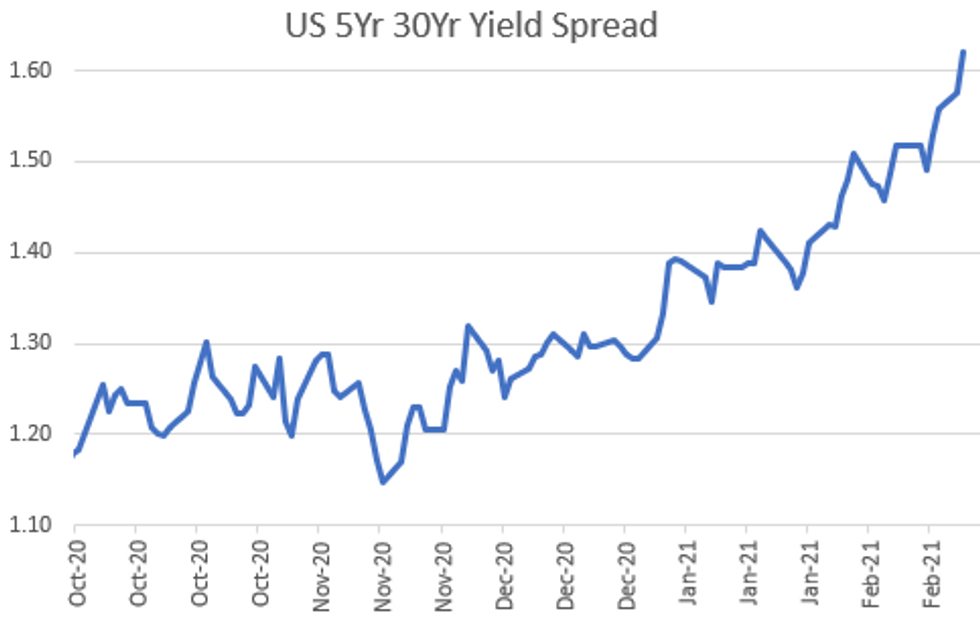

MNI ASIA OPEN - Tsy 5s30s Yld Curve Back To Aug 2014 Lvls

EXECUTIVE SUMMARY

- MNI POLICY: Powell Says Economy is Long Way From Fed Goals

- MNI POWELL: SUBSTANTIAL PROGRESS ON GOALS TO 'TAKE SOME TIME'

- MNI POWELL: VACCINES POINT TO IMPROVED OUTLOOK LATER THIS YEAR

- POWELL: THERE'S LONG WAY TO GO, WE'RE 10M JOBS BELOW PRE-VIRUS, Bbg

- POWELL: EXPECT INFLATION TO BE VOLATILE OVER NEXT YEAR OR SO, Bbg

- MNI POLICY: BOC's Macklem Signals Patience to Aid Jobs Rebound

- MNI BRIEF: BOC Says Rising Yields Reflect Vaccine, Policy Gains

- US: Pandemic Chief Fauci: CDC Could Relax Some Guidelines For Those Vaccinated

US

FED: Federal Reserve Chair Jay Powell on Tuesday pledged the Fed would continue its QE program for "some time" to support an economy a long way from maximum employment and 2% inflation, noting mixed signs of slowing momentum and progress on vaccinations.- "The economic recovery remains uneven and far from complete," he said in prepared testimony ahead of a semiannual hearing at the Senate Banking Committee. For more, see MNI Policy Main Wire at 1000ET.

- To the extent there would be downward pressure on the Fed funds rate because of "for example, the Treasury General Account shrinking in size", "we have tools to keep it within our intended policy range" which should limit extent to which other short end rates including t-bills could go negative. Regarding possible collateral shortage in bills, Powell says he doesn't see that.

- As in other countries there remains major division over whether domestic 'vaccine passports' should be utilised for those that have been inoculated. With political divisions as deep as they have been for many years in the US, this policy could cause significant backlash among some sections of society.

- Fauci also says that while he expects things to return to normal in the autumn, but that mask wearing could become commonplace into 2022.

CANADA

BOC: Bank of Canada Governor Tiff Macklem on Tuesday signaled the central bank should be patient about testing how strong the job market rebound can be through the pandemic, saying the last economic cycle proved record low unemployment can be consistent with stable inflation.

- The job market has been set back in the near term by the quarter million jobs lost during the second wave of Covid-19, he said in the text of a speech to the Edmonton and Calgary chambers of commerce. Vaccine rollouts suggest brighter prospects later on, though Macklem said the recovery will be choppy, repeating guidance that the 0.25% policy rate will likely be needed until 2023 and asset purchases now worth CAD4 billion a week are ongoing. For more, see MNI Policy main wire at 1230ET.

OVERNIGHT DATA

US CONF BOARD CONSUMER CONFIDENCE 91.3 IN FEB V JAN 88.9

US Q4 FHFA HPI Q/Q SA +3.8% V +10.8% Q4 2020

US Q4 FHFA HPI Q/Q SA +3.8% V +10.8% Q4 2020

US DEC FHFA HPI SA +1.1% V +1.0% NOV; +11.4% Y/Y

US DEC CASE-SHILLER SEAS ADJ HOME PRICE INDEX +1.3% M/M

US DEC CASE-SHILLER UNADJ HOME INDEX +0.8% M/M; +10.1% Y/Y

US DEC CASE-SHILLER NATIONAL IDX +1.3% SA, +0.9% NSA, +10.4% Y/Y

US REDBOOK: FEB STORE SALES -0.8% V JAN THROUGH FEB 20 WK

US REDBOOK: FEB STORE SALES +2.6% V YR AGO MO

US REDBOOK: STORE SALES +2.9% WK ENDED FEB 20 V YR AGO WK

The February reading of the Richmond Fed Manufacturing Index is 14

MARKET SNAPSHOT

Key late session market levels:- DJIA up 4.17 points (0.01%) at 31527.87

- S&P E-Mini Future down 4 points (-0.1%) at 3869.25

- Nasdaq down 141.8 points (-1%) at 13392.81

- US 10-Yr yield is down 0.5 bps at 1.3602%

- US Mar 10Y are up 3/32 at 135-13.5

- EURUSD down 0.0015 (-0.12%) at 1.2142

- USDJPY up 0.23 (0.22%) at 105.32

- Gold is down $5.63 (-0.31%) at $1804.04

European bourses closing levels:

- EuroStoxx 50 down 10.75 points (-0.29%) at 3689.1

- FTSE 100 up 13.7 points (0.21%) at 6625.94

- German DAX down 85.23 points (-0.61%) at 13864.81

- French CAC 40 up 12.4 points (0.22%) at 5779.84

US TSY SUMMARY: Choppy Day For Few Surprises From Fed Chair Testimony

Choppy session for rates and equities, Tsy yields mixed, 5s30s curve making new high (162.463H, Aug 2014 levels) while equities manage to recover from broad losses to mildly higher (ESH1 -1.8% midmorning to +.26% by rates close).- Not much react to data: Feb consumer confidence better than exp: 91.3 vs 88.9 in Jan; DEC CASE-SHILLER SEAS ADJ HOME PRICE INDEX +1.3% M/M. Focus more on Fed chair Powell's semi annual testimony on economy to Sen Banking Comm -- though few surprises revealed.

- Tsy futures had started to reverse modest gains prior to Powell's testimony, support evaporated ahead the risk event coupled w/bounce in equities (weaker levels helped kick off bounce in Tsys in the first place). Some had hoped yield curve control would have been mentioned spurred sharp duration sell-off to new session lows (10YY 1.3875%H; 30YY 2.2144%H). Powell dismissed n/t inflation concerns, cautiously optimistic on outlook, has tools to keep funds rate in range. Stated central clearing and "digital dollar" being looked at.

- Heavy volumes tied to massive rolling of March to June, latter takes lead quarterly Friday (TYH/TYM>2M, >50% March volume by the close).

- US Tsy $60B 2Y Note (91282CBN0): draws 0.119% high yield (0.125% last month) vs. 0.118% WI, bid/cover 2.44 vs. 2.67 previous. Corp issuance hedging in the mix.

- The 2-Yr yield is up 0.4bps at 0.1149%, 5-Yr is down 2.1bps at 0.5777%, 10-Yr is down 0.5bps at 1.3602%, and 30-Yr is up 2.4bps at 2.1972%.

MONTH-END-EXTENSIONS: Preliminary Barclays/Bbg Extension Estimates

Forecast summary compared to the avg increase for prior year and the same time in 2020. TIPS 0.09Y; Govt inflation-linked, 0.12.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.13 | 0.09 | 0.13 |

| Agencies | 0.06 | 0.05 | 0.05 |

| Credit | 0.09 | 0.09 | 0.09 |

| Govt/Credit | 0.1 | 0.09 | 0.11 |

| MBS | 0.08 | 0.06 | 0.08 |

| Aggregate | 0.1 | 0.08 | 0.11 |

| Long Gov/Cr | 0.16 | 0.09 | 0.15 |

| Iterm Credit | 0.09 | 0.08 | 0.1 |

| Interm Gov | 0.11 | 0.08 | 0.09 |

| Interm Gov/Cr | 0.1 | 0.08 | 0.09 |

| High Yield | 0.1 | 0.09 | 0.25 |

US TSY FUTURES CLOSE: Yield Curves Marching Steeper

Choppy day on heavy volumes tied to March/June rolls (TYH/TYYM >2M, TYH appr 4M after the close). Little new gleaned from Fed Chair Powell's semi-annual testimony to Senate Banking Comm. New yield highs, 5s30s back to Aug 2014 levels.

- 3M10Y -0.841, 132.475 (L: 131.453 / H: 135.961)

- 2Y10Y -0.332, 124.536 (L: 123.176 / H: 127.495)

- 2Y30Y +2.535, 208.379 (L: 204.716 / H: 210.28)

- 5Y30Y +4.624, 161.939 (L: 157.178 / H: 162.538)

- Current futures levels:

- Mar 2Y up 0.125/32 at 110-16 (L: 110-15.625 / H: 110-16.25)

- Mar 5Y up 2.75/32 at 125-11.5 (L: 125-08.25 / H: 125-13.75)

- Mar 10Y up 2.5/32 at 135-13 (L: 135-06.5 / H: 135-17.5)

- Mar 30Y down 6/32 at 162-6 (L: 161-23 / H: 162-25)

- Mar Ultra 30Y down 20/32 at 191-14 (L: 190-24 / H: 192-30)

US EURODOLLAR FUTURES CLOSE: Lead Quarterly Weaker After 3M LIBOR bounce

Lead quarterly EDH1 came under heavy sell pressure after 3M LIBOR set jumped +0.01200 to 0.18750% (+0.01225/wk). Reds-Golds gradually firmed, near highs by the bell:

- Mar 21 -0.007 at 99.837

- Jun 21 -0.005 at 99.850

- Sep 21 -0.005 at 99.830

- Dec 21 steady at 99.785

- Red Pack (Mar 22-Dec 22) steady to +0.015

- Green Pack (Mar 23-Dec 23) +0.010 to +0.020

- Blue Pack (Mar 24-Dec 24) +0.020 to +0.035

- Gold Pack (Mar 25-Dec 25) +0.030

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00075 at 0.08050% (+0.00237/wk)

- 1 Month +0.00275 to 0.11763% (+0.00212/wk)

- 3 Month +0.01200 to 0.18750% (+0.01225/wk) ** (Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00025 to 0.20375% (+0.00875/wk)

- 1 Year -0.00087 to 0.28463% (-0.00187/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $206B

- Secured Overnight Financing Rate (SOFR): 0.03%, $860B

- Broad General Collateral Rate (BGCR): 0.02%, $360B

- Tri-Party General Collateral Rate (TGCR): 0.02%, $327B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.400B accepted vs. $4.852B submission

- Next scheduled purchases:

- Wed 2/24 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Thu 2/25 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 2/26 1010-1030ET: Tsy 0Y-2.25Y, appr 12.825B

PIPELINE: Waiting For Western Union Launch

- Date $MM Issuer (Priced *, Launch #)

- 02/23 $5.5B #Fidelity National Information 6-Part: $750M each: 2Y +30, 3Y +40, 7Y +75 and 20Y +110; $1.25 each: 5Y +60 and 10Y +95

- 02/23 $1B #Macquarie Bank 15NC10 +170

- 02/23 $1B #Interpublic $500M 10Y +105, $500M 20Y +135

- 02/23 $1B #Southern Company $600M 3Y +38, $400M 7Y +80

- 02/23 $Benchmark Western Union 5Y +80a, 10Y +140a

- 02/23 $Benchmark Bank of New Zealand investor calls

- 02/23 $Benchmark Peru, includes EUR issue investor calls

- Rolled to Wednesday:

- 02/24 $Benchmark KFW 3Y +2a

- 02/24 $Benchmark ADB 10Y +12a

FOREX: Stellar Sterling as GBP/USD Tops 1.41 For First Time Since 2018

GBP's outperformance continued Tuesday, with the currency outperforming all others in G10. Today's moves are further evidence that the market is heavily endorsing the UK government's gradual, but solid, reopening plan which looks to remove all COVID-19 restrictions on June 21st. GBP/USD topped all near-term resistance ahead of the psychological handle, opening a move on the 1.4167 76.4% Fib retracement for the 2016 - 2020 sell-off.

- Elsewhere, the greenback was mixed, taking little from the appearance of Fed chair Powell in front of the Senate Banking Committee. The USD index was mixed-to-lower, but managed to steer clear of testing the key support at 90.05.

- The poorest performer Tuesday was CHF, which fell against all others in G10 despite a less than impressive turn out from equities. USD/CHF neared the 2021 highs of 0.9045.

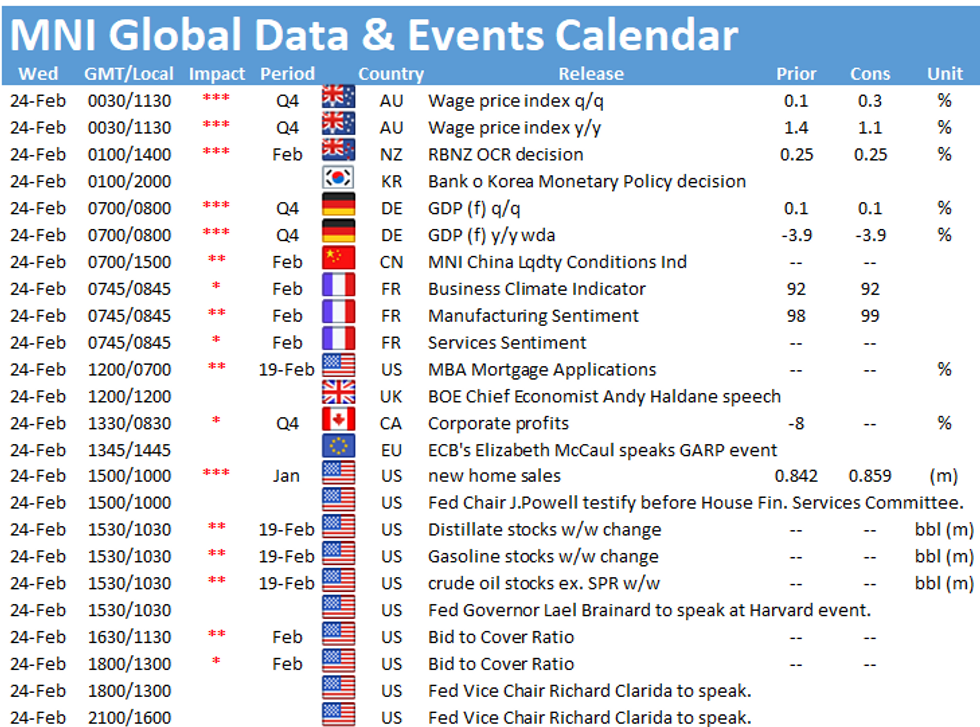

- Wednesday is a light session for data, with no tier releases due across the continent or the US. The speaker slate should be of more interest, with comments due from BoE's Bailey, Haldane, Broadbent, Vlieghe and Haskel as well as Fed's Powell (again), Clarida & Brainard.

BONDS/EGBs-GILTS CASH CLOSE: Gilts Underperform As Long End Continues To Weaken

Gilts underperformed Tuesday with the long end getting hit hard, 30/40/50-year yields up 7+bps.

- German yields rose but in more subdued fashion.

- Periphery spreads widened as risk appetite proved mixed-to-lower.

- UK labour market data was mixed (strong earnings, weak employment).

- Germany sells 10-Yr Bund Wednesday; Haldane, Bailey among other BOE speakers.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.4bps at -0.682%, 5-Yr is up 1.4bps at -0.615%, 10-Yr is up 2.4bps at -0.315%, and 30-Yr is up 2.8bps at 0.195%.

- UK: The 2-Yr yield is up 0.1bps at 0.042%, 5-Yr is up 1.9bps at 0.284%, 10-Yr is up 4bps at 0.719%, and 30-Yr is up 7.3bps at 1.328%.

- Italian BTP spread up 2.3bps at 95.9bps / Spanish spread up 1.3bps at 67.9bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.