-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: ISM SERVICES PMI Underscores New Highs For Stocks

EXECUTIVE SUMMARY

- MNI INTERVIEW: ISM Sees Service Inflation Creep Amid Rebound

- US DATA: ISM Services PMI At All-Time High in Mar

- MNI BRIEF: Savings Spike Won't Spark Demand Surge--NY Fed

- Cleveland Fed Mester: JOBS REPORT WAS GREAT BUT STILL 8.5M OUT OF WORK; EXPECT HIGH (but unsustainable) READINGS ON INFLATION IN NEXT COUPLE MONTHS, Bbg

- TSY SEC YELLEN: RISKS `ASYMMETRIC,' DEEPER CONCERN NOT ENOUGH STIMULUS, Bbg

- TSY SEC YELLEN: GLOBAL MINIMUM TAX CAN ENSURE MORE LEVEL PLAYING FIELD, HELP SPUR INNOVATION, GROWTH PROSPERITY, Rtrs

- UK SCIENCE ADVISERS SAY AN EPIDEMIC RESURGENCE (THIRD WAVE) IS HIGHLY LIKELY, THOUGH THERE REMAINS UNCERTAINTY ABOUT THE TIMING, SCALE AND SHAPE OF THIS; NEW PEAK COULD OCCUR IN EITHER SUMMER OR LATE SUMMER/AUTUMN - Reuters

US

ISM: U.S. service price increases should continue with labor and material in short supply, ISM survey chair Anthony Nieves told MNI Monday, but some pressure will be released once a rollback of Covid restrictions fuels the birth of new enterprises.- The service sector is "starting to see price pressure across the board" and some respondents in the ISM survey "are already categorizing this as strong inflation," Nieves said. "I think it's more of a creeping inflation." For more see MNI Policy main wire at 1300ET.

FED: The rise in overall savings in the U.S. economy won't lead to a surge in consumer spending because the money mostly went to households that already had plenty of it, a New York Fed economist Andrea Tambalotti writes in a new blog. "It is certainly possible that some of these savings will pay for extra travel and entertainment once the COVID-19 nightmare is behind us, but our conclusion is that the resulting boost to expenditures will be limited," he said.

- Richmond Fed President Thomas Barkin told MNI last week he still sees powerful disinflationary forces dominating the U.S. outlook despite recent improvements.

Excerpts below; link to US Tsy

- Credibility abroad begins with credibility at home. How can America help lead the world out of the dual crises of pandemic and economic recession if we can't lead ourselves out of it? It's a fair question, and it's why last month, President Biden signed the American Rescue Plan into law.

- Beyond our borders, as the pandemic has made clearer than ever before, the global community is in this together. We will fare better if we work together and support each other.

- The first objective is a stable and growing world economy that benefits the U.S. economy.

- The second objective is to fight poverty and promote a more inclusive global economy that aligns with our values.

- Finally, there are certain matters where we are in it together—where the challenges are global and no one country will be successful if it goes at it in isolation.

OVERNIGHT DATA

- US ISM-NY CURRENT CONDITIONS INDEX 37.2 MAR

- US ISM-NY 6-MONTH OUTLOOK INDEX 57 MAR

- U.S. IHS MARKIT MARCH FINAL SERVICES PMI AT 60.4 (VS FLASH 60.0)

- US ISM SERVICES PMI 63.7 MAR VS 55.3 FEB

- US ISM SERVICES BUSINESS INDEX 69.4 MAR VS 55.5 FEB

- US ISM SERVICES EMPLOYMENT INDEX 57.2 MAR VS 52.7 FEB

- US ISM SERVICES NEW ORDERS 67.2 MAR VS 51.9 FEB

- US ISM SERVICES SUPPLIER DELIVERIES 61.0 MAR VS 60.8 FEB (NSA)

- US FEB FACTORY ORDERS -0.8%; EX-TRANSPORT NEW ORDERS -0.6%

- US FEB DURABLE ORDERS -1.2%

- US FEB NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT -0.9%

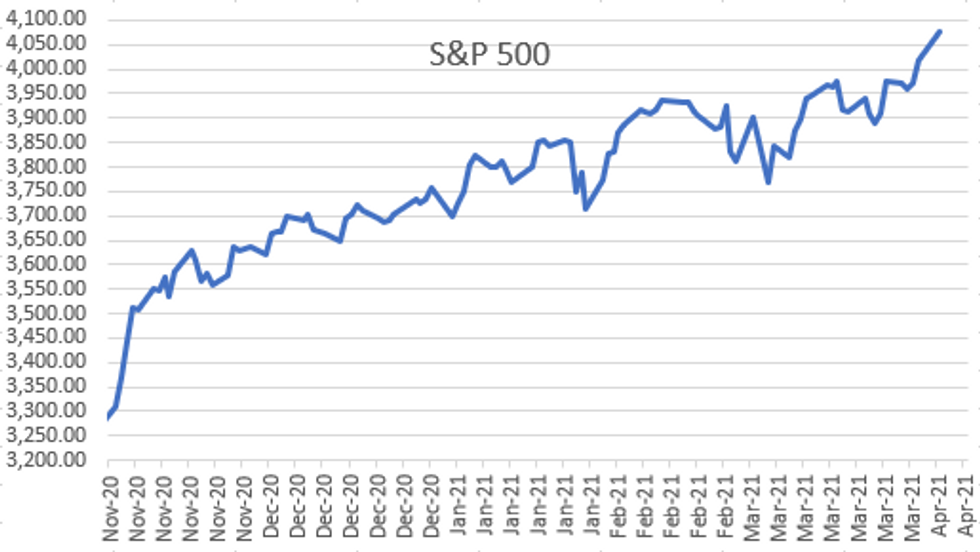

MARKETS SNAPSHOT

Key late session market levels- DJIA up 352.7 points (1.06%) at 33513.35

- S&P E-Mini Future up 55.25 points (1.38%) at 4065.5

- Nasdaq up 228.6 points (1.7%) at 13708.29

- US 10-Yr yield is down 0.4 bps at 1.7181%

- US Jun 10Y are up 4.5/32 at 131-3

- EURUSD up 0.0052 (0.44%) at 1.1812

- USDJPY down 0.51 (-0.46%) at 110.16

- WTI Crude Oil (front-month) down $2.66 (-4.33%) at $58.79

- Gold is down $2.81 (-0.16%) at $1726.00

US TSY SUMMARY

Inside range session Monday, Tsy futures mildly higher for the most part, 30Y Bond weaker after some choppy first half trade on light volume (TYM1<800K). Much of Asia out on extended weekend (Australia, New Zealand, China, Taiwan and Hong Kong), Europe close for Easter Monday holiday. Expect pick-up in activity, depth of market upon return; FX LIBOR settles resume Tue.- Rates sold off prior to mid-morning ISM Services PMI that hit a series high in March: 63.7, well above market expectations (BBG: 58.7). Previous high in near 25Y history of series was 62.0 in Aug'97. Rise was broad-based w/ New Orders recording a gain of 15.3 points. Business Activity increased 13.9pt, while Employment rose by 4.5pt. Prices paid rose again, up 2.2 points to 74.0.

- Modest chop on two-way flow w/rates climbing back to hold narrow range through the second half. FI option flow centered on buying low delta puts, continued hedging for economic recovery/reflation.

- Unscheduled comments from Tsy Sec Yellen: GLOBAL MINIMUM TAX CAN ENSURE MORE LEVEL PLAYING FIELD, HELP SPUR INNOVATION, GROWTH PROSPERITY. Link: Tsy.

- CNBC interview w/Cleveland Fed Mester on the close: JOBS REPORT WAS GREAT BUT STILL 8.5M OUT OF WORK; EXPECT HIGH (but unsustainable) READINGS ON INFLATION IN NEXT COUPLE MONTHS, Bbg

- The 2-Yr yield is down 1.4bps at 0.1724%, 5-Yr is down 3.9bps at 0.9382%, 10-Yr is down 0.5bps at 1.7163%, and 30-Yr is up 0.2bps at 2.358%.

US TSY FUTURES CLOSE:

- 3M10Y -0.356, 169.853 (L: 167.195 / H: 171.768)

- 2Y10Y +1.026, 154.193 (L: 151.063 / H: 155.684)

- 2Y30Y +1.617, 218.442 (L: 215.276 / H: 221.11)

- 5Y30Y +4.359, 141.898 (L: 137.757 / H: 143.527)

- Current futures levels:

- Jun 2Y up 0.75/32 at 110-10.5 (L: 110-09.5 / H: 110-10.875)

- Jun 5Y up 6/32 at 123-12.25 (L: 123-04.25 / H: 123-13.75)

- Jun 10Y up 5/32 at 131-3.5 (L: 130-25.5 / H: 131-07.5)

- Jun 30Y down 2/32 at 155-20 (L: 155-06 / H: 156-06)

- Jun Ultra 30Y up 6/32 at 183-24 (L: 182-18 / H: 184-14)

US EURODOLLAR FUTURES CLOSE:

- Jun 21 steady at 99.820

- Sep 21 steady at 99.80

- Dec 21 steady at 99.720

- Mar 22 +0.005 at 99.750

- Red Pack (Jun 22-Mar 23) +0.015 to +0.035

- Green Pack (Jun 23-Mar 24) +0.040 to +0.045

- Blue Pack (Jun 24-Mar 25) +0.035

- Gold Pack (Jun 25-Mar 26) +0.030 to +0.010

Short Term Rates

US DOLLAR LIBOR:No settles across currencies Friday and Monday due to Easter holiday

STIR: FRBNY EFFR for prior session:- Daily Effective Fed Funds Rate: 0.07% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $92B

- Tsy 0Y-2.25Y, appr $12.801B accepted vs. $46.852B submission

- Next scheduled purchases:

- Tue 4/06 1010-1030ET: Tsys 20Y-30Y, appr $1.750B

- Wed 4/07 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 4/08 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Fri 4/09 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

PIPELINE: April Kicks Off $4.45B High-Grade Issuance

- $4.45B To price Monday

- Date $MM Issuer (Priced *, Launch #)

- 04/05 $2B #Marvell Tech $500B 5Y +75, $750M 7Y +105, $750M 10Y +125

- 04/05 $1B #Equitable Financial Life $350M 2Y +35, $650M 2Y FRN SOFR+39

- 04/05 $850M #Protective Life 2Y +33, 5Y +68

- 04/05 $600M #Principal Life Global Funding $300M 2Y +43, $300M 2Y FRN SOFR+45

FOREX: Dollar Dropped as Stocks Roll Higher Still

- After a solid start to the holiday-thinned Monday session, the dollar reversed in NY hours, pressing the greenback to fall sharply against all others in G10. EUR/USD rallied back above the $1.18 handle, opening key Fib resistance marking the retracement of the 2021 downtrend as well as the 1.1884 200-dma.

- The move was also evident in USD/JPY, which undid much of the progress made at the beginning of last week as prices briefly showed below the Y110 level.

- The weakness in the dollar coincided with a rip higher in US equities (both futures and cash) which performed particularly well from the Monday open and hit new record levels. The firm risk sentiment was evident in consumer discretionary and communication services firms outperforming, which topped the pile Monday.

- US data was wholly pro-inflationary, with both the Markit and ISM Services Indices beating forecast and showing a sharp move higher in input prices (Markit's gauge was highest since records began).

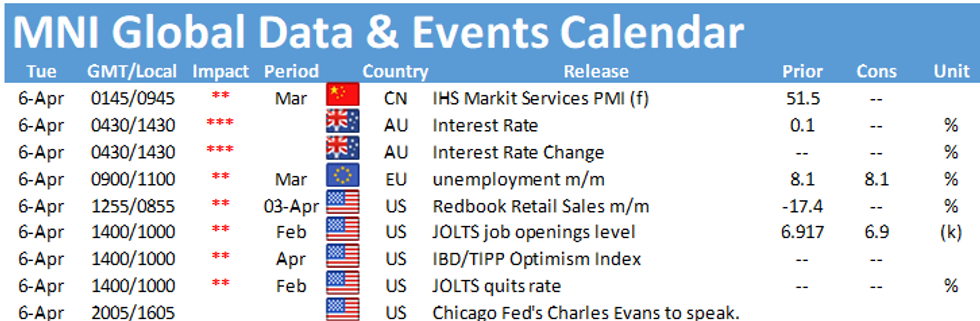

- Focus turns to China's Caixin PMI, the RBA rate decision and US JOLTS job openings numbers.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.