-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Corporate Supply Pipeline

US Treasury Auction Calendar

MNI ASIA OPEN: Ylds Moderate Ahead Wed FOMC Minutes

EXECUTIVE SUMMARY

- MNI INTERVIEW: Inflation Fears Premature-- Boston Fed Staffer

- FAUCI SAYS U.S. IS ON BRINK OF ANOTHER COVID SURGE, Bbg

- U.S. GOVERNMENT WON'T REQUIRE VACCINE CREDENTIAL SYSTEM, Bbg

- TORONTO ORDERS SCHOOLS TO SHIFT TO REMOTE LEARNING WEDNESDAY, Bbg

US

FED: Rising worries on Wall Street about the prospect of runaway inflation are so far misplaced because there is still ample slack in the economy according to a wide range of key metrics, though supply chain disruptions bear watching, Boston Fed Senior Economist Viacheslav Sheremirov told MNI.

- "Concerns about inflation rising persistently above the target are still premature, in my view," he said in an email interview. "Output is still significantly below its pre-pandemic level, labor markets have room to improve further, inflation readings are low, and both survey and market-based inflation expectations are relatively stable." For more see MNI Policy main wire at 1241ET.

OVERNIGHT DATA

- US BLS: JOLTS OPENINGS RATE 7.367M IN FEB

- US BLS: JOLTS QUITS RATE 2.3% IN FEB

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 54.97 points (-0.16%) at 33471.9

- S&P E-Mini Future up 3.25 points (0.08%) at 4071

- Nasdaq up 37.9 points (0.3%) at 13743.61

- US 10-Yr yield is down 4.6 bps at 1.6542%

- US Jun 10Y are up 18.5/32 at 131-22

- EURUSD up 0.0059 (0.5%) at 1.1872

- USDJPY down 0.34 (-0.31%) at 109.84

- WTI Crude Oil (front-month) up $0.61 (1.04%) at $59.24

- Gold is up $15.16 (0.88%) at $1743.39

European bourses closing levels:

- EuroStoxx 50 up 24.46 points (0.62%) at 3970.42

- FTSE 100 up 86.25 points (1.28%) at 6823.55

- German DAX up 105.51 points (0.7%) at 15212.68

- French CAC 40 up 28.38 points (0.47%) at 6131.34

US TSY SUMMARY: Carry-Over Rate Bid

With the exception of early L:ondon hours reversal (Europe accts returning from extended Easter holiday weekend to pare longs after last Fri's March NFP jobs surge +916k vs. +660k est), Tsys continued to trade higher Tuesday, with equities making new all-time highs (ESM1 tapped 4076.0) around noon before scaling back in second half.- No react to JOLTS data (OPENINGS RATE 7.367M IN FEB; QUITS RATE 2.3%), rates drew better buying as angst over a third COVID-wave of closures spread:

- "FAUCI SAYS U.S. IS ON BRINK OF ANOTHER COVID SURGE" aired late while "TORONTO ORDERS SCHOOLS TO SHIFT TO REMOTE LEARNING" starting Wednesday.

- Unlikely adding to rate bid, but more likely keeping some squared-up on the sidelines is Wednesday afternoon release of March FOMC minutes.

- Pick-up in swappable corporate supply generated some selling (late launches, for Mexic, GM, Toyota and Penske still waited to price before hedges unwound). Core options positions remain hedged for rate hikes mid-2022 through 2023, while session trade say pick-up in in upside call buying.

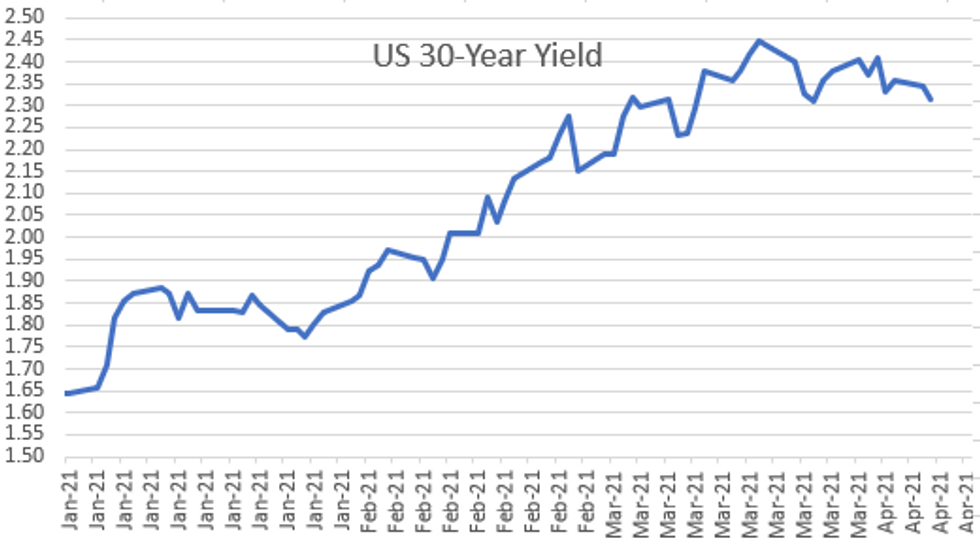

- The 2-Yr yield is down 0.8bps at 0.1586%, 5-Yr is down 5.3bps at 0.8688%, 10-Yr is down 4.6bps at 1.6542%, and 30-Yr is down 3.3bps at 2.3129%.

US TSY FUTURES CLOSE:

- 3M10Y -3.992, 164.005 (L: 163.043 / H: 169.512)

- 2Y10Y -3.461, 149.723 (L: 149.014 / H: 154.261)

- 2Y30Y -1.776, 216.009 (L: 215.004 / H: 219.147)

- 5Y30Y +2.433, 144.698 (L: 140.793 / H: 145.332)

- Current futures levels:

- Jun 2Y up 1/32 at 110-11.5 (L: 110-10.625 / H: 110-11.625)

- Jun 5Y up 10.75/32 at 123-23 (L: 123-12.75 / H: 123-24.25)

- Jun 10Y up 18/32 at 131-21.5 (L: 131-03.5 / H: 131-23.5)

- Jun 30Y up 27/32 at 156-14 (L: 155-19 / H: 156-20)

- Jun Ultra 30Y up 1-12/32 at 185-1 (L: 183-21 / H: 185-12)

US EURODOLLAR FUTURES CLOSE:

- Jun 21 steady at 99.820

- Sep 21 steady at 99.805

- Dec 21 steady at 99.725

- Mar 22 +0.010 at 99.760

- Red Pack (Jun 22-Mar 23) +0.010 to +0.050

- Green Pack (Jun 23-Mar 24) +0.070 to +0.10

- Blue Pack (Jun 24-Mar 25) +0.10 to +0.110

- Gold Pack (Jun 25-Mar 26) +0.105 to +0.105

Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00313 at 0.07788% (+0.00137 total last wk)

- 1 Month -0.00025 to 0.11013% (+0.00313 total last wk)

- 3 Month -0.00237 to 0.19738% (+0.00075 total last wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00025 to 0.20100% (-0.00200 total last wk)

- 1 Year +0.00575 to 0.28625% (-0.00025 total last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $73B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $262B

- Secured Overnight Financing Rate (SOFR): 0.01%, $985B

- Broad General Collateral Rate (BGCR): 0.01%, $368B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $338B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, appr $1.734B accepted vs. $3.985B submission

- Next scheduled purchases:

- Wed 4/07 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 4/08 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Fri 4/09 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

PIPELINE: $8.7B to Price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 04/06 $2.5B #Mexico 20Y +205

- 04/06 $700M #Brighthouse Financial Global Funding $400M 3Y +72, $300M 3Y FRN SOFR+76

- 04/06 $2.25B #General Motors $850M 3Y +73, $400M 3Y FRN SOFR+76, $1B 7Y +108 (adds to $2.5B on Jan 5: $1.5B 5Y +92, $1B 10Y +140)

- 04/06 $2.5B #Toyota Motor Cr $1B 2Y +28, $750M 2Y FRN SOFR+32, $750M 7Y +58 (adds to $3B on Jan 6: $1B 3Y +25, $750M 3Y FRN SOFR+33, $700M 5Y +40, $550M 10Y +62.5)

- 04/06 $750M #Penske Trucking +5Y +83

- Later in week:

- 04/07 $Benchmark Ontario 5Y +13a

- 04/06 $Benchmark Asia Development Bank (ADB) 5Y +5a

- 04/07 $Benchmark EBRD 5Y FRN SOFR+20a

- 04/08 $3.5B Organon $2B 7NC3, $1.5B 10NC5

- 04/09 $Benchmark Aflac multi-tranche

- 04/?? $Benchmark Philippines

FOREX: Shine Comes Off Sterling as Vaccine Rollout Falters

- GBP traded poorly, reversing the recent spell of strength and dragging GBP/USD off 1.3919 and back below the 1.3853 50-dma.

- Reversal in GBP follows continued concerns over an expected slowdown in the UK's vaccine rollout, as a supply crunch results in a marked slowdown of those receiving first doses. Nonetheless, UK PM Johnson has maintained that the lockdown easing schedule is currently on track.

- After a decent start, retracing the Monday losses, the dollar faltered in NY hours, keeping the USD Index oscillating on either side of the 200-dma.

- SEK was the strongest performer alongside CHF and EUR, while GBP, CAD and NZD were the weakest.

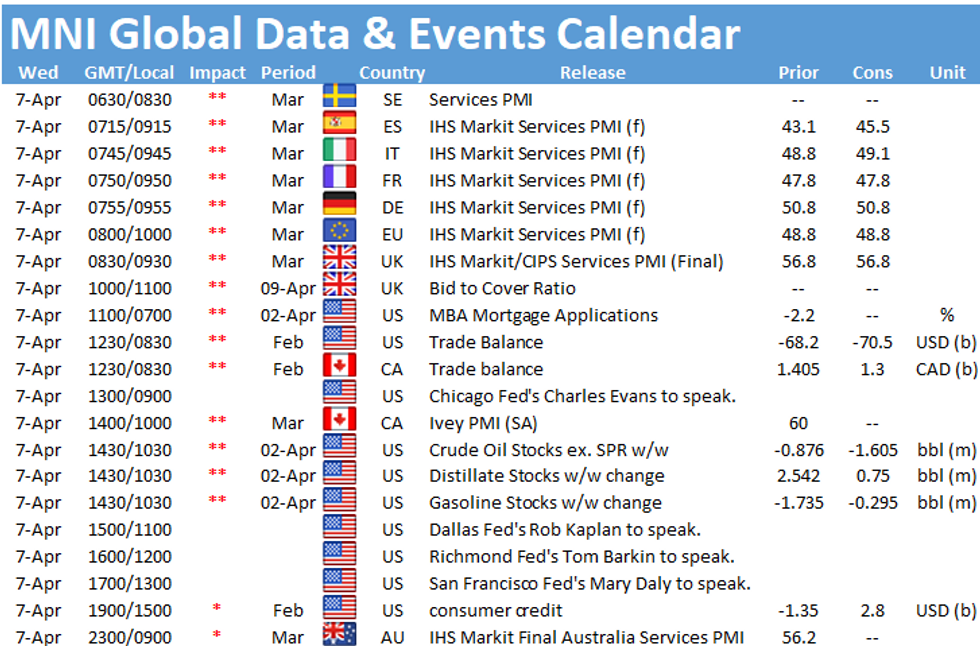

- Focus Wednesday turns to final revisions to March PMI data from across the Eurozone, UK, Australia and the US. US trade balance and the FOMC minutes from their latest rate-setting meeting also cross. Fed's Evans, Kaplan, Barkin & Daly all speak.

EGBs-GILTS CASH CLOSE: BTP Spreads Widen On Supply

European bond markets returned from the long weekend on a weak note, but Bunds and Gilts improved from worst levels in the session in tandem with US Tsys.

- While Bunds weakened by the end of the cash session, Gilts went from underperformer to outperformer.

- But new issuance stole the show in the afternoon, with Italy announcing a dual-tranche syndication (7-/50-Yr) and Portugal a 10-Yr. 10-Yr BTP spread moved from 98bps to over 100bps on the announcement.

- Attention Wednesday is on aforementioned syndications (which are likely to take place tomorrow), plus E4bn of German Bobl - and services PMIs. G20 meeting involving finance ministers and central bankers also bears some attention.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.7bps at -0.701%, 5-Yr is up 1bps at -0.649%, 10-Yr is up 1.2bps at -0.316%, and 30-Yr is up 0.9bps at 0.235%.

- UK: The 2-Yr yield is down 0.1bps at 0.075%, 5-Yr is up 0.7bps at 0.373%, 10-Yr is up 0.2bps at 0.797%, and 30-Yr is down 0.6bps at 1.337%.

- Italian spread +5bps at 100.9bps/ Spain +2.5bps at 66.1bps/ Portugal +2.1bps at 55.7bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.