-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak ISM Employ, Preview of May NFP?

EXECUTIVE SUMMARY

- MNI INTERVIEW: US Labor Shortage to Help Long-Term Unemployed

- MNI INTERVIEW: US Hiring May Quicken as Benefits End-ISM Chief

MNI INTERVIEW: Plosser Says Fed Policy Echoes The 60s and 70s - MNI BRIEF: Fed's Quarles: Still Likely to Propose SLR Reform

- MNI: UK Lawmakers Ask Govt For Details Of BOE Indemnity Deal

- FED: 43 COUNTERPARTIES TAKE $447.9B AT FIXED-RATE REVERSE REPO

- FED VC Quarles: Hints He May Stay at Fed After Term as Vice Chair Ends, Bbg

US

FED: Federal Reserve Governor Randy Quarles said Tuesday the Fed is still likely to propose permanent reforms to its supplemental leverage ratio requirement in light of historical growth of cash reserves under QE.

- There are roughly three types of reforms and "we're looking at whether we need to do any of them," he said without elaborating. SLR relief expired at the end of March.

- MNI has reported that retooling the capital requirement is seen as a pragmatic move for Treasury market liquidity but faces an uphill political battle.

- "Today Fed policy sounds a lot like it did in the 60s and 70s -- all we have to do is keep monetary policy easy and accept a little inflation and we'll march down the road to lower unemployment," Plosser said in an interview. "For them to argue the outcome will be different -- well prove it to me, show me the evidence." For more see MNI Policy main wire at 1515ET.

- "This should be helpful for people who have been out of work for a long time," she said in an interview. "When labor markets are tight, employers get more flexible about who they consider." For more see MNI Policy main wire at 1327ET.

- May's report showed record backlogs, record too-low customer inventories, record-long raw material lead times, and the highest supplier delivery numbers since 1974, Fiore said. The ISM reported Tuesday its overall Manufacturing PMI climbed 0.5 points to 61.2 and could have advanced further if the job market was normal. For more see MNI Policy main wire at 1408ET.

EUROPE

UK: UK lawmakers have asked the government to reveal the terms of the agreement detailing how it would indemnify the Bank of England for any losses made on its quantitative easing programme, and to clear up uncertainty which a legal expert told MNI left a "floating derivative" on the Treasury's balance sheet.

- When the BOE first launched quantitative easing in March 2009, policymakers stressed that any losses would be picked up by the government. But the Deed of Indemnity underpinning the arrangement has been kept under wraps, and the House of Lord's Economic Affairs Committee (LEAC) wrote last week to Chancellor of the Exchequer Rishi Sunak demanding to know why. For more see MNI Policy main wire at 1202ET.

US TSY SUMMARY: Early Risk-On Tempered by ISM Employ Data

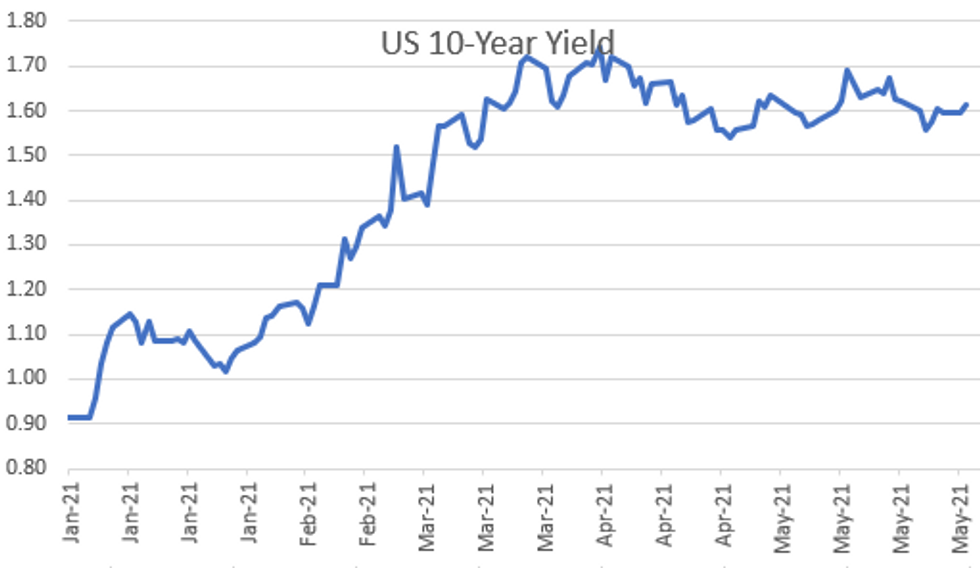

Markets returned from extended holiday weekend with a stronger risk-on tone in early trade Tuesday: Equities traded firmer after the open (ESM1 +23.0), Tsys under pressure w/10YY near middle of 1.55%-1.70% range at 1.6284%.- Rates recovered some ground after ISM employ data -- focus on drop in ISM employment index to 50.9 vs. 55.1 last month. Notable with the week's main focus on Fri's NFP (+266k prior, +650k est).

- Fed speakers did not cover any new ground. Fed Gov Brainard answered questions after speaking at Economic Club of NY event: nothing really new, boiler plate comments no late session reaction in rates or equities. Reminder, Fed media blackout starts midnight Friday.

- Interesting -- VIX had almost 3.0 range today, is +1.24 at 18.0 vs. session high of 18.53.

- Two-way overall flow with a couple waves of better selling in the long end noted early in the first and second half.

- The 2-Yr yield is up 0.6bps at 0.1466%, 5-Yr is up 0.8bps at 0.8076%, 10-Yr is up 1.9bps at 1.613%, and 30-Yr is up 1.2bps at 2.2946%.

OVERNIGHT DATA

- US APR CONSTRUCT SPENDING +0.2%

- US APR PRIVATE CONSTRUCT SPENDING +0.4%

- US APR PUBLIC CONSTRUCT SPENDING -0.6%

- US ISM May Manufacturing PMI Ticked Up To 61.2 vs Apr 60.7

- US ISM NEW ORDERS INDEX 67.0 MAY VS 64.3 APR

- US ISM EMPLOYMENT INDEX 50.9 MAY VS 55.1 APR

- US ISM PRODUCTION INDEX 58.5 MAY VS 62.5 APR

- US ISM SUPPLIER DELIVERY INDEX 78.8 MAY VS 75.0 APR

- ISM Employment misses (50.9 vs 54.6 expected) - the weakest figure in that subcategory since November 2020 and a sharp dropoff from 55.1 in April. Reading through the anecdotes, seeing a lot of supply-side labor issues: "difficulty finding workers"... "lack of qualified candidates"..."labor shortages impacting internal and supplier production"... "business is good, but labor and raw materials are becoming very problematic"... "very busy, but still experiencing labor shortages". Here's what the ISM release says on employment:

- "Of the six big manufacturing sectors, only two (Fabricated Metal Products; and Food, Beverage & Tobacco Products) expanded. Continued strong new-order levels, low customer inventories and expanding backlogs continue to indicate employment strength; however, survey panelists' companies continue to struggle to meet labor-management plans. Panelists' comments indicate an overwhelming majority of their companies are hiring or attempting to hire, with more than 50 percent of them expressing difficulty in doing so"

- FINAL US MAY MANUF PMI 62.1 (FLASH 61.5, EXP. 61.5)

- U.S. MAY DALLAS FED MANUFACTURING INDEX AT 34.9

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 76.3 points (0.22%) at 34607.28

- S&P E-Mini Future up 3 points (0.07%) at 4205.5

- Nasdaq up 18.7 points (0.1%) at 13767.55

- US 10-Yr yield is up 1.9 bps at 1.613%

- US Sep 10Y are down 4.5/32 at 131-25.5

- EURUSD down 0 (0%) at 1.2227

- USDJPY down 0.16 (-0.15%) at 109.42

- WTI Crude Oil (front-month) up $1.62 (2.44%) at $67.94

- Gold is down $6.23 (-0.33%) at $1900.58

- EuroStoxx 50 up 32.29 points (0.8%) at 4071.75

- FTSE 100 up 57.85 points (0.82%) at 7080.46

- German DAX up 146.23 points (0.95%) at 15567.36

- French CAC 40 up 42.23 points (0.66%) at 6489.4

US TSY FUTURES CLOSE:

- 3M10Y +1.872, 159.528 (L: 158.174 / H: 162.171)

- 2Y10Y +1.477, 146.448 (L: 145.963 / H: 148.863)

- 2Y30Y +0.605, 214.389 (L: 213.96 / H: 217.915)

- 5Y30Y +0.357, 148.487 (L: 147.437 / H: 150.57)

- Current futures levels:

- Sep 2Y down 0.25/32 at 110-11.5 (L: 110-11.25 / H: 110-11.75)

- Sep 5Y down 1.75/32 at 123-25.5 (L: 123-22.75 / H: 123-27)

- Sep 10Y down 4.5/32 at 131-25.5 (L: 131-19.5 / H: 131-28)

- Sep 30Y down 14/32 at 156-3 (L: 155-16 / H: 156-13)

- Sep Ultra 30Y down 24/32 at 184-16 (L: 183-11 / H: 185-04)

US EURODOLLAR FUTURES CLOSE

- Jun 21 +0.005 at 99.883

- Sep 21 +0.005 at 99.880

- Dec 21 +0.005 at 99.830

- Mar 22 steady00 at 99.840

- Red Pack (Jun 22-Mar 23) -0.01 to steady

- Green Pack (Jun 23-Mar 24) -0.02 to -0.015

- Blue Pack (Jun 24-Mar 25) -0.04 to -0.03

- Gold Pack (Jun 25-Mar 26) -0.05 to -0.045

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N -0.00688 at 0.05425% (+0.00138 total last wk)

- 1 Month +0.00287 to 0.08875% (-0.00575 total last wk)

- 3 Month -0.00288 to 0.12850% (-0.01562 total last wk) ** (Record Low)

- 6 Month +0.00388 to 0.17488% (-0.00775 total last wk)

- 1 Year -0.00125 to 0.24688% (-0.01150 total last wk)

- Daily Effective Fed Funds Rate: 0.05% volume: $61B

- Daily Overnight Bank Funding Rate: 0.03% volume: $219B

- Secured Overnight Financing Rate (SOFR): 0.01%, $868B

- Broad General Collateral Rate (BGCR): 0.01%, $378B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $355B

- (rate, volume levels reflect prior session)

- Tsys 2.25Y-4.5Y, $8.401B accepted vs. $32.966B submission

- Next scheduled purchases:

- Wed 6/02 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 6/03 1100-1120ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 6/04 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

PIPELINE: $3B TD Launched, 5Y FRN Dropped

- Date $MM Issuer (Priced *, Launch #)

- 06/01 $3B #TD Bank $900M 2Y +18, $800M 2Y FRN SOFR +22, $1.3B 5Y +40

- 06/01 $800M #Pacific Gas & Electric 7Y +180

- 06/01 $500M #MetLife 3Y +28

- 06/01 $Benchmark Vodafone 60NC5.25 3.87%a, 60NC10 4.5%a, 60NC30 5.5%a

- Expected later in the week:

- 06/02 $Benchmark ADB 3Y +0, 7Y +12a

EGBs-GILTS CASH CLOSE: Poor Start To A Short Week For Gilts

A poor, bear steepening start to a shortened week for Gilts, with Bunds weakening slightly and periphery spreads tighter Tuesday.

- Gilts bear steepened on the return to trading after the long weekend. They were underpinned early in part by 3rd COVID wave concern, but underperformed in the afternoon following a poor long-dated APF (offer-to-cover 2.78x).

- Heavy Eurex future roll volumes (around half of front-month volume was spread related).

- The morning's data put the focus on strong activity and inflationary pressures, including strong Italian and Spanish PMIs, Italy Q1 GDP revised from contraction to expansion, and 2.0% Y/Y flash Eurozone inflation. Germany sold E0.8bln of linkers.

- On Wednesday, UK sells GBP4.75bln of Gilts; Germany sells E4bln of Bobl.

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is up 0.3bps at -0.659%, 5-Yr is up 0.3bps at -0.564%, 10-Yr is up 0.9bps at -0.178%, and 30-Yr is up 1.5bps at 0.382%.

- UK: The 2-Yr yield is up 0.7bps at 0.07%, 5-Yr is up 1.7bps at 0.359%, 10-Yr is up 3.1bps at 0.826%, and 30-Yr is up 4.1bps at 1.345%.

- Italian BTP spread down 1.7bps at 107.9bps/ Spanish spread down 0.3bps at 64.7bps

FOREX: USDCAD New 6-Year Lows, Bounces Ahead of 1.20 Support

- Buoyant commodities helped lift the Canadian dollar to six-year highs against the greenback on Tuesday. USDCAD printed a fresh low at 1.2007, however, the psychological 1.20 support barrier proved a step too far. The pair squeezed 0.5% as the US dollar regained some poise in the latter half of the session.

- In similar fashion GBPUSD managed to break to new 2021 highs with 1.4250 capping the price action during European trade. Sterling proceeded to be the worst performing G10 currency, losing 0.4% as of writing. A lack of follow through after the February high was breached left fresh longs susceptible to an unwind, which was prompted by a small miss in the manufacturing PMI data as well as fresh Covid concerns.

- Media speculation is escalating that the final stage of unwinding COVID-19 restrictions in England could be delayed from the intended date of 21 June due to a rise in new infections and a very small uptick in hospitalisations from the virus.

- China FX is softer for a second session by around 0.2%, snapping the extended winning streak that pressured USD/CNY to its lowest levels since 2018. Markets continue to react to the PBoC's policy tweak on Monday, in which they raised the FX RRR to 7% from 5%.

- Despite the statement on Monday morning, the DTCC has tracked close to $7bln in USD/CNY options trades, the bulk of which have been USD/CNY puts (with an average strike of 6.3845). USD/CNY put strikes at 6.25 and 6.30 have also garnered significant focus, with close to $1.5bln in notional trading across both strikes.

- Broadly the US dollar has lacked direction following the US holiday, exactly unchanged on the day. The better performers include the Swedish Krona and the Australian Dollar, lifted by the strong commodity complex.

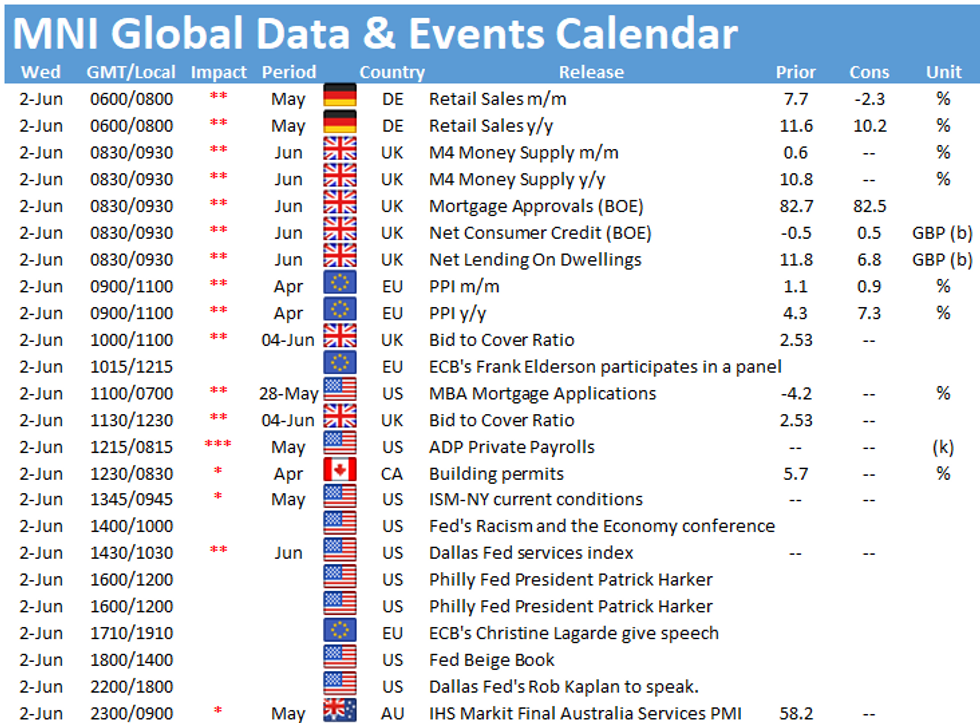

- Wednesday's docket includes Australian GDP, German Retail Sales and Spanish Unemployment before a quiet US session headlined by the Fed's Beige Book.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.