-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN: Faster Taper Chatter From Fed

EXECUTIVE SUMMARY

- MNI: Fed Economists Play Down Wage-Price Spiral Worries

- MNI BRIEF: Fed's Waller Warns Faster Taper May Be Necessary

- MNI BRIEF: Faster Fed Taper Debate in Dec Appropriate-Clarida

- MNI INTERVIEW: Czech Central Bank To Hike Twice, Then Fine Tune

- GERMAN FOREIGN MINISTER EXCLUDES NATIONAL GENERAL LOCKDOWN:BILD, Bbg

- BIDEN'S TAX-AND-SPENDING PLAN PASSES HOUSE AND HEADS TO SENATE, Bbg

US

FED: Rapid U.S. wage growth is unlikely to trigger higher inflation despite worsening employee shortages and signs the labor market is tighter than low participation rates would suggest, current and former Fed economists told MNI.

- Recent compensation gains are faster than in pre-pandemic years, but well-anchored inflation expectations, a weaker Phillips-curve relationship between labor market slack and inflation and relatively steady business profit margins give little reason to worry about a 1970s-style inflationary spiral, the economists said.

- "There seems to be a sense that there's less pass-through from wages to prices now. The wage growth we're seeing now is pretty similar to pre-pandemic levels -- a little higher for low-skilled workers but not a crazy amount higher -- and we weren't seeing huge amounts of inflation prior to the pandemic," said former Fed Board economist Stephanie Aaronson, now at the Brookings Institution. For more see MNI Policy main wire at 1112ET.

FED: Federal Reserve Vice Chair Richard Clarida said Friday that it could be appropriate for the FOMC to discuss speeding up the central bank's slowing of asset purchases at its next meeting December 14-15.

- "Speaking for myself, I'll be looking at the data between now and the December meeting, and it may well be appropriate to have a discussion about increasing the pace at which we're reducing our balance sheet," he said in Q&A at a San Francisco Fed virtual event.

FED: The Federal Reserve may need to wind down its asset purchase program faster next year with the economy "rapidly approaching" maximum employment and inflation expectations escalating, and conditions for hiking near-zero interest rates are also approaching, Fed Governor Christopher Waller said Friday.

- "The rapid improvement in the labor market and the deteriorating inflation data have pushed me towards favoring a faster pace of tapering and a more rapid removal of accommodation in 2022," he said in remarks prepared for a Center for Financial Stability event in New York. "The next few months will be critical, however, in determining how the tapering process plays out."

- The economy is only 2 million jobs short of where it was prior to the pandemic if early retirements are excluded, Waller said, adding "the unemployment rate could be below 4 percent before too long." For more see MNI Policy main wire at 1047ET.

EUROPE

CNB: The Czech National Bank will look to raise interest rates in December 2021 and February 2022 then only fine-tune the tightening cycle begun in June, Deputy Governor Tomas Nidetzky told MNI in an interview.

- Labour shortages will put continued pressure on inflation next year, Nidetzky said, but consumer spending could moderate, amid a "perfect storm" of sluggish growth and rising inflation caused by the Covid-19 pandemic.

- "We will also have to increase our rates at our December meeting. By how much depends on the situation. But I wouldn't expect to see as big a hike again as we did during our last meeting at the beginning of November," Nidetzky said. "We will tweak our decision in December and at the following meeting in February, so we wanted to step up the level of our two-week repo rate, and then wait for transmission by all channels and then proceed with only possible fine-tuning." For more see MNI Policy main wire at 0935ET.

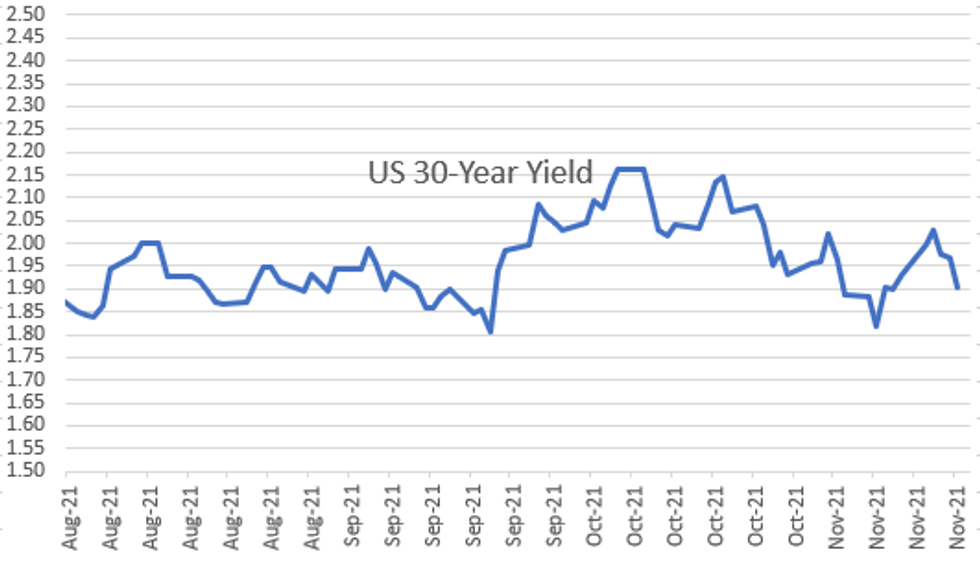

US TSYS: Fed VC Clarida on Taper Talk Weighs on Short End

Shorter-dated Tsys have almost fully unwound today's earlier rally after relatively more hawkish commentary from both Fed Waller then VC Clarida on potential for Fed accelerating taper.- Long-end held onto a sizeable rally though, with 10Y yields down -5bps at 1.536% and the 30Y down -6.1bps at 1.907%, driven by European lockdown fears and at weekly lows. Combination has seen a 5bp bull flattening in 2s/10s on the day to 103.7bps, the lowest this week and getting towards the low end of the monthly range.

- Earlier, BBB passed in the House now moves to the Senate.

- Heavy overall volumes (TYZ1 >1.9M) tied to surge in Dec/Mar futures rolling (first notice on Nov 30); large selling Eurodollar Whites-Reds EDZ1-EDU3) following Fed VC Clarida comments re: taper debate in Dec.

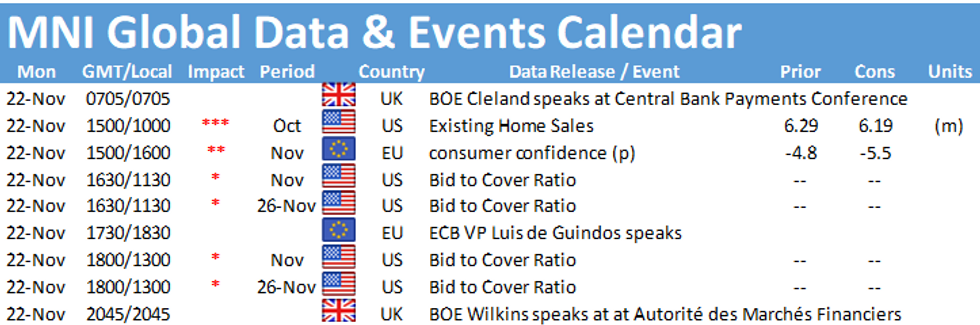

- Ahead: Fed minutes on Wed amidst heavy data week including the Nov PMI,PCE/incomes for Oct and the second Q3 GDP print before Thanksgiving on Thursday. Next wk's Tsy auction schedule is front-end focused ahead of Thanksgiving, with 2s, 5s and 7s on offer. Markets see full day Wed, closed Thu and early close Fri.

- The 2-Yr yield is down 0.4bps at 0.4986%, 5-Yr is down 1.8bps at 1.2018%, 10-Yr is down 5bps at 1.536%, and 30-Yr is down 6.3bps at 1.9059%.

OVERNIGHT DATA

No economic data released Friday.

MARKET SNAPSHOT

Key late session market levels:- DJIA down 264 points (-0.74%) at 35606.65

- S&P E-Mini Future down 3.5 points (-0.07%) at 4697.75

- Nasdaq up 78.4 points (0.5%) at 16071.45

- US 10-Yr yield is down 5 bps at 1.536%

- US Dec 10Y are up 9.5/32 at 130-28

- EURUSD down 0.008 (-0.7%) at 1.1291

- USDJPY down 0.33 (-0.29%) at 113.93

- WTI Crude Oil (front-month) down $2.91 (-3.68%) at $76.10

- Gold is down $10.43 (-0.56%) at $1848.48

- EuroStoxx 50 down 27.23 points (-0.62%) at 4356.47

- FTSE 100 down 32.39 points (-0.45%) at 7223.57

- German DAX down 61.76 points (-0.38%) at 16159.97

- French CAC 40 down 29.69 points (-0.42%) at 7112.29

US TSY FUTURES CLOSE

- 3M10Y -2.245, 148.698 (L: 146.055 / H: 154.797)

- 2Y10Y -5.072, 102.86 (L: 102.689 / H: 109.986)

- 2Y30Y -6.305, 139.924 (L: 139.851 / H: 148.559)

- 5Y30Y -4.548, 70.009 (L: 69.673 / H: 77.899)

- Current futures levels:

- Dec 2Y up 0.25/32 at 109-20.875 (L: 109-20.125 / H: 109-24.75)

- Dec 5Y up 1.25/32 at 121-18.75 (L: 121-14.5 / H: 121-30.25)

- Dec 10Y up 8/32 at 130-26.5 (L: 130-13.5 / H: 131-08)

- Dec 30Y up 26/32 at 161-24 (L: 160-16 / H: 162-04)

- Dec Ultra 30Y up 2-02/32 at 196-30 (L: 194-03 / H: 197-11)

US EURODOLLAR FUTURES CLOSE

- Dec 21 -0.0075 at 99.785

- Mar 22 -0.025 at 99.730

- Jun 22 -0.030 at 99.550

- Sep 22 -0.025 at 99.320

- Red Pack (Dec 22-Sep 23) -0.025 to -0.01

- Green Pack (Dec 23-Sep 24) -0.01 to steady

- Blue Pack (Dec 24-Sep 25) +0.005 to +0.045

- Gold Pack (Dec 25-Sep 26) +0.055 to +0.075

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00175 at 0.07600% (+0.00125/wk)

- 1 Month +0.00225 to 0.09338% (+0.00425/wk)

- 3 Month +0.00437 to 0.16400% (+0.01125/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00588 to 0.22938% (+0.00325/wk)

- 1 Year +0.00200 to 0.39175% (-0.00675/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $77B

- Daily Overnight Bank Funding Rate: 0.07% volume: $273B

- Secured Overnight Financing Rate (SOFR): 0.05%, $898B

- Broad General Collateral Rate (BGCR): 0.05%, $358B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $337B

- (rate, volume levels reflect prior session)

- Tsy 1Y-7.5Y, $1.751B accepted vs. $6.036B submission

- Next scheduled purchases

- Mon 11/22 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Tue 11/23 1010-1030ET: TIPS 7.5Y-30Y, appr $1.075B

- Operational purchases paused until Nov 29

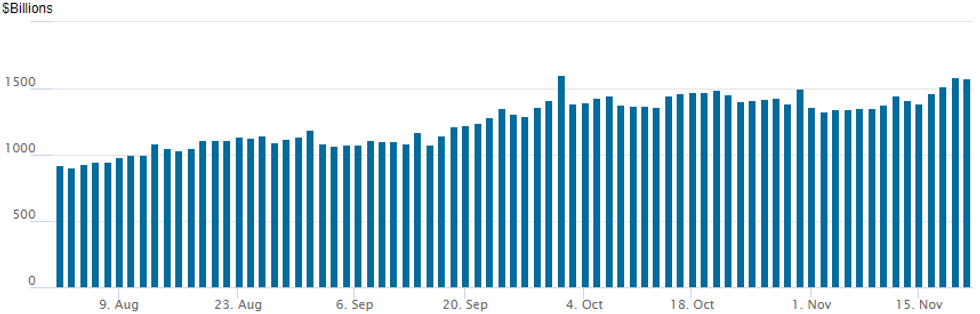

FED REVERSE REPO OPERATION

NY Federal Reserve

NY Fed reverse repo usage recedes to $1,575.384B from 74 counterparties vs. $1,584.097B on Thursday (Nov high and second highest on record). Closing in on record high of 1,604.881B from Thursday, September 30.

PIPELINE: Just Over $60B Corporate Debt Issued on Week

Issuance expected to slow down Friday after $60.625B issued on week.

- Date $MM Issuer (Priced *, Launch #)

- $7.075B Priced Thursday

- 11/18 $1.45B *Valero Energy $500M 10Y +125, $950M 30Y +170

- 11/18 $1.35B *Renesas $500M 3Y Green +70, $850M 5Y +95

- 11/18 $1.05B *CubeSmart $550M 7Y +85, $500M 10Y +100

- 11/18 $1B *Kommuninvest 2Y 0.539%

- 11/18 $1B *IHS Towers $500M 5NC2 5.625%, $500M 7NC3 6.25%

- 11/18 $675M *Massachusetts Mutual Life 40Y +125

- 11/18 $550M *HUB Int 8NC3 5.625% (dropped $650M 7NC3)

- 11/19 $Benchmark CDW Corp investor calls Fri

FOREX: Volatile Session Results In Euro Weakness Amid Fresh Lockdown Concerns

- A fresh wave of euro weakness to kick off the US trading session on Friday saw EURUSD make fresh weekly lows, printing 1.1250.

- Renewed virus concerns in Europe benefitted safe haven FX and as such, EURJPY came under significant pressure, trading below 1.28 for the first time in 2 months, just shy of the August/September lows residing at 1.2793/4. In unison, EURCHF extended below the 1.0505 break level down to 1.0448 at its worst point.

- Despite the significant weakness, the Euro did find some support and volatile price action sparked a strong recovery off the early NY session lows. Two main reasons behind the bounce were some slightly more firm remarks from Weidmann on inflationary persistence as well as the German Foreign Minister excluding any national lockdowns.

- EURUSD rose back above 1.13 while EURJPY completed a +100 pip recovery above the 129 handle before both pairs settled a little lower into the close.

- With bouts of equity weakness and heavy energy prices, the dollar was a beneficiary overall on Friday, with the dollar index gaining 0.5%. This erases the majority of Wed/Thu losses and keeps the greenback in strong positive territory for the week.

- Given the strong performance of haven FX, AUD and NZD naturally gravitated around 0.6% lower throughout the day.

- A light data calendar to kickstart next week, before European Flash PMI data headlines Tuesday's docket.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.