-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN:Job Gains, Supply Constraints, Inflation Remains

EXECUTIVE SUMMARY

- MNI: Wary Fed Will Test Neutral Rate From Below -- Ex-Staffers

- MNI: Low Immigration To Keep Lid on Labor Supply -Fed Staffers

- MNI INTERVIEW: Firms See Year-End Inflation In 6%-7% Range-ISM

- MNI BRIEF: US May Jobs Beat Expectations; Wage Growth Steady

- MNI INTERVIEW: BOC Needs Faster Hikes, Risks Slump-Ex Adviser

US

FED: Federal Reserve officials will likely turn cautious as interest rates approach a level they consider neutral, potentially slowing the pace of rate hikes because they fear shocking the economy into recession if financial conditions tighten more quickly than anticipated, former central bank staffers told MNI.

- Moreover, ex-staff said the Fed will target a neutral policy rate using a lower trend measure despite recent energy and commodity price spikes, presuming underlying inflation pressures are still under control because much of the recent inflation is driven by short-term supply shocks.

- "Neutral should be defined in inflation adjusted terms, but the adjustment should be long-run expected inflation, which has not really moved yet," said Joseph Gagnon, a former Fed board economist now at the Peterson Institute. For more see MNI Policy main wire at 1138ET.

- The loss of older workers and women from the workforce during the Covid-19 pandemic have been cited as top reasons for the lack of labor supply. But the decline in immigration is also playing a significant role, and the trend isn't likely to improve soon due to massive backlogs and Fed tightening that may weaken growth prospects, the economists said. For more see MNI Policy main wire at 1250ET.

- "Based on recent forecasts firms see price growth in the 6% to 7% range and even higher on the manufacturing side, through the end of the year," he said. "Normally there would be strategic cost management and we wouldn't see prices going above that 3%-mark in any kind of forecast."

- Prices in the May services survey dipped to 82.1, down 2.5 points from April which then showed the survey's highest reading ever. The survey showed 72% of service firms reporting higher prices, up from 64% in February, while only 1% registered lower prices. For more see MNI Policy main wire at 1415ET.

US: U.S. employers added 390,000 jobs in May, more than analyst expectations for 325,000 but slowing from April's 436,000 pace, while the unemployment rate held steady at 3.6%, the Bureau of Labor Statistics reported Friday.

- Average hourly earnings grew 0.3% last month, a tenth below expectations, and flat from April's rate. It's up 5.2% on the year. Federal Reserve officials are looking for wage gains to slow as they raise interest rates.

- The leisure and hospitality (+84,000), professional and business services (+75,000) and transportation and warehousing (+47,000) sectors led job gains.

- The labor force participation rate at 62.3% and the employment to population ratio at 60.1% were both up a tenth from April.

CANADA

BOC: The Bank of Canada needs to raise interest rates even faster after being late to curb inflation that was foreseeable through major pandemic stimulus, and the economy faces the risk of a hard landing, former BOC research fellow Randall Morck told MNI.

- "The hard landing fears arise because many banks in particular might be carrying loans that will turn out to be bad after the post-Covid dust settles," said Morck, a University of Alberta professor whose work focuses on financial stability and monetary policy.

- The Bank hiked its overnight lending benchmark to 1.5% from 1% on Wednesday, the second 50b move in a row, and signaled it could be more forceful if needed to pull inflation back from around 7% to its 2% target.

US TSYS: Compelling Case for 50Bp Hikes

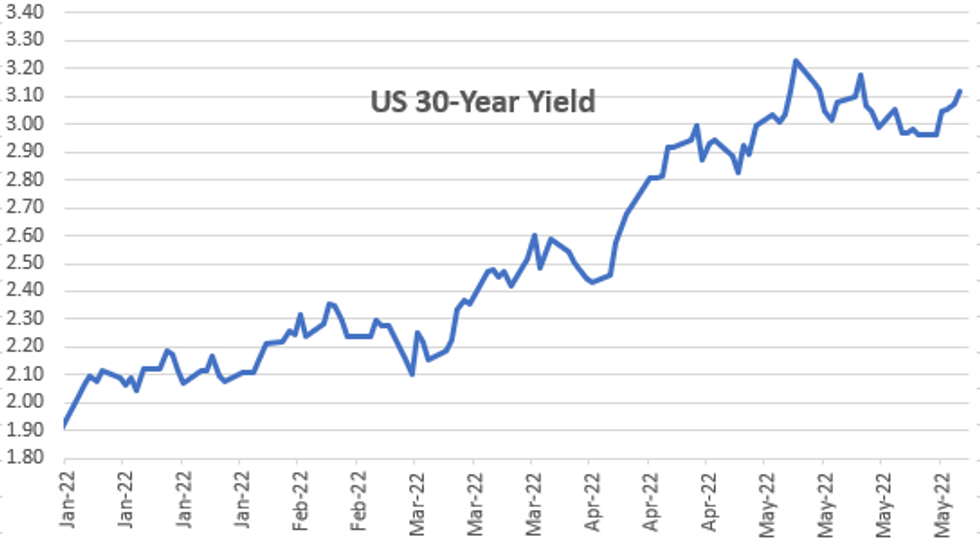

Tsys futures trade weaker, off lows to near middle of session range on light volumes for a headline payroll session, TYU2 less than 950k after the bell. Tsys gapped lower following May NFP gain of +390k vs. +310k est, 30YY climbs to 3.1554% high, while yield curves steepened out briefly.

- Fed hike expectations gained slightly out the curve while 50bp hikes at each of the next two meeting remain a lock. Implied Fed hikes firm slightly for meetings later in the year after payrolls. The 143bp for Sep takes it back to yesterday highs whilst the 199bp to year-end nudges 1bp higher and closes on the post May FOMC high of 202bps.

- Limited react to S&P Global composite PMI revised 0.2pts lower in the final release, 53.6 in May. Short end eased after ISM Services index slightly softer than expected, falling from 57.1 to 55.9 (cons 56.5), still Seeing Covid-19 Impact.

- Aside from data, market reacted negatively to reports of Elon Musk email to Tesla execs: "pause all hiring worldwide" late Thu. Reuters reported Musk would like to cut 10% of Tesla's workforce due to a "super bad feeling" about the economy. Musk clarified later in the day: hiring freeze for salaried employees while hourly jobs to rise.

- Cleveland Fed Pres Mester states she wants to see "COMPELLING EVIDENCE INFLATION IS ON DOWNWARD PATH" implying the Fed will continue to hike past signs of inflation peaking. Follow up headline: Mester "COULD BACK 50 BPS SEPT. HIKE IF INFLATION DOESN’T COOL, Bbg.

Needless to say, nothing really new, markets not reacting to CNBC interview - Reminder Fed enters media blackout at midnight tonight. No significant data next Monday, but Tsy does have two bill auctions

OVERNIGHT DATA

- US MAY NONFARM PAYROLLS +390K; PRIVATE +333K, GOVT +57K

- US PRIOR MONTHS PAYROLLS REVISED: APR +436K; MAR +398K

- US PAYROLLS NET REVISIONS FOR APRIL, MARCH -22K

- US MAY AVERAGE HOURLY EARNINGS +0.3% Vs APR +0.3%; +5.2% YOY

- US MAY AVERAGE WEEKLY HOURS 34.6 HRS

- US MAY UNEMPLOYMENT RATE 3.6%

DATA REACT: US AHE Below Consensus But Shouldn't Surprise. AHE a tenth lower than consensus at an unchanged +0.31% M/M but as a few analysts had noted in our preview, there was a calendar quirk biasing the number lower in May so it's shouldn't be too surprising.

- For what it's worth, the non-supervisory measure (lower ~80% of earners) continues the theme from the past year of coming in stronger, accelerating from +0.44% to +0.55% M/M.

- Getting into the weeds Headline participation increased a tenth as expected to 62.3% in May as it remains below March's peak of 62.4% (1pt below the 63.4% pre-pandemic). It belies a more encouraging 0.2pt rise in prime-age participation to 82.6%, a new post-pandemic high which whilst 0.5pts off Jan/Feb'20 is back at mid-2019 levels.

- The overall rate lags prime-age because 20-24yr olds have been leaving the labour force, down 1pt in the past four months as they potentially return to studies despite record job openings.

- US ISM MAY SERVICES COMPOSITE INDEX 55.9

- US ISM MAY SERVICES BUSINESS INDEX 54.5

- US ISM MAY SERVICES PRICES 82.1

- US ISM MAY SERVICES EMPLOYMENT INDEX 50.2

- US ISM MAY SERVICES NEW ORDERS 57.6

- US S&P GLOBAL MAY SERVICES PMI AT 53.4 VS 55.6 LAST MONTH

- S&P Global composite PMI revised 0.2pts lower in the final release, leaving a decline from 56.0 to 53.6 in May.* Press release excepts: It signals “a solid but slower upturn in private sector business activity. The softer rise in output reflected slower increases in the manufacturing and service sectors, amid hikes in selling prices and supply-chain disruption.”

- “Although the pace of input price inflation quickened to a series high, there was evidence of a hesitancy to completely pass higher costs on, as output charges rose at a softer pace.”

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 289.49 points (-0.87%) at 32958.83

- S&P E-Mini Future down 60.25 points (-1.44%) at 4114.5

- Nasdaq down 292.4 points (-2.4%) at 12024.81

- US 10-Yr yield is up 4.4 bps at 2.9515%

- US Sep 10Y are down 9.5/32 at 118-18

- EURUSD down 0.0026 (-0.24%) at 1.0721

- USDJPY up 0.99 (0.76%) at 130.83

- WTI Crude Oil (front-month) up $2.18 (1.87%) at $119.04

- Gold is down $18.07 (-0.97%) at $1850.51

- EuroStoxx 50 down 11.47 points (-0.3%) at 3783.66

- German DAX down 25.08 points (-0.17%) at 14460.09

- French CAC 40 down 15.14 points (-0.23%) at 485.3

US TSY FUTURES CLOSE

- 3M10Y +0.83, 176.956 (L: 173.227 / H: 182.879)

- 2Y10Y +1.69, 28.888 (L: 25.435 / H: 30.334)

- 2Y30Y +0.815, 44.51 (L: 41.984 / H: 47.675)

- 5Y30Y -0.323, 16.036 (L: 14.843 / H: 18.665)

- Current futures levels:

- Sep 2Y down 1/32 at 105-10.75 (L: 105-09 / H: 105-13.625)

- Sep 5Y down 5.5/32 at 112-9 (L: 112-04.25 / H: 112-15.5)

- Sep 10Y down 9/32 at 118-18.5 (L: 118-11.5 / H: 118-30)

- Sep 30Y down 18/32 at 138-5 (L: 137-13 / H: 138-28)

- Sep Ultra 30Y down 1-01/32 at 154-09 (L: 152-28 / H: 155-13)

US 10Y FUTURES TECH: (U2) Extends The Week’s Bear Leg

- RES 4: 121-27+ High Apr 5

- RES 3: 120-27+ High Apr 7

- RES 2: 120-09+/19+ 50-day EMA / High May 26 and bull trigger

- RES 1: 119-16+ High Jun 1

- PRICE: 118-21 @ 15:47 BST Jun 3

- SUP 1: 118-01+ Low May 18 and a key short-term support

- SUP 2: 117-18 Low May 11

- SUP 3: 116-21 Low May 9 and a bear trigger

- SUP 4: 116-00 Round number support

Treasuries traded lower Friday, extending the week’s bear leg and the move away from the 50-day EMA. The EMA intersects at 120-09+ and represents a key resistance area. A clear break would pave the way for a stronger recovery towards 122-00. Recent gains are still considered corrective though and the primary trend direction is down. Key support and the bear trigger is 116-21, May 9 low. Initial firm support to watch is 118-01+, May 18 low.

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.003 at 98.238

- Sep 22 -0.005 at 97.350

- Dec 22 -0.020 at 96.775

- Mar 23 -0.040 at 96.575

- Red Pack (Jun 23-Mar 24) -0.05 to -0.045

- Green Pack (Jun 24-Mar 25) -0.055 to -0.045

- Blue Pack (Jun 25-Mar 26) -0.05

- Gold Pack (Jun 26-Mar 27) -0.05

SHORT TERM RATES

US DOLLAR LIBOR: No LIBOR settles today w/ London banks out for Spring and Platinum Jubilee holidays, settles resume Monday. Meanwhile, lead quarterly EDM2 holding steady at 98.2325.

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $83B

- Daily Overnight Bank Funding Rate: 0.82% volume: $256B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.79%, $974B

- Broad General Collateral Rate (BGCR): 0.79%, $368B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $355B

- (rate, volume levels reflect prior session)

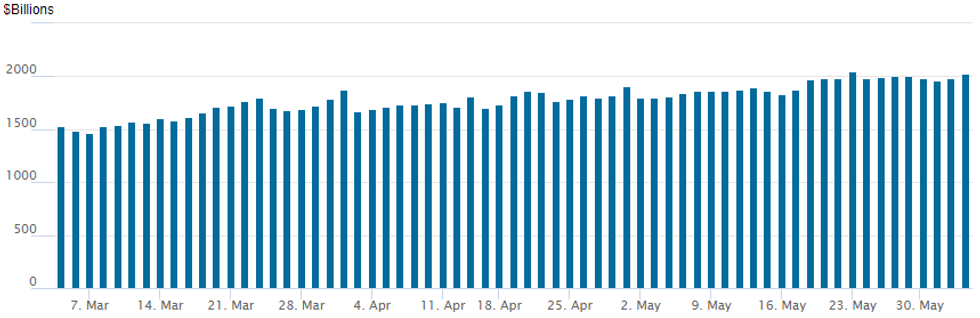

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 2,031.228B w/ 101 counterparties vs. 1,985.239B prior session, shy of Monday, May 23 record high $2,044.658B.

FOREX: Dollar Extends Bounce Off Support on NFP Beat

- The May NFP report was swallowed positively by markets Friday, with the headline beat on job gains allied with positive net revisions to make for a solid release. Markets brushed off the unchanged unemployment rate (median was for a 0.1 ppts drop) to help the USD Index bounce further off support at the 50-dma, which remains a key for markets headed through June and the next Fed rate decision.

- The JPY was among the weakest currencies in G10 Friday, with EUR/JPY hitting fresh YTD highs as the cross rallied through the Y140.00 bull trigger (the April 2022 high) to hit the highest levels since 2015.

- USD/CAD extended the recent downtick into the Friday close, extending the CAD rally that followed the hawkish nudge on Thursday from Dep Gov Beaudry, who noted that the Bank can act “more forcefully” on rates.

- The recovery in NZD/USD across the May stalled Friday as the pair failed to mount an attempt on the key resistance at the 0.6601 50-dma.

- Rate decisions from the Eurozone, Australia, India, Russia and Poland should keep markets busy next week. China PMI, trade balance & inflation releases are the data highlights alongside Japanese GDP.

Monday/Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/06/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 06/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 06/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 07/06/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 07/06/2022 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 07/06/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 07/06/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 07/06/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 07/06/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 07/06/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/06/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/06/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 07/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/06/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/06/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/06/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.